Trying to figure out government healthcare programs can feel like a maze, but the difference between Medicare vs. Medicaid coverage really boils down to one simple idea: you earn Medicare through work, while you qualify for Medicaid based on financial need.

Think of it this way: Medicare is a federal health insurance plan designed mostly for people 65 or older, plus younger individuals with specific disabilities. Medicaid, on the other hand, is a joint federal and state assistance program that acts as a safety net for low-income people and families of all ages.

Understanding Medicare and Medicaid at a Glance

Let's break that down a bit more. Medicare works a lot like the health insurance you might be used to from an employer. It's a national program, which means the rules are generally the same no matter where you live in the U.S. You become entitled to it based on your work history and the payroll taxes you've contributed over the years.

Medicaid operates very differently. Because it's a partnership between the federal government and individual states, the eligibility rules, benefits, and even the application process can change dramatically depending on your zip code. Eligibility isn't about age or work history; it's almost entirely about your income and household size. Getting a handle on this key difference is the first step to figuring out which program might be the right fit.

Core Differences Medicare vs Medicaid

To see them side-by-side, this table gives a quick snapshot of how the two programs are structured.

| Feature | Medicare | Medicaid |

|---|---|---|

| Primary Beneficiaries | Individuals 65+, younger people with disabilities, and those with End-Stage Renal Disease (ESRD) | Low-income individuals, children, pregnant women, and people with disabilities |

| Administering Body | Federal Government (Centers for Medicare & Medicaid Services) | Federal & State Governments (State-specific agencies) |

| Funding Source | Payroll taxes, beneficiary premiums, and federal funds | Jointly funded by federal and state tax dollars |

| Eligibility Basis | Primarily age, work history, or disability status | Primarily financial need (income and asset limits) |

As you can see, their purpose, funding, and who they serve are fundamentally distinct. Both are massive federal programs that together provide a healthcare lifeline to tens of millions of Americans.

Medicare itself was signed into law back in 1965 as a way to provide federal health insurance for older adults and certain younger people with disabilities. Today, it serves more than 65 million beneficiaries across the country. If you're interested in the numbers, you can learn more about Medicare enrollment trends on avalerehealth.com.

Who Is Eligible for Medicare vs Medicaid?

Before you can even begin to compare benefits, you have to understand who can enroll in each program. This is the first, and most important, fork in the road when comparing Medicare vs. Medicaid, because they were built for completely different groups of people.

At its core, Medicare is an earned benefit program. Think of it like Social Security—your eligibility is directly tied to the years you (or your spouse) worked and paid payroll taxes. Because of this, the rules are pretty consistent no matter where you live in the U.S.

Medicaid, on the other hand, is a needs-based assistance program. It’s not about your age or work history. Instead, it’s all about your financial picture: your income, your assets, and the size of your household. This is precisely why the rules for Medicaid can vary so dramatically from one state to the next.

Medicare Eligibility: The Age and Disability Pathway

The most common way people get on Medicare is by turning 65. It’s a milestone many of us plan for. To qualify, you generally need to meet these three criteria:

- You are age 65 or older.

- You’re a U.S. citizen or have been a legal resident for at least five straight years.

- You or your spouse worked and paid Medicare taxes for a minimum of 10 years (which adds up to 40 quarters).

But age isn't the only entry point. Younger individuals can also qualify for Medicare if they have a significant disability. For instance, you can enroll before 65 if you've been receiving Social Security Disability Insurance (SSDI) benefits for at least 24 months.

There are also a couple of specific medical conditions that fast-track eligibility for people of any age:

- End-Stage Renal Disease (ESRD), which is permanent kidney failure that requires dialysis or a transplant.

- Amyotrophic Lateral Sclerosis (ALS), often called Lou Gehrig's disease, which grants immediate eligibility right after diagnosis.

Key Takeaway: Medicare eligibility is a federal issue. It’s based on age, work history, or specific health diagnoses. If you meet the criteria, you’re in—your income or assets don't play a role.

Medicaid Eligibility: The Financial Need Pathway

Medicaid eligibility is a whole different ballgame. It’s all about your financial situation. As a program run jointly by federal and state governments, the feds set the basic rules, but each state decides how generous to be, creating a patchwork of different requirements across the country.

