When the cost of long-term care looms, it can feel like a financial tidal wave threatening to wash away a lifetime of savings. Long term care Medicaid is the government-funded program designed to be a lifeline, helping to cover the often staggering costs of nursing homes, assisted living, and in-home care for seniors who qualify.

This isn't your standard health insurance. Think of it as a crucial safety net that activates when a person’s own financial resources have been exhausted by care needs, ensuring they can continue to receive support without bankrupting their family.

Understanding the Financial Lifeline for Seniors

Picture your life savings as a reservoir you've carefully filled over decades. A sudden illness or the growing need for daily assistance can feel like a drought, draining that reservoir faster than you ever imagined. Long term care Medicaid is the system that steps in to replenish that supply, making sure essential care continues long after private funds have run dry.

It’s also important to understand how this differs from Medicare. Medicare is fantastic for short-term, rehabilitative care—think a few weeks in a facility after a hospital stay. But it was never intended to pay for ongoing custodial care, which is the non-medical help with daily activities like bathing, dressing, and eating. Medicaid is what fills that enormous gap.

Why Is This Program So Essential Today?

The reality is, more Americans need long-term care than ever before. As our population ages, the demand for nursing home beds and in-home support is exploding. The global long-term care market is on track to grow from about $1.27 trillion in 2025 to over $1.75 trillion by 2032, and nursing care is a massive piece of that puzzle. You can dig into the full long-term care market analysis to see just how these trends are impacting families everywhere.

This program ensures that an individual’s need for care doesn't lead to a family’s financial ruin. It provides peace of mind by creating a clear path to pay for services that could otherwise cost over $100,000 per year.

Getting a handle on how long term care Medicaid works isn't just about navigating a government system; it's about smart, proactive planning for the future. It gives families the tools to protect their hard-earned assets while securing quality care for the people they love most. Without it, countless families would face impossible choices between their health and their financial security.

Meeting the Three Tests for NJ Medicaid Eligibility

Qualifying for New Jersey’s long term care Medicaid isn’t quite like applying for a loan or filling out a typical health insurance form. It's a much more detailed process where you have to pass three separate and equally important evaluations. Think of it as a three-gate system—you must clear each one to access the benefits on the other side.

These gates are the medical test, the income test, and the asset test. Each one looks at a different piece of your life to build a complete picture of your need for help. The tricky part? Failing even one of these tests can bring the entire application to a dead stop.

