Imagine finding an old, dusty rulebook in the attic that says you’re on the hook for your parents’ unpaid bills. It sounds like something from another century, but that’s the reality of filial responsibility laws. These are state-level statutes that can legally require adult children to pay for their parents' care, including overdue nursing home or hospital debts, if they can't pay themselves.

The Overlooked Financial Duty to Your Parents

For most people, hearing they could be legally forced to pay for a parent's long-term care is a total shock. It feels like an outdated concept, yet these laws are still active in many states, creating a surprising and often unwelcome financial risk for families.

Think of it like a dormant volcano. It sits there, forgotten and seemingly harmless for years. But when the right pressures build up—like a parent racking up huge medical bills while waiting for Medicaid to kick in—it can suddenly erupt. These laws give care providers a legal path to come after adult children for payment.

Why Are These Old Laws Still Around?

The recent buzz around filial responsibility laws is tied directly to our country's shifting demographics. We have an aging population and skyrocketing healthcare costs, which sometimes leaves nursing homes and hospitals with massive unpaid invoices. To recover their losses, some are digging deep into the legal archives and dusting off these old statutes.

The idea behind them is pretty straightforward: if a parent is deemed "indigent" (meaning they can't support themselves) and has an adult child who can afford to help, the law might force that child to chip in.

A few key things usually need to happen for these laws to be invoked:

- An Indigent Parent: The parent must be unable to cover their own essential needs, like housing, food, or medical care.

- An Adult Child with Financial Means: A court has to decide that the child has enough income or assets to help without causing themselves major financial hardship.

- A Debt for Necessities: The bill is almost always for essential services, like a nursing home stay, hospital bills, or necessary in-home care.

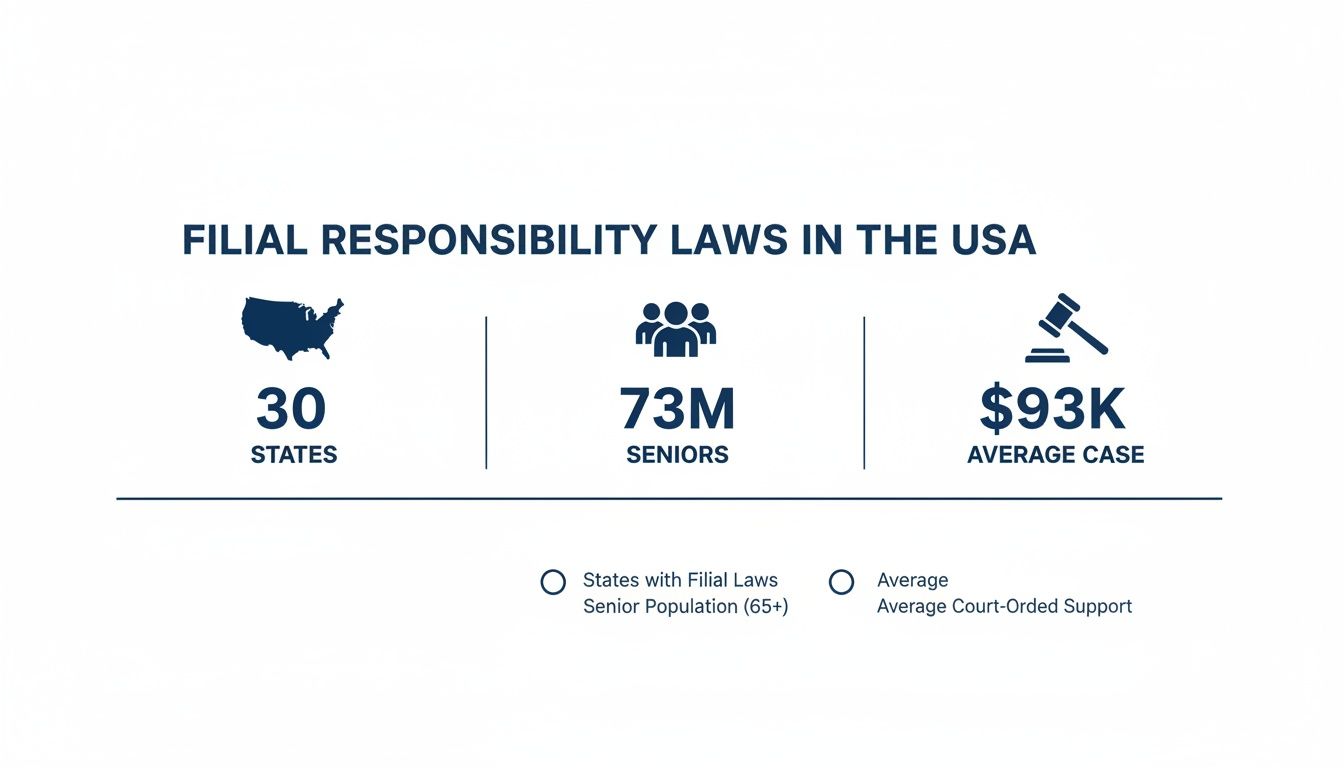

This infographic really puts the numbers into perspective.