Created back in 1965, Medicaid was designed to provide health coverage for low-income Americans, including kids, pregnant women, adults, and people with disabilities. It’s a massive program—as of January 2025, Medicaid provided coverage for about 21% of the entire U.S. population. You can dig deeper into these numbers by checking out the research findings on Medicaid enrollment from Pew Research Center.

The main yardstick for Medicaid is your Modified Adjusted Gross Income (MAGI) compared to the Federal Poverty Level (FPL). States that chose to expand Medicaid under the Affordable Care Act (ACA) typically cover adults with incomes up to 138% of the FPL.

But income is just one piece of the puzzle. States also look at:

- Household Size: A larger family means a higher income limit.

- Assets: For some groups, particularly seniors needing long-term care, there are very strict limits on things like savings accounts or property.

- Disability Status: People with disabilities often have unique pathways to qualify.

- Age: Seniors over 65 might qualify for Medicaid based on low income, even if they already have Medicare.

Real-World Scenarios: Comparing Eligibility

Let's look at how this plays out for two very different people.

Scenario 1: The Retiree

- Meet Sarah, age 68. She was a teacher for 40 years, so she has a small pension and some savings. Because she’s over 65 and paid Medicare taxes her whole career, she is eligible for Medicare. It doesn't matter what her income or savings look like; her work history earned her this benefit.

Scenario 2: The Young Adult

- Meet David, age 30. He works part-time, and his income is just a bit over the Federal Poverty Level. He lives in a state that expanded Medicaid, so his income is low enough to fall under the 138% FPL cutoff. He is eligible for Medicaid based solely on his financial situation, even though he's young and healthy.

Comparing In-Home Care Coverage and Benefits

When a loved one needs help to keep living safely at home, trying to figure out how to pay for it is often the biggest hurdle. This is where the differences between Medicare and Medicaid really stand out. Each program looks at in-home assistance through a completely different lens.

Medicare's role is almost entirely clinical and focused on rehabilitation. Think of it as a short-term solution to help you recover after an illness, injury, or hospital stay. On the other hand, Medicaid is the country's main source for long-term care, zeroing in on helping people with their daily activities over the long haul.

Medicare Home Health Care: A Short-Term Solution

For Medicare Part A and Part B to cover home health services, you must be certified as homebound by a doctor, and you have to need what they call "intermittent skilled care." The entire focus is on medical necessity and recovery, not ongoing personal help.

It’s best to view Medicare's home health benefit as a temporary bridge, designed to get you from a hospital or skilled nursing facility back to being independent. It was never intended for long-term custodial care, which is the hands-on help with everyday things like bathing, dressing, or making meals.

What Medicare typically covers for home health:

- Skilled Nursing Care: Services that can only be performed by a registered nurse, like wound care, injections, or keeping a close eye on a serious health condition. This care has to be part-time or intermittent.

- Physical and Occupational Therapy: Professional therapy to help you get back your movement, strength, and ability to handle daily activities safely after you’ve been sick or injured.

- Speech-Language Pathology Services: Therapy to help with communication challenges or swallowing disorders.

