When you start looking into senior care for a family member, one of the first questions on your mind is almost always the same: how much is this going to cost? It's a practical question, and understanding the financial side of things is a huge part of planning for the future.

The average cost of in-home care for elderly loved ones typically falls between $27 and $30 per hour. For full-time support, that can quickly add up to over $5,000 a month. But that number isn't set in stone. It can shift quite a bit depending on where you live and the exact kind of help your loved one needs.

What Is the Average Cost of In Home Care for Elderly?

The cost of in-home care isn't a single, fixed price. It's best to think of it as a flexible expense that scales with the level of support your family member requires.

It's a lot like ordering from a menu—you only select the services you actually need. Some families might just want a companion for a few hours a week to help with loneliness and light chores. Others may need round-the-clock medical assistance from a skilled professional. This ability to customize the care plan is exactly why so many families find in-home care to be the right fit.

Breaking Down the Different Types of Care

To get a clearer picture of the costs, it helps to split the services into two main groups: non-medical and medical care. As you might expect, each comes with a different price tag that reflects the caregiver's qualifications and the complexity of their duties.

- Companion and Homemaker Services: This is the most basic level of support. A caregiver helps with things like light housekeeping, preparing meals, running errands, and simply providing companionship. These services are the most affordable starting point.

- Personal Care Assistance: This is a step up, involving hands-on help with what we call Activities of Daily Living (or ADLs). Aides assist with personal tasks like bathing, dressing, grooming, and moving around safely, which helps maintain personal dignity and safety.

- Home Health Care: This is skilled medical care provided by licensed professionals, like a registered nurse or a physical therapist. It can include wound care, giving injections, managing medications, and other therapies ordered by a doctor.

Simply put, the cost goes up as the required skill level increases. A companion's hourly rate will be lower than a certified nursing assistant's (CNA), which in turn will be less than a registered nurse's (RN).

A Quick Look at Average In-Home Care Costs

To help you get a baseline for your budget, the table below provides a snapshot of typical hourly and annual costs for different levels of in-home care. This should give you a quick reference point as you begin planning.

| Type of Care | Average Hourly Rate | Estimated Annual Cost (44 hrs/week) |

|---|---|---|

| Homemaker/Companion Services | $27 | $61,776 |

| Home Health Aide | $28 | $63,936 |

These numbers give you a solid idea of what to expect for consistent, nearly full-time care.

In the United States, the cost of in-home care for elderly individuals is substantial, with average annual expenses hovering around $54,912. While this is a major financial consideration, it remains significantly lower than institutional nursing home care. This cost advantage is a key reason why approximately 90% of seniors prefer to age in place. Discover more insights about U.S. home care industry statistics on nchstats.com.

What Factors Influence Home Care Pricing

Knowing the average hourly rate for senior care is a great first step, but it doesn't really paint the full picture. The truth is, the cost of in home care for elderly loved ones is rarely a one-size-fits-all number because every family's situation is so different. Several key factors come together to shape your final monthly expenses.

Think of it like getting your car serviced. A basic oil change has a pretty standard, predictable price. But if your car needs a full engine rebuild that requires a master mechanic and specialized tools, the cost is going to be worlds apart. In-home care works on a similar principle—the final price tag reflects how complex and intensive the needed support is.

The Level of Care Required

By far, the biggest factor driving the cost is the specific type of care your loved one needs. As the skill level required of the caregiver goes up, so does the hourly rate. This makes sense, as it ensures caregivers are fairly paid for their training, experience, and the significant responsibilities they take on.

Here’s a quick breakdown of how different care levels affect the price:

- Companion Care: This is the most foundational level of support, focused on things like social engagement, emotional support, and helping with light household tasks like making a meal or running to the store. It typically comes with the lowest hourly rate.

- Personal Care: When a senior needs hands-on help with what we call activities of daily living (ADLs)—things like bathing, getting dressed, or moving around safely—the cost goes up. This type of care demands aides with specific training to protect your loved one’s safety and dignity.

