Understanding NJ Medicaid for Seniors: Your Healthcare Safety Net

For many older adults, the idea of government benefits can seem complex or even like a final option. However, it's more helpful to see NJ Medicaid for seniors as a vital healthcare safety net, designed to protect your independence and ensure you get essential care in your later years. It’s much more than a simple insurance card; it’s a program created to support your quality of life, shield your family from overwhelming costs, and offer valuable peace of mind.

Think of it less as a handout and more like a foundational support system, much like how Social Security offers financial stability during retirement. This program is especially important when facing the high expenses of long-term care. Many families mistakenly think they have to spend their entire life savings before getting help. In reality, NJ Medicaid provides a clear path to receive care without giving up everything you've worked so hard to build.

Beyond Basic Medical Bills: What Medicaid Truly Offers

The true strength of NJ Medicaid for seniors is its focus on overall well-being. While it certainly covers doctor appointments and hospital visits, its greatest effect is often seen through its long-term services and supports (LTSS). These are the benefits that help seniors live with dignity in the environment that is best for them.

Key areas of support include:

- Nursing Home Care: When round-the-clock medical care becomes necessary, Medicaid covers the significant expense of a nursing facility.

- Home and Community-Based Services (HCBS): This is a game-changer for anyone wanting to age in place. It pays for services like in-home nursing, personal care aides, and adult day care.

- Prescription Drugs: It helps with the cost of essential medications, relieving a major financial pressure for many seniors.

- Specialized Medical Equipment: This covers items needed at home, such as hospital beds, walkers, or oxygen equipment.

The scale of this support is substantial. To get an idea of how crucial this program is, consider that as of August 2024, New Jersey's Medicaid program covered about 1,937,011 people, which is roughly 18% of the state's population. With long-term care making up 16% of the state's $21.2 billion in Medicaid spending, it's evident how many seniors depend on these services to afford necessary care. You can find more detailed information in this fact sheet about Medicaid in New Jersey.

Dispelling Myths and Building Confidence

A common misunderstanding is that applying for Medicaid is a sign of giving up. In truth, it is a smart financial and healthcare choice. Seniors all over New Jersey have used the program to get specialized dementia care, receive help with daily tasks at home, and ensure a spouse is not left financially ruined by care costs. By learning the basics of how NJ Medicaid for seniors works in the real world—not just in theory—you are taking the first and most critical step. This knowledge prepares you to make sound decisions, ensuring your healthcare future is safe and secure. For a better understanding of how we can help, take a look at our NJ Caregiving guide for more details.

Qualifying for NJ Medicaid: Eligibility Made Simple

Trying to figure out the rules for NJ Medicaid for seniors can feel like trying to put together a complicated puzzle. The official guidelines often seem confusing, making families worry they won’t be able to get help. However, the core requirements are much simpler than they appear. The process really comes down to two key areas: your monthly income and your countable assets.

Think of it like this: Medicaid needs to see that your financial situation fits within specific limits before it can provide support. It's not about being penniless; it’s about meeting certain thresholds designed to assist those with the most significant need. Many families are relieved to discover that the rules are more flexible than they initially thought.

A common worry is the fear of losing your home, but this is one of the biggest myths about Medicaid. In New Jersey, your primary residence is generally considered an exempt asset as long as you or your spouse lives there, or you plan to return. The same often goes for one car, personal items, and household furniture. These things are not counted when determining your eligibility.

Breaking Down the Numbers: Income and Asset Limits

So, what exactly does the state look at? While the specific numbers are updated from time to time, the basic structure stays the same. The officials from the NJ Caregiving program will focus on two main categories when you apply.

- Income Limits: This is the total money you receive each month from sources like Social Security, pensions, and retirement funds.

- Asset Limits: These are your "countable" resources, which include money in bank accounts, stocks, bonds, and any real estate other than your main home.

