Getting Medicaid to cover in-home care comes down to meeting two very specific sets of rules: one for your finances and one for your health. Think of Medicaid home care eligibility as a two-part test. You have to show that you medically need the help and that your income and assets are below the limits set by your state. Grasping this dual requirement is really the first step to getting the support you or your loved one needs.

Cracking the Code of Medicaid Home Care Eligibility

Trying to figure out Medicaid can feel like you’ve been handed a complex puzzle without the picture on the box. But the basic idea is actually pretty simple.

Imagine you're trying to open a combination lock. You have two dials. One represents your financial picture—your income and assets. The other represents your physical or cognitive need for day-to-day help. To get that lock to click open, you have to get the numbers right on both dials.

Having a low income by itself isn’t enough. And needing a lot of medical help won't automatically qualify you, either. You have to meet both criteria at the same time for Medicaid to approve home care services. This whole system is designed to make sure that help goes to people who truly need care and don't have the financial means to pay for it on their own.

To make this crystal clear, every Medicaid decision boils down to four fundamental pillars. These are the building blocks that every state uses to determine who qualifies for in-home care.

The Four Pillars of Medicaid Home Care Eligibility

| Eligibility Pillar | What It Means | Key Factors to Consider |

|---|---|---|

| Financial Eligibility | A deep dive into your income and "countable" assets. | Income (Social Security, pensions), assets (bank accounts, stocks), and property you own. |

| Functional Eligibility | A medical assessment to see if you need help with daily life. | Ability to handle activities like bathing, dressing, eating, or managing medications. |

| State Residency | You must be a resident of the state where you are applying. | Proof of address, like utility bills or a driver's license. |

| U.S. Citizenship/Legal Status | You must be a U.S. citizen or a qualified non-citizen. | Birth certificate, passport, or immigration documents. |

These four pillars form the complete picture that Medicaid reviews. While residency and citizenship are straightforward checks, the financial and functional pieces are where things get more complex.

Understanding the Numbers Behind the Financial Rules

The financial limits are often the biggest hurdle for families. These numbers aren't just pulled out of thin air; they’re based on federal guidelines that each state then adapts. This means Medicaid has very specific, non-negotiable caps on both income and assets.

For instance, in 2025, the average income limit for long-term care services was around $3,452 per month for one person. States also have strict rules about assets and even home equity—most cap it at $730,000, although some states like California have no limit at all.

You can see a full breakdown of these complex financial rules and how much they vary from state to state. These figures show just how precise the financial side of Medicaid home care eligibility is, making it absolutely critical to know your state's exact numbers before you even start the application.

Breaking Down the Financial Requirements

Let's talk about the part of the Medicaid process that causes the most stress: the money. This is where most families get tripped up, assuming their nest egg or monthly income is an automatic dealbreaker. But here's the thing you need to understand right away—Medicaid doesn't lump all your finances together. It sorts everything into two buckets: what’s countable and what’s non-countable (or exempt).

Think of it like getting ready for a flight with a strict baggage allowance. You have essentials that don’t count against your limit, like your coat or a book. Medicaid works the same way. It sets aside certain essential assets, like your primary home and one car, so they don’t count against you. Everything else—from your checking account to that little piece of land you own upstate—goes into the "countable" pile.

That’s the fundamental concept you need to grasp. Figuring out what goes in each bucket is the very first step toward meeting the financial requirements for home care.

What Are the Income and Asset Limits?

Once you’ve sorted your finances, you need to know the magic numbers you're aiming for. While the exact figures change from state to state, there are general guidelines that give you a pretty good idea of where you need to be. The limits are intentionally low to make sure the program helps those who truly need it most.

- Asset Limit: For a single person, the countable asset limit usually lands around $2,000.

- Income Limit: The monthly income limit is often set near the amount someone might get from a typical Social Security check.

Keep in mind, these are just starting points. Your state, marital status, and the specific Medicaid program you’re applying for will determine the exact numbers.

