When you hear "long-term care insurance for home care," what comes to mind? For many, it's a confusing financial product. But let's simplify it. At its heart, this is a special kind of policy designed to cover the costs of getting help right in the comfort of your own home as you get older.

It’s a financial safety net that pays for everyday assistance—like help with bathing, getting dressed, or making meals. This allows you to maintain your independence without having to drain your retirement savings.

Securing Your Future at Home

Think about it. You’ve planned carefully for retirement, setting aside money for your passions, travel, and a comfortable life. Then, an unexpected health issue makes it tough to handle daily tasks alone. This is a reality for countless families. I’ve seen it happen time and again.

Take the story of the Miller family. Their father, a vibrant retiree, needed help after a bad fall. The cost of a home health aide quickly became a major financial burden, forcing them to pull from savings meant for completely different things. This story highlights a massive gap in most people's financial plans.

It's a common mistake to assume Medicare or your regular health insurance will step in. The truth is, they typically only cover short-term, skilled medical care—not the long-term personal help most people need. This is exactly where a long term care insurance home care policy proves its worth.

Understanding Its True Purpose

Instead of seeing it as complicated insurance, think of it as a proactive plan for your own future comfort. It’s a dedicated fund you build over time, specifically to pay for the non-medical support you might need to continue living at home.

The core idea is to empower you to age in place, in the familiar and comforting surroundings of your own home, without placing a heavy financial or emotional burden on your loved ones.

This kind of policy is built to cover a range of services that make living at home safe and possible. This often includes:

- Personal Care Assistance: Hands-on help with what we call Activities of Daily Living (ADLs), like bathing, dressing, eating, and moving around.

- Companionship: Having someone there for social interaction and supervision, which is crucial for safety and well-being.

- Homemaker Services: Getting a hand with light housekeeping, preparing meals, and running errands.

- Skilled Nursing Care: Occasional visits from a licensed nurse for medical needs, like wound care or managing medications.

The demand for these solutions is skyrocketing. The global long-term care insurance market, which includes strong coverage for in-home care, was valued at around USD 32.25 billion and is expected to hit USD 45.89 billion by 2032. This isn't just a random trend; it shows a huge shift in how people want to live as they age—at home.

By getting a policy, you’re not just buying insurance. You’re making an investment in your own freedom and peace of mind. To see what services might be available, check out our guide on home care services.

Alright, let's break down how these home care insurance policies work in the real world. Think of it like learning the rules of a game before you start playing—you need to know how the pieces move to make a winning strategy. Not all policies are created equal, and understanding the nuts and bolts is the only way to pick one that will actually protect you down the road.

Let's unpack the core mechanics so you can feel confident choosing a plan that truly fits your life.

Traditional vs. Hybrid Policies: Which Path is Right for You?

The first big decision you’ll run into is the type of policy. There are two main roads you can take, and each one has its own set of pros and cons.

-

Traditional Stand-Alone Policies: This is the classic, old-school option. It's built for one single purpose: to pay for your long-term care. You pay your premiums regularly, and if you eventually need care, the policy starts paying out benefits. If you never end up needing care, the policy doesn't pay out, and you don't get the premiums back. It's pure insurance in its simplest form.

-

Hybrid (or Linked-Benefit) Policies: This is a newer, more flexible approach that combines long-term care coverage with another financial product, like a life insurance policy or an annuity. If you need home care, the money comes from your benefit pool. But if you pass away without ever using those benefits, your family receives a death benefit. This design gets rid of the "use it or lose it" problem, which a lot of people find appealing because it guarantees a payout one way or another.

There’s a clear trend globally toward policies that help people age in place, a movement that really picked up steam during the pandemic. Still, not that many people have this kind of coverage. As of 2020, only about 7.5 million Americans were covered by any form of long-term care insurance. If you want to dig deeper into market trends, you can get more details from Market Research Future.

Customizing Your Coverage

Once you’ve settled on a policy type, it's time to fine-tune the details. These next few choices are what really shape your plan, determining how much it pays, when it kicks in, and for how long.

