Trying to figure out New Jersey Medicaid income limits is the essential first step toward getting affordable healthcare coverage. For most adults under 65, the main question is whether your income falls under 138% of the Federal Poverty Level. This is the key that unlocks eligibility for NJ FamilyCare.

Your Quick Guide To NJ Medicaid Income Limits

Navigating the financial side of NJ FamilyCare, New Jersey's Medicaid program, can seem intimidating. But it really boils down to one core idea: your household's monthly income must be below a specific amount set by the Federal Poverty Level (FPL). This system creates a clear, straightforward benchmark for who qualifies.

The Affordable Care Act (ACA) was a game-changer for healthcare in New Jersey. After it passed, the state expanded its program to cover more low-income residents, including single adults and childless couples who couldn't get help before. This one change opened the doors for thousands, and now NJ FamilyCare covers nearly two million people—that's a huge 20% of the state's entire population.

How Income Limits Work

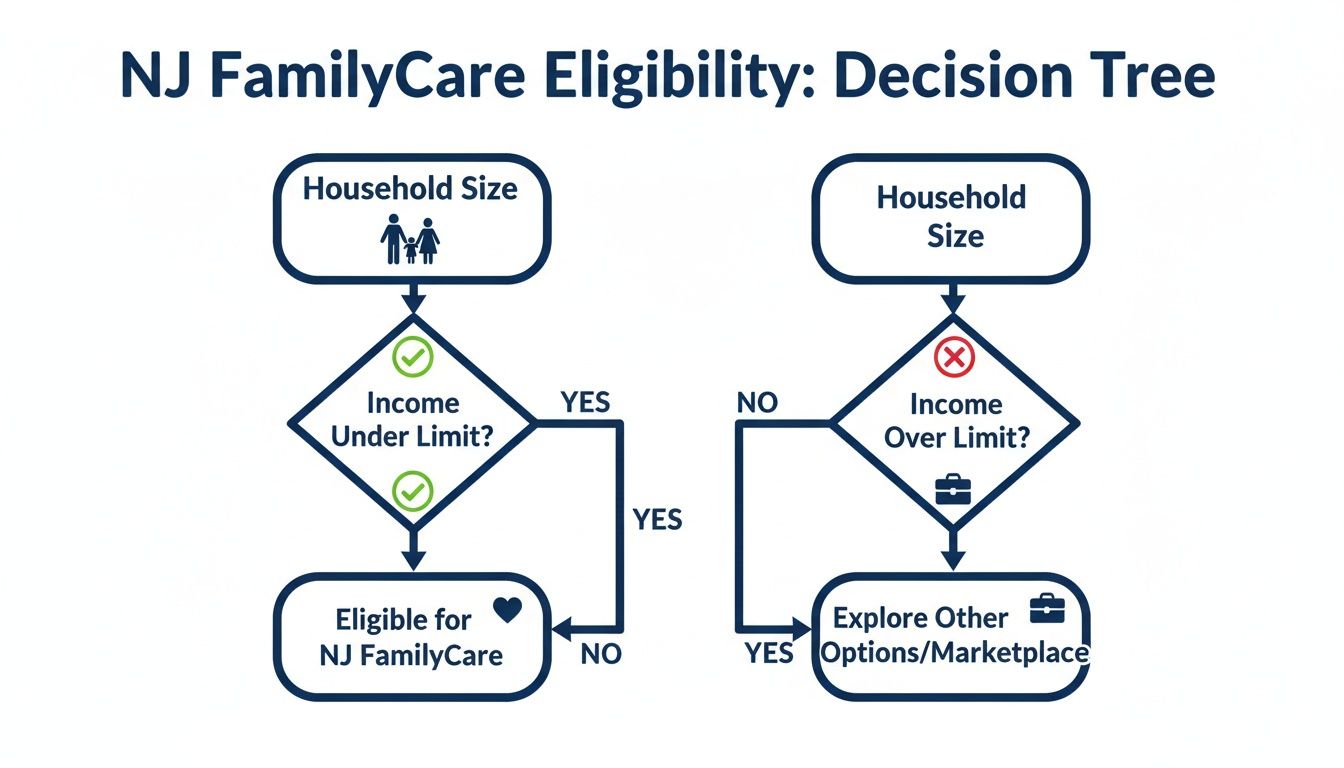

At its heart, the process is pretty simple. The state looks at two main things: your household size and your Modified Adjusted Gross Income (MAGI). It’s just common sense—a single person will have a lower income cutoff than a family of four.