To help you understand these financial requirements, we've put together a table outlining the typical limits for seniors seeking long-term care services.

| NJ Medicaid Income and Asset Limits for Seniors |

| :— | :— | :— | :— |

| Category | Individual Limit | Married Couple Limit | Special Considerations |

| Monthly Income Limit | $2,829 (as of 2024) | $5,658 (if both spouses apply) | Income rules vary if only one spouse needs care. |

| Countable Asset Limit | $2,000 | $3,000 (if both spouses apply) | Your primary home, one car, and personal belongings are usually exempt. |

| Spousal Protections | N/A | The spouse not needing care can keep a higher portion of assets and income. | These spousal impoverishment provisions protect the at-home spouse from financial hardship. |

Disclaimer: These figures are for informational purposes and can change. Always confirm the latest numbers with your local County Board of Social Services.

This table shows that while the limits are specific, there are important protections in place, especially for married couples. The goal is to provide care without leaving the at-home spouse financially insecure.

What if You’re Over the Limit? The "Spend-Down" Strategy

Seeing these numbers can be discouraging if your savings are above the limit. But this is where planning makes a difference. You aren't expected to just give your money away. Instead, you can "spend down" your extra assets on valid expenses, which allows you to become eligible by paying for things that benefit you or your spouse.

Examples of approved spend-down expenses include:

- Paying off a mortgage, credit card debt, or car loan.

- Making home modifications for safety, like installing a wheelchair ramp or a stairlift.

- Pre-paying for funeral and burial arrangements.

- Buying essential medical equipment not covered by other insurance.

For married couples where only one person needs care, special rules called spousal impoverishment provisions protect the "community spouse" (the one living at home). These rules let the healthy spouse keep a larger share of the couple's income and assets. This ensures they are not left in a difficult financial position. Understanding these options is a key step in securing NJ Medicaid for seniors without giving up everything you've built.

What NJ Medicaid Covers: Benefits That Transform Lives

Once you qualify for NJ Medicaid for seniors, you gain access to a powerful set of benefits created to support your health and well-being. This coverage isn't just a basic safety net for doctor appointments; it's a complete system designed to address the real-life health challenges older adults often encounter. Think of it as a toolkit filled with different supports you can use to build a secure and healthy future, from essential medical care to services that help you live comfortably at home.

The program’s most significant value is often found in areas where costs can be financially crushing for families. The most critical of these is long-term care, a benefit that provides a lifeline when daily assistance becomes a necessity. This is where Medicaid truly steps in to protect your life savings from being entirely used up by healthcare expenses.

Core Medical and Long-Term Care Benefits

The benefits available through NJ Medicaid are extensive, covering nearly every aspect of healthcare. For seniors, the most valuable services are frequently those that provide ongoing support for chronic conditions and daily living needs.

Here’s a breakdown of the key coverage areas:

- Doctor and Hospital Visits: This includes your primary care check-ups, appointments with specialists like cardiologists or rheumatologists, and stays in the hospital.

- Prescription Drugs: Medicaid helps cover the costs of most necessary medications, offering huge financial relief for those managing ongoing health issues.

- Durable Medical Equipment (DME): This covers important items like hospital beds for home use, walkers, wheelchairs, and oxygen tanks.

- Preventive Services: The program pays for routine screenings, shots, and wellness visits designed to keep you healthy and detect problems early.

- Dental, Vision, and Hearing: Basic dental work, eye exams, glasses, and hearing aids are often included benefits.

However, the foundation of NJ Medicaid for seniors is its strong support for long-term care. This is a vital area, as shown by the fact that about 75% of nursing home residents in New Jersey rely on Medicaid to pay for their care. The federal government works with the state, sharing the cost to make sure these services are available. You can explore insights on Medicaid's role in New Jersey to learn more about this financial partnership.

Aging in Place: Home and Community-Based Services (HCBS)

While many people connect Medicaid with nursing homes, the program has made great progress in helping seniors stay in their own homes. Through programs like Managed Long-Term Services and Supports (MLTSS), Medicaid provides funds for services that allow you to live on your own for as long as possible.

