So, does Medicaid cover in-home care? The short answer is yes, but it’s not as straightforward as you might think. There isn't a single, national Medicaid program for home care. Instead, what's available is a patchwork of state-specific programs, which means eligibility and the services you can get change dramatically depending on where you live.

Unpacking How Medicaid Handles In-Home Care

It helps to think of Medicaid’s approach like a national cookbook. The federal government writes the main recipe book, setting the broad guidelines and rules. But each state gets to be the chef, choosing which specific "recipes," or programs, to offer and what "ingredients," or services, to include in them.

This is where you'll hear the term Home and Community-Based Services (HCBS) waivers come into play. These waivers are essentially the special recipes states create to help people get the care they need in their own homes, rather than in an institution like a nursing home. The whole point is to support "aging in place," allowing people to stay independent and comfortable in a familiar setting.

The Foundation of Home Care Funding

Medicaid’s role here is massive. It’s the primary public payer for long-term services and supports, which includes the in-home care so many families depend on. The system is designed to give a real alternative to institutional care, empowering seniors and individuals with disabilities to get help without having to leave their homes. For a deeper dive, you can discover more insights about Medicaid's critical role in funding long-term care.

This state-by-state flexibility means the system is incredibly diverse. One state might have a really strong program for personal care aides, while another might put more focus on skilled nursing or providing respite care for family caregivers.

To help you keep track, here's a quick look at the core components of how Medicaid's in-home care coverage works.

Medicaid In-Home Care Coverage at a Glance

| Coverage Aspect | Key Takeaway |

|---|---|

| Federal Role | Sets the basic rules and provides funding, but doesn't run a single national program. |

| State Role | Designs and manages its own specific in-home care programs, often through HCBS waivers. |

| Primary Goal | To help people "age in place" by offering an alternative to institutional care like nursing homes. |

| Eligibility | Varies widely from state to state based on financial need and level of care required. |

| Covered Services | Can include anything from personal care and skilled nursing to home modifications and respite care. |

This table should give you a solid starting point. The main takeaway is that while Medicaid is a huge funder of home care, the path to getting it is paved by your state’s specific choices.

The core principle behind these programs is empowerment. By offering services at home, Medicaid helps prevent or delay the need for more costly nursing facility care, aligning with the preference of most older adults to remain in their own communities.

Getting a handle on this federal-state partnership is the first step. Next, you’ll need to look closely at your state's unique programs, its specific eligibility rules, and exactly what types of services it has decided to offer.

Understanding Medicaid's Role in Long-Term Care

To figure out if Medicaid can help pay for in-home care, you first need to understand how the program is built. It’s not one giant, single system. Instead, Medicaid is a partnership between the federal government and each individual state, which is why rules and services can look so different depending on where you live.

Think of it like a franchise. The federal government is the main headquarters—it sets the core rules and provides a big chunk of the money. But each state is a local franchisee, free to adapt its program to meet the specific needs of its own residents.

This unique setup creates two different kinds of benefits: the ones every state must offer, and the ones they can choose to offer.

Mandatory vs. Optional Benefits

Every state’s Medicaid program is required to cover a list of core services called mandatory benefits. These are the essentials, like doctor’s appointments, hospital stays, and lab work. They form the non-negotiable foundation of care for everyone on Medicaid.

Here’s the catch: most long-term care services, including the in-home care so many families need, fall into the optional benefits category. This is a critical distinction to understand.

Because these services are optional, each state gets to decide if they’ll offer them, what kind of services they’ll include, and who gets to qualify. It’s the single biggest reason why the question "Does Medicaid cover in-home care?" has such a complicated answer. One state might have a fantastic in-home care program, while its neighbor offers something much more limited.

The Key Takeaway: In-home care is not a federally guaranteed Medicaid benefit. Its availability hinges entirely on the choices your state has made. Your zip code is the most important factor in determining what kind of help you can get.

The Shift Toward Aging in Place

It wasn't always this way. For a long time, Medicaid-funded long-term care was heavily biased toward nursing homes. If a person needed daily help, a facility was often the only option Medicaid would pay for. This approach was not only expensive but also ran counter to what most people actually want—to stay in their own homes.