The data makes it clear: while these laws aren't everywhere, they cover a big chunk of the country and have led to some hefty financial judgments in those rare—but very real—cases.

While it's true that enforcement is uncommon, the fact that it's even possible makes proactive planning a must. The existence of these laws highlights just how important it is to have a long-term care strategy in place for your parents before a crisis hits.

As of 2025, a surprising 30 states still have some version of filial responsibility laws on the books. These laws are leftovers from old English "poor laws" but have found new relevance as the baby boomer generation ages. Projections show there will be over 73 million Americans aged 65+ by 2030, which could put more pressure on these statutes.

Pennsylvania is a famous example where these laws were brought back to life. In one well-known 2012 case, an adult son was ordered to pay a staggering $93,000 for his mother's nursing home bill—a debt she incurred before she qualified for Medicaid. You can read more about filial responsibility cases and their implications to understand the full scope.

States with Active Filial Responsibility Laws

Curious if you live in a state with one of these laws? It’s a critical piece of information for any family caregiver. The table below lists the states that currently have filial responsibility statutes.

| State | Statute Reference (Example) | Key Provisions |

|---|---|---|

| Alaska | AS 25.20.030 | Adult children must support a parent who is poor or unable to work to maintain themselves. |

| Arkansas | Ark. Code Ann. § 20-47-106 | An individual is responsible for the support of their spouse, child, or parent. |

| California | Cal. Fam. Code § 4400 | Adult children must support a parent who is in need and unable to maintain themselves. |

| Connecticut | Conn. Gen. Stat. § 46b-215 | Adult children may be required to contribute to the support of a parent on public assistance. |

| Delaware | Del. Code Ann. tit. 13, § 503 | A person of sufficient means must support their parent who is in need. |

| Georgia | Ga. Code Ann. § 36-12-3 | Adult children are responsible for the support of their parents who are unable to support themselves. |

| Idaho | Idaho Code § 32-1002 | Adult children have a duty to support parents in need. |

| Indiana | Ind. Code § 31-16-17-1 | A child is liable for the support of a parent if the parent provided for the child. |

| Iowa | Iowa Code § 252.2 | The parents or adult children of a poor person are liable for their support. |

| Kentucky | Ky. Rev. Stat. Ann. § 530.050 | A person is guilty of nonsupport if they fail to provide support to a needy parent. |

| Louisiana | La. Civ. Code Ann. art. 229 | Children are bound to maintain their father and mother and other ascendants who are in need. |

| Maryland | Md. Code Ann., Fam. Law § 13-102 | Adult children have a duty to support a destitute parent. |

| Massachusetts | Mass. Gen. Laws ch. 273, § 20 | Adult children with sufficient means must provide support for parents in need. |

| Mississippi | Miss. Code Ann. § 43-31-25 | Children are required to support their parents if they are able. |

| Montana | Mont. Code Ann. § 40-6-214 | An adult child has a duty to support a parent who is in need. |

| Nevada | Nev. Rev. Stat. § 428.070 | Children, if able, are liable for the support of their parents who are on public assistance. |

| New Hampshire | N.H. Rev. Stat. Ann. § 546-A:2 | Relatives are chargeable with the support of a person in need. |

| New Jersey | N.J. Stat. Ann. § 44:1-140 | Spouses, parents, and children are responsible for supporting their relatives who seek public aid. |

| North Carolina | N.C. Gen. Stat. § 14-325 | A person is guilty of a misdemeanor if they fail to support a parent in need. |

| North Dakota | N.D. Cent. Code § 14-09-10 | Adult children must support a parent who is unable to maintain themselves. |

| Ohio | Ohio Rev. Code Ann. § 2919.21 | No person shall abandon or fail to provide adequate support to a parent in need. |

| Oregon | Or. Rev. Stat. § 109.010 | Parents are bound to maintain their children who are poor; the same duty extends to children for parents. |