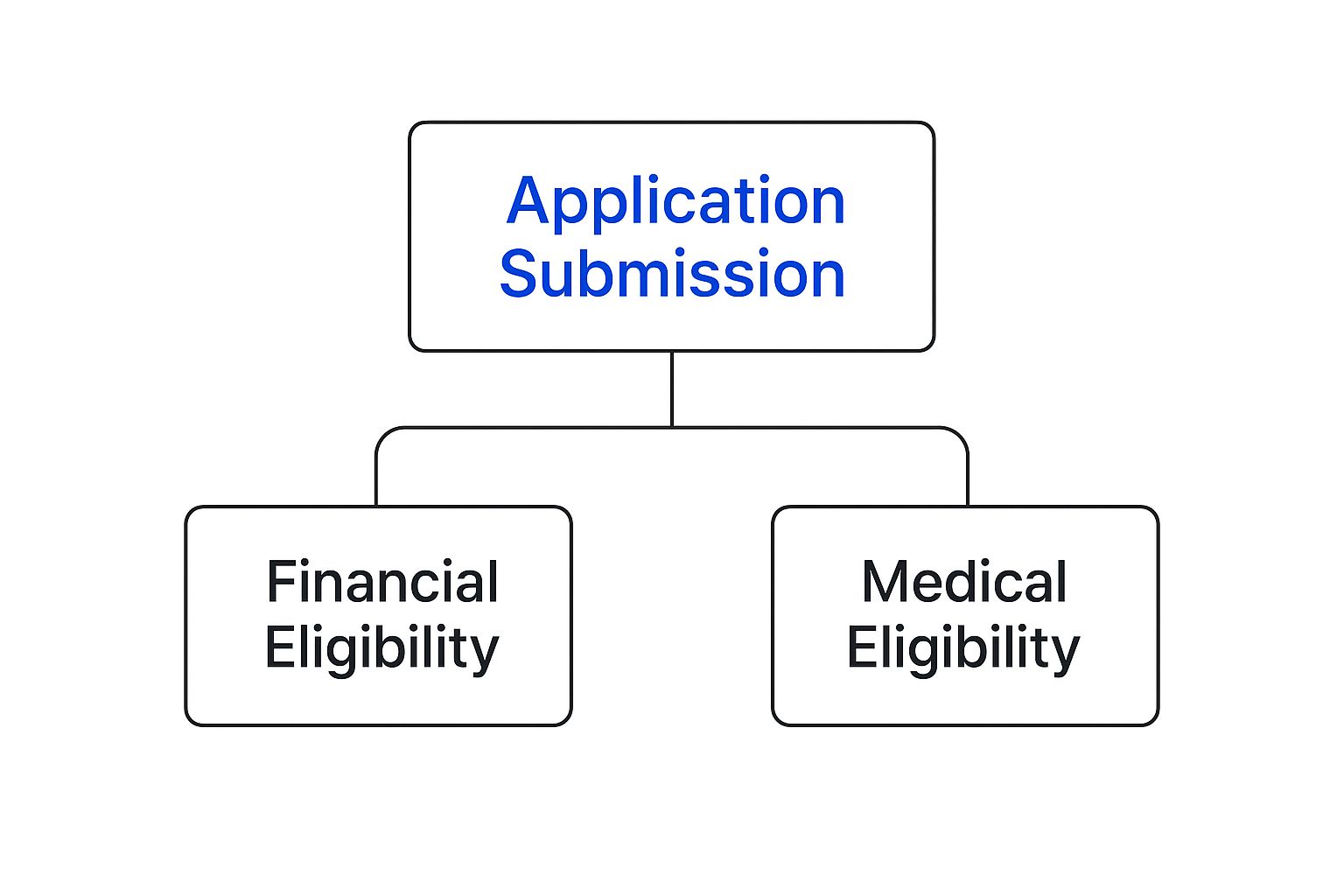

This diagram shows how the application splits into two main tracks that are reviewed at the same time.

As you can see, your financial situation and your medical needs are parallel requirements. You have to meet both sets of criteria for your application to get approved.

The First Gate: Medical Necessity

Before New Jersey even glances at your bank statements, it needs to confirm that you are medically eligible for long-term care. This isn't about having a specific diagnosis; it's about your functional ability to get through the day. The state needs to see that you require a "nursing home level of care."

That phrase might sound intimidating, but it simply means you need significant, hands-on help with what are known as Activities of Daily Living (ADLs). This can include things like:

- Bathing and personal hygiene

- Getting dressed

- Eating or feeding yourself

- Mobility, like getting out of a bed or a chair

- Using the restroom

To figure this out, a nurse from the state will conduct a Pre-Admission Screening (PAS). During this assessment, they'll evaluate your physical health, cognitive status, and how well you can perform these tasks on your own. If they determine you need this level of support, you've passed the first test.

The Second Gate: The Income Test

Once your medical need is established, the focus shifts to your finances, starting with your monthly income. New Jersey has a strict income cap for applicants, and this includes all sources of money—Social Security, pensions, 401(k) distributions, and any other regular payments you receive.

A lot of people hear about this cap and mistakenly think that if their income is even a dollar over the limit, they’re automatically out of luck. Fortunately, that’s not the case. New Jersey is what's known as an "income cap" state, which means there's a powerful legal tool to solve this exact problem.

A Qualified Income Trust (QIT), often called a Miller Trust, is a special type of bank account that allows you to legally deposit your "excess" income each month. Once the money is in the trust, it's no longer counted for eligibility purposes, letting you pass the income test.