- Skilled Nursing Care: If the situation calls for medical services like wound care, administering injections, or monitoring a serious health condition, you'll need a licensed nurse (an LPN or RN). This is the most expensive type of in-home care, and for good reason—it requires advanced medical expertise.

Your Geographic Location

Just like a house in a major city costs way more than one in a small rural town, the cost of care changes dramatically depending on where you live. A caregiver in a high-cost-of-living area like Princeton, NJ, will naturally command a higher hourly rate than one in a more affordable part of the country.

Between January 2020 and September 2024, the national price index for home care shot up by over 35%. This means that the budget that would have covered 12 hours of care just a few years ago might now only get you about eight hours. It makes understanding your local market more critical than ever.

State and local wage laws also play a huge part. For instance, states with higher minimum wages or specific overtime rules for domestic workers will see those costs baked into agency pricing. This is exactly why national averages are just a starting point for your financial planning.

Agency vs. Independent Caregivers

Another fork in the road that directly impacts your costs is whether you hire through a home care agency or find an independent caregiver on your own. Each route has its own set of financial and logistical pros and cons.

| Feature | Home Care Agency | Independent Caregiver |

|---|---|---|

| Cost | Higher hourly rate | Typically lower hourly rate |

| Management | The agency handles payroll, taxes, and scheduling | You become the employer and manage everything |

| Vetting | Caregivers are background-checked and insured | You are responsible for all screening and vetting |

| Backup Care | The agency finds a replacement if a caregiver is sick | You have to find a backup on your own |

While hiring an independent caregiver can look cheaper on paper, it turns you into an employer with a whole new set of responsibilities. An agency like NJ Caregiving rolls costs like insurance, ongoing training, and administrative oversight into its rates. For many families, that built-in safety net provides invaluable peace of mind when navigating the complexities of senior care.

The Financial Reality of 24-Hour Home Care

When a loved one’s needs become constant, requiring supervision and help around the clock, the conversation naturally turns to 24-hour home care. This level of support offers incredible peace of mind for families, but it’s also a major financial step that requires a clear-eyed look at the costs involved.

For many, this is the most intensive—and most expensive—form of in-home support you can get. Moving from part-time help to round-the-clock care isn't just a small adjustment; it's a huge leap in both service and expense. Getting a handle on the numbers is the first step toward building a plan that works for the long haul.

Decoding the Cost of Constant Care

So, what makes 24-hour care so expensive? It’s pretty straightforward: you’re paying for 168 hours of professional support every single week. This isn’t one person pulling a very long shift. It's a coordinated team of caregivers working in rotation to make sure someone is always awake, alert, and ready to help, whether it’s 2 in the afternoon or 2 in the morning.

This continuous coverage is absolutely critical for seniors with advanced dementia, serious mobility challenges, or complex health conditions that make it unsafe for them to be alone. The cost simply reflects the professional labor needed to provide that constant, reliable safety net.

When you start looking at the numbers, the median monthly cost can be a bit of a shock. In the U.S., you're looking at approximately $18,144, with a typical range falling between $15,000 to over $25,000. This all depends on where you live and the specific level of care needed. For example, in major cities like Boston, those rates are often higher, pushing the annual cost well over $200,000. You can find a deeper dive into the cost of 24/7 in-home care at globalonehomecare.com.

Live-In Care vs. Shift-Based Care

It’s really important to know the difference between the two main ways round-the-clock support is provided. They have different structures and, crucially, different price points. Figuring this out is key to finding the right fit for your family and your budget.

- 24-Hour Shift Care: This setup uses multiple caregivers (usually two or three) who work in 8- or 12-hour shifts. This guarantees that the caregiver on duty is always awake and attentive. It’s the most comprehensive option, and also the most expensive.

- Live-In Care: In this arrangement, one caregiver actually lives in the home. They are given a private space and are expected to get a full night's sleep (usually about 8 hours). They can help with brief needs during the night, but they aren't awake the whole time. This is often a more budget-friendly choice than shift care.

A key consideration is the nature of nighttime needs. If your loved one frequently wakes up disoriented or requires assistance multiple times during the night, the shift-based model is often necessary to prevent caregiver burnout and ensure consistent, high-quality care.