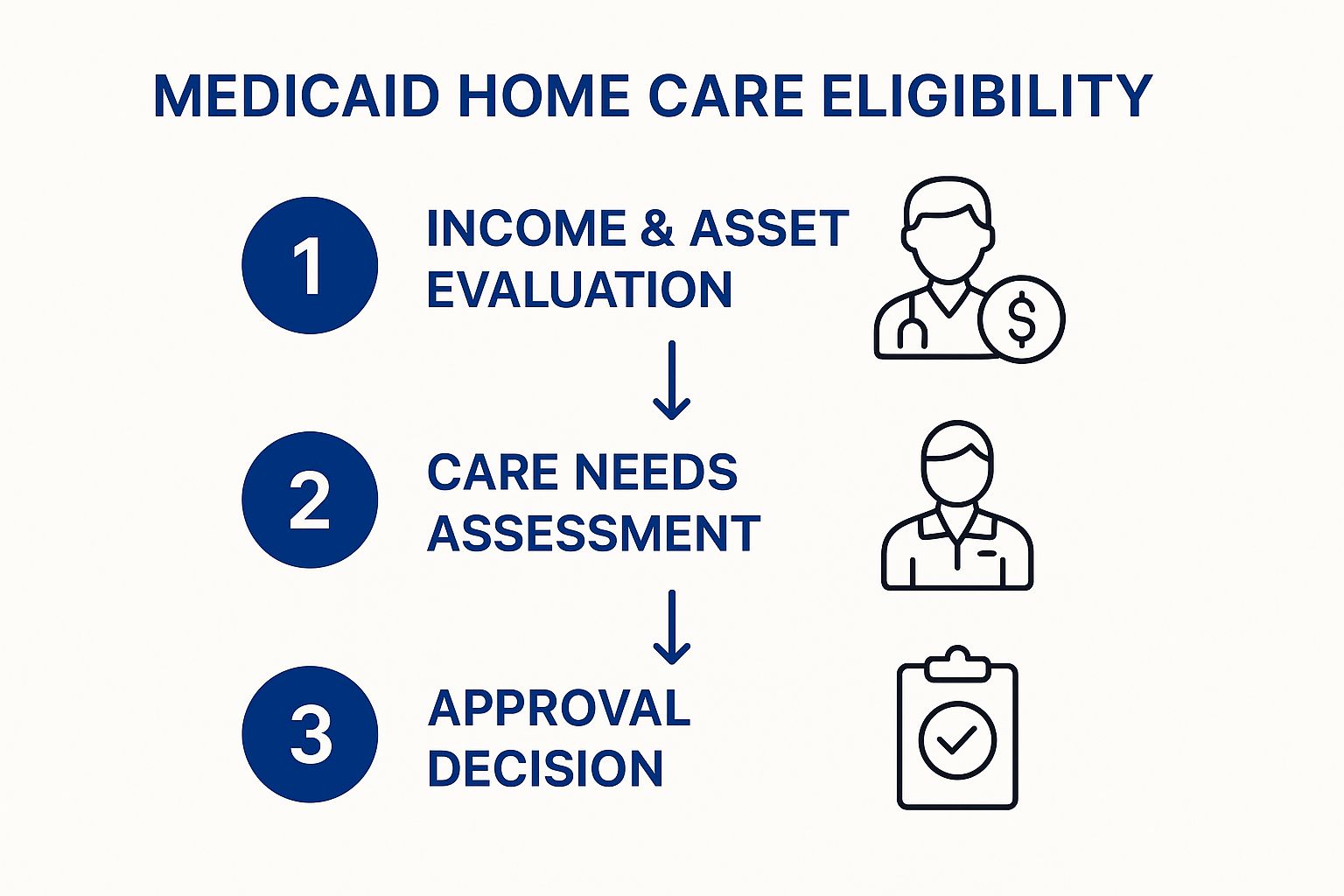

This chart gives you a bird's-eye view of how an application moves through the system, starting with that all-important financial review.

As you can see, the financial piece is the first gate you have to pass through. Before anyone even looks at your medical needs, you have to clear the financial hurdle.