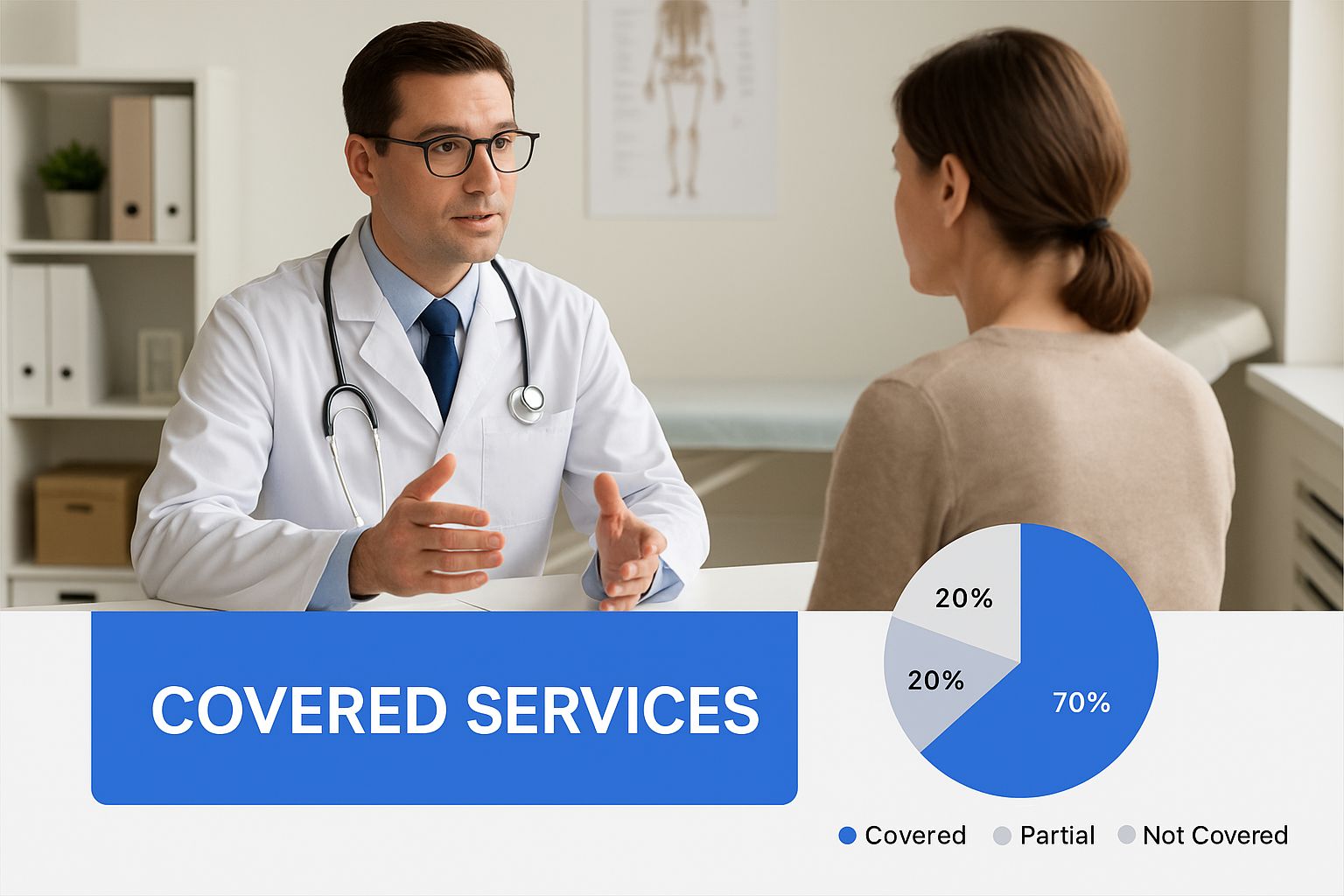

This image breaks down the core services each program offers, showing their different priorities at a glance.

You can see right away how Medicare's services are medically focused, while Medicaid provides much broader, life-assistance benefits.

Medicaid In-Home Care: A Long-Term Lifeline

When it comes to paying for long-term in-home care in the U.S., Medicaid is the primary player. While the specifics change from state to state, every Medicaid program is required to offer some level of home health services for people who qualify.

More importantly, states have Home and Community-Based Services (HCBS) waiver programs. These waivers are specifically designed to provide long-term care services right in a person’s own home or community, helping them avoid having to move into a nursing home.

The Key Distinction: Medicare helps you get better at home after a medical event. Medicaid helps you live safely at home when you have ongoing needs.

Under an HCBS waiver, Medicaid can pay for a huge range of non-medical services that Medicare simply won’t touch, including:

- Personal Care Assistance: Hands-on help with Activities of Daily Living (ADLs) like bathing, dressing, grooming, and eating.

- Homemaker Services: Assistance with tasks like preparing meals, doing laundry, and light housekeeping to keep the home safe and clean.

- Respite Care: Provides short-term relief for family caregivers who need a break.

- Home Modifications: Minor changes to a home to make it safer and more accessible, like installing grab bars or wheelchair ramps.

This approach makes Medicaid an absolutely essential resource for seniors and people with disabilities who need consistent support to stay independent.