Using a QIT is a standard, perfectly legal strategy for long term care Medicaid planning. But it's not a simple DIY project. It requires precise setup and ongoing management, which is why working with an experienced elder law attorney is so important to make sure it's done right.

The Third Gate: The Asset Test

The final gate—and often the most complex—is the asset test. Medicaid is a program for those with limited financial resources, so the state puts a firm limit on the value of an applicant’s "countable assets." For a single person applying in New Jersey, this limit is incredibly low, typically just $2,000.

Understanding the difference between what's "countable" and what's not is absolutely critical.

- Countable Assets: These are things Medicaid expects you to spend on your own care before it will start paying. This includes cash in checking and savings accounts, stocks, bonds, vacation homes, and extra cars.

- Non-Countable Assets: These are resources that Medicaid generally ignores when looking at your eligibility. Common examples include your primary home (up to a certain equity value), one vehicle, pre-paid funeral plans, and your personal belongings.

This is where many families get into trouble, as simply giving assets away to get under the limit can trigger harsh penalties. The table below breaks down the key financial limits for both an applicant and their spouse.

New Jersey Medicaid Financial Eligibility at a Glance

Here’s a quick summary of the key financial hurdles for anyone applying for Long Term Care Medicaid in New Jersey, including special provisions for a spouse who continues to live at home.

| Eligibility Factor | Limit for Applicant (Individual) | Rules for a Community Spouse | Key Notes |

|---|---|---|---|

| Monthly Income | Capped at a specific limit (this amount changes annually). | The spouse at home can keep all their own income, and sometimes a portion of the applicant's income. | A Qualified Income Trust (QIT) can be used if the applicant's income is over the limit. |

| Countable Assets | $2,000 | Can keep a much larger amount called the Community Spouse Resource Allowance (CSRA). | The CSRA is protected to prevent the healthy spouse from becoming impoverished. |

| Primary Home | Generally exempt up to a high equity value. | The home is fully exempt if the community spouse lives there, with no equity limit at all. | The state may seek repayment from the home's value after the Medicaid recipient passes away (estate recovery). |

Successfully navigating all three of these tests—medical, income, and assets—is the key to unlocking long term care Medicaid benefits in New Jersey. Each gate has its own set of detailed rules, and getting through them requires careful planning and a clear understanding of how the system works.

What Medicaid Actually Pays For

Once you've cleared the eligibility hurdles, the big question is, "What does long term care Medicaid actually cover?" You might be surprised. The answer is a lot more than just nursing homes.

Think of Medicaid as a versatile toolkit for care. New Jersey’s program is specifically designed to be flexible, supporting you in the most comfortable and least restrictive setting that still meets your medical needs. This focus on both facility-based and home-based care is the foundation of the entire system.

The goal is simple: fund the specific services you require because of your medical condition, so you can get the help you need without draining your family's life savings.

Institutional Care in a Nursing Facility

For many, the first thing that comes to mind is traditional nursing home care. When someone needs round-the-clock supervision and skilled medical attention, a nursing facility is often the right choice. In these situations, Medicaid's role is massive.

In fact, Medicaid is the single largest payer for this type of care in the country. In 2023 alone, it covered 44% of the total $147 billion spent on institutional long-term care in the United States. That number really shows just how essential the program is for millions of families. You can discover more insights about Medicaid's role in nursing facilities.

When long term care Medicaid pays for a nursing home, it typically covers a wide range of essentials:

- Room and Board: The cost of a semi-private room, daily meals, and housekeeping.

- Skilled Nursing Care: Services from licensed nurses, like medication administration, wound care, and monitoring vitals.

- Rehabilitative Therapies: Physical, occupational, and speech therapy to help maintain or improve function.

- Personal Care Assistance: Hands-on help with daily activities like bathing, dressing, and eating.

- Medical Supplies and Equipment: Necessary items like wheelchairs, walkers, and oxygen.

This comprehensive coverage acts as a critical safety net, ensuring access to high-level care that would be financially impossible for most families to handle on their own.