1. The Daily or Monthly Benefit Amount

This is the maximum amount of cash your policy will pay out for care, either per day or per month. It's critical to pick a number that actually reflects the cost of home care where you live. A policy with a $150 daily benefit will stretch a lot further in a rural area than it will in a major city.

2. The Benefit Period

This simply defines the total length of time your policy will pay for care. You’ll see common options ranging from two to five years, though some plans offer lifetime benefits. A longer benefit period offers more security, but you can bet it will come with a higher premium.

3. The Elimination or "Waiting" Period

You can think of this as your policy's deductible, but it’s measured in time, not money. It's the number of days you have to pay for your own care out-of-pocket before the insurance company starts reimbursing you. Most policies have waiting periods of 30, 60, or 90 days. Choosing a longer waiting period will lower your premium, but it means you'll need more savings ready to go when care begins.

Key Insight: The real art of building a good policy is finding the right balance between these three things: your benefit amount, benefit period, and waiting period. It's a strategic trade-off between what you pay in premiums and the level of financial safety you get in return.

What Does "Home Care Coverage" Actually Include?

A question I hear all the time is, what does an insurance company even mean by "home care"? A solid policy won’t be vague. It will clearly define a wide range of services designed to help you live safely and comfortably right where you are.

| Service Category | What It Typically Covers |

|---|---|

| Personal Care | Hands-on help with the Activities of Daily Living (ADLs), like bathing, getting dressed, eating, and moving around. |

| Skilled Nursing | Occasional care from a licensed nurse for things like wound care, injections, or managing medications. |

| Therapy Services | Physical, occupational, or speech therapy delivered in your home to help you recover or maintain your abilities. |

| Home Modifications | Coverage for practical updates to your home that make it safer, like installing grab bars, building ramps, or adding a stairlift. |

Thankfully, modern policies are getting much more flexible. They recognize that great home care isn't just about medical tasks—it’s about providing the practical support that makes daily life easier and helps you hold onto your independence.

The True Cost of Aging at Home

Most of us have a deeply personal and powerful goal: to age in place, right in the comfort of our own home. But making this dream a reality often comes with a financial truth that catches many families completely off guard. The cost of professional in-home care, even if it's less than a nursing facility, can stack up with surprising speed and put a serious strain on your finances.

Getting a handle on these numbers is the very first step toward building a plan that works. Without a clear picture of the potential expenses, the retirement savings you’ve worked so hard to build could be at risk. Let's get real about the figures behind long-term care at home.

The Financial Realities of Home Care

Once you or a loved one needs daily help, the bills start to accumulate quickly. In the U.S., the average annual cost for a home health aide is now well over $50,000. If more intensive care is needed, a private room in a nursing home can soar past $100,000 a year.

Despite these staggering numbers, a recent study highlighted by GallagherRe shows that only about 8% of Americans over 50 have a private long-term care policy. This gap means many people are forced to pay for care out-of-pocket until their assets are gone, eventually having to rely on public systems.

To make this tangible, let’s look at the math. A home health aide at $30 an hour for just 20 hours a week comes out to $600 weekly, or over $31,000 per year. If that need grows to 40 hours a week, the cost doubles to more than $62,000 annually.

Paying for this level of care out-of-pocket can rapidly drain a carefully built nest egg. For many, it means selling investments, the family home, or leaning on family for financial help—outcomes nobody wants.

This is exactly where a long term care insurance home care policy steps in to act as a financial firewall. It’s designed specifically to cover these expenses, preserving your savings for what you intended them for.

How Insurance Protects Your Nest Egg

Think of your retirement savings as a reservoir of water, carefully collected to sustain you for decades. An unexpected need for long-term care is like a major leak, draining that reservoir far faster than you ever planned. A good insurance policy is the patch that stops the leak, allowing your savings to remain intact.

Let's walk through a quick case study to see this in action:

- The Scenario: A 75-year-old man, Robert, needs a home health aide for 25 hours a week after a stroke. The out-of-pocket cost is roughly $40,000 per year.