Choosing between these two models comes down to an honest look at your loved one’s condition. While live-in care can lower the cost of in home care for elderly individuals who just need someone present, it might not be enough for those with unpredictable sleep patterns or urgent medical needs that pop up overnight.

How Your Location Affects Senior Care Expenses

Think about how the price of gas or a gallon of milk changes from one town to the next. The cost of in home care for elderly loved ones works the same way, only on a much larger scale. In fact, where you live is one of the biggest factors that will determine your family's budget for senior care.

It’s not just a small difference, either. The gap can be massive. A caregiver in a busy city is going to have a very different hourly rate than one in a quiet, rural town. For families trying to plan for the long haul, getting a handle on these regional price differences is absolutely essential. It helps you set a realistic budget and can even influence big life decisions, like where a parent might choose to spend their retirement years.

Why Does Location Matter So Much?

So, what's behind these dramatic price swings? It really boils down to a few core economic realities that create a unique financial picture for senior care in every single state and city.

The biggest driver is the local cost of living. It’s simple, really: in places where housing, food, and transportation cost more, caregivers need to earn more just to get by. That higher wage naturally gets passed on, leading to higher hourly rates from home care agencies.

State and local labor laws also play a huge part.

- Minimum Wage Laws: States with a higher minimum wage floor automatically have a higher starting point for care costs.

- Overtime Rules: Specific regulations about overtime pay for home care workers can really add up, especially for families who need round-the-clock or extensive care.

- Caregiver Supply and Demand: In some areas, there's a real shortage of qualified, professional caregivers. When more families need help than there are caregivers available, agencies have to offer better pay to attract and keep good people.

