Trying to figure out the cost of in-home care can feel like putting together a puzzle without all the pieces. You might hear that the average is somewhere between $25 and $35 per hour, but that number is just a starting point. The final price tag really depends on what you need, where you live, and the level of support your loved one requires.

Understanding the Basics of In Home Care Costs

When you start planning for senior care, the first question on everyone's mind is always: "What's this going to cost?" Unlike buying a product off the shelf, in-home care isn't one-size-fits-all. Think of it more like building a custom plan where every service and each hour of support is a block that contributes to the final monthly bill. The great thing about this approach is you only pay for the care you actually use.

Most often, care is structured at an hourly rate. This gives families incredible flexibility, whether they need just a few hours of help a week or more consistent, daily support. While the national average for in-home care runs from $25 to $35 per hour, that rate can shift based on a caregiver's credentials, your geographic area, and the specific tasks involved. This hourly rate is the foundation, but it's good to know that many agencies offer slightly lower rates for longer shifts, which can make extended care more manageable. For more on this, you can discover more insights about 2025 home care costs on elder-answers.com.

Common Billing Structures

Getting a handle on the different pricing models is the first real step to building a budget that works. For most families, it boils down to a few key options, each tailored for different needs and financial realities.

- Hourly Care: This is by far the most popular setup. It’s perfect for families who need an extra set of hands for specific tasks like making meals, driving to appointments, or help with personal grooming for a set number of hours.

- Overnight Care: If you’re worried about a loved one who might wander, be at risk for a fall, or need help during the night, this option provides crucial peace of mind. A caregiver is present and available all night long.

- Live-In Care: This model involves a caregiver living in the home. It sounds like constant coverage, but it's important to understand that live-in caregivers are legally entitled to their own breaks and a block of uninterrupted sleep.

- 24/7 Care: For those who need true, around-the-clock support, this is the most comprehensive choice. It uses a team of caregivers working in shifts to ensure someone is always awake, alert, and ready to help.

The goal is to match your loved one’s needs with the right financial model. By understanding these structures, you can avoid paying for more care than is truly necessary while making sure they are safe and comfortable.

At-a-Glance In Home Care Cost Estimates

To give you a clearer picture, it helps to see how these structures translate into potential expenses. The following table provides a quick summary of typical cost structures and average rates to give you an initial understanding of potential expenses.

| Care Type | Typical Billing Structure | Average National Hourly Rate | Estimated Monthly Cost (40 hrs/week) |

|---|---|---|---|

| Companion Care | Hourly | $25 – $30 | $4,300 – $5,200 |

| Personal Care Aide | Hourly | $28 – $33 | $4,800 – $5,700 |

| Home Health Aide | Hourly | $30 – $35 | $5,200 – $6,000 |

Keep in mind, these are national averages based on a standard 40-hour week. Your actual costs will vary based on the factors we've discussed, but this should give you a solid baseline for planning.

What Actually Drives Your In-Home Care Costs

Knowing the average hourly rate for in-home care is a great place to start, but it really doesn't paint the whole picture. The final number on your monthly bill is shaped by a few key factors that are unique to your family’s needs.

Think of it like ordering a pizza—the base price is just the beginning. The final cost depends on the size, the crust, and every single topping you decide to add. Similarly, in-home care costs are built from a few core components. The biggest driver is the specific level of care your loved one requires. From there, things like your geographic location and even the type of provider you choose will all play a part.

Once you understand these elements, you can forecast your expenses with much better accuracy and create a budget that truly works for you.

The Impact of Care Levels

Not all care is the same, and the caregiver's required skills and training directly influence the hourly rate. Simply put, the more specialized the support, the higher the cost. This is the single biggest factor in figuring out what your family will spend.