What if Your Income Is Too High?

Seeing that strict income cap can feel like hitting a brick wall, but it’s often not the end of the road. For example, in 2025, many programs set the monthly income limit around $2,901 for an individual. If you're over that, don't panic. States have created ways to help, like "spend-down" programs or something called a Miller Trust (also known as a Qualified Income Trust). You can learn more about these specific income rules to see how different states handle these situations.

The bottom line is this: The financial rules are tough, but they're also full of specific workarounds and exceptions. The goal isn't just to be "poor," but to get your finances structured in a way that aligns with Medicaid's complex system.

Understanding the Five-Year Look-Back Period

This is one of the most critical parts of Medicaid home care eligibility. Medicaid wants to make sure people don't just give away all their money to family right before they apply. To prevent this, they implement a five-year look-back period. This means they will scrutinize every single financial transaction you've made for the 60 months right before you submit your application.

If they find you gave away money or sold something for less than it was worth—like selling your house to your son for a dollar—they’ll hit you with a penalty. This penalty is a period of ineligibility, where you'll have to pay for your own care for a set number of months before Medicaid kicks in. It’s a serious rule that highlights just how important it is to plan ahead.

Special Rules to Protect a Healthy Spouse

What happens when one spouse needs care at home, but the other is still healthy and living there? Medicaid has special rules to ensure the healthy spouse—called the "community spouse"—isn't left with nothing. These are known as spousal impoverishment protections.

These rules allow the community spouse to keep a significant amount of income and assets, way above the usual $2,000 limit. This protection, called the Community Spouse Resource Allowance (CSRA), is designed to make sure the spouse at home has enough money to actually live on. The exact amount varies by state, but it can be well over $150,000 in assets. It's a lifeline that keeps the whole family financially stable.

Meeting the Medical and Functional Needs Test

Passing the financial review is a huge step, but it's only half the battle for Medicaid home care eligibility. The second critical piece is proving you have a genuine medical need for help. This is where the functional needs test comes in—it’s how Medicaid confirms that your health condition requires the kind of support home care provides.

Think of it this way: the financial rules confirm you can't afford care on your own, while the functional rules confirm you actually need it. You have to meet both sides of the coin to qualify.

Most states use a standard called "Nursing Home Level of Care" (NHLOC) to figure this out. That term can sound a little scary, but it doesn't mean you’re being sent to a nursing home. It's just the benchmark Medicaid uses to measure how much help someone needs, whether that care happens in a facility or, ideally, right in their own home.

How Functional Need Is Measured

To see if you meet this level of care, Medicaid will arrange for a comprehensive assessment. A nurse or social worker will visit to evaluate your ability to handle routine daily tasks on your own. They break these tasks down into two main categories that are absolutely crucial for your assessment.

These categories are Activities of Daily Living (ADLs) and Instrumental Activities of Daily Living (IADLs). Showing that you have real difficulty with these activities is what paints a clear picture of why home care is so necessary.

- Activities of Daily Living (ADLs): These are the most basic, fundamental self-care tasks. Think about everything you do just to get yourself ready and get through the day.

- Instrumental Activities of Daily Living (IADLs): These are slightly more complex activities that you need to be able to do to live independently in your community.

The assessor will usually meet with you at home to talk about and observe your abilities. They'll ask very specific questions and might chat with your family members to get a complete understanding of your daily challenges.

This assessment isn’t a test you can pass or fail. It’s a structured conversation designed to get an accurate, on-the-record picture of your need for support. The best thing you can do is be completely honest and thorough about your struggles—that’s what ensures the final report truly reflects your situation.

What Assessors Look For

Assessors look at your ability to handle each task, noting whether you can do it independently, with some help, or not at all. Qualification often hinges on needing help with a certain number of ADLs. For instance, a state might require that an applicant needs "hands-on assistance" with at least two or three ADLs to meet the Nursing Home Level of Care standard.

This table breaks down the specific activities that are evaluated during the functional needs assessment.