This flowchart breaks down the basic eligibility question into a simple decision tree.

As you can see, if your household's income is under the limit for your family size, you're likely on the right track to qualify for coverage.

Current Income Thresholds for NJ FamilyCare

To give you a concrete idea of where you might stand, here are the current monthly income limits based on 138% of the FPL. It's always a good idea to double-check for the latest numbers, as these figures get updated.

Key Takeaway: For most NJ FamilyCare applicants, the focus is almost entirely on income, not what you own. Unlike programs for seniors or people with disabilities, your savings account, your house, or your car typically won't be counted against you.

To give you the exact numbers you need to see if you qualify, the table below lays out the income limits for different household sizes.

NJ FamilyCare (MAGI Medicaid) Monthly Income Limits

| Household Size | Maximum Monthly Income | Maximum Annual Income |

|---|---|---|

| 1 | $1,732 | $20,784 |

| 2 | $2,351 | $28,212 |

| 3 | $2,970 | $35,640 |

| 4 | $3,588 | $43,056 |

| 5 | $4,207 | $50,484 |

| 6 | $4,826 | $57,912 |

| 7 | $5,445 | $65,340 |

| 8 | $6,064 | $72,768 |

For each additional person in households larger than 8, add $619 per month.

Getting a handle on these rules is crucial for a smooth application. Since these programs operate within a strict legal framework, understanding the basics of regulatory compliance can provide helpful context for why these rules are so specific. The numbers in the table above are your best guide to determining your eligibility.

How New Jersey Calculates Your Income Using MAGI

When New Jersey looks at your application for NJ FamilyCare, they don't just glance at your paycheck. To determine if you meet the New Jersey Medicaid income limits, the state uses a specific federal formula called Modified Adjusted Gross Income (MAGI).

Think of MAGI as a special lens that focuses your financial picture to see if you qualify for health coverage. It's basically a version of the Adjusted Gross Income (AGI) you see on your tax return, but with a few key items added back in. This ensures everyone is evaluated fairly using the same set of rules. Getting a handle on what counts as income—and what doesn't—is the first and most important step.

What Income Counts Toward Your MAGI

For most of us, the calculation starts with our taxable earnings. This includes the money you make from your job, of course, but it also covers a whole range of other sources. It's a comprehensive look at the funds available to your household.

Common types of income that get folded into your MAGI calculation are:

- Wages, salaries, and tips from your job.

- Unemployment compensation benefits.

- Taxable interest and ordinary dividends.

- Pensions and annuity payments.

- Capital gains from investments.

- Rental real estate income.

- Social Security Disability Insurance (SSDI) benefits for many individuals.

This isn't a complete list, but it covers the most common sources of income that NJ FamilyCare will look at when you apply.

What Income Is Excluded From Your MAGI

Just as important as knowing what counts is knowing what doesn't. Certain types of income are left out of the MAGI calculation on purpose, and this can make all the difference in whether you qualify.

Important Note: A huge one here is Supplemental Security Income (SSI). SSI benefits are not counted as income for MAGI Medicaid. This is a critical distinction because SSI is specifically for people with very limited resources due to age, blindness, or disability.

Other common income sources that are generally not counted in your MAGI include:

- Child support payments you receive.

- Workers' compensation benefits.

- Proceeds from loans (like student loans).

- Gifts and inheritances.

- Veterans' benefits.

These exclusions can lower your calculated income enough to bring you under the eligibility line, which is why it’s so vital to understand how the formula works.

A Practical Example of Calculating MAGI

Let's walk through a real-world scenario. Imagine a single mother in Princeton with one child. She’s trying to figure out if her family can get NJ FamilyCare.

Here’s a quick look at her monthly finances:

- Her Job Income: She earns $2,500 per month.

- Child Support: She also receives $400 per month in child support.

- Excluded Income: That $400 in child support doesn't count in the MAGI calculation.

So, her countable monthly income for Medicaid is just her $2,500 wage. For a household of two, the current monthly income limit is $2,351. In this case, her income is just a bit too high.