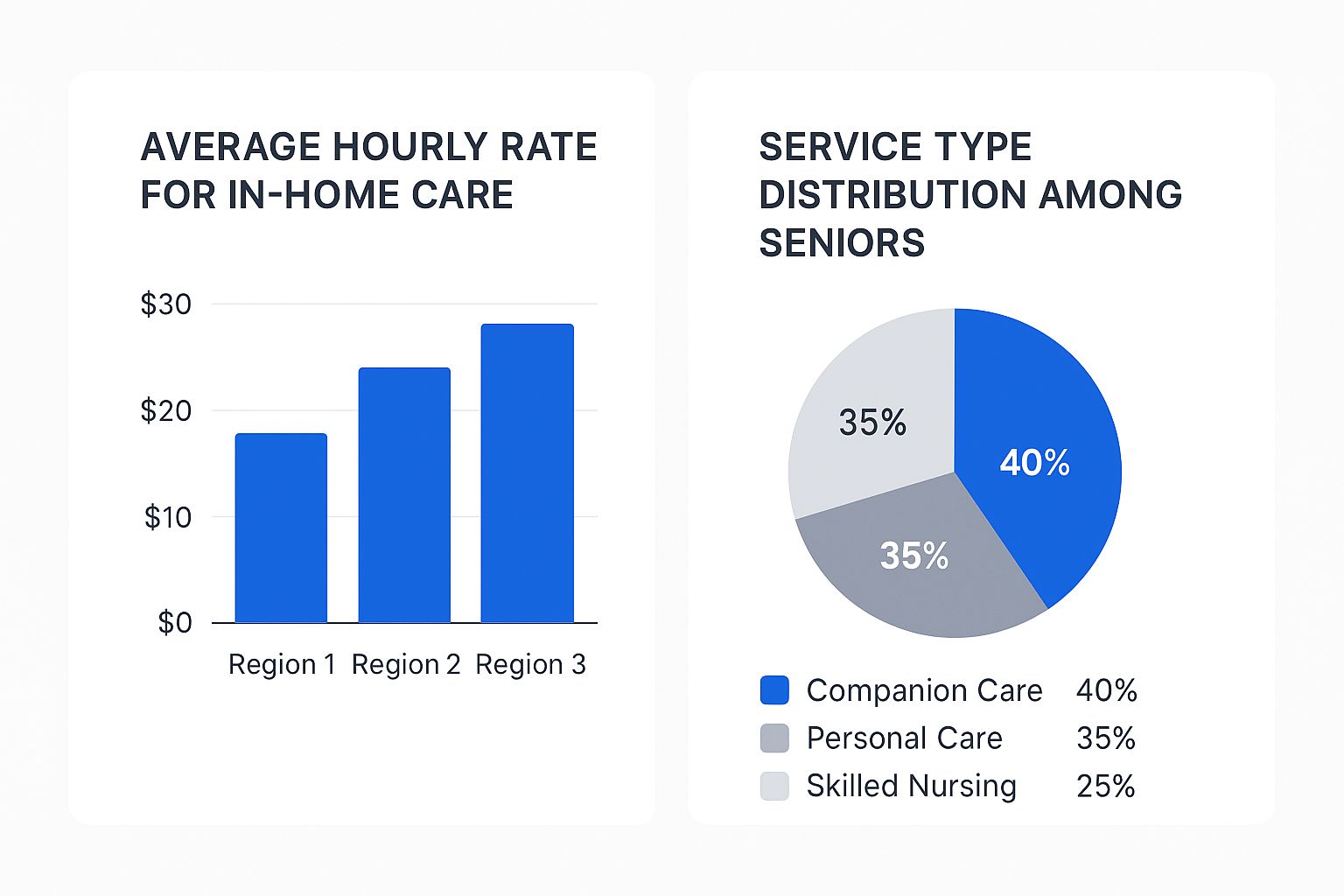

This infographic breaks down how much average hourly rates can differ by region and shows the kinds of services most families are looking for.

As you can see, it’s not just about the cost—it's also clear that the vast majority of seniors are using non-medical companion and personal care to help them live safely at home.

A Look at State-by-State Differences

To really see what this means in dollars and cents, let’s look at how wildly the average monthly costs can swing across the U.S. A family in a state like Washington could easily pay thousands more each month than a family in Alabama for the exact same level of care.

The national median monthly cost for a home health aide hovers around $5,148. But that number can be really deceptive. It hides the extremes, with some states seeing costs climb well over $6,000 per month while others stay comfortably below $4,000.

These figures make it crystal clear why you can't rely on a national average when you're trying to budget. The only numbers that truly matter are the ones in your local area.

To give you a better feel for this financial spectrum, the table below compares average monthly in-home care costs in a handful of states.

State-by-State Comparison of In-Home Care Costs

Here’s a snapshot of how much monthly costs for a home health aide can vary, highlighting just how significant the regional differences are.

| State | Average Monthly Cost | Comparison to National Average |

|---|---|---|

| Washington | $6,578 | Significantly Higher |

| Colorado | $6,387 | Significantly Higher |

| New Jersey | $5,529 | Higher |

| Illinois | $5,339 | Slightly Higher |

| Texas | $4,576 | Lower |

| Georgia | $4,290 | Lower |

| Alabama | $3,813 | Significantly Lower |

| Louisiana | $3,623 | Significantly Lower |

This side-by-side comparison makes it obvious: where you call home has a direct and powerful impact on whether aging in place is an affordable option.

Urban vs. Rural: The Local Divide

Even inside the same state, costs can be a rollercoaster. Big cities and their surrounding suburbs almost always have higher care costs than the state's smaller towns and rural communities. This is again due to a higher cost of living and more competition for services in those densely populated areas.

But there's a flip side. While rural areas might look cheaper on paper with lower hourly rates, they can sometimes have a shortage of available caregivers or specialized services. That can make finding consistent, high-quality care a real challenge, even if it seems more affordable at first glance. Understanding this local push-and-pull is a critical part of making the best choice for your family.

Exploring Ways to Pay for In Home Care

Once you have a handle on the potential costs, the next big question is a practical one: how do we actually pay for this? The sticker shock can feel overwhelming, but it’s important to know that most families use a combination of resources to cover the cost of in home care for elderly loved ones.