Staying at Home with Community Based Services

Here's where things get really interesting. New Jersey recognizes that most seniors would much rather age in place, and the state's Medicaid program strongly supports that. This is done through a program called Managed Long Term Services and Supports (MLTSS), which focuses on Home and Community-Based Services (HCBS).

The idea behind MLTSS is powerful: provide the right support to keep people living safely and comfortably in their own homes for as long as possible. Not only does this respect a person’s independence, but it's often more cost-effective than institutional care.

By bringing care directly to you, MLTSS empowers individuals to maintain their quality of life and connections to their community. It shifts the focus from "where you live" to "what you need."

Under the MLTSS waiver program, long term care Medicaid can pay for a whole host of services delivered right to your door, including:

- Personal Care Assistance: A caregiver comes to the home to help with bathing, getting dressed, preparing meals, and light housekeeping.

- Home Health Aide Services: Provides more medically-focused support, always under the supervision of a nurse.

- Adult Day Care: A safe and social environment for seniors during the day, offering meals, fun activities, and health services.

- Respite Care: Gives family caregivers a much-needed break by having a professional step in for a short period.

- Home Modifications: Pays for minor but crucial changes to the home, like installing grab bars or a wheelchair ramp to improve safety.

- Personal Emergency Response Systems: A medical alert button that can summon help with one push in an emergency.

This flexibility allows families to build a care plan that’s truly customized to their needs, making it one of the most valuable parts of the modern long term care Medicaid system.

Your Step-by-Step Application Guide

Applying for long-term care Medicaid can feel like trying to build a complex piece of furniture without the instructions. You've got a lot of parts, confusing diagrams, and a real fear of getting it wrong. But if you break the process down into a clear, manageable roadmap, you can turn that confusion into confidence and get on the path to a successful approval.

The absolute key is organization. A rushed or incomplete application is the single most common reason for delays and denials. Taking the time to get everything you need in order upfront will make every other step that much smoother. Think of it as your pre-flight checklist for a very important journey.

Stage 1: Assembling Your Documentation

Before you even think about filling out the application form, your first job is to gather a complete file of personal and financial records. The state needs to verify every single piece of information you provide, and having these documents ready will save you from frantically searching for them later. This is the foundation of a strong application.

Your initial document checklist should include:

- Proof of Identity and Citizenship: This means your birth certificate, driver's license, Social Security card, and Medicare card.

- Proof of Income: Go ahead and collect recent pay stubs, Social Security benefit letters, pension award letters, and statements for any other income you receive.

- Medical Records: You'll need documents that confirm the need for a nursing home level of care. This often comes in the form of physician's orders or records that detail specific medical conditions and functional limitations.

Once you have these core documents, it's time to tackle the most detailed part of the process—your financial history.

Stage 2: Gathering Your Financial Records

This is where the five-year look-back period really comes into play. You will need to provide 60 months of complete financial records for every single account you hold. I can't stress this enough: this requirement is non-negotiable and is almost always the most time-consuming part of the application.

Be prepared to collect the following:

- Bank Statements: Every page of every statement for the last five years from all your checking and savings accounts.

- Investment Records: Statements from any brokerage accounts, stocks, bonds, or mutual funds.

- Real Estate Documents: The deeds to any property you own, along with recent tax assessments to show its value.

- Life Insurance Policies: The full policy documents, which will show the cash surrender value.

- Annuity Contracts: All the paperwork related to any annuities you might have.

- Vehicle Titles: Proof of ownership for any cars, trucks, or other vehicles.

Pro-Tip: Do not throw away any pages from your bank statements, even the blank ones. Medicaid caseworkers are trained to look for complete, uninterrupted records, and a single missing page can cause significant delays while they wait for you to track it down.

Stage 3: Completing and Submitting the Application

With all your documents neatly organized, you're finally ready to fill out the New Jersey Medicaid application. Be meticulous. Answer every single question accurately and completely. Any inconsistencies between what you write on the application and what's in your supporting documents will raise red flags and grind the review process to a halt.

Once it's submitted, your case will be assigned to a caseworker at the County Board of Social Services. This person becomes your main point of contact. They will carefully scrutinize every document you’ve provided to make sure you meet both the medical and financial eligibility rules for long-term care Medicaid.