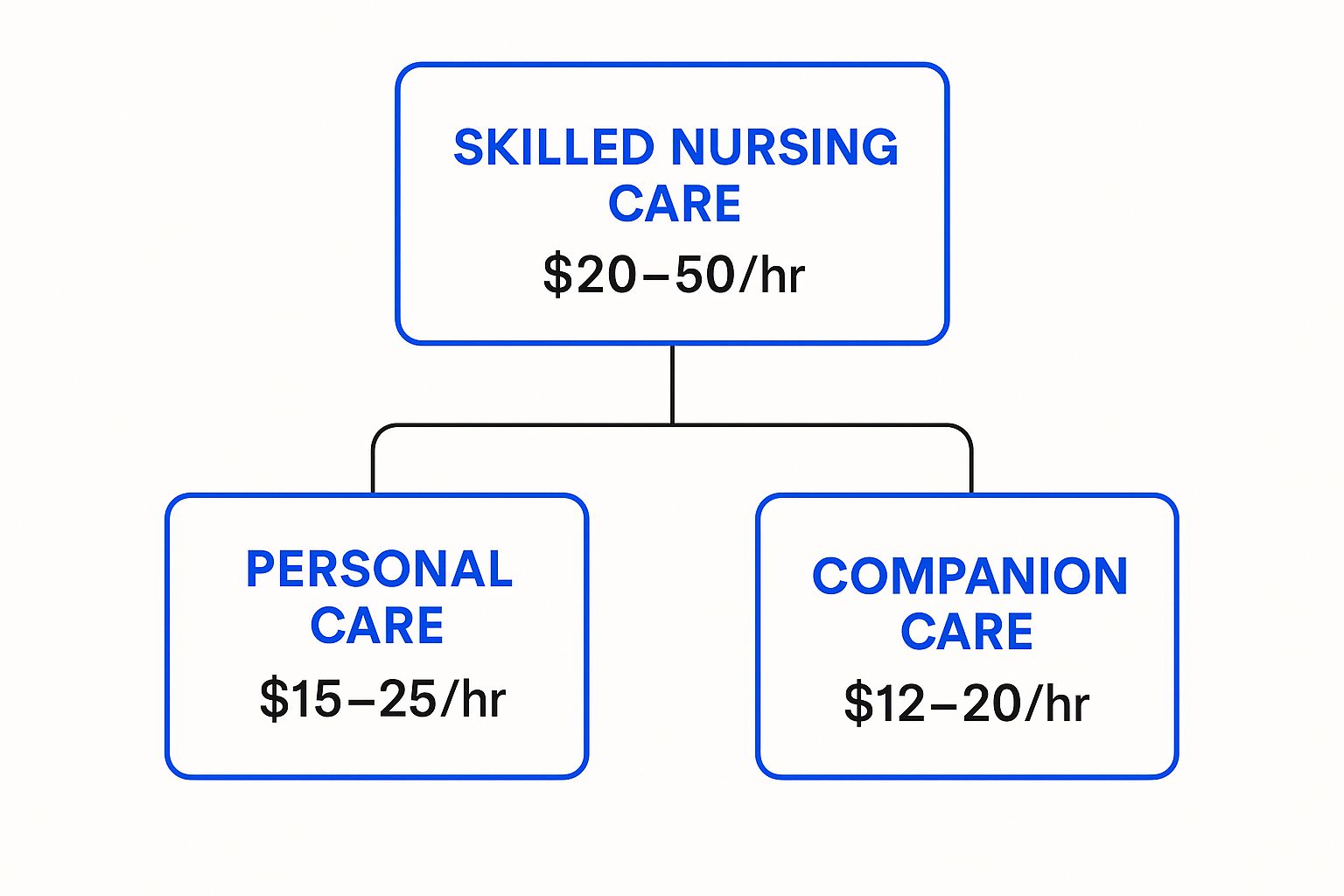

This infographic breaks down the typical cost structure based on the level of care.

As you can see, skilled nursing commands the highest rates because of the medical expertise involved, while companion care is the most affordable tier.

Let's unpack what each level really means:

- Companion Care: This is a non-medical service that’s all about emotional support and helping around the house. A companion might prepare meals, run errands, provide a ride to an appointment, or simply be there to chat and combat loneliness.

- Personal Care: This level includes everything in companion care but adds hands-on help with Activities of Daily Living (ADLs). This means direct assistance with tasks like bathing, getting dressed, grooming, and mobility support.

- Skilled Nursing Care: This is medical-grade care provided by a licensed nurse, usually under a doctor's orders. Services can include wound care, giving injections, managing IVs, and monitoring serious health conditions.

Location and Its Effect on Rates

Where you live plays a massive role in your total in-home care costs. Just like the cost of housing varies wildly from state to state and city to city, so do caregiver wages. A family in a major metro area like Princeton, NJ, will almost always pay a higher hourly rate than a family in a more rural part of the state.

This difference comes down to local economics:

- Higher minimum wage laws in certain cities or states.

- Greater demand for caregivers in densely populated areas.

- A higher general cost of living for the caregivers themselves, which shapes their pay expectations.

For instance, the annual cost of round-the-clock home care in Columbus, Ohio, was $67,496 back in 2021. This number reflects the higher wages and demand you’d expect in an urban center compared to more remote parts of the state.

Agency Caregivers vs. Independent Hires

Another big decision that will impact your budget is whether you hire a caregiver through a professional agency or find an independent provider on your own. While hiring independently often seems cheaper at first with a lower hourly rate, it’s crucial to look at the total financial picture.

An agency, like NJ Caregiving, takes care of all the administrative headaches. They manage payroll, taxes, liability insurance, and run thorough background checks. They also have backup caregivers ready to go if your regular aide gets sick, so you’re never left without help.