However, if she made pre-tax contributions to a 401(k) or had other allowable deductions, her MAGI could dip below the limit. This just goes to show how every single detail matters.

Understanding The Rules For Aged, Blind, And Disabled Applicants

When it comes to Medicaid in New Jersey, the path looks a little different for applicants who are 65 or older, blind, or have a disability. Unlike the NJ FamilyCare program (which focuses almost entirely on income), these applications add a second, equally important financial hurdle: your assets.

This means the state looks not just at what you earn each month but also at what you own. For these specific pathways, known as Aged, Blind, and Disabled (ABD) Medicaid, this dual-check system is in place to ensure resources go to those with the most pressing financial and medical needs.

What New Jersey Considers An Asset

Thinking about assets can feel overwhelming, but the state has clear guidelines. The simplest way to think about it is to imagine two buckets: one for "countable" assets and one for "exempt" assets. Only the things in that first "countable" bucket are measured against the Medicaid limit.

Countable assets are generally things that can be easily turned into cash to pay for your care. New Jersey will look at:

- Cash in your checking and savings accounts.

- Investments like stocks, bonds, and mutual funds.

- Retirement accounts, such as 401(k)s and IRAs (though the rules here can get complex).

- A second home or any other vacation properties.

- Extra vehicles beyond your primary one.

The total value of all these countable assets has to be below a very specific, and often surprisingly low, threshold. For a single person, that limit is often just $4,000. For a couple, it's typically $6,000. These tight limits are why careful financial planning is so crucial for many families.

Assets That Do Not Count Against You

Thankfully, New Jersey understands that you need certain things to live. The state protects these essential resources by making them "exempt" from the asset calculation, meaning they won't stand in the way of your eligibility.

Key Takeaway: Your primary home is almost always exempt as long as you, your spouse, or a dependent child lives there. This is a massive protection that allows many seniors to qualify for care without being forced to sell their family home.

Other major exempt assets typically include:

- One primary vehicle used for transportation.

- Personal belongings like furniture and clothing.

- Pre-paid funeral and burial plans up to a certain value.

- Life insurance policies with a small cash value.

This dual-criteria system exists for a clear reason. Elderly and disabled enrollees, while a smaller part of the total Medicaid population, account for the vast majority of program spending. The strict asset limits are designed to channel limited resources to these high-need groups.

Comparing Different ABD Programs

Navigating the various programs for aged, blind, and disabled residents can get tricky because the limits change depending on the level of care you need. Someone who needs daily in-home help through the Managed Long Term Services and Supports (MLTSS) program will face different rules than someone applying for basic ABD Medicaid. This is where understanding the specific New Jersey Medicaid income limits for each track is vital.

For those who need more extensive support, our in-depth guide to long-term care Medicaid offers a much deeper look into the specific eligibility rules and application process for those services. Knowing these differences can make all the difference in getting the right help.

The table below breaks down the limits for the most common programs, giving you a clear, side-by-side view of what to expect.

NJ Medicaid Limits for Aged, Blind, & Disabled Programs

Here's a quick comparison of the monthly income and total asset limits for individuals and couples applying for ABD Medicaid and long-term care services in New Jersey.

| Program Category | Individual Monthly Income Limit | Individual Asset Limit | Couple Monthly Income Limit | Couple Asset Limit |

|---|---|---|---|---|

| ABD Medicaid (Community) | $1,255 | $4,000 | $1,704 | $6,000 |

| MLTSS (In-Home/Community Care) | $2,829 | $2,000 | $5,658 (both applying) | $3,000 (both applying) |

| Institutional (Nursing Home) Medicaid | $2,829 | $2,000 | $5,658 (both applying) | $3,000 (both applying) |

As you can see, the income limits are higher for those who need long-term care services, but the asset limits get even stricter. This structure ensures that individuals with the highest level of medical need can access care while still demonstrating financial eligibility.

Your Step-By-Step Guide To Applying For NJ FamilyCare

Okay, you've figured out the New Jersey Medicaid income limits. That’s the first big hurdle. Now, it's time to actually get the application in.

Applying for NJ FamilyCare is a straightforward process, but being prepared makes a world of difference. Think of it like gathering your ingredients before you start cooking—having everything in its place makes for a much smoother, less stressful experience. This guide will walk you through what you need, how to submit it, and what comes next.