Over the last couple of decades, there’s been a huge policy shift toward supporting "aging in place." Everyone from policymakers to healthcare providers now recognizes the incredible physical, mental, and emotional benefits of letting people live in familiar surroundings for as long as they can.

As a result, states have started using the flexibility of the Medicaid system to build out robust in-home and community-based care programs. This evolution has turned Medicaid into the single largest payer for long-term care services in the entire country.

Medicaid's Broad Reach

The program’s scale is just massive. Nationally, Medicaid provides coverage for over 72 million people, from infants with disabilities to seniors getting help at home. Its reach shows just how vital it is to our country's healthcare system, especially for those who need long-term support. You can explore more data on Medicaid's demographics from the Pew Research Center.

This commitment to home-based care also makes good financial sense. It’s often much more cost-effective to support someone in their home than in an institution. Plus, it helps create a more stable and higher-quality caregiving workforce, though improving worker pay and support continues to be a major focus.

Ultimately, getting a handle on this federal-state dynamic and the cultural shift toward community-based care is the first step. It explains why in-home care coverage exists at all and why it varies so much from place to place. Now, let's look at who actually qualifies for these benefits.

Who Qualifies for Medicaid In-Home Care Benefits

Figuring out if you or a loved one can actually get help through Medicaid is often the most confusing part of the whole process. It really boils down to clearing two major hurdles: a financial evaluation and a functional needs assessment.

Think of it this way: The financial rules are like getting pre-approved for a mortgage. You have to prove you meet the bank's income and asset requirements just to be in the running. The functional assessment is like getting a prescription from a doctor; a healthcare professional has to officially determine that you need the care. You absolutely have to pass both tests to move forward.

The Financial Eligibility Puzzle

At its core, Medicaid is designed for people with limited financial resources. While each state has its own specific income and asset limits, the basic idea is the same everywhere. These limits can be pretty strict, and they're a common reason why applications get denied.

An applicant's income covers regular money coming in, like Social Security checks, pension payments, or any wages. Assets are things you own, such as money in the bank, stocks, bonds, and any property besides your main home. The good news is that some key assets, like your primary residence (up to a certain value) and one car, usually don't count against you.

In New Jersey, for example, a single person applying in 2024 generally needs an income below $2,829 per month and can't have more than $2,000 in countable assets. These numbers change, so it’s always a good idea to double-check the current limits.

It’s a common myth that you have to be completely broke to get help. Even if your income is a bit too high, states offer programs like a 'spend-down' that can bridge the gap.

A spend-down works a lot like an insurance deductible. If your income is over the limit, you can become eligible by spending that excess amount on your medical bills each month. Once you've "spent down" to the Medicaid income level, your in-home care coverage can kick in for the rest of that month.

The Functional Need Assessment

Passing the financial check is only half the battle. You also have to show that you have a medical need for the kind of care you’d typically get in a nursing home. This is decided through a functional needs assessment, sometimes called a "level of care" evaluation.

A nurse or social worker will conduct this assessment in person. They’ll look at how well the applicant can manage their Activities of Daily Living (ADLs), which are the absolute basics of self-care.

Here are the main ADLs they look at:

- Bathing and Showering: Can you wash yourself without help?

- Dressing: Are you able to get your clothes on and off?

- Eating: Can you feed yourself?

- Toileting: Are you able to use the restroom and manage your own hygiene?

- Transferring: Can you move from a bed to a chair or wheelchair on your own?

- Continence: Can you control your bladder and bowel functions?

The assessor also considers Instrumental Activities of Daily Living (IADLs). These are tasks that are necessary for living independently but aren't quite as fundamental as ADLs. They include things like managing money, preparing meals, light housekeeping, and taking medications correctly.

Putting It All Together

To get approved for in-home care, a person usually has to need help with a specific number of ADLs. The exact number varies by state and the particular program you're applying for. For instance, a state might say you need help with at least three ADLs to be considered at a "nursing home level of care."

A cognitive impairment, like from Alzheimer's or dementia, is also a huge factor. Someone might be physically able to perform ADLs, but if a cognitive issue prevents them from doing so safely or reliably, they can still qualify for care.

Ultimately, this two-part evaluation ensures that Medicaid in-home care goes to the people who truly need significant, ongoing support to stay safe and healthy in their own homes. Getting through these requirements takes some preparation and a clear picture of both your finances and your daily care needs.