Stage 4: The Verification and Interview Process

It's very common for a caseworker to come back with questions or requests for more information. They might ask for details about a specific bank transaction or need an updated note from a doctor. It is critical that you respond to these requests as quickly as possible. If you miss a deadline, they can close your application, forcing you to start the entire process all over again.

In some cases, the caseworker may want to schedule a phone or in-person interview to go over everything. This is a normal part of the process and a good opportunity to clear up any confusion. Just be honest, direct, and have your file of documents handy so you can reference it during the conversation.

Finally, after the full review is complete, you'll receive a determination letter in the mail. This is the official notice stating whether your application for long-term care Medicaid has been approved or denied. If you're approved, it will list the date your coverage starts. If denied, it will explain why and detail your right to appeal that decision.

Understanding the Five-Year Look-Back Period

When it comes to long-term care Medicaid, one rule stands out as the most critical—and most misunderstood: the five-year look-back period. This single regulation is why planning ahead isn’t just a good idea; it’s an absolute necessity for protecting your family’s financial future.

Think of Medicaid as a meticulous financial detective. When you apply for benefits, they don't just glance at your current bank balance. Instead, they pull out a magnifying glass and scrutinize every financial transaction you've made for the last 60 months—that's five full years leading up to your application.

The Purpose Behind the Scrutiny

The look-back period exists for one simple reason: to make sure the program helps those who genuinely need it. Its primary job is to stop people from giving away their life savings to family members just to get under the asset limit and qualify for coverage.

Without this rule, someone could transfer a huge sum of money to their kids on Monday and apply for Medicaid on Tuesday, claiming they have no money to pay for care. The look-back period closes that loophole, keeping the system fair for everyone.

Any transfer made for less than what it was worth—what Medicaid calls "fair market value"—gets a red flag. This covers everything from outright cash gifts and selling a house to a relative for a token amount, to paying a family member for care without a formal, legally sound contract. You can find more details on how to correctly structure these arrangements in our comprehensive caregiver guide.

The High Cost of Improper Transfers

If Medicaid’s detective finds a transfer that breaks the rules within that five-year window, the consequences are steep. It triggers what’s known as a penalty period—a set amount of time where you are ineligible for long-term care Medicaid benefits, even if you’re otherwise medically qualified.

It's like being put in a "Medicaid time-out." You're barred from receiving coverage, forcing you to pay for your own care out-of-pocket until the penalty is over.

The length of this penalty isn't random. It’s calculated with a simple formula:

- Total Value of Improper Gifts ÷ Average Monthly Cost of Nursing Care in NJ = Number of Months of Ineligibility

For instance, if you gave away $120,000 and the average cost of care in New Jersey is $12,000 per month, you’d be ineligible for Medicaid for 10 months. This penalty period doesn't start until you are approved for benefits, meaning you are left completely without coverage right when you need it most.

This penalty is one of the most financially devastating pitfalls in Medicaid planning. It can force families to burn through every last penny and even go into debt to cover care costs while they wait for the penalty to expire.

Shifting from Reaction to Proactive Planning

Understanding the look-back period shouldn't create panic; it should spark action. The key takeaway is that the five-year window gives you a clear timeline for smart, legal, and ethical asset protection. By planning ahead, you can structure your finances in a way that is fully compliant with Medicaid rules, preserving your legacy while ensuring you qualify for care when you need it.

Waiting until a health crisis strikes is almost always too late. The most effective strategies need time to be put in place so they fall safely outside that five-year look-back.

Compliant Asset Protection Strategies

Instead of making improper gifts, proactive planning uses established legal tools to reposition your assets. This isn't about hiding money—it's about restructuring your estate in a way the law recognizes and permits. Just remember, these strategies have to be implemented well before the 60-month look-back period kicks in.

Some of the most common and effective methods include:

- Irrevocable Trusts: Placing assets into a properly drafted irrevocable trust takes them out of your name. After five years pass, those assets are no longer considered yours and are protected from both long-term care costs and the Medicaid look-back.