- Without Insurance: Robert has to pull this money directly from his retirement accounts. This not only shrinks his nest egg but also cuts off its potential to grow, jeopardizing his long-term financial security.

- With Insurance: Robert’s policy, which he started paying for in his late 50s, kicks in after a 90-day waiting period. It covers the full cost of the aide, leaving his retirement savings untouched to continue supporting his other living expenses.

This shows that long-term care insurance isn't just another bill. It's a strategic investment in your financial future and your family's peace of mind. To get a better sense of the kinds of help available, take a look at our guide on comprehensive care options. By planning ahead, you can ensure a health challenge doesn't turn into a financial crisis.

Annual Care Costs Versus Sample Insurance Premiums

To put the value of planning ahead into perspective, this table compares the high annual cost of paying for care out-of-pocket with some representative annual insurance premiums.

| Care Type | Average Annual Cost (Out-of-Pocket) | Sample Annual Premium (Age 55) | Sample Annual Premium (Age 65) |

|---|---|---|---|

| Home Health Aide (44 hrs/week) | $62,000 | $2,200 | $3,600 |

| Assisted Living Facility | $54,000 | $2,200 | $3,600 |

| Nursing Home (Private Room) | $108,000 | $2,200 | $3,600 |

As you can see, the annual premium for a robust policy is a small fraction of what a single year of care could cost. The earlier you start a policy, the lower the premiums generally are, making proactive planning a financially savvy decision.

Qualifying for Coverage and When to Apply

https://www.youtube.com/embed/GNIEtj2yVpc

Timing is everything when it comes to getting long-term care insurance for home care. Unlike the health insurance you might get through an employer, this kind of coverage isn’t guaranteed. Insurers use a detailed process called medical underwriting to decide who they’ll cover and what it will cost. In short, your current health and medical history are the biggest factors in play.

It helps to think of it like buying a fire extinguisher. You don't wait until you see smoke to go shopping for one; you buy it when everything is calm and safe. Applying for long-term care insurance follows the same logic. You need to get it while you’re healthy, long before you think you’ll ever need it. Waiting until a health problem pops up can make it incredibly difficult—or even impossible—to get approved.

Why Your Health Is the Deciding Factor

Insurance companies are trying to predict the future, in a way. They look closely at your health to figure out how likely it is you’ll need care down the road. This is why the application digs deep with health questionnaires, a full review of your medical records, and often a phone interview or even an in-person health check.

Unfortunately, certain pre-existing conditions can make it very tough to get a policy.

Common reasons an application might be denied include:

- Existing need for care: If you already get help with daily activities, you generally won't qualify.

- Progressive neurological conditions: A diagnosis like Parkinson's, multiple sclerosis, or Alzheimer's often means a denial.

- Certain types of cancer: A recent or metastatic cancer diagnosis can be a disqualifying factor.

- Significant mobility issues: If you already use a walker or wheelchair, it's very difficult to get coverage.

The point isn't to discourage you, but to underscore just how important it is to plan ahead. The healthier you are when you apply, the better your odds of locking in a good policy on favorable terms.

The Ideal Time to Start Planning

So, what’s the magic number? For most people, the sweet spot for applying is in their mid-to-late 50s. At this age, you’re usually still in good health, but the thought of needing care in the future starts to feel more real.

Applying in your 50s is your best bet for locking in more affordable premiums. If you wait until your 60s or 70s, you can expect much higher costs, and the chances of a new health issue popping up increase with every year that goes by.

The application process is thorough, so it’s good to know what’s coming.

What to Expect During the Application:

- Health Questionnaire: You'll complete detailed forms about your personal and family medical history, plus any medications you take.

- Medical Records Review: The insurance company will almost certainly ask for permission to review your records from your doctors.

- Personal Interview: It’s common to have a phone call with a nurse. They’ll ask questions to get a clearer picture of your health and cognitive state.

- Cognitive Assessment: They may ask simple memory questions to screen for any early signs of cognitive decline.