In-Home Care Services Medicare vs Medicaid

To really nail down the difference, it helps to see a direct, side-by-side comparison of common in-home services. The table below lays out exactly how Medicare and Medicaid approach these needs.

| In-Home Service | Medicare Coverage Details | Medicaid Coverage Details |

|---|---|---|

| Skilled Nursing | Covered on a part-time or intermittent basis when medically necessary for recovery. Requires a doctor's order and being homebound. | Covered as a mandatory benefit, often for chronic condition management, not just short-term recovery. |

| Personal Care (Custodial) | Not covered. Medicare does not pay for help with bathing, dressing, or other daily activities if that is the only care you need. | Widely covered through HCBS waiver programs. This is a cornerstone of Medicaid's long-term care benefit, enabling individuals to age in place. |

| Homemaker Services | Not covered. Does not pay for meal preparation, cleaning, or shopping. | Often covered under HCBS waiver programs as a supportive service to help maintain a safe and healthy home environment. |

| Therapy (Physical, etc.) | Covered when part of a doctor-prescribed plan of care to help a patient recover function after an illness or injury. | Covered as both a mandatory and optional benefit, often available for longer-term maintenance or habilitative purposes, not just post-acute recovery. |

| Duration of Care | Short-term and finite. Coverage typically ends when the patient's condition is stable and skilled care is no longer needed. | Long-term and ongoing. Designed to provide support for as long as the individual meets the eligibility criteria, which can be for years. |

This clear breakdown shows the very different jobs these two programs do. For families trying to plan for the future, the most important thing to remember is this: Medicare is for short-term recovery, while Medicaid is for long-term support. If you're in New Jersey and need help figuring this all out, providers like NJ Caregiving can offer expert guidance on getting the Medicaid-funded home care services you need.

Breaking Down the Costs for Each Program

Let's talk about the bottom line. Getting a handle on the real-world financial impact of Medicare versus Medicaid is crucial, because while both open doors to healthcare, their cost structures are night and day.

Medicare operates on a cost-sharing model, which means you'll be paying a portion of the bills as you go. Medicaid, on the other hand, is built to have little to no out-of-pocket expenses for the people it serves.

Medicare Out-of-Pocket Expenses

When you sign up for Medicare, you're also signing up for several types of payments that can definitely add up. These aren't optional fees; they're baked into how the program works, so it's smart to budget for them from the start.

Here’s a look at the typical costs you'll see with Original Medicare (Part A and Part B):

- Part A Premium: The good news is most people get Part A (Hospital Insurance) premium-free. This is usually because they or their spouse paid Medicare taxes for at least 10 years. If you don't qualify, though, you may have to buy it—and that can be several hundred dollars a month.

- Part A Deductible and Coinsurance: Even with premium-free Part A, you're not totally off the hook. You’ll have a deductible for each hospital stay, which is over $1,600 for 2025. And if your stay is a long one, daily coinsurance payments will start to kick in.

- Part B Premium: Nearly everyone with Part B (Medical Insurance) pays a monthly premium. The standard amount changes each year and can be higher if you have a larger income.

- Part B Deductible and Coinsurance: There's also an annual deductible for Part B. Once you've met that, you are on the hook for 20% coinsurance on most doctor visits, outpatient care, and medical equipment. This is a big one, because there is no annual limit on what that 20% can amount to.

On top of all that, many people buy a separate Medicare Part D plan for their prescriptions, which adds its own monthly premium, deductible, and copayments to the mix.

Key Insight: That 20% coinsurance for Medicare Part B services has no yearly cap. A single, expensive treatment or a chronic illness that requires a lot of doctor visits can quickly lead to thousands of dollars in out-of-pocket costs.

Medicaid Minimal Cost-Sharing

Medicaid was created from the ground up to provide free or extremely low-cost health coverage. For almost everyone on the program, the financial weight is practically zero, a massive departure from Medicare's model.

State Medicaid programs aren't allowed to charge premiums for anyone with an income below 150% of the federal poverty level. Any cost-sharing that does exist is limited to tiny, nominal amounts.

Here’s what you might pay with Medicaid:

- Premiums: Usually $0 for most people and families.

- Deductibles: Almost always $0.

- Copayments: Some states might ask for a small copayment for things like a doctor's visit or a prescription—we're talking just a few dollars. And many groups, like children and pregnant women, are exempt from these anyway.

Here’s the most important part: federal law actually prevents doctors from turning away a Medicaid patient just because they can't pay a copayment. This guarantees that money is never the reason someone can't get the medical care they need.