Activities Assessed for Functional Eligibility

| Activity Category | Examples | Typical Level of Impairment for Qualification |

|---|---|---|

| Activities of Daily Living (ADLs) | Bathing, dressing, eating, transferring (moving from bed to chair), toileting, and maintaining continence. | Needing direct physical help with 2-3 of these activities on a daily basis. |

| Instrumental Activities of Daily Living (IADLs) | Managing finances, preparing meals, shopping, doing housework, managing medications, and using the telephone. | Requiring significant help or being completely unable to perform multiple IADLs. |

While having trouble with IADLs is important and adds to the overall picture, a significant need for help with ADLs is usually the main driver for qualifying. For example, being unable to cook a meal is a real concern, but being unable to safely get out of bed on your own carries much more weight in the final decision. This focus makes sure that Medicaid directs its resources to those with the most critical physical needs.

How State-Specific Rules Change Everything

It’s easy to think of Medicaid as one giant, national program, but that’s probably the biggest misconception out there. The reality is that Medicaid is a partnership between the federal government and each individual state. Washington D.C. sets the basic ground rules, but from there, every state builds its own program on top of that foundation.

This means the rules in New Jersey can look wildly different from what you'd find in New York or Pennsylvania. Think of it like this: the federal government provides the basic recipe for a cake—flour, sugar, eggs. But then, each state gets to decide what kind of frosting to use, how many layers it will have, and what fillings to add. You end up with 50 different cakes, all starting from the same core ingredients but each one distinctly unique.

That's why you can't rely on general advice you find online or hear from a friend in another state. The income limits, asset allowances, and even the kinds of care offered can change dramatically the moment you cross a state line.

A Real-World Look at State Differences

To see just how big these differences can be, let's look at a concrete example. In Maine, the financial rules for Medicaid are very specific. As of 2025, a single person needing nursing home level care must have a monthly income below $2,901 and less than $10,000 in assets.

For married couples, though, the rules offer crucial protections. If only one spouse applies, the non-applicant spouse is allowed to keep up to $157,920 in assets. You can discover more insights about these specific state rules and see how they stack up.

Now, compare that to another state that might have an asset limit of just $2,000 for an individual but offers more generous income rules. These details matter immensely and can be the single factor that determines whether an application is approved or denied. It all comes down to researching the specific rules for your state.

Relying on national averages for Medicaid eligibility is like using a map of the entire country to find a specific street in your town. You need local details to get where you're going.

Understanding HCBS Waivers: The Key to Home Care

So, how does Medicaid actually pay for care in someone's home instead of a nursing facility? The answer is through special state-run programs called Home and Community-Based Services (HCBS) waivers.

Think of the standard Medicaid plan as a package deal that primarily covers care in institutions like nursing homes. An HCBS waiver is like an approved exception—a special ticket that lets you use those funds differently. Specifically, it allows you to pay for services that help you stay right in your own home and community.

These waivers are the engine that powers Medicaid home care. Each state creates its own set of waivers, and they are often designed to help specific groups of people, such as:

- Seniors aged 65 and over

- Adults with physical disabilities

- Individuals with intellectual or developmental disabilities

- People with traumatic brain injuries

Because each waiver is its own separate program, it often has its own unique eligibility criteria on top of the general Medicaid rules. A person might meet the main financial and medical requirements for Medicaid but still need to qualify for a specific waiver to get their home care funded.

The Challenge of Waiting Lists

Here's one of the most critical things to know about HCBS waivers: they are not an entitlement. Unlike standard Medicaid benefits, states are not federally required to provide home care to everyone who qualifies. States get a limited amount of funding for these waiver programs, which means they can only serve a certain number of people.

When more eligible people apply than there are available spots, the state creates a waiting list. Depending on the state and the specific waiver, these lists can be hundreds or even thousands of people long, with waits that can stretch for months—or in some cases, years. This makes it absolutely essential to start the application process as early as you possibly can.