Going through this process while you're healthy and thinking clearly is so much less stressful than trying to manage it in the middle of a health crisis. When you act proactively, you give yourself the best possible chance to secure a plan that will protect both your independence and your savings when you need it most.

Activating Your Benefits and Starting Home Care

So, you’ve made the smart move and invested in a long term care insurance home care policy. That’s a fantastic step in securing your future. But what happens when the time actually comes to use it? The process can feel a bit daunting, but knowing what to expect makes all the difference. Getting your benefits activated smoothly means you get the support you need, right when you need it, without any extra stress.

Think of your policy like a first-aid kit you've tucked away. It’s there for when you need it, but it doesn't just open itself. You have to be the one to unlock it. The good news is that this process is designed to be straightforward, and it all starts with something called a "benefit trigger."

This is simply the specific event or medical condition that officially makes you eligible to start receiving your benefits. For most policies, it means a doctor or other medical professional has certified that you either need help with daily living activities or are dealing with a cognitive impairment.

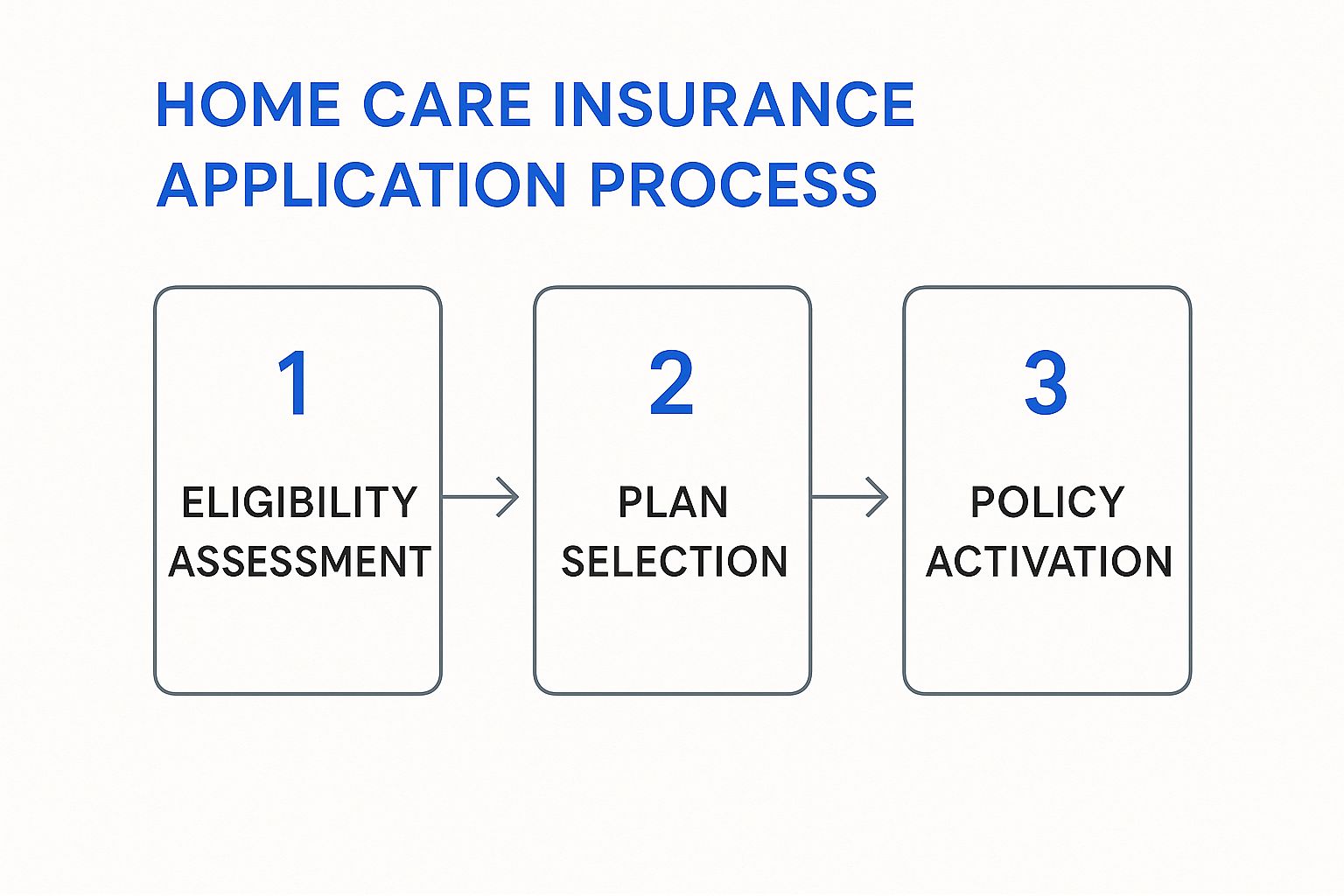

The image below breaks down the key phases of putting your long term care insurance to work for your home care needs.

As you can see, activating your home care benefits is a structured process. It moves logically from an initial assessment to the final policy activation, making sure every box is checked along the way.

Understanding Your Benefit Triggers

The most common benefit trigger is when a person can no longer perform a certain number of Activities of Daily Living (ADLs) without help. These are the basic self-care tasks most of us do every single day without a second thought.

Common Activities of Daily Living (ADLs) Include:

- Bathing: Being able to wash yourself, whether in a shower or a tub.

- Dressing: Choosing appropriate clothes and being able to put them on.

- Eating: The ability to feed yourself.

- Toileting: Getting to and from the toilet and managing personal hygiene.

- Continence: Having control over bladder and bowel functions.

- Transferring: Moving from a bed into a chair or wheelchair, and back again.

Typically, a licensed healthcare practitioner must certify that you need significant help with at least two of these six ADLs. Another common trigger is a diagnosis of a severe cognitive impairment, like Alzheimer's disease or another form of dementia. This can activate your benefits even if you are still physically able to perform all the ADLs.

Navigating the Elimination Period