Step 1: Gather Your Essential Documents

Before you even think about filling out a form, get your paperwork in order. This will save you a massive headache later on. The state needs to verify who you are, where you live, and your financial situation. It’s no different from showing your ID at the bank; it's a standard part of the process.

Here’s a quick checklist of what you'll likely need for everyone in your household who is applying:

- Proof of Identity and Citizenship: This could be a birth certificate, U.S. passport, or naturalization certificate.

- Proof of New Jersey Residency: A recent utility bill, your lease, or a driver's license usually does the trick.

- Income Verification: Grab recent pay stubs (usually from the last four weeks), a letter from your employer, or your most recent tax return.

- Social Security Numbers: You'll need the Social Security number for each person applying.

If you plan on applying online, do yourself a favor and get digital copies or clear photos of these documents ready to go.

Step 2: Choose Your Application Method

New Jersey gives you a few different ways to apply for NJ FamilyCare, so you can pick whatever works best for you. Don't worry, every path leads to the same place. It's just about choosing the one you're most comfortable with.

- Apply Online: This is the fastest and most recommended way to do it. Head to the official NJ FamilyCare online portal, create an account, fill everything out, and upload your documents directly. This route almost always leads to quicker processing times.

- Apply By Mail: If you're more comfortable with pen and paper, you can download the application form from the NJ FamilyCare website. Just fill it out completely, make copies of your documents, and mail everything to the address listed on the form.

- Apply In Person: Need a little face-to-face help? You can always visit your local County Board of Social Services. The staff there can help you with the application and answer questions on the spot, which is a great option if you feel stuck.

Expert Tip: Honestly, applying online is your best bet. The system walks you through every question, which cuts down on mistakes, and you can easily check your application status later.

For a more detailed breakdown of each method, check out our guide on how to apply for NJ FamilyCare, which has more tips and direct links to get you started.

Step 3: Know What Happens Next

Once you've hit "submit" or dropped that envelope in the mail, the waiting game begins. The state will now review all your information to make sure you meet the eligibility rules. This can take several weeks, so a little patience goes a long way.

You’ll eventually get a determination letter in the mail. It will either approve your application or deny it. If you're approved, the letter will explain your coverage and when it starts. If you're denied, it will state the reason—it's often due to income being too high or missing documents.

You can usually check the status of your application online through the same portal where you applied. This is a great feature for peace of mind, so you're not just left wondering where things stand.

What To Do If Your Income Is Too High

It can feel like hitting a brick wall when you get that denial notice saying your income is too high for Medicaid. But before you get discouraged, you need to know that this isn't necessarily the end of the road. New Jersey has other pathways to affordable healthcare, and one of them might be the perfect fit for you.

Whether you're an older adult who needs long-term care or just looking for a standard health plan, there are strategies and programs designed to help. The next step is figuring out which one matches your situation.

Using The Spend-Down Provision for ABD Medicaid

For New Jerseyans applying under the Aged, Blind, or Disabled (ABD) category, the Medically Needy Program is an incredibly important tool. You’ll often hear it called the spend-down provision.

Think of it like a healthcare deductible you have to meet before your Medicaid benefits kick in for the month.

If your monthly income is a little over the ABD limit, you aren’t automatically out of luck. Instead, the state calculates your "excess" income—that's the amount you're over the limit. To become eligible for that month, you just have to show that you've racked up medical bills equal to that excess amount.

These qualifying medical costs can include a whole range of things:

- Doctor visits and hospital bills

- The cost of your prescriptions

- In-home care services

- Medical supplies and equipment

Once your medical expenses for the month hit that spend-down amount, Medicaid can step in to cover your remaining healthcare costs for the rest of the month. It's a way to make sure that people with high medical needs can still get help. To see if this could work for you, a specialized Medicaid spend-down calculator can give you a good estimate of what you'd need to meet.

Exploring Get Covered NJ The State Marketplace

What if you applied for NJ FamilyCare (the program for kids, parents, and pregnant women) and were denied because of your income? In most cases, your application is automatically sent over to Get Covered NJ, which is the state's official health insurance marketplace. This is a smooth handoff designed to connect you with other affordable options right away.

