When you start looking into in-home care, one of the first questions on your mind is almost always, "What is this going to cost?" It’s a completely valid and practical question. While you might see a national median figure of around $33 per hour for nonmedical care, it’s best to think of that number as a starting point, not a final price tag.

The truth is, the cost of in-home care is rarely a simple, one-size-fits-all fee.

What Is the Real Cost of In-Home Care?

Let's cut through the confusion and get straight to what really shapes the final number on your bill. Think of in-home care costs as being completely dynamic—shaped entirely by your family's unique situation and the specific needs of your loved one. The final price tag is a blend of several key factors.

To get a realistic financial picture, it helps to start with a broad benchmark. Recent data shows the national median hourly rate for nonmedical in-home care hovers around $33. Of course, this can swing quite a bit, from as low as $24 per hour in some areas to over $43 per hour in others. Using the median gives you a more grounded sense of cost by smoothing out the extremes. If you want to dig deeper into these national averages, A Place for Mom has a helpful guide on in-home care costs.

Quick Look at In-Home Care Cost Factors

To give you a clearer idea of what influences your total cost, here's a quick summary of the main components. Each one plays a part in determining the final hourly rate.

| Factor | Description | Impact on Cost |

|---|---|---|

| Geographic Location | Caregiver wages vary based on local cost of living. | Higher in urban centers like Mercer County, NJ; lower in rural areas. |

| Level of Care | The complexity of support required. | Basic companionship is most affordable; costs rise for personal and specialized care. |

| Hours of Service | The total number of hours needed per week or day. | The more hours of care, the higher the overall weekly or monthly cost. |

This table provides a snapshot, but understanding why these factors matter is key to building an accurate budget.

Key Factors That Influence Your Final Cost

Getting a handle on the primary drivers behind the in-home caregiver cost is the first step toward creating a realistic budget. Each of these elements can either raise or lower the hourly rate you'll ultimately pay.

-

Geographic Location: Just like housing prices are different from one town to the next, so are caregiver wages. A caregiver in a higher cost-of-living area, such as Mercer County, NJ, will naturally have a higher hourly rate than someone in a more rural, less expensive region.

-

Level of Care Needed: The kind of support required is a huge factor. Basic companionship and help with housekeeping are generally the most affordable services. The cost increases when personal care—like assistance with bathing, dressing, and mobility—is needed. It rises even more for specialized services, such as memory care for dementia or skilled nursing tasks.

-

Hours of Service: This one is straightforward: the total number of hours you need directly shapes your budget. A few hours of respite care each week to give a family caregiver a break will be far less expensive than having daily, around-the-clock supervision for a loved one.

Think of it like this: Hiring a caregiver is a bit like hiring a contractor for a home renovation. A simple paint job (companionship) costs a lot less than a full kitchen remodel (skilled nursing care with complex needs). Every detail, from the "materials" used to the hours worked, shapes the final bill.

This overview should give you a solid foundation. From here, we can dive deeper into how specific choices, like hourly vs. live-in care, will ultimately shape your family’s budget.

Hourly Rates vs. Live-In Care Costs

When you start exploring in-home care, one of the first big decisions you'll face is choosing between hourly and live-in support. This isn't just a financial puzzle; it's a deeply personal choice that hinges on your loved one’s specific needs, your family's schedule, and, of course, your budget.

Think of it this way: are you hiring a handyman for a few specific repairs, or are you bringing in a general contractor for a full-scale kitchen remodel? The first is paid by the hour for targeted tasks, while the second works on a project basis, present every day. Each approach has its place, and the in home caregiver cost is structured to reflect that difference.

Understanding the Hourly Care Model

Hourly care is the most common and flexible route families take. It's essentially a "pay-as-you-go" system, perfect for when you need a caregiver for specific blocks of time—maybe a few hours each morning to help with getting dressed and making breakfast, or during the afternoons while you're at work.

You’re essentially scheduling support precisely when it’s needed. These services usually cover the essentials:

- Personal Care Assistance: Hands-on help with daily activities like bathing, dressing, and using the restroom.

- Companionship and Supervision: Providing friendly interaction and ensuring your loved one is safe while you’re out.

- Meal Preparation and Light Housekeeping: Keeping the kitchen tidy, doing laundry, and preparing nutritious meals.

- Medication Reminders and Transportation: Making sure medications are taken on schedule and getting to doctor's appointments.