Once your benefits are triggered, the next step is the elimination period. You can think of this as your policy's deductible, but instead of being measured in dollars, it’s measured in days. It's a set number of days you must wait—and often pay for care out of your own pocket—before the insurance company starts paying.

The elimination period is a critical detail in your long-term care insurance policy. Common periods are 30, 60, or 90 days. A longer period usually means a lower premium, but requires you to have more savings ready to cover initial care costs.

This waiting period starts on the very first day you receive eligible care after your benefits have been triggered. It's a great idea to keep detailed records of all care services and payments during this time to make the transition to your policy’s coverage as seamless as possible.

Your Step-by-Step Activation Checklist

When you break it down, the claims process is much less intimidating. When you and your family are ready to activate your home care benefits, just follow this simple checklist.

-

Notify the Insurer: Your first call should be to your insurance company to officially open a claim. They will send you all the necessary forms and walk you through their specific process.

-

Get a Doctor’s Certification: Your physician or another certified healthcare provider will need to fill out paperwork confirming that your need for care meets the policy’s requirements (for example, being unable to perform 2+ ADLs).

-

Develop a Plan of Care: The insurance company will ask for a formal plan of care. This is a document, usually put together with a nurse, case manager, or doctor, that details the exact home care services you need, how often you need them, and who will be providing them.

-

Submit All Required Paperwork: Finally, gather all your documents—the claim forms, the doctor's certification, and your plan of care—and submit everything to the insurance company for their review and approval.

By following these steps, you can confidently activate your policy and ensure your long-term care insurance for home care is ready to support you when you need it most.

Choosing the Right Home Care Policy

Picking a long term care insurance home care policy feels like a huge decision, because it is. With so many choices out there, it's natural to feel a bit overwhelmed. The key is to take it one step at a time, really focusing on the details that will give you genuine security down the road. You’re not just buying a product; you’re building a strategy for your own independence and peace of mind.

A great first move is to team up with an independent insurance specialist. Unlike an agent who works for just one company, an independent expert can lay out policies from a whole range of carriers. This gives you a bird's-eye view of the market, helping you compare features and costs without any bias. You can find a plan that truly fits your life, not just a salesperson's quota.