| Pennsylvania | 23 Pa. Cons. Stat. § 4603 | An individual has a duty to care for and maintain an indigent parent. |

| Rhode Island | R.I. Gen. Laws § 15-10-1 | Every person of sufficient ability shall maintain their parents. |

| South Dakota | S.D. Codified Laws § 25-7-27 | Every adult child, having the financial ability, shall provide necessary support for a parent. |

| Tennessee | Tenn. Code Ann. § 71-5-115 | Adult children are liable for the support of parents receiving public assistance. |

| Utah | Utah Code Ann. § 17-14-2 | Relatives are bound to support their kin who are poor or unable to work. |

| Vermont | Vt. Stat. Ann. tit. 15, § 202 | An adult child has a duty to support a parent who is in need. |

| Virginia | Va. Code Ann. § 20-88 | A person with sufficient earnings shall provide for the support of their aged or infirm parent. |

| West Virginia | W.Va. Code § 9-5-9 | A person is responsible for the support of their parent who is a recipient of public assistance. |

Disclaimer: This table is for informational purposes only and is not legal advice. Laws can change, so it's always best to consult with a legal professional for the most current information.

Seeing your state on this list doesn't mean a nursing home will automatically send you a bill, but it does mean the legal framework is in place. This makes understanding your family's financial situation and long-term care plan more important than ever.

How Often Are These Laws Actually Enforced?

Just hearing that filial responsibility laws exist is enough to give any family caregiver a serious dose of anxiety. It’s completely natural to worry about getting hit with a massive, unexpected bill for your parent’s care. But the reality on the ground is far less alarming than these old statutes might suggest.

While the laws are still on the books in over half the country, they are very rarely enforced. Think of them as a legal relic—a dusty old rule that only gets pulled out under a very specific set of circumstances. For the vast majority of families, these laws never become a real-world problem.

The main reason for this is the powerful role of Medicaid, the federal and state program that covers healthcare costs for millions of low-income Americans, including long-term care for seniors. Federal law actually creates a strong shield for families.

The Medicaid Shield: Why Most Families Are Protected

Once a parent is approved for Medicaid, care providers like nursing homes are legally blocked from going after family members for payment. The federal government essentially steps in and says, "We are the payer of last resort, and you cannot chase the children for this debt."

This creates a protective barrier that shuts down most potential filial responsibility claims. Since Medicaid covers the lion's share of long-term nursing home stays for seniors without significant assets, the opportunity for a provider to sue an adult child is almost completely erased.

Even though about 29 to 30 U.S. states have these laws, federal Medicaid rules prevent providers from recovering medical debts incurred before a parent qualifies. In fact, despite some of these laws being on the books since the 19th century, there were virtually no major enforcement cases nationwide between 2013 and 2025, with one famous exception in Pennsylvania. You can read more about these protections in this legal encyclopedia on filial obligations.

The Pittas Case: A Perfect Storm of Circumstances

So, if these laws are so rarely used, why do we even talk about them? The conversation often circles back to one high-profile case: Health Care & Retirement Corporation of America v. Pittas. This 2012 Pennsylvania case is the cautionary tale everyone cites, but it's critical to see it for what it was—an exception, not the rule.

In that case, a son was ordered to pay over $93,000 for his mother’s nursing home bill. That sounds terrifying, but it was the result of a "perfect storm" of factors that almost never happen together.

Here’s what made the Pittas case so unique:

- A Massive Pre-Medicaid Debt: The huge bill was for care his mother received before her Medicaid application was ever approved.

- An International Move: The mother moved to Greece while her application was still pending, which complicated things and ultimately tanked the approval process.

- A Child with Proven Means: The court found that her son had the financial ability to pay the bill. He wasn't struggling financially.

- A State with Strong Precedent: Pennsylvania’s courts had a history of upholding the state's filial responsibility law, making the lawsuit more likely to succeed.

This case wasn't about a nursing home going after a middle-class child for a parent's ongoing, Medicaid-covered care. It was about recovering a specific, large debt created under unusual circumstances from a child who could clearly afford to pay it.

Understanding this context is key. The Pittas case doesn't mean a wave of lawsuits against adult children is coming. Instead, it highlights the very rare and specific scenario where these old laws might still have teeth: a large, pre-Medicaid debt combined with a child who has the clear financial means to cover it.

How New Jersey Filial Responsibility Laws Work

When you’re navigating the complexities of elder care in New Jersey, you have to understand the state’s specific rulebook. Lots of states technically have “filial responsibility” laws, but how they’re interpreted and enforced can be wildly different from one place to the next.