- Personal Care Agreements: This is a formal contract where you pay a family member or friend for providing legitimate care. When structured correctly by an attorney, these payments are a valid expense, not a gift, and don’t trigger a penalty.

- Strategic Spend-Downs: If your assets are over the limit, you can spend down the excess on things that benefit you and are allowed by Medicaid. This includes paying off a mortgage, making your home more accessible, buying a new car, or prepaying for funeral expenses.

Ultimately, the five-year look-back period defines the playing field for long-term care Medicaid planning. By understanding the rules and acting well in advance, you can give your family the ultimate gift: financial security and peace of mind.

Common Questions About Long Term Care Medicaid

Even after you get a handle on the basics of long term care Medicaid, the "what if" questions are what keep you up at night. These are the personal, practical concerns that can cause the most stress for families. Let’s tackle some of the most common questions head-on so you can move forward with confidence.

Getting clear on these details is the key to effective planning and real peace of mind.

Can I Keep My House If I Go on Long Term Care Medicaid?

This is almost always the first question families ask, and the short answer is yes—in most cases, you can keep your primary residence. New Jersey Medicaid doesn’t count your home as an asset (up to a pretty high equity value), especially if your spouse or another dependent relative is still living there.

But there’s a huge catch you need to know about: Medicaid Estate Recovery. After the person receiving Medicaid passes away, the state has the right to seek repayment for the care costs it covered. Since the house is usually the most valuable asset, it becomes the primary target for this collection effort.

The only way to truly protect your home for your heirs is to plan ahead. A tool like a properly structured irrevocable trust, set up well before the five-year look-back period starts, can legally take the house out of your estate. This shields it from both the cost of care and from being seized for estate recovery.

Simply owning your home isn't enough; you have to plan to protect it. This becomes even more critical when you realize that about 70% of people over 65 will need long-term care services at some point, with the average cost hitting around $138,000. You can dig into the full nursing home care statistics and insights to see just how significant these financial impacts can be.

What Happens if My Income Is Too High for Medicaid?

It’s a common problem to be over the strict income limit, but it doesn't automatically shut the door on long term care Medicaid benefits. New Jersey is what’s known as an "income cap" state, which means there’s a specific legal workaround for this exact situation.

The solution is called a Qualified Income Trust (QIT), though you’ll often hear it called a Miller Trust. Think of it as a special funnel for your excess income.

Here’s how it works: each month, any income you have over the Medicaid limit gets deposited directly into the QIT account. The money in that trust is then used to pay for your share of care costs or other approved medical bills. Because the extra money flows through this trust, it’s no longer counted as your income for eligibility, allowing you to meet the test.

Getting a QIT set up correctly requires an elder law attorney to make sure it follows all the state rules. Our team can connect you with the right resources as you plan your care journey. You might find our guide on how NJ Caregiving can support your family helpful.

What Is a Penalty Period and How Do I Avoid It?

A penalty period is a block of time where you are disqualified from receiving Medicaid benefits, even if you’re otherwise eligible. It’s the direct result of giving away money or assets during the five-year look-back period.

Basically, if you gave away assets or sold them for less than they were worth, Medicaid will trigger this penalty. They calculate the total value of the gifts you made and divide that number by the average monthly cost of nursing home care in New Jersey. The answer to that equation is the number of months you are banned from getting coverage.

There are really only two ways to avoid this devastating financial setback:

- Don't make any improper transfers within the 60 months before you apply.

- Use compliant legal strategies for any transfers that are necessary, like a personal service contract for caregiving or other Medicaid-approved planning tools.

The penalty period is designed to stop people from trying to hide their assets. The only way to win is to be honest, transparent, and plan ahead with strategies that respect the rules from day one.

Navigating the complexities of elder care can be challenging, but you don't have to do it alone. At NJ Caregiving, we provide compassionate and professional in-home care services to help your loved ones live with dignity and independence. For a personalized care plan, visit us at https://njcaregiving.com.