Your Policy Selection Checklist

When you're ready to dive in and compare plans, having a simple checklist keeps you from missing the details that really matter. This little bit of organization now can save you a world of headaches later.

-

Insurer’s Financial Stability: You're counting on this company to be around in 10, 20, or even 30 years. Check their financial strength rating from an agency like A.M. Best. You want to see a high rating, like an A+ or A++, which signals a stable and reliable partner for your future.

-

Definition of Home Care: The fine print is where the truth lives. Look for a broad definition that covers a wide array of services—from personal care aides and skilled nursing to physical therapy and even home modifications like ramps or grab bars.

-

Robust Inflation Protection: The cost of care goes up every single year. A policy without solid inflation protection will shrink in value over time, leaving you with a major gap when you finally need to use it. Always go for a compound inflation rider to make sure your benefit can keep up with real-world expenses.

-

Premiums vs. Meaningful Coverage: The cheapest policy is almost never the best one. Your goal is to find that sweet spot between a premium you can comfortably afford and a benefit package that offers real, substantial protection. A low-cost plan with a tiny daily benefit or a short coverage period might not be worth the paper it's written on.

Finding the right policy is really a process of self-reflection. Think about your family's health history, what your ideal future looks like as you age, and your current financial picture. The best plan is one that feels like a natural extension of your life goals.

Making the Final Decision

As you narrow down your choices, think about your personal risk factors. Does your family have a history of conditions that often lead to needing long-term care? If so, you might want to lean toward a policy with a longer benefit period.

Ultimately, you want to make a choice that you feel confident in—one that protects your hard-earned assets and honors your wish to age in place. By doing your homework and working with a professional you trust, you can lock in a long term care insurance home care policy that delivers true security.

For a clearer picture of what that support can look like, check out our home care service guide. This kind of planning isn’t just about protecting your future; it’s about empowering yourself to live life on your own terms.

Of course. Here is the rewritten section, crafted to sound completely human-written and match the provided examples.

Common Questions About Home Care Insurance

Thinking about long-term care insurance for home care can definitely bring up a lot of questions. It’s a major decision, and you’re smart to dig into the details. Getting clear, straightforward answers is the best way to feel confident you're making a choice that truly protects your future.

Let's walk through some of the questions we hear most often.

Does Medicare Cover Long-Term Home Care?

This is easily the biggest point of confusion, and the answer is critical: generally, no. Medicare is set up to cover short-term, skilled medical care you might need after an injury, illness, or hospital stay. It was never designed to pay for long-term "custodial care."

Custodial care is all that non-medical help that people often need as they age—things like assistance with bathing, getting dressed, or making meals. A long term care insurance home care policy exists specifically to fill this gap, covering the ongoing support that Medicare and your regular health insurance simply won't.

What if I Pay for a Policy but Never Use It?

That’s a completely fair question, and it’s one that makes a lot of people hesitate. With a traditional, stand-alone long-term care policy, it works like most insurance: if you pass away without needing care, the premiums you paid aren't returned to your family. You pay for the protection, hoping you never have to use it.

But the industry has evolved quite a bit to address this very concern. "Hybrid" or "linked-benefit" policies are now available that combine life insurance with long-term care coverage. If you don't use the care benefits, your loved ones receive a tax-free death benefit, making sure the money you invested isn't lost.

Can I Use My Benefits to Pay a Family Member?

Whether you can pay a family member to provide your care depends entirely on the policy you choose. This feature has become much more common in recent years, which is great because it reflects how many families prefer to manage care.

Many newer policies allow you to pay a relative (as long as it's not your spouse) if their work is part of a formal plan of care. On the other hand, some older or more restrictive plans might require you to only use licensed home care agencies or certified caregivers. It is absolutely essential to verify this detail as you compare your options.

At NJ Caregiving, we know that planning for the future can feel overwhelming. Our team provides compassionate, personalized care to help people maintain their independence right at home. If you're looking at your options in Princeton, Hamilton, or anywhere in Mercer County, contact us today to see how we can support you and your family.