What In-Home Care Services Does Medicaid Actually Cover?

Once you’ve wrestled with the eligibility rules, the next big question is a practical one: what specific help can you actually get? Knowing which in-home care services Medicaid covers is absolutely essential for building a care plan that works long-term. While the specifics change from state to state, most programs offer a core set of services designed to help someone live safely and healthily at home.

Think of it this way: the federal government sets up the basic framework for Medicaid, but each state gets to decide the details of its own programs. This is especially true for in-home care, which is mostly funded through state-specific Home and Community-Based Services (HCBS) waivers.

So, while we can talk about what's generally covered, you'll always need to check the specifics of your state's waiver programs to see the full menu of options available.

Personal Care and Homemaker Services

This is the real foundation of most in-home care plans. Personal care services are all about hands-on assistance with Activities of Daily Living (ADLs)—the fundamental tasks of self-care. It’s not about medical treatment; it's about providing the support needed to live with dignity.

On the flip side, homemaker services focus on what are known as Instrumental Activities of Daily Living (IADLs). These are the chores and tasks required to keep a household running smoothly and safely.

You'll often find these services bundled together, including help with:

- Bathing and Grooming: Assistance with showers, getting dressed, and other personal hygiene routines.

- Mobility Assistance: Help moving from a bed to a chair, or just walking safely around the home.

- Meal Preparation: Planning and cooking healthy meals. This can also include help with eating if needed.

- Light Housekeeping: Essential chores like laundry, vacuuming, and keeping living areas tidy.

- Grocery Shopping and Errands: Making sure the kitchen is stocked and other essential errands are handled.

For many older adults and people with disabilities, these services are the bedrock of support that allows them to remain in their own homes instead of moving to a nursing facility.

Skilled Nursing and Therapy Services

Sometimes, daily support isn't enough. For people with more complex health conditions, Medicaid also covers certain medical services that can be provided at home by a licensed professional. This is often called skilled nursing care, and it's a huge benefit for those needing regular medical oversight.

This is a step up from personal care and involves tasks that only a registered nurse (RN) or licensed practical nurse (LPN) can perform.

Here’s a simple way to think about the difference: A personal care aide can remind your mom to take her pills from a pre-sorted pillbox. But only a skilled nurse can give an injection, manage a complex medication schedule, or provide wound care.

Medicaid waivers also frequently cover different therapies to help with recovery or maintain function, such as:

- Skilled Nursing: Wound care, injections, catheter management, and monitoring vital signs.

- Physical Therapy: Helps to restore strength and mobility after an injury or illness.

- Occupational Therapy: Focuses on improving someone’s ability to perform daily tasks.

- Speech Therapy: Assists with communication or swallowing disorders.

These skilled services are what bridge the gap between a hospital stay and a safe, successful recovery at home.

Other Essential Support Services

A truly comprehensive care plan recognizes that support goes beyond just hands-on help. Many state Medicaid programs offer other services that support both the person receiving care and their family caregivers.

One of the most valuable—and often overlooked—services is respite care. This offers temporary relief for family caregivers, giving them a much-needed break to rest and avoid burnout. A substitute caregiver can come for a few hours or even a few days, which is critical for sustaining the family's ability to provide care long-term.

Other vital supports might include:

- Home Modifications: Minor, practical changes to make a home safer, like installing grab bars in the bathroom, building a wheelchair ramp, or adding a stairlift.

- Assistive Technology: Devices that boost independence, like a personal emergency response system (PERS) button.

- Transportation Services: Getting to and from doctor's appointments and other necessary medical visits.

To make it clearer, here's a look at what Medicaid waiver programs often do—and don't—cover.