Think of it like funding a college education. Very few people pay the entire bill from a single savings account. Instead, they pull from a mix of scholarships, loans, personal savings, and maybe a part-time job. Financing senior care works in a similar way; it's about exploring every available avenue to build a plan that works for the long haul.

Unpacking Government and Public Programs

Many families first look to public programs for help. While these programs are a vital lifeline for many, they come with specific rules and limitations that are crucial to understand right from the start.

-

Medicare and Its Limits: This is probably the biggest misconception out there. Many people assume Medicare will cover long-term in-home care. The reality is, traditional Medicare does not pay for non-medical, custodial care—the day-to-day help with bathing, dressing, or meals. It’s designed to cover short-term, skilled medical care at home, usually right after a hospital stay and only when ordered by a doctor.

-

Medicaid Waiver Programs: Unlike Medicare, Medicaid is a joint federal and state program for individuals with limited income and assets. Many states have Home and Community-Based Services (HCBS) waivers that can cover personal care costs. The goal is to allow seniors to stay at home instead of moving into a nursing facility. Be prepared, though—eligibility is strict and often involves a pretty lengthy application process.

-

Veterans Benefits: If your loved one served in the military, the Department of Veterans Affairs (VA) offers several helpful programs. The most well-known is the Aid and Attendance benefit. This can provide a monthly pension to eligible veterans and their surviving spouses to help pay for long-term care services.

Leveraging Private Funding Sources

Beyond government aid, a variety of private payment options can fill in the gaps. These resources often give you more flexibility and control over the kind of care your loved one gets.

A study from the U.S. Department of Health and Human Services found that about two-thirds of adults aged 65 and older who are not on Medicaid could fund at least two years of paid home care using only their income and easily accessible financial assets.

This really highlights just how much personal finances come into play when planning for care.

Here are the most common private funding strategies people use:

-

Long-Term Care Insurance: This type of insurance is designed specifically to cover services like in-home care, assisted living, or nursing homes. Policies can vary a lot in what they cover, how much they pay out per day, and how long you have to wait before benefits kick in (the "elimination period"). If your loved one has a policy, it can be a powerful tool for managing expenses.

-

Personal Savings and Assets: This is the most straightforward method. Many families lean on retirement funds, pensions, savings accounts, and annuities to pay for care out-of-pocket. It offers the most flexibility, but you'll need to budget carefully to make sure the funds last as long as they're needed.

-

Reverse Mortgages: For homeowners aged 62 or older, a reverse mortgage can turn a portion of their home equity into cash payments. This can create a steady stream of income to pay for care, but it’s a complex financial move. It has significant long-term implications, so it's definitely something to discuss with a trusted financial advisor.

Finding the right mix of these options is the key to creating a plan that protects your loved one’s well-being without putting an unsustainable financial strain on the family. It's often a good idea to talk with a financial planner or an elder law attorney who can offer personalized guidance for your unique situation.

Actionable Tips for Managing Care Costs

Figuring out the financial side of elder care can feel overwhelming, but a little proactive planning can make a world of difference. Getting a handle on the cost of in home care for elderly loved ones isn't about finding one silver bullet solution. It’s about combining a few practical strategies to build a plan that works for the long haul.

Think of it like you would your own household budget. You clip coupons, shop for better insurance rates, and find ways to lower the utility bills. The same mindset applies here. A handful of smart, intentional choices can add up to real savings over time, all without cutting corners on the quality of care.

Create a Detailed and Dynamic Care Plan

The first and most important step is to make sure you’re not paying for services your loved one doesn't actually need. Sit down with your care provider and map out a highly specific plan that details the exact tasks and hours required. A vague plan is a recipe for paying for a caregiver's downtime or for help that isn't necessary.

And remember, this plan isn't set in stone. As your loved one's needs evolve, so should their care plan. Setting up regular check-ins—maybe once a quarter—is a great way to adjust services up or down. This ensures you're always paying for the precise level of support they need right now.

Explore Hybrid Care Models

You don't have to go all-in on professional care or try to do everything yourself. A hybrid model, where you blend professional services with support from family and friends, is often the most affordable and emotionally supportive path forward. This lets you bring in a professional for the heavy lifting while family steps in for companionship or lighter duties.