The biggest plus here is control. You only pay for the hours a caregiver is actively on the clock, making it a great choice for those who don't need someone there 24/7. But be mindful—if the need for care is extensive, those hours can add up fast.

For instance, if you need 24/7 care, you'll likely be scheduling multiple caregivers in 8- or 12-hour shifts to cover the full day and night. The cost for that level of continuous, active support can be significant. Nationally, around-the-clock care can run approximately $720 per day, or $21,823 per month. When you compare that to the average home health aide rate of about $27 per hour, you can see how quickly costs scale. It’s worth exploring these home care service costs to get a clearer financial picture.

Demystifying the Live-In Care Model

Now, let's talk about live-in care. There's a common misconception that a live-in caregiver is on duty and awake for 24 hours straight. That's simply not true—nor would it be safe or legal.

Instead, a live-in caregiver moves into your loved one's home and is paid a flat daily or weekly rate. The arrangement is built on the understanding that the caregiver will have their own private room and be able to get several hours of uninterrupted sleep each night. They also get daily breaks, just like any other employee.

A live-in caregiver provides a comforting and consistent presence. This model is not for 24/7 active supervision but for ensuring someone is always there for support, safety, and peace of mind, especially through the night.

This model is a fantastic solution for individuals who don't necessarily need constant, hands-on attention but cannot be left alone safely. It offers incredible peace of mind, knowing someone is always there. And financially, hiring one live-in caregiver is almost always more affordable than staffing three separate 8-hour shifts to cover a 24-hour period.

Comparing Financial Realities

So, which path is right for your family? It really boils down to balancing the level of need against the cost. The best way to start is by honestly evaluating the total number of care hours your loved one truly requires.

Here’s a quick breakdown to help you weigh your options:

| Feature | Hourly Care | Live-In Care |

|---|---|---|

| Best For | Part-time needs, respite for family caregivers, or help with specific daily tasks. | A consistent presence, overnight safety, and ongoing companionship. |

| Cost Structure | Pay-per-hour worked. Rates can sometimes be higher for nights or weekends. | Flat daily or weekly rate. Generally more cost-effective for 24/7 presence. |

| Flexibility | Very flexible. You can easily scale hours up or down as needs change. | Less flexible for short-term help; it’s designed for consistency. |

| When It Gets Pricey | When you start needing more than 8-10 hours of care per day. | If your loved one requires frequent, active assistance throughout the night. |

If your mom just needs a hand for four hours each weekday, hourly care is the clear winner. But if she needs someone in the house at all times for safety and companionship, the in home caregiver cost for a live-in arrangement will almost certainly be the more sustainable choice.

How New Jersey Location Affects Your Care Costs

When you start looking into in-home care, you quickly realize that geography plays a huge role in the final price tag, especially in a state as diverse as New Jersey. It's a lot like real estate—the cost of a house can change dramatically just one town over. The same is true for the hourly rate of a professional caregiver.

This isn't just a random fluctuation. It’s all tied to the local economy: cost of living, average wages, and even how many care agencies are in a specific area. Getting a handle on these regional differences is the first step to setting a realistic budget and feeling confident in your search.

Mercer County: A Prime Example of Higher Care Costs

Let's take a look at Mercer County, which is home to towns like Princeton and Hamilton. It’s generally a more expensive place to live compared to the more rural corners of the state. That economic reality has a direct impact on what it takes to attract and keep qualified, experienced caregivers—they need to earn a higher wage to live there.

As a result, home care agencies in more affluent, populated areas have to set their rates to match the local market. In a place like Mercer County, you can expect the hourly in home caregiver cost to be on the higher end of the statewide average.

On the other hand, if you go to counties in southern or northwestern New Jersey, where the cost of living is lower, caregiver rates are often more moderate. It really boils down to simple supply and demand, mixed with local wage standards.

Key Takeaway: Your zip code is one of the most powerful predictors of your care costs. The exact same level of service can have a very different price tag in Princeton than it would in a more rural community, simply because of local economics.

Doing a little research on the typical rates in your specific county is a critical first step to avoid sticker shock. It gives you a solid benchmark to compare agency quotes against. For families in our primary service area, exploring our resources can offer more clarity on how we build our care plans. You can learn more about our mission to provide exceptional local care.

Comparing Regional Averages Across New Jersey

While every agency sets its own prices, we can spot some general trends across the state to get a better sense of the financial landscape. New Jersey’s in home caregiver cost is consistently higher than the national median, which isn't surprising for a high-cost-of-living state.