On the marketplace, your income might make you eligible for some serious financial help. This assistance usually comes in two forms:

- Premium Tax Credits: These directly lower the monthly premium you pay for your health insurance.

- Cost-Sharing Reductions: These reduce your out-of-pocket costs—things like deductibles, copayments, and coinsurance—when you actually go to get care.

A denial from Medicaid is often an open door to a subsidized health plan. For many individuals and families, these marketplace plans offer comprehensive coverage at a fraction of the full cost, making healthcare genuinely affordable.

Help for Seniors Through Medicare Savings Programs

For seniors who are already on Medicare but find it tough to cover all the costs, New Jersey offers a lifeline through its Medicare Savings Programs (MSPs). These state-run programs are designed to help pay for some or even all of your Medicare-related expenses, providing much-needed financial relief.

There are a few different levels of MSPs, and each has its own income and asset limits. Depending on which one you qualify for, these programs can cover:

- Medicare Part B premiums: This alone can save you over a hundred dollars every single month.

- Deductibles, coinsurance, and copayments: This cuts down on what you have to pay out-of-pocket when you visit a doctor or hospital.

Applying for an MSP can significantly stretch your retirement income, making sure you can access the Medicare benefits you've earned without the constant financial strain. It’s a critical resource for older adults trying to navigate the New Jersey Medicaid income limits and find the assistance they need.

Common Questions About New Jersey Medicaid Income Limits

Even with the numbers laid out, navigating the specifics of Medicaid eligibility can feel a bit tricky. We often hear the same practical questions from families trying to figure out where they stand, so let's tackle some of the most common points of confusion right now.

Think of this as a quick-start guide to clear up those nagging "what if" scenarios. From how your unemployment check is viewed to what happens if you own a home, these are the direct, simple answers you need.

Does Unemployment Count As Income For New Jersey Medicaid?

Yes, it absolutely does. Unemployment benefits are considered taxable income, which means they are part of the Modified Adjusted Gross Income (MAGI) calculation for NJ FamilyCare. When you're filling out your application, you have to report these benefits just as you would report a paycheck.

It's really important to be upfront about this. Forgetting to include unemployment benefits can lead to a wrong decision on your eligibility and could cause problems with your coverage later on.

Can I Own A House And Still Qualify For Medicaid In NJ?

For the majority of people applying, the answer is a resounding yes. If you're applying for NJ FamilyCare through the standard MAGI rules—which covers kids, parents, pregnant women, and other adults under 65—there is no asset test. That means the value of your house, car, or savings account doesn't factor in at all.

But, things get a little different if you're applying for Medicaid because you are over 65, blind, or have a disability.

Important Distinction: For Aged, Blind, or Disabled (ABD) Medicaid, there is an asset limit. However, your primary residence is typically considered an exempt asset. As long as you or your spouse is living in the home, its value won't be held against the program's strict asset cap. This is a crucial protection for many seniors.

How Often Do I Report Income Changes To NJ FamilyCare?

This is a big one: You are required to report any significant changes in your household's situation within 10 days. This isn't just a guideline; it's a key part of your responsibility as a Medicaid recipient.

What kind of changes are we talking about?

- Income Shifts: Getting a new job, receiving a raise, or losing a source of income all count.

- Household Size: You must let them know if someone moves in or out of your home.

- A New Address: Keeping your contact information up-to-date is non-negotiable.

Reporting these changes quickly is in your best interest. A sudden drop in income might mean you're eligible for more help. On the flip side, a big raise could mean you no longer qualify for Medicaid but might become eligible for a subsidized plan on the state's health insurance marketplace.

What Is The Income Limit For A Single Person For Medicaid In NJ?

For a single adult under 65, the magic number is 138% of the Federal Poverty Level (FPL). That specific dollar amount changes every year to keep up with inflation and new federal guidelines, so it’s always good to check the latest figures.

You can find the most current monthly and annual income limits for one person in the detailed table at the top of this guide. This is the standard for most adults who aren't applying based on age or disability.

Navigating these rules, especially when planning for long-term care, can be complex. NJ Caregiving provides expert in-home care services throughout Mercer County, helping families in Princeton and surrounding areas find peace of mind. If you need compassionate, professional support for a loved one, explore our services at https://njcaregiving.com.