Commonly Covered vs. Typically Excluded Services

| Service Category | Examples of Covered Services | Examples of Excluded Services |

|---|---|---|

| Personal & Homemaker | Bathing, dressing, meal prep, light housekeeping, errands, mobility help. | 24/7 live-in care, heavy-duty cleaning, yard work, home repairs. |

| Skilled Medical | Wound care, injections, medication management, physical/occupational/speech therapy. | Experimental treatments, cosmetic procedures, services not deemed "medically necessary." |

| Home & Safety | Grab bars, wheelchair ramps, personal emergency response systems (PERS). | Major home renovations, paying for monthly rent or mortgage, utility bills. |

| Support Services | Respite care for family caregivers, non-emergency medical transportation. | Room and board costs, payment for care provided by a spouse, companionship-only services. |

Keep in mind this is a general guide. The only way to know for sure is to explore your state's specific HCBS waiver programs. They will lay out the full list of options available to you or your loved one.

Navigating the Application Process Step-by-Step

Applying for Medicaid to cover in-home care can feel like you're trying to navigate a maze blindfolded. There's so much paperwork, and the waiting can be stressful. But if you break it down into a clear, step-by-step roadmap, the whole journey becomes much more manageable.

Think of it not as one giant hurdle, but as a series of smaller, more achievable tasks. Being organized and knowing what to expect can make all the difference, smoothing out the process and cutting down on delays.