Here’s a rough sketch of how costs can differ based on where you are and the type of care needed:

- North Jersey (Bergen, Essex, Hudson Counties): This is usually the priciest region for in-home care. Proximity to New York City and a high cost of living push hourly rates well above the state average.

- Central Jersey (Mercer, Middlesex, Somerset Counties): This region, which includes places like Princeton, sits in the upper-middle range. The costs are significant but might be a bit less than what you’d find in the northernmost counties.

- South Jersey (Camden, Gloucester, Atlantic Counties): You’ll generally find more affordable care options here. The lower cost of living translates directly into more moderate hourly rates for both companion and personal care.

- The Jersey Shore (Monmouth, Ocean Counties): Costs here can be a mixed bag. They sometimes shift based on seasonal demand and the specific wealth of a given coastal town.

Understanding this geographic pricing is vital. A family in Bergen County might need to budget for $35-$40+ per hour, while a family down in Cumberland County could find excellent care closer to the $28-$32 per hour range.

These differences are exactly why getting quotes from a few local agencies is so important. It’s the only way to be sure you’re paying a fair market rate for your neighborhood. Always ask if an agency’s rates are tiered based on the level of care required, as that will also affect your final bill.

Uncovering the Hidden Costs of Home Care

When you start looking into the in-home caregiver cost, it's easy to focus on the hourly rate. But that number is really just the starting point—it's only the tip of the iceberg.

Think of it like buying a car. The sticker price you see on the window is rarely what you actually pay to drive it off the lot. Once you add in taxes, dealership fees, and any optional features, the final cost looks quite different. Home care pricing works much the same way.

To create a realistic budget, you have to dig deeper than that initial hourly quote. There are several other expenses that can pop up, and if you aren't ready for them, they can add up fast. Getting a handle on these factors from the start ensures there are no surprises down the road, whether you hire through an agency or find a caregiver on your own.