These Home and Community-Based Services (HCBS) can include:

- Personal Care Assistance: Help with daily activities such as bathing, getting dressed, and preparing meals.

- Skilled Nursing at Home: Visits from a registered nurse for medical needs like wound care or managing medications.

- Adult Day Health Services: Supervised care in a group setting, which offers social activities and health services during the day.

- Transportation Assistance: Rides to and from your medical appointments.

- Home Modifications: Small changes to your home, like installing grab bars or a wheelchair ramp, to make it safer and easier to get around.

These services mark a fundamental change in how we approach elder care, focusing on dignity and independence. Instead of making it necessary for a senior to move into a facility, NJ Medicaid brings the support directly to them. This method not only improves quality of life but also lines up with what most seniors want: to remain in the familiar comfort of their own homes. By understanding these benefits, you can champion the care that best suits your needs and goals.

County-by-County Differences: Location Matters for Coverage

While NJ Medicaid for seniors is a program that operates statewide, how you experience its benefits can feel very different from one county to the next. Think of it like a major pizza chain; the core recipe is the same everywhere, but the final product often depends on the local franchise. Similarly, the availability of Medicaid doctors and services is shaped by local conditions in each of New Jersey’s 21 counties.

Your zip code can influence everything from the number of local doctors accepting Medicaid to the specific community-based programs you can access. This isn't because the rules change, but because factors like population density and the local healthcare system create different realities. A senior in a busy urban area like Hudson County might find many clinics nearby but also face longer waits. On the other hand, someone in a rural county like Sussex may have fewer choices close to home, meaning they might need to travel for specialized care.

These regional differences aren't just stories; they are supported by data showing how communities use the program. The demand for NJ Medicaid for seniors can be particularly strong in certain areas. For example, in Atlantic County, the senior Medicaid coverage rate is about 21.6%, meaning over one in five older adults there relies on these benefits. Such statistics show how local economic and demographic factors influence healthcare needs. You can discover more insights about Medicaid coverage across New Jersey counties to see how your community compares.

Navigating Your Local Healthcare Landscape

Knowing about these county-specific differences is the first step to making your Medicaid benefits work effectively for you. It requires a bit of planning to ensure you get quality care, regardless of where you live. For families in areas with fewer providers, taking a proactive approach is crucial.

Here are a few practical ways to manage geographic hurdles:

- Use Telehealth: Many specialists now offer virtual appointments, which can save you a long trip. Don't hesitate to ask your doctor if telehealth is an option for routine check-ins.

- Plan Your Travel: For essential in-person visits with specialists, it might be worthwhile to travel to a nearby county with more healthcare facilities. Medicaid can often help cover transportation costs.

- Work With Your MCO: Your Managed Care Organization (MCO) is an important ally. They keep lists of in-network doctors and can help you locate specialists who accept Medicaid in your area or just outside it.

- Find Local Resources: Groups like NJ Caregiving, which serves Mercer County, can offer valuable local knowledge about the best providers and services available near you.

By actively researching your choices and thinking outside the box, you can assemble a strong support network. Your location might present some challenges, but it doesn't have to define the quality of your healthcare.

Applying for NJ Medicaid: Your Step-by-Step Roadmap

Facing the Medicaid application can feel like a major hurdle, but with the right preparation, it's a process you can manage successfully. Instead of getting bogged down in stories of endless paperwork, think of it as assembling a complete puzzle. Each piece of information and documentation is crucial to creating a full picture for the eligibility worker.

The first and most important step is organization. Before you fill out a single form, gather all your essential documents in one place. This preparation prevents the frustrating back-and-forth that often causes long delays. You wouldn’t start baking a cake without getting all the ingredients out first—the same idea applies here.

Choosing Your Application Path

Once you have your documents ready, you need to decide how you’ll apply. New Jersey provides a few different ways to submit your application, so you can choose the one that best fits your comfort level and need for assistance.

- Online Application: If you're comfortable using a computer, applying through the NJ FamilyCare website is usually the fastest route. It allows you to upload documents electronically and check your application status online.