Let’s put this into a real-life context. Picture a senior living on a fixed income of $1,500 a month. With Medicare, their standard Part B premium alone could eat up more than 10% of that income before they’ve even seen a doctor or paid a deductible. If that same person qualified for Medicaid, their healthcare costs would almost certainly be zero, leaving that money for essentials like food and rent.

Qualifying for Both Medicare and Medicaid

When we talk about Medicare vs. Medicaid coverage, it's natural to think you have to pick one or the other. But for millions of Americans, the strongest healthcare support comes from having both programs working together.

This is what’s known as being “dual eligible.” It happens when someone meets the age or disability rules for Medicare and also meets the low-income and limited-asset requirements for Medicaid. The result is a seamless, comprehensive safety net that can cover nearly all healthcare costs.

When you're dual eligible, the two programs have a clear pecking order. Medicare always pays first as the primary insurance. After that, Medicaid steps in to act as the secondary payer, picking up many of the costs Medicare doesn't cover.

How Dual Eligibility Creates a Powerful Safety Net

For anyone who qualifies, becoming dual eligible is a complete game-changer. It combines Medicare's wide network of doctors and hospitals with Medicaid's powerful financial protection, creating what is essentially a cost-free healthcare experience.

This partnership tackles the biggest financial pain points of Medicare. For instance, Medicaid can cover:

- Medicare Part B Premiums: That monthly premium for medical insurance? Medicaid can often pay for it.

- Deductibles and Coinsurance: The out-of-pocket costs for hospital stays (Part A) and doctor visits (Part B) are typically covered.

- Services Medicare Doesn’t Cover: Most critically, Medicaid can pay for long-term services and supports, like extended in-home personal care, which Medicare explicitly doesn't cover.

This setup helps low-income seniors and people with disabilities get the medical care they need without the constant stress of accumulating bills.

The real power of dual eligibility is how Medicaid fills in the gaps. It turns Medicare—a program with significant cost-sharing—into a fully-covered benefit. This is especially life-changing for families needing long-term in-home care.

Introducing Medicare Savings Programs

What if your income is just a little too high to qualify for full Medicaid? You might still get a lot of help through Medicare Savings Programs (MSPs). These are state-run programs, managed by Medicaid, designed specifically to help people with limited resources afford their Medicare costs.

There are a few different types of MSPs, and each has its own income and asset limits:

- Qualified Medicare Beneficiary (QMB) Program: This is the most comprehensive MSP. It helps pay for Part A and Part B premiums, plus deductibles, coinsurance, and copayments.

- Specified Low-Income Medicare Beneficiary (SLMB) Program: This program helps pay for your Part B premiums.

- Qualifying Individual (QI) Program: This one also helps pay for Part B premiums.

These programs really do act as a bridge, making Medicare affordable for people who might otherwise struggle with the out-of-pocket expenses.

Let’s put this into a real-world context. Think about a 70-year-old with a few chronic health conditions who lives on a small Social Security check. With only Medicare, the 20% coinsurance for all those specialist visits could be financially crippling.

But if they are dual eligible, Medicaid steps in to cover that 20%, plus their monthly Part B premium. If they also need daily help with bathing and meals, Medicaid's home care benefits can provide that support, allowing them to stay safely in their own home without burning through what little savings they have.

Of course. Here is the rewritten section, crafted to sound human-written and natural, following the provided style guide and examples.

How to Apply: A Tale of Two Programs

Trying to get government benefits can feel like navigating a maze, but breaking down the application process for Medicare and Medicaid makes it far less intimidating. Each program has its own path, timeline, and set of rules because they're designed for different things. Medicare is all about your age and work history, while Medicaid hinges on your current financial picture.

Knowing where to apply and—more importantly—when is the first step. Missing a deadline, especially with Medicare, can unfortunately lead to penalties that stick with you for life.

The Medicare Enrollment Path

For most folks, signing up for Medicare happens through the Social Security Administration (SSA). The process itself isn't too complicated, but the timing is everything.

You can only apply for Medicare during specific windows. The big one is your Initial Enrollment Period (IEP). This is a seven-month window that opens three months before you turn 65 and closes three months after. Getting enrolled during your IEP is the absolute best way to sidestep late enrollment penalties that could bump up your monthly premiums forever.