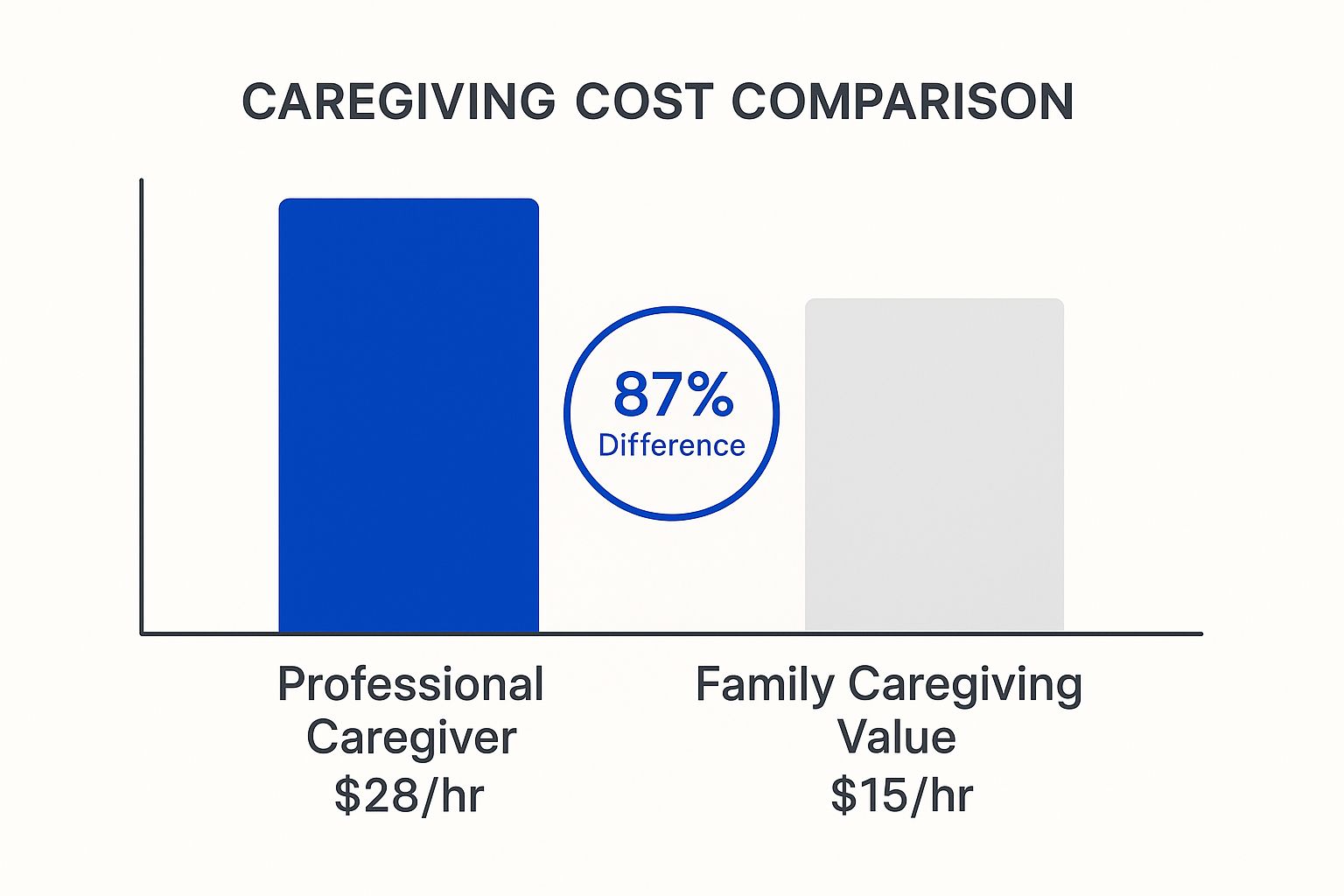

This visual gives you a stark look at the difference between the market rate for a professional caregiver and the estimated value of unpaid care provided by a family member.

As you can see, the financial commitment for professional help is significant. It highlights just how much economic value family caregivers provide and why budgeting for expert care is so critical.

Agency vs. Private Hire Cost Breakdown

The path you take to find a caregiver—going through a professional agency or hiring someone directly—will lead to two very different financial roadmaps. Each route has its own set of costs, some obvious and some not so obvious.

When you work with an agency, their higher hourly rate is essentially a bundled price. It typically covers a lot of the background work and protections you might not think about at first glance.

On the other hand, hiring a private caregiver might seem cheaper upfront because their hourly rate is lower. But with that lower rate comes a new job title for you: employer. This means you are now legally and financially on the hook for all the things an agency would normally manage.

The table below breaks down the key differences to help you see where the money goes in each scenario.

Agency Care vs Private Hire Cost Comparison

| Cost/Responsibility | Hiring Through an Agency | Hiring a Private Caregiver |

|---|---|---|

| Hourly Rate | Generally higher; an all-inclusive price | Generally lower; an à la carte price |

| Screening & Vetting | Included (background checks, references) | Your responsibility and cost |

| Payroll & Taxes | Handled by the agency | Your responsibility (W-2s, withholding) |

| Insurance | Included (liability, workers' comp) | You must purchase separately |

| Backup Care | Provided by the agency if caregiver is out | Your responsibility to find and pay for |

| Training & Supervision | Managed and provided by the agency | Your responsibility to arrange or provide |

Ultimately, the choice comes down to balancing cost with convenience and risk. While the lower hourly rate of a private caregiver is tempting, it shifts a heavy administrative and financial burden onto your shoulders.

Potential Expenses Beyond the Hourly Rate

No matter which path you choose, certain costs can arise depending on your family's specific needs. It's smart to think about these possibilities from the very beginning so you can factor them into your budget.

Here are a few common "extra" expenses to plan for:

- Overtime Pay: If your caregiver works more than 40 hours a week, federal law requires you to pay them overtime. This is typically calculated at 1.5 times their regular hourly rate.

- Transportation Costs: Will the caregiver need to use their own car to run errands or take your loved one to appointments? It's standard practice to reimburse them for mileage, usually at the official IRS rate.

- Specialized Training: If your loved one is living with a condition like dementia or has complex medical needs, you'll likely need a caregiver with advanced certifications. This specialized expertise almost always comes at a premium rate.

- Holiday Pay: Most caregivers, whether they work for an agency or for you directly, expect to earn a higher rate for working on major holidays like Christmas or Thanksgiving.

The financial pressure of caregiving is a real challenge for families across the country. The economic impact is serious—one report found that families spend an average of 40% of their household income on care expenses. For senior care alone, a standard 40-hour week averaged about $762 weekly. You can dive into more of the data in the full 2023 Cost of Care Report.

If you don't account for these variables, you can easily find yourself with unexpected budget problems. By taking the time to understand the full spectrum of costs—from agency fees and insurance to overtime and mileage—you can build a financial plan that truly works. This proactive approach is the best way to make sure the in-home caregiver cost is something your family can manage for the long haul.