New Jersey’s version is defined by a statute that, while rarely dusted off, creates a potential financial backstop that every family should know about.

The heart of the law is N.J.S.A. 44:1-140. In plain English, this statute says certain relatives—including adult children—have a legal obligation to support a family member who is "indigent," or unable to pay their own way. It gives the government, or sometimes a care provider, a legal path to seek payment from a child if their parent can’t cover essential bills.

This isn’t just a moral suggestion; it’s a legal one. Think of it as a safety net designed to prevent someone from becoming a public charge when they have relatives who could reasonably help out.

The Key Conditions for Liability in New Jersey

Before you start worrying, it’s important to know that a filial responsibility claim isn't easy to make. A nursing home can’t just decide to send you a bill for your mom’s care. A very specific set of circumstances has to fall into place, creating a narrow window of risk.

A claim really boils down to two main things:

- The Parent is Deemed Indigent: First, the parent must be completely out of money to pay for their own "necessary" care. This usually means they’ve run through their savings and assets and can’t cover costs for medical treatment, rehab, or a long-term care facility.

- The Adult Child Has Sufficient Financial Means: The court also has to determine that the adult child has the ability to pay without creating a serious financial hardship for themselves. They’ll look at your income, assets, and other responsibilities to see if you can realistically provide support.

Basically, the law is only meant to kick in when there’s a clear and proven need on the parent's side and an obvious ability to pay on the child's side.

Common Triggers for Filial Responsibility Claims

Even though enforcement is rare, certain situations are more likely to create the kind of unpaid debt that could spark a claim. These high-risk scenarios almost always involve a gap in payment coverage, especially when a loved one is first moving into long-term care.

A common misconception is that these laws apply to ongoing, Medicaid-covered care. In reality, the greatest risk lies in the period before public benefits like Medicaid are approved, when large bills can accumulate quickly and unexpectedly.

This "Medicaid gap" is a classic example. Let’s say your dad enters a nursing home after a hospital stay, and you immediately apply for Medicaid to cover the costs. That application process can drag on for months. All the while, the facility is providing care, and the bill is climbing. If the application is denied or hits a snag, the facility might start looking for other ways to get paid, and N.J.S.A. 44:1-140 is one tool in their toolbox. In some cases, this can lead to what's known as Medicaid payback or estate recovery, but it could also trigger a direct claim against a child.

Other potential flashpoints include:

- Unpaid Hospital Bills: A major medical event can leave behind large co-pays or uncovered expenses that a senior on a fixed income simply can’t manage.

- Short-Term Rehabilitation Costs: Stays in skilled nursing facilities after surgery can cost thousands a month, wiping out a parent's savings fast.

- In-Home Care Services: Bills from private home care agencies that pile up before Medicaid or other benefits start can also become a source of debt.

Historically, these laws are a holdover from a time before programs like Social Security. As of 2025, 30 states still have them on the books. New Jersey is a key state that has kept its statute, making it especially relevant for the 1.4 million seniors in NJ who qualify for Medicaid. You can discover more insights about state-by-state filial responsibility laws to see how New Jersey stacks up.

The point of understanding these triggers isn’t to cause panic. It’s to frame proactive care planning as an essential strategy for any New Jersey family. By seeing these financial pressure points ahead of time, you can take steps to protect both your parent's well-being and your own financial future.

It’s easy to dismiss filial responsibility laws as some dusty old legal concept—until your family gets tangled up in a real-life financial nightmare. While these laws aren't used every day, certain high-stakes situations can push a care provider to come looking for payment from adult children.

Knowing what these scenarios look like is the best way to steer clear of them altogether. They almost always pop up when there's a gap in payment, usually because a parent's need for expensive care gets ahead of their ability to pay or their approval for programs like Medicaid.

Let's look at a few common ways a family can suddenly find themselves on the hook.

The Medicaid Gap Scenario

Picture this: your mother, Sarah, has a sudden stroke. She needs to move into a skilled nursing facility, and the bill is a jaw-dropping $12,000 a month. Her savings won't last long, so you hire an elder law attorney and apply for Medicaid, which is the only realistic way to cover her long-term care.

Here’s the problem. In New Jersey, getting a Medicaid application approved can take anywhere from three to six months, and sometimes even longer. While you wait, the nursing home is providing care 24/7, and that bill is climbing fast. After just four months, Sarah's unpaid balance hits $48,000.