- By Mail: For those who prefer having physical copies, you can download, print, and mail a completed application to your county’s Board of Social Services.

- In-Person: If you want direct, hands-on help, applying in person at your local Mercer County office is a great option. Staff members are available to answer your questions and review your application for completeness before you submit it.

No matter which method you pick, the fundamental requirements are the same. The goal is to provide a clear and accurate look at your financial and personal circumstances. After you submit, the state may take up to 45 days to review your case, or up to 90 days if a disability determination is required.

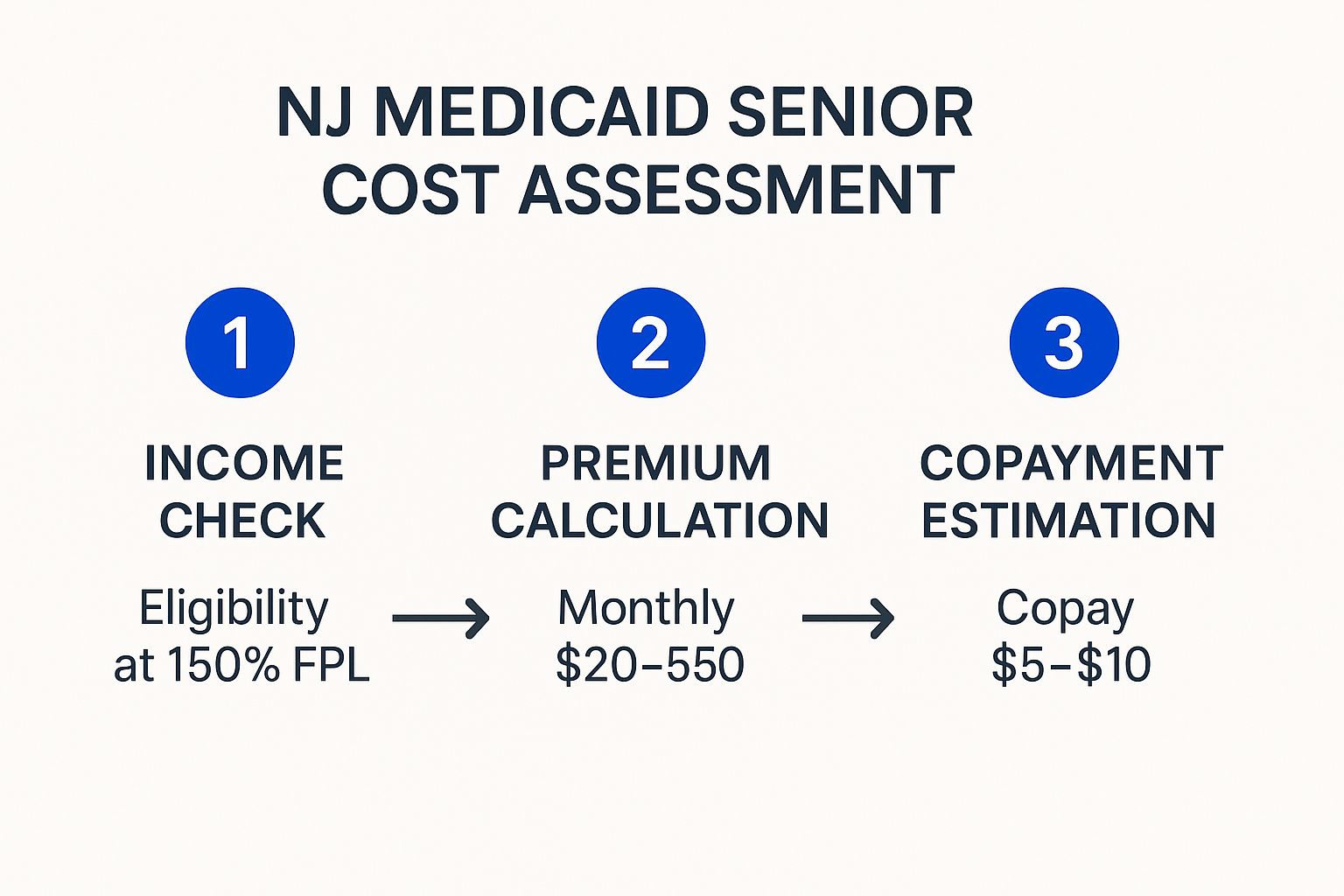

This simple infographic breaks down the basic financial assessments involved in the process.