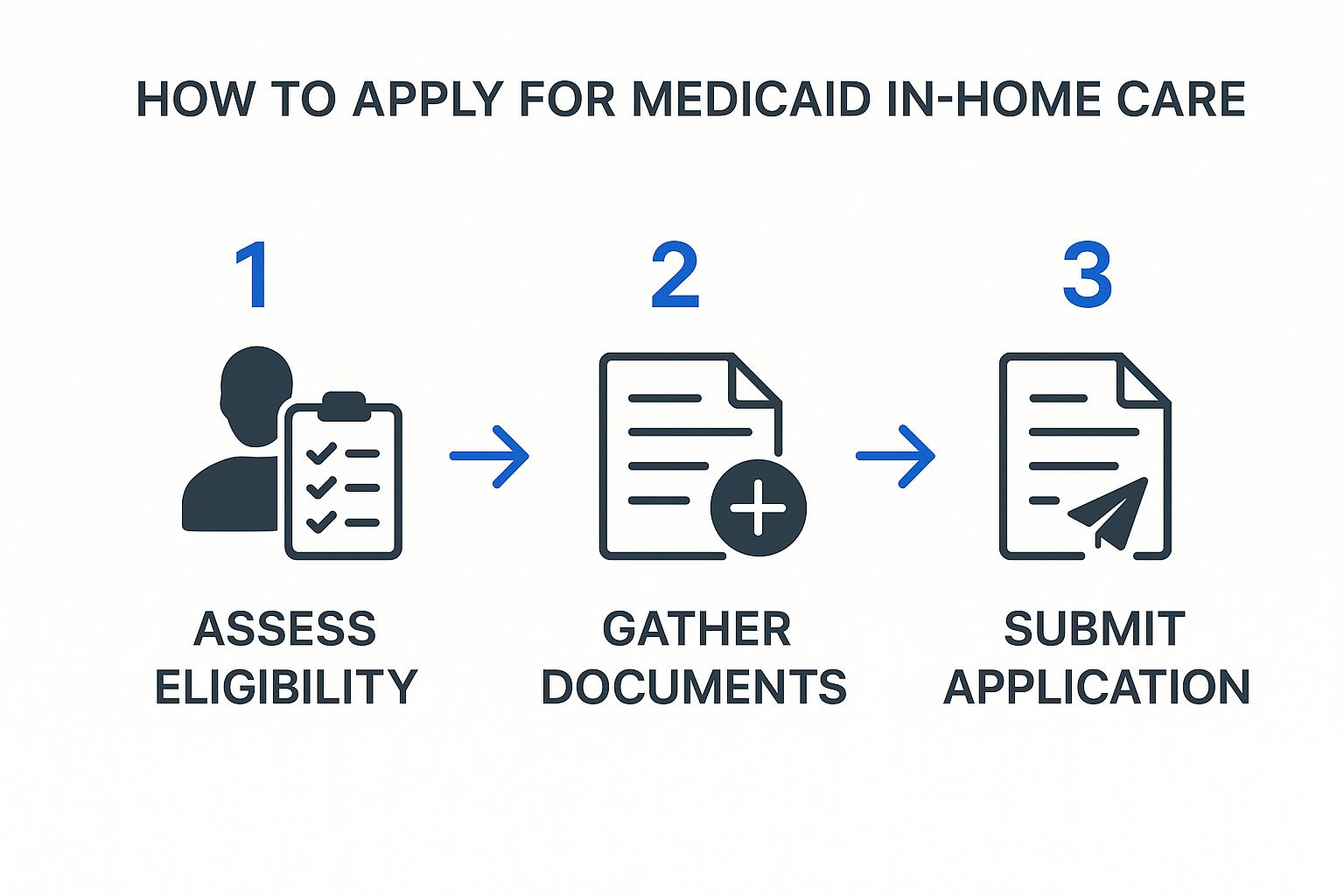

This visual guide shows the first few steps in a simple, three-part flow.

As you can see, it's a sequence of events. Having all your documents ready from the start is the critical bridge between knowing you’re eligible and getting your application successfully submitted.

Step 1: Gather All Your Documentation

Before you even think about filling out a form, the most important thing you can do is gather every single piece of required paperwork. Scrambling to find these items later is a surefire way to cause setbacks. Treat this step like you're preparing for tax season—you need precise, verifiable information right at your fingertips.

This prep work is non-negotiable because Medicaid has to verify everything about your financial situation and your identity. In fact, incomplete information is one of the top reasons applications get delayed or denied.

Here’s a checklist of what you’ll likely need:

- Proof of Identity and Citizenship: Your birth certificate, passport, or a valid driver’s license.

- Proof of New Jersey Residence: Recent utility bills, your lease agreement, or mortgage statements will work.

- Financial Records: This is the big one. Gather recent bank statements for all accounts (checking and savings), proof of all income (Social Security letters, pension statements, recent pay stubs), and details on any assets like stocks, bonds, or property.

- Medical Information: You'll need medical records that document your health condition and, crucially, letters from doctors explaining exactly why you need in-home care.

Step 2: Submit the Initial Medicaid Application

Once your document pile is complete, it's time to fill out and submit the official Medicaid application. You can usually do this online through the state's portal, by mail, or in person at your local County Board of Social Services. The form will ask for in-depth details about your household, income, assets, and health.

Be meticulous here. Double-check every single entry for accuracy. Even a tiny mistake can create a processing headache. If you feel overwhelmed, organizations like the Area Agency on Aging or an elder law attorney can be invaluable resources.

Key Insight: Pay close attention to the date you submit your application. If you're approved, Medicaid coverage can sometimes be made retroactive for up to three months before your application date. This could potentially cover recent medical bills, so getting your application in promptly is incredibly important.

Step 3: Request and Complete the Functional Assessment

Submitting the main application is just the beginning. You also have to formally request an assessment for long-term care services. This tells Medicaid that you aren't just looking for basic health insurance—you need hands-on support to continue living at home. This is often a separate form or may require a call to a specific long-term care office.

After your request is processed, a nurse or social worker will schedule a time to visit you in person. During this evaluation, they’ll assess your ability to handle Activities of Daily Living (ADLs) and Instrumental Activities of Daily Living (IADLs). Their goal is to determine your official "level of care." Being open and honest during this assessment is the best way to paint a clear picture of the support you truly need.

Step 4: Await a Decision and Choose a Provider

With your assessment complete, the whole application package goes into review. This is where patience comes in. It can take several weeks, or sometimes even a few months, to get a final decision. It's also good to know that some waiver programs have waiting lists, even for people who have already been approved.

If you are approved, you’ll receive an official notice that spells out the services you’re eligible for and the number of care hours you’ve been authorized to receive. The final step is to choose a state-approved home care agency, like NJ Caregiving, to provide your care. From there, you'll work directly with the agency to create a personalized care plan and get your caregivers scheduled.

What to Do if Your Home Care Application Is Denied

Getting a denial letter after a long wait for a Medicaid in-home care decision is a gut punch. It's frustrating and can feel like a dead end, but it's important to know this isn't necessarily the final word.

Think of a denial as the start of a conversation, not the end of one. You have every right to challenge the decision. The first thing you need to do is read that denial notice, front to back. It’s legally required to tell you exactly why you were turned down. That reason is your roadmap for an appeal.

Common Reasons for Denial

Most of the time, Medicaid home care denials boil down to a few common issues. If you can figure out which category your denial falls into, you'll know exactly what kind of evidence you need to gather to fight back.