Your Step-by-Step Guide to the Application Process

The Medicaid application can feel like a mountain of paperwork, but with a clear plan, it's completely manageable. Think of it less as a daunting task and more as a series of straightforward steps. The real key is preparation—knowing what to gather and how to present it can make all the difference.

You’re essentially building a case for eligibility. Your goal is to provide undeniable proof that you meet both the financial and medical requirements for Medicaid home care. Every document you submit is a piece of evidence, and a well-organized file is far more likely to sail through the approval process.

Assembling Your Document Checklist

Before you even look at the application form, your first job is to gather all the necessary paperwork. This is often the most time-consuming part, so starting early is a huge advantage. Having everything on hand will prevent last-minute scrambles and frustrating delays down the road.

Start by collecting these essential items:

- Proof of Identity and Residency: This includes things like a birth certificate, driver's license, and recent utility bills to confirm your age and that you live in New Jersey.

- Proof of Citizenship or Legal Status: A U.S. passport, birth certificate, or naturalization papers will work perfectly.

- Social Security Information: You’ll need the Social Security cards for both the applicant and their spouse, if applicable.

Once you have these basics covered, you can move on to the more detailed financial and medical documents.

Detailing Your Financial History

Get ready for a deep dive. The financial review is the most intensive part of the application, as Medicaid will scrutinize your finances going back five years to enforce its look-back period. Comprehensive, organized records are non-negotiable here.

Your financial documentation packet should include:

- Income Statements: Gather recent pay stubs, Social Security benefit statements, pension award letters, and records of any other money coming in.

- Asset Records: This is the big one. You'll need complete bank statements (both checking and savings) for the past 60 months. You’ll also need documentation for stocks, bonds, retirement accounts like 401(k)s or IRAs, and any real estate you own besides your primary home.

- Insurance Policies: Pull together information on any life insurance policies, as their cash value might be counted as an asset.

Pro Tip: As you gather your bank statements, be ready to explain any large deposits or withdrawals. Medicaid caseworkers are trained to look for undocumented money transfers that could be seen as an attempt to hide assets.

Compiling Your Medical and Health Records

Finally, you need to provide evidence showing your medical need for care. While the state will conduct its own functional assessment, having supporting documents from your own doctors can significantly strengthen your case.

Be sure to include:

- Physician's Statement: A letter from your doctor is powerful. It should detail your diagnoses, medical conditions, and explain exactly what kind of care you need.

- Medical Records: A summary of recent hospitalizations, treatments, and a complete list of current prescriptions is also essential.

Tips for a Clean and Accurate Application

With all your documents in hand, it's time to fill out the application itself. Accuracy is everything. A simple mistake or an unanswered question can cause major delays or even an outright denial, forcing you to start all over again.

To avoid common pitfalls, follow these simple rules:

- Answer Every Single Question: Never leave a field blank. If a question doesn’t apply, write “N/A” (Not Applicable). This shows the caseworker you didn't just skip it by accident.

- Be Completely Honest: You must disclose all income and assets. Trying to hide resources is a serious offense that will lead to disqualification and could have legal consequences.

- Keep Copies of Everything: Before you submit your application and all its supporting documents, make a complete copy for your own records. This is your proof of what you sent and when you sent it.

After you submit everything, the waiting period begins. Decision times can vary, but they typically range from 45 to 90 days. During this time, a caseworker might reach out for more information or clarification. Responding to these requests as quickly as possible is crucial to keep your application moving forward.

So, you’ve run the numbers and discovered your income or assets are just over the line for Medicaid home care eligibility. It’s a frustrating spot to be in, and for many, it feels like hitting a dead end.

But I’m here to tell you it’s often just the start of a new conversation. This is a common hurdle, and there are well-established, totally legal ways to qualify for the care you need without having to lose everything you’ve worked a lifetime to build.

Think of it this way: exceeding the limits doesn’t mean you’re disqualified forever. It simply means it’s time to look at restructuring your finances to align with Medicaid’s rulebook. This isn't about hiding money—it's about smart, strategic planning to bridge the gap between where you are now and where you need to be.