This visual helps clarify how the state looks at your finances to determine eligibility and potential costs, giving you a better idea of what to expect.

Preparing for the Eligibility Interview and Document Requests

After submitting your application, you will likely have an interview with a caseworker, which could happen over the phone or in person. This isn't an interrogation; it's simply a conversation to confirm the details you provided. Be ready to answer questions about your income, assets, and household situation honestly.

To help you get ready, here's a checklist of the documents you'll need to have on hand. Preparing these items ahead of time will make the entire process much smoother.

| Document Category | Specific Items Needed | Where to Obtain | Special Notes |

|---|---|---|---|

| Proof of Identity & Age | Birth certificate, U.S. Passport, Driver’s License, State ID card | Vital records office, DMV, U.S. Department of State | Must be current and valid. Photocopies are usually acceptable. |

| Proof of Citizenship | Birth certificate, U.S. Passport, Naturalization Certificate | Vital records office, U.S. Department of State, USCIS | Required for all U.S.-born and naturalized citizens. |

| Proof of Residency | Utility bills (gas, electric, water), lease agreement, property tax bill | Utility companies, landlord, municipal tax office | Must show your name and a Mercer County address. |

| Income Verification | Pay stubs, Social Security benefit letter, pension statements, tax returns | Employer, Social Security Administration, pension provider, IRS | Provide documentation for all sources of income for the past 3-5 years. |

| Asset Verification | Bank statements (checking & savings), investment account statements, property deeds, life insurance policies | Banks, financial institutions, county recorder's office, insurance company | Include all assets, even those held jointly. Statements for the last 5 years are required. |

| Medical Information | Medicare card, other health insurance cards, records of medical expenses | Your wallet, insurance providers, doctor's offices, pharmacies | This helps determine medical necessity and potential spend-down amounts. |

This table provides a solid foundation for your application. Having these documents organized and ready will show caseworkers that you are prepared and serious about your application.

It’s also common to receive a request for more information. Don’t worry—this is a standard part of the process. Respond quickly and provide exactly what is requested. This is where your organized file will be a huge help. For more detailed support on this journey, our dedicated NJ Caregiving resources can offer additional guidance.

Successfully applying for NJ Medicaid for seniors is about being thorough and proactive. With careful preparation, you can confidently work through each step, from gathering your documents to getting your final approval, securing the healthcare support you deserve.

Maximizing Your Medicaid Benefits: Insider Strategies

Getting approved for NJ Medicaid for seniors is a huge accomplishment, but it’s really just the beginning of the journey. The next step is just as important: learning how to use your benefits effectively to get the best care. Think of it like being handed the keys to a new car; you still need to learn how to drive it to get where you want to go—in this case, toward better health. This requires you to be an active participant in your healthcare, not just a passenger.

Building a strong, working relationship with your healthcare team is essential. Your primary care physician, specialists, and your Managed Care Organization (MCO) case manager are your most important partners. Don't hesitate to ask questions during appointments, clearly explain your needs, and keep good notes on your conversations and treatments. Effective communication is your most powerful tool for making sure your health concerns are heard and properly addressed.

Addressing Common Roadblocks and Challenges

Even with a solid plan, you might hit some bumps in the road. It’s a common frustration when seniors find out their long-time doctor isn’t part of their new Medicaid plan. If this happens, your first call should be to your MCO. They can give you a list of in-network doctors in your area and may even help make the switch smoother.

Another frequent problem is having a service or prescription denied. While this can feel defeating, remember that you have the right to appeal the decision.