How to Pay for In-Home Caregiver Services

Figuring out the financial side of in-home care can feel like one of the biggest hurdles you'll face. But you’re not alone in this, and there are clear paths forward. Honestly, understanding your payment options is just as important as finding the perfect caregiver for your loved one. This guide will serve as your roadmap, breaking down the primary ways families fund care so you can build a sustainable strategy.

We’ll walk through everything from using personal funds to navigating government programs. The goal is to give you a clear, no-nonsense picture of every financial tool available, helping you make confident decisions without feeling buried in the details of the in home caregiver cost.

Starting with Private Pay and Insurance

The most direct route for covering care is private pay. This simply means using your own money—whether from personal savings, retirement funds, or other assets. The biggest advantage here is flexibility. You have complete control over who you hire and the exact services you receive, without needing to jump through hoops for a third-party payer.

For families who planned ahead, Long-Term Care (LTC) insurance can be a game-changer. These policies are specifically designed to cover services like in-home care when someone can no longer manage a certain number of Activities of Daily Living (ADLs), like bathing or dressing, on their own.

But here’s the thing about LTC insurance: no two policies are the same. It is absolutely critical to dig into the fine print of your specific plan.

- Elimination Period: Think of this as a deductible measured in time, not dollars. It’s a waiting period, often 30 to 90 days or more, that must pass before the policy starts paying out.

- Daily or Lifetime Limits: Nearly every policy has a cap on how much it will pay per day and over the lifetime of the policy. You need to know these numbers cold to budget for any potential gaps in coverage.

- Covered Services: Check exactly what the policy will pay for. Some are great with personal care and skilled nursing but might not cover companionship or basic homemaker services.

You can think of an LTC policy like car insurance for your health. You pay your premiums for years, and when an "accident" (the need for care) happens, the policy kicks in to cover the costs—but only according to the specific terms and limits you agreed to from the start.

Navigating Government Assistance Programs

Beyond your own pocket and private insurance, several government programs can help soften the blow of the in home caregiver cost. The two you'll hear about most are Medicare and Medicaid, and it's essential to understand their very different roles.

Medicare is the federal health insurance program primarily for people aged 65 or older. It’s a common misconception that Medicare will cover long-term, ongoing in-home care. In reality, its home health benefit is designed for short-term, skilled care after a hospital stay or injury, and it must be prescribed by a doctor. It does not cover custodial personal care or companionship.

Medicaid, on the other hand, is a joint federal and state program for people with limited income and assets. In New Jersey, Medicaid offers several Home and Community-Based Services (HCBS) waiver programs that are designed to pay for in-home care, specifically to help individuals avoid moving into a nursing home. Eligibility is strict, based on both medical need and financial standing.

Our team at NJ Caregiving has spent years helping families make sense of these complex systems. To see how we align our services with local needs, you can review details about our mission and approach to caregiving in Mercer County.

Specialized Benefits and Alternative Funding

Beyond those main routes, some families have access to other specialized funding sources. It’s always worth exploring every possible avenue to make sure you aren't leaving any support on the table.

One major option is through the Department of Veterans Affairs (VA). The VA offers several programs, like the Aid and Attendance benefit, which provides a monthly pension supplement to eligible veterans and their surviving spouses who need help with daily activities. This can be a substantial financial resource for covering care costs.

Here are a few other creative options to look into:

- Reverse Mortgages: For homeowners aged 62 or older, a reverse mortgage can turn home equity into cash payments. This money can be used for anything, including in-home care, but it's a very complex financial product with long-term consequences. You should always discuss this with a trusted financial advisor.

- Life Insurance Conversions: Some life insurance policies can be converted into a long-term care benefit plan. This lets you access the death benefit while you are still alive to pay for care services.

- Annuities: Certain types of annuities can be structured to provide a dedicated stream of income specifically for long-term care expenses.

Each of these avenues has its own set of rules, benefits, and potential drawbacks. For most families, a sustainable financial plan involves combining multiple sources. By understanding what’s out there, you can start piecing together a strategy that makes high-quality care an affordable and manageable reality.

Practical Ways to Manage Your Care Budget

Let’s be honest: figuring out how to manage the in home caregiver cost can feel like a puzzle. The key isn't about finding the cheapest option, but about being smart and strategic. It’s about making sure every dollar you spend directly improves your loved one's quality of life, without paying for extras you just don't need. A little proactive planning can make professional care feel much more sustainable.