- Financial Ineligibility: This is a big one. You might be just a little bit over the very strict income or asset limits.

- Insufficient Level of Care: The state's assessment may have determined that you don't meet the "nursing home level of care" requirement, even if you feel you clearly do.

- Missing Documentation: It’s amazing how often simple paperwork errors or a forgotten document can bring the whole process to a halt.

- Failure to Cooperate: If Medicaid asked for more information and didn't get a response in time, that can trigger an automatic denial.

Understanding the Appeals Process

Once you know the why behind the denial, you can kick off the formal appeals process. The single most important factor here is time. Your denial letter will state a clear deadline to file an appeal, usually somewhere between 30 to 90 days. If you miss that window, you may have to start all over again.

To officially start, you'll request what's called a Fair Hearing. This is a legal proceeding where you get to present your side of the story to an impartial administrative law judge. You can bring new evidence, have witnesses like your doctor or caregiver speak for you, and explain why you believe the state's decision was wrong.

A Fair Hearing is your chance to be heard. It lets you paint a much fuller picture of your daily struggles and financial reality—details that might have been lost in the initial paperwork.

Preparing for this hearing is everything. Start gathering all your medical records, get letters from doctors that clearly detail why you need in-home care, and pull together any corrected financial statements.

For really complex situations, especially if the denial was based on tricky financial rules, getting help from an elder law attorney or a local legal aid service can be a game-changer. They live and breathe this stuff and can advocate for you, giving you the best shot at getting the care you need.

Your Top Questions About Medicaid and Home Care, Answered

When you start digging into Medicaid, it’s easy to get lost in the details. A lot of specific questions pop up. Let's tackle some of the most common ones we hear from families trying to figure out in-home care.

Can I Choose My Own Caregiver With Medicaid?

In many cases, yes! This is a huge relief for a lot of families. New Jersey is one of many states with what are often called "self-directed" or "consumer-directed" care programs. They’re designed to give you the driver's seat in your own care.

Instead of an agency sending a stranger to your home, you’re given a budget based on your approved services. With that budget, you can hire, train, and manage your own caregivers. This often means you can hire a trusted friend or even a family member (though typically not a spouse) to provide care. It's an incredible option, but the specific rules and availability really depend on your state and the exact waiver program you're in.

Does Medicaid Pay for 24/7 In-Home Care?

This is a tough one. Getting Medicaid to cover round-the-clock, 24/7 in-home care is extremely rare. This level of support is usually only an option for people with the most severe and complex medical needs—the kind of needs that would otherwise require them to be in a hospital or nursing home full-time.

For most people, a needs assessment will determine a set number of care hours per day or week. While this provides a huge amount of support, it almost never adds up to 24/7 coverage. What families often end up doing is supplementing the Medicaid-funded hours with their own money or coordinating with other family members to fill in the gaps and ensure someone is always there.

The real goal of Medicaid home care is to provide the support needed to live safely at home, not to perfectly replicate the 24/7 supervision of a nursing facility. The hours you get approved for reflect what's considered medically necessary to hit that target.

What Is the Difference Between Medicare and Medicaid for Home Care?

This is probably one of the most common points of confusion, and it’s critical to get it straight. They’re both government programs, but they do completely different things for home care.

-

Medicare: Think of Medicare as short-term medical insurance for recovery. It covers skilled home health care for a limited time, usually after you’ve been in the hospital. The whole point is rehabilitation—things like skilled nursing, physical therapy, or occupational therapy to help you get back on your feet after an illness or injury.

-

Medicaid: On the other hand, Medicaid is the main source of funding for long-term personal care at home. It’s designed for people who need ongoing, non-medical help with daily activities like bathing, getting dressed, or making meals, and who also meet strict financial and functional requirements.

The easiest way to remember it is this: Medicare is for recovering at home, while Medicaid is for living at home long-term.

At NJ Caregiving, we know how tangled these rules can feel, and we're here to help you sort through them. We work with families all over Mercer County to build personalized care plans that make the most of your Medicaid benefits and give your loved one the compassionate support they deserve. If you're trying to figure out your options, contact us today for a free consultation at njcaregiving.com.