- Understand the Reason for Denial: The denial letter must explain why the request wasn't approved. Sometimes it's a simple paperwork mistake or a question of medical necessity.

- Gather Supporting Documents: Ask your doctor for a letter of medical necessity. This letter should explain why the treatment or service is critical for your health.

- Follow the Appeals Process: Your MCO has a specific, step-by-step process for filing an appeal. Be sure to follow the instructions and meet all deadlines.

Juggling care between different specialists can also be a headache. To keep important information from getting lost, always make your primary care physician your central point of contact. Make sure every specialist sends their notes and test results back to your main doctor so your health record stays complete and up-to-date.

Uncovering Lesser-Known Benefits

Many seniors don't use all of their available benefits simply because they don't know everything that's included. Beyond doctor visits and prescriptions, NJ Medicaid for seniors often covers other valuable services that can significantly improve your quality of life. These might include transportation to medical appointments, dental and vision care, or even minor home updates like installing grab bars to prevent falls. Make it a habit to check your MCO's member handbook or call your case manager to ask about benefits that are often overlooked. Our visual guide on NJ Caregiving services can help you see how these different supports work together.

This proactive mindset is important on a national level, too. Medicaid is a cornerstone of support for long-term care for the elderly across the country. As of January 2025, national Medicaid enrollment was over 71 million people, and a significant number are seniors who rely on it for nursing homes, home health aides, and other essential long-term support. New Jersey’s program is a key piece of this national safety net. To see the bigger picture, you can discover more insights about national Medicaid enrollment data. By staying informed and advocating for yourself, you can make sure you receive all the care you're entitled to.

Taking Action: Your Next Steps to Healthcare Security

You now have a solid foundation for understanding how NJ Medicaid for seniors can work for you. But knowing is only half the battle; the real power comes from taking action. This final step is about creating your personal roadmap to secure your healthcare future. It’s not about piling on more information, but turning what you’ve learned into confident, concrete steps.

Think of this as your own personalized action plan. The journey to securing Medicaid doesn't follow a universal timeline, but you can generally expect the process to take between 45 and 90 days from application to approval. This window gives the county office the time it needs to properly review all your information.

Your Immediate Action Plan

To get started, focus on these manageable first steps. The goal is steady progress, not doing everything at once.

- Gather Your Documents: As we’ve covered, being organized is your biggest asset. Start collecting all the necessary paperwork, such as bank statements, proof of income, and identification. Having everything in one place will make the application much smoother.

- Contact Your Local Office: The Mercer County Board of Social Services is your primary point of contact. You can find their details on the official New Jersey Department of Human Services website. A quick call can help you ask initial questions or schedule a meeting.

- Talk to Your Family: Keeping your loved ones in the loop is essential. Explain the benefits of Medicaid and how it fits into your long-term health plan. This helps ensure everyone is on the same page and can offer their support along the way.

Maintaining Your Benefits and Planning Ahead

Once your application is approved, the work doesn't stop entirely. Staying eligible and informed is an ongoing responsibility. You'll need to complete an annual recertification to confirm you still meet the program's requirements. Keeping your financial records organized throughout the year will make this a simple yearly task.

It's also helpful to know that the program can adapt to changing circumstances. For instance, during public health emergencies or natural disasters, New Jersey can implement emergency plans. These might include waiving certain rules to ensure you have continuous care, which shows how the program is built to support you even in a crisis.

Finally, remember that you are not alone in this process. Many seniors across New Jersey have successfully gone through these same steps, gaining access to life-changing care that allows them to live with dignity and peace of mind. Their stories are proof that with some preparation and persistence, you can take firm control of your healthcare.

At NJ Caregiving, we see firsthand how the right in-home care transforms lives. If you are in Mercer County and need compassionate, professional support for yourself or a loved one, our team is ready to assist. We can help you understand how your benefits apply to home care services, allowing you to age comfortably at home.

To learn more about our personalized care options, visit NJ Caregiving today.