Here are a few ways a hybrid model can work:

- Professional Care for Mornings and Evenings: Hire a paid caregiver for the crucial routines like bathing, dressing, and getting meals ready during the busiest parts of the day.

- Family and Friends for Afternoons: Family members can then cover the less intensive afternoon shifts, offering companionship, running errands, or providing rides to appointments.

- Technology as a Supplement: Smart-tech like remote monitoring systems, automatic pill dispensers, and emergency alert devices can add an extra layer of safety when no one is physically there.

This approach gives you the best of both worlds: professional expertise where it counts and the irreplaceable comfort of family, all while keeping your budget in check.

Affordability is a global challenge. Across many developed nations, high out-of-pocket expenses put nearly half of older adults with significant care needs at risk of poverty, consuming on average 70% of their median income. This widespread financial strain underscores the importance of finding creative and sustainable ways to manage care expenses. Learn more about global care affordability from the OECD.

Leverage Community and Financial Resources

Never underestimate the power of the resources right in your community. Local and national organizations are out there specifically to help seniors and their families, offering everything from direct financial aid to guidance on subsidized services.

- Contact Your Local Area Agency on Aging (AAA): This should be your first call. It’s a gateway to a ton of local programs like meal delivery, transportation services, and even respite care grants that can seriously lower your overall costs.

- Investigate Tax Deductions: You might be surprised by the tax benefits available. If you're providing significant financial support for a parent, you could potentially claim them as a dependent. Medical expenses for in-home care can also be deductible if they pass a certain threshold of your income. It's always best to talk to a tax professional to see what you qualify for.

- Negotiate Rates and Schedules: Don't be shy about having a frank conversation with your care agency. While their hourly rates might be set, they may have some wiggle room on scheduling or minimum hour requirements that could help trim your weekly bill.

Answering Your Top Questions About Home Care Costs

Thinking about the financial side of care can bring up a lot of questions. It's completely normal. Below, we’ve put together some straightforward answers to the most common things families ask when they start exploring the cost of in home care for elderly loved ones.

Is It Cheaper to Hire an Independent Caregiver Than an Agency?

At first glance, hiring a caregiver privately often seems cheaper on an hourly basis. That's because agencies have built-in costs for things like caregiver insurance, extensive background checks, ongoing training, and all the administrative work that keeps things running smoothly.

But when you hire someone independently, you become the employer. That means you're on the hook for payroll taxes, liability insurance, and the big one—finding backup care when your caregiver calls in sick. For many families, the slightly higher agency cost is well worth the security and total peace of mind that comes with it.

Does Medicare Cover In-Home Care Services?

This is a huge point of confusion for so many people, so let's clear it up. Traditional Medicare does not pay for long-term, non-medical care. This is the kind of help that covers daily activities like bathing, getting dressed, or making meals, often called "custodial care."

Where Medicare might step in is for short-term, skilled home health care—but only if it's ordered by a doctor, typically right after a hospital stay. It's not designed to be a funding source for ongoing personal or companion care.

Are Home Care Expenses Tax-Deductible?

Yes, they can be, which can provide some welcome financial relief. If you're paying for more than half of your parent's support and they meet certain income rules, you might be able to claim them as a dependent.

Also, if the care expenses are for medically necessary services, they can often be deducted as medical expenses, as long as they add up to more than a certain percentage of your adjusted gross income. Your best bet here is always to chat with a tax professional who can look at your specific situation.

What Is Respite Care?

Think of respite care as a helping hand for the primary family caregiver. It’s short-term relief that provides a much-needed break, allowing you to rest, run errands, or even take a vacation while a professional caregiver steps in. It's a vital tool for preventing caregiver burnout and can be set up for just a few hours, a full day, or even a few weeks at a time.

At NJ Caregiving, we know these questions are just the start of the conversation. Our team is here to bring clarity and compassionate support to your family as you figure out the best path forward. Let us show you how we can create a personalized and affordable care plan for your family. Learn more by visiting us at https://njcaregiving.com.