This is what’s known as the "Medicaid Gap," and it’s one of the riskiest situations for families. If Sarah’s application is denied for any reason—a simple paperwork mistake or a forgotten asset—the nursing home is suddenly facing a massive loss. With Medicaid no longer an option, their collections team might start exploring other avenues, and New Jersey’s filial responsibility law gives them a legal path to come after you for that $48,000.

The biggest financial threat isn't the ongoing cost of care covered by Medicaid. It's the huge, unsecured debt that builds up while an application is pending, giving providers a strong reason to pursue family members for payment.

The Hospital Discharge Pressure Scenario

Here's another situation that happens all the time. Your father, David, is recovering from surgery in the hospital. The discharge planner is pushing to move him to a short-term rehab facility. They hand you a huge stack of admission papers and tell you to sign them right away so they can make the transfer happen.

You're stressed and just want what's best for your dad, so you sign where they point. But hidden in the fine print of that 30-page document is a section titled "Responsible Party" or "Financial Guarantor." Without realizing it, you may have just signed a contract agreeing to personally pay for anything not covered by his insurance.

This isn't even a filial responsibility claim; it's a direct contractual agreement. You’ve turned a moral family obligation into your own legally binding debt. If his stay lasts longer than planned or his insurance denies part of the claim, the facility doesn't need to use an old law to sue you—they’ll just use the contract you signed.

The Out-of-State Parent Scenario

Let's walk through one last example. You live and work here in New Jersey, where filial laws are hardly ever used. But your aging father lives alone in Pennsylvania, a state known for aggressively enforcing its statute—the famous Pittas case is a perfect example.

Your father moves into a nursing home in Pennsylvania, and a large bill piles up while his benefits are getting sorted out. That Pennsylvania facility can sue you under their state's laws, even though you live in New Jersey. They would file a lawsuit in a Pennsylvania court, and if they win a judgment against you, they can then transfer that judgment to New Jersey and use our local court system to collect the debt.

Where you live doesn't always protect you. The laws that often matter most are the ones where your parent is receiving care. Each of these situations highlights a different kind of pressure point, but they all lead to the same conclusion: proactive planning is your best defense.

Practical Steps To Protect Your Family's Finances

Knowing that filial responsibility laws exist is one thing. Taking concrete steps to make sure they never affect your family is something else entirely. The good news is that you're not helpless. With some proactive planning, you can turn that anxiety into a well-managed strategy.

This is your playbook for protecting your own assets and ensuring your parents get the care they need—without putting your family's financial future on the line. These steps aren't just about dodging a lawsuit; they’re about building a clear, sustainable care plan that works for everyone.

Start Medicaid Planning Early

One of the most dangerous times for families is during the "Medicaid gap"—that stressful period between when a parent needs care and when their Medicaid application finally gets approved. This is when huge, unsecured debts can pile up, giving a care facility a powerful reason to look for payment from anyone they can.

Getting ahead of this with early Medicaid planning is your single best defense. When you work with an expert long before a crisis hits, you can properly structure your parent's assets to meet eligibility requirements from the start. This makes the application process much smoother, shortens the approval time, and shrinks that window of financial risk. To truly secure your loved ones' future, a comprehensive approach to estate planning for families is an essential piece of the puzzle.

Scrutinize All Admission Paperwork

Picture this: your loved one is being discharged from the hospital, and a stack of paperwork is pushed in front of you. You're stressed, emotional, and just want to get them settled. But right here, in this moment, a simple signature can lock you into a personal financial obligation.

Never sign admission forms as a "guarantor" or "responsible party." These aren't just fancy words for being a point of contact. Signing as a guarantor creates a direct contract, making you personally responsible for the bill. It gives the facility a shortcut to coming after you, completely bypassing filial responsibility laws.

Always read the fine print. If you're even slightly unsure about the language in an admission agreement, don't sign. Ask for clarification, or better yet, have an elder law attorney look it over before you commit.

Open Clear Lines of Communication

Talking openly and honestly with care providers from day one can head off the kinds of misunderstandings that end in collections. Be upfront about your parent's financial situation and what you're doing to secure payment, like applying for Medicaid.

A few key communication tips:

- Discuss Payment Plans: Don't be afraid to ask about options for managing costs while benefit applications are in process.

- Provide Regular Updates: Keep the facility's business office in the loop on the status of the Medicaid application.

- Document Everything: Keep a simple written log of your conversations—the date, who you spoke with, and what was agreed upon.