The most powerful tool you have right from the start is a detailed care plan. Before you even think about calling an agency, take the time to sit down and make a specific list of needs and wants. A clear plan helps you get truly accurate quotes and keeps you from getting locked into a bundled service package when all you really need is help with a few specific tasks for a couple of hours.

Create a Hybrid Care Model

One of the best strategies we see families use is blending professional support with their own involvement. This “hybrid” approach is a game-changer. It lets you focus your budget on the things that require a skilled professional, while family members can step in for the lighter duties. You really do get the best of both worlds: expert care where it matters most and significant savings.

Here’s what that might look like in practice:

- Professional Caregiver: Hired for 4 hours each morning to handle the more demanding personal care, like bathing, dressing, and medication reminders.

- Family Members: Take turns covering companionship, preparing evening meals, and doing some light housekeeping.

A model like this doesn't just make professional care more affordable; it keeps the family deeply connected and involved in the day-to-day journey. It transforms what feels like an all-or-nothing expense into a shared, manageable responsibility. Our team often helps families map out these kinds of blended plans. You can find some inspiration by looking at our local caregiving resources.

Explore All Financial Avenues

Beyond your own budget, there are several financial tools and community programs out there that can ease the load. It's surprising how many families don't realize these options exist, but they can make a real dent in your monthly costs.

Don't assume you have to cover the entire cost alone. Exploring every option, from tax credits to local senior programs, can unlock thousands of dollars in savings and support each year.

Make a checklist and start looking into each of these possibilities:

- Negotiate Rates: If you're planning on long-term care, some agencies might be open to a slightly lower hourly rate. It never hurts to ask, especially if you can guarantee consistent hours.

- Tax Credits and Deductions: Are you paying for care so you can go to work? You might be eligible for the Child and Dependent Care Credit. In some cases, you may even be able to claim your parent as a dependent. It's always best to talk to a tax professional to see what you qualify for.

- Local Senior Resources: Your county's Area Agency on Aging is an incredible, often overlooked, resource. They can connect you with subsidized respite care, volunteer companion programs, or services like Meals on Wheels that can cut down on the number of hours you need to hire a paid caregiver.

Common Questions About In–Home Care Costs

When you start digging into the details of in-home care, a lot of practical, financial questions naturally come up. To help you plan with confidence, we've put together answers to some of the most common questions families ask us about the in home caregiver cost.

Does Long-Term Care Insurance Cover All Costs?

It's a great tool to have, but it usually doesn't cover everything. Think of long-term care insurance as a significant financial partner, not a blank check. Most policies have specific limits on how much they’ll pay out per day or over a lifetime.

You’ll want to pull out your policy documents and read the fine print. Look specifically for the “elimination period,” which is how long you have to pay out-of-pocket before the benefits kick in. Also, check which Activities of Daily Living (ADLs) are actually covered. This will give you a realistic picture of your out-of-pocket responsibilities.

Is It Cheaper to Hire a Private Caregiver?

At first glance, it can seem that way. An independent caregiver’s hourly rate is often lower because you aren’t paying for the overhead that comes with a professional agency, like office staff and insurance.

But hiring privately means you essentially become an employer, and that comes with a whole new set of responsibilities. Suddenly, you're on the hook for all the things an agency normally handles behind the scenes:

- Running thorough background and reference checks

- Managing payroll, including withholding and paying taxes

- Securing liability and workers' compensation insurance

- Scrambling to find (and pay for) backup care when your caregiver calls in sick or takes a vacation

When you factor in the time, stress, and extra expenses, those initial savings can disappear fast. An agency provides a safety net and handles the administrative headaches, often for a comparable all-in cost.

Can I Claim My Parent as a Dependent for Tax Breaks?

There's a good chance you can. To claim your parent as a "qualifying relative" on your tax return, you’ll have to meet several specific IRS criteria. The big one is that you must provide more than half of their total financial support for the year. Their own gross income also has to be under a certain threshold set by the IRS.

And here's another potential benefit: If paying for their care allows you to go to work or look for a job, you might qualify for the Child and Dependent Care Credit. It can be a real financial help for many families.

Tax rules can get complicated in a hurry, so your best bet is always to chat with a qualified tax professional. They can walk you through your specific situation to make sure you’re getting every credit and deduction you’re entitled to.

Finding the right care solution in Mercer County means balancing quality, reliability, and cost. At NJ Caregiving, we help families navigate these decisions with confidence. To learn more about our personalized care plans and transparent pricing, visit us at https://njcaregiving.com.