Here are the main ways you can get it done:

- Online: The quickest and simplest route is right on the Social Security website.

- By Phone: If you prefer, you can call the SSA and apply with a representative over the phone.

- In Person: You can also book an appointment and handle the paperwork at your local Social Security office.

Here's a key piece of information: if you're already drawing Social Security or Railroad Retirement Board benefits by the time you turn 65, you'll likely be enrolled in Medicare Parts A and B automatically. Your Medicare card will just show up in the mail, no application needed.

The Medicaid Application Process

Unlike Medicare's one-size-fits-all national system, applying for Medicaid is handled at the state level. That's because every state runs its own program, complete with its own income and asset qualifications.

You generally have two ways to get your application in:

- Directly Through Your State Medicaid Agency: Every state has an office dedicated to Medicaid. You can typically apply on their website, send in a paper application, or go in person. This is the most direct path.

- Via the Health Insurance Marketplace: When you go to HealthCare.gov and fill out an application for health coverage, the system will automatically check to see if your income makes you eligible for Medicaid. If it does, your info gets forwarded to your state agency to finish the process.

When you apply for Medicaid, you'll need to have your documents ready to prove you qualify. They'll typically ask for things like:

- Proof of your citizenship and where you live.

- Income verification, such as recent pay stubs or tax returns.

- Information on your assets, like bank statements.

Because Medicaid is based on financial need, there are no strict enrollment periods. You can apply any time of year. If your situation changes and you suddenly become eligible, you can—and should—apply right away.

Of course, here is the rewritten section, crafted to sound completely human-written and natural, following the style of the provided examples.

Medicare vs. Medicaid: Your Questions Answered

Even after getting the basics down, it’s normal to have a few lingering questions when you’re trying to sort out Medicare vs. Medicaid coverage. Think of this section as a quick reference guide to clear up some of the most common points of confusion.

My goal here is to tackle those specific "what-if" scenarios so you can move forward with confidence.

Can I Have Private Insurance with Medicare or Medicaid?

Yes, you can, but it works very differently depending on the program. For Medicare, it’s actually quite common. Many people buy Medigap policies to help with out-of-pocket costs like deductibles, or they might choose a private Medicare Advantage (Part C) plan, which is an alternative way to get your Medicare benefits.

With Medicaid, things are a bit stricter. Medicaid is considered the "payer of last resort," which means if you have private insurance, it has to pay its share first. Medicaid then picks up the remaining costs for services it covers in your state.

What Are the Asset Limits for Medicaid?

This is a huge question, especially for families trying to figure out long-term care for an aging parent. While income is a big piece of the puzzle for most people on Medicaid, asset limits become a major factor for seniors or individuals with disabilities. The exact numbers change by state, but they’re almost always very low.

For an individual looking for long-term care benefits, the asset limit through Medicaid is often around $2,000. The good news is this usually doesn't count your primary home, one car, or your personal belongings.

Because the rules are so tight, many families find they need to do some careful financial planning—often called a "Medicaid spend down"—to become eligible without having to give up their entire life's savings.

How Do Medicare Advantage Plans Compare to Original Medicare?

Medicare Advantage, also known as Part C, is an all-in-one alternative to Original Medicare, offered by private insurance companies. They’re required to cover everything that Original Medicare (Parts A and B) does, but they usually sweeten the deal by bundling in extra perks like dental, vision, hearing, and even prescription drug coverage (Part D).

Here are the main differences you’ll notice:

- Provider Networks: Medicare Advantage plans work a lot like the HMOs or PPOs you might be used to, meaning you have a network of doctors. Original Medicare, on the other hand, lets you see any doctor in the country who accepts Medicare.

- Costs: Part C plans can have lower monthly premiums, but you’ll want to look at the copayments and deductibles. A big plus is that they come with an annual out-of-pocket maximum, which Original Medicare doesn't have.

Deciding between them really comes down to your personal situation—your health needs, what you can budget, and whether you value the flexibility of a wide network over the convenience of bundled benefits.

Navigating the complexities of Medicaid eligibility for in-home care can be challenging. For personalized assistance in New Jersey, the team at NJ Caregiving can guide you through the process, helping you access the benefits you deserve. Learn more about our services at https://njcaregiving.com.