This level of transparency builds trust. It shows you’re a partner in finding a solution, not an adversary to chase down for a debt. You can learn more about how to protect assets from nursing homes in our detailed guide which dives deeper into these strategies.

Here’s a simple checklist to help you stay on track and reduce your family's risk.

Family Caregiver Risk Reduction Checklist

| Action Item | Why It's Important | When to Do It |

|---|---|---|

| Start Medicaid Planning | Ensures eligibility is met quickly, minimizing the period of private-pay debt. | Years before care is needed, or as soon as a potential need arises. |

| Review All Paperwork | Prevents you from accidentally signing as a personal financial guarantor. | At admission to any hospital, rehab, or long-term care facility. |

| Communicate with Providers | Builds trust and keeps the facility from seeing you as a source of payment. | From day one and throughout the care journey. |

| Explore In-Home Care | Can be more affordable and prevents the large bills common in nursing facilities. | When a loved one first starts needing daily assistance. |

| Consult an Elder Law Attorney | Provides expert legal defense if a claim is made against you. | The moment you receive a demand letter or call from a collector. |

Following these steps provides a strong shield against potential claims and, more importantly, helps ensure your loved one's care journey is managed smoothly.

Explore In-Home Care Alternatives

For many families, a nursing facility isn't the only answer. In-home care can be a much more affordable and personalized alternative, allowing a parent to stay in the comfort and familiarity of their own home. This approach directly reduces the financial stakes by preventing the massive bills that often come with institutional care.

By managing care at home, you have far more control over the costs and services. At NJ Caregiving, we specialize in helping families create care plans that fit their budget and their loved one's needs, often preventing the kind of financial crisis that leads to filial responsibility issues in the first place.

Know When To Seek Legal Counsel

Finally, you have to know when it's time to call in a professional. If you get a letter or a phone call from a collections agency or an attorney representing a care facility, do not ignore it. This is your cue to immediately contact an experienced elder law attorney.

An attorney can determine if the claim is valid, navigate the complexities of New Jersey law, and fight for your best interests. Trying to handle this kind of legal pressure on your own can lead to disastrous and costly mistakes. Getting expert advice ensures you're protected and can build the strongest possible defense.

Navigating Care Challenges with Confidence

Learning about filial responsibility laws isn’t meant to scare you. Think of it more as a wake-up call—a nudge to recognize that proactive, thoughtful planning is the best shield you can build for both your parents’ well-being and your family’s financial future.

The goal here is to shift away from crisis management. Instead of scrambling to find care after an emergency, you can move forward with confident, informed decisions. This knowledge puts you back in the driver's seat, ensuring your loved one gets the best care possible without putting your own savings on the line.

At its heart, this is all about creating a sustainable, long-term care plan that tackles needs before they become emergencies.

Building a Proactive Care Strategy

A solid care plan is your roadmap for navigating the often-confusing healthcare system. It’s a strategy that looks ahead, anticipates potential roadblocks, and puts solutions in place before you need them. This is what truly neutralizes the risks that could lead to a filial responsibility claim.

Here are the key pieces of a proactive strategy:

- Explore All Care Options: Get familiar with the full spectrum of care. From in-home assistance that lets seniors age in place to different types of residential facilities, understanding your choices helps you make smart, cost-effective decisions.

- Organize Legal and Financial Documents: Having clear legal directives is non-negotiable. You can learn more about why documents like medical and financial power of attorney forms are so critical for managing a parent’s affairs when they no longer can.

- Start the Conversation Early: Don’t wait for a crisis to talk about finances and care preferences. Open, honest family discussions prevent future misunderstandings and get everyone on the same page.

Taking these steps transforms a daunting challenge into a manageable process, giving your family a clear path to follow.

Ultimately, confidence in caregiving comes from preparation. By understanding the system and planning ahead, you protect not only your parent's dignity and comfort but also your own financial security, no matter what the future holds.

Your Partner in Confident Planning

Trying to figure out elder care can feel incredibly isolating, but you don’t have to do it alone. The best plans are built with expert guidance and compassionate support. Having a dedicated partner to help you weigh options, understand costs, and put a plan into action can make all the difference.

By taking these deliberate steps, you create a safety net that protects both generations. You make sure your parents are cared for with dignity while safeguarding the financial future you’ve worked so hard to build. It’s the ultimate expression of responsible, loving care.

At NJ Caregiving, we specialize in helping families create personalized in-home care plans that enhance independence and provide peace of mind. If you're ready to move from anxiety to action, visit us at https://njcaregiving.com to learn how we can support your family’s journey.