The "Spend-Down" Strategy

The most direct route is what’s known as a “spend-down.” It’s a bit like a deductible on an insurance plan. You’re responsible for spending your “excess” assets on approved medical and care-related costs until you get down to the official asset limit (which is typically $2,000 for an individual here in NJ).

Now, this doesn’t mean you should go on a spending spree. The goal is to use that money on things that genuinely benefit you or your spouse and are permissible under Medicaid’s rules. Do it right, and you won’t have to worry about penalties from the five-year look-back period.

What kind of spending is allowed? Here are a few common examples:

- Wiping out debt: You can use the extra funds to pay off your mortgage, clear a credit card balance, or settle a car loan.

- Making your home safer: Installing things like grab bars, a wheelchair ramp, or a stairlift are all valid and incredibly useful expenses.

- Prepaying for a funeral: Setting up an irrevocable funeral trust is a popular and fully accepted way to lower your countable assets.

- Other big-ticket items: Buying a new, reliable vehicle or making essential home repairs are also on the approved list.

By putting your money toward these kinds of legitimate needs, you can effectively and legally reduce your countable assets to meet the threshold.

Advanced Planning: Trusts and Annuities

When the financial picture is a bit more complex, especially if there are significant assets involved, it’s time to bring in the bigger tools. These strategies definitely need a legal expert in your corner, but they can be game-changers for preserving your life savings.

A Qualified Income Trust (QIT), which you might also hear called a Miller Trust, is essential if your monthly income is the problem. It’s a special legal arrangement where your income gets deposited into the trust each month. From there, the trust pays for your medical bills, your share of care costs, and a small personal allowance.

Think of a Miller Trust as a funnel. It redirects your excess income so that it no longer counts against you for eligibility. For people with pensions or higher Social Security checks, this is often the only way to qualify in states that have strict income caps.

Another powerful tool is a Medicaid Compliant Annuity (MCA). This is a financial product that turns a lump sum of countable assets into a non-countable income stream for you or your spouse. It has to be structured perfectly to meet Medicaid’s strict guidelines, but when done correctly, it can protect a substantial nest egg from having to be spent down on care.

You Absolutely Need Professional Guidance

Let me be clear: this is not a do-it-yourself project. The rules around spend-downs, trusts, and annuities are incredibly complex and, frankly, unforgiving. One wrong move—like gifting money to your kids or setting up a trust incorrectly—can trigger a devastating penalty period, leaving you without benefits for months or even years.

Working with an experienced elder law attorney isn't just a good idea; it's non-negotiable. They live and breathe your state’s specific Medicaid regulations and can build a personalized plan that works for you. Investing in their expertise gives you peace of mind and ensures you’re taking the safest, most effective path to securing the Medicaid home care eligibility you need.

Common Questions We Hear

Does My Home Count as an Asset for Medicaid?

This is a big one, and the answer is usually "no, but…" For the most part, your primary home is considered an exempt asset, so it won't count against you. In many states, this exemption goes up to an equity value of $730,000.

Where it gets tricky is if you have to move into a nursing home permanently. The rules can get complicated fast, and they change from state to state, so it’s always best to check with your local Medicaid office.

What Is the Medicaid Look-Back Period?

Think of the look-back period as Medicaid's way of reviewing your financial history. They look at the five years right before you apply to make sure you haven't given away assets or sold them for less than they were worth just to qualify.

If they find any transactions like that, it can trigger a penalty period, which means you’ll be temporarily ineligible for benefits.

Can I Choose My Own Caregiver?

In many states, absolutely! Medicaid has programs, often part of what are called Home and Community-Based Services (HCBS) waivers, that support "self-directed care."

These programs are great because they give you the freedom to hire, train, and manage your own caregivers. More often than not, this can even include family members.

Figuring out Medicaid home care eligibility can feel like a puzzle, but you don't have to piece it together alone. At NJ Caregiving, we offer expert guidance and truly compassionate in-home care for seniors in Princeton, NJ, and all across Mercer County.

Take a look at our website at https://njcaregiving.com to see how we can support your family on this journey.