When you hire an independent caregiver, you effectively become their employer. That means you are responsible for withholding taxes, paying for workers' compensation, and handling all the legal and financial compliance. These "hidden" costs can add up fast, often closing the price gap between the two options. The trade-off is often between a lower upfront hourly rate and the security and convenience that an agency provides.

Choosing Your Care Schedule: Hourly, Live-In, or 24/7?

Once you’ve figured out the level of care your loved one needs, the next big decision is the schedule. This choice—whether to go with hourly, live-in, or 24/7 support—is one of the single biggest drivers of your final in-home care costs. Each option is built for a different kind of situation, and really getting a feel for how they work is the key to building a care plan that’s both effective and sustainable.

I like to compare it to picking a data plan for your phone. A pay-as-you-go option is perfect if you only use it occasionally. A standard monthly plan works great for predictable, everyday use. But for someone who’s always streaming video, only an unlimited plan will do. In the same way, the right care schedule has to line up with your loved one's day-to-day needs and your family's budget.

Getting this right isn't just about the final bill; it also shapes the entire dynamic in the home. Let's break down each option so you can see which one feels like the best fit for your family.

The Flexibility of Hourly Care

Hourly care is easily the most common and adaptable choice, giving you a completely personalized approach. It’s tailor-made for seniors who are still fairly independent but could use a hand with certain tasks at specific times of the day. Maybe that's a few hours in the morning to help with bathing and making breakfast, or a couple of hours in the evening for dinner and medication reminders.

The biggest plus here is that you only pay for the time you actually use, making it incredibly cost-effective. It's an excellent starting point for families looking to supplement the care they're already providing or for seniors who just need a little boost to keep living safely and comfortably at home.

Key Takeaway: Hourly care delivers targeted support without the price tag of a full-time schedule, making it a smart, budget-friendly option for many families.

Understanding Live-In Care Arrangements

Live-in care is a whole different ballgame. With this model, a single caregiver actually resides in the home with your loved one. It’s often mistaken for constant, around-the-clock supervision, but that’s not quite how it works. A live-in caregiver is typically paid a flat daily rate and must be given their own private room for sleeping, along with meals.

What's really crucial to understand is that they are legally required to have uninterrupted breaks and a solid block of sleep time—usually about eight hours. If a caregiver is being woken up multiple times during the night to help out, you'll likely need to shift gears to a more intensive care model to stay compliant and ensure everyone is safe.

- Best For: Seniors who need the security and companionship of having someone in the house but generally sleep through the night without issue.

- Cost Structure: A flat daily fee is the norm, which can be much more affordable than paying an hourly rate for 16-24 hours of coverage.

- Important Consideration: You have to set clear boundaries and follow labor laws about sleep and breaks. This is non-negotiable for a successful live-in arrangement.

The Commitment of 24/7 Round-the-Clock Care

When a loved one needs constant supervision, day and night, 24/7 care is the only way to go. Unlike live-in care with its single aide, this model uses a team of caregivers who work in shifts, usually 8 or 12 hours at a time. This guarantees that someone is always awake, alert, and ready to provide immediate help at any hour.

The need for this intensive level of care is growing, especially since the population of seniors aged 65 and older has now topped 50 million in the U.S. With the median hourly rate for non-medical home care hovering around $30 to $31, the numbers add up fast. Full 24/7 coverage (168 hours a week) can push monthly costs to approximately $21,823 for basic services, and even higher for a home health aide. You can find out more about the financial demands of continuous in-home support to prepare.

Comparing Costs: Home Care vs. Other Senior Living Options

Choosing the right care for a loved one is a delicate balancing act. You're weighing their needs, their comfort, and of course, the family budget. We've talked about what goes into in-home care costs, but the picture isn't complete until you see how those numbers stack up against other common choices, like assisted living or a nursing home.

This isn't just about finding the cheapest route. It’s about understanding the real value behind the price tag for each option.

Think of it like this: in-home care is the private car service—it’s completely personalized, door-to-door, and tailored to a specific schedule and needs. Assisted living is more like a community shuttle bus, offering a great balance of independence with scheduled support and social opportunities. A nursing home, then, is the dedicated ambulance, providing intensive, specialized medical care for complex health situations. Each has a different purpose and a different cost.

Looking at the financials side-by-side helps clarify where your investment is going, so you can make a choice that feels right for both your heart and your wallet.

A Financial Snapshot of Senior Care

The price tags for different types of care can be a bit of a shock at first. But it’s crucial to look at what’s actually included in that cost. In-home care is typically an hourly rate for services, while facilities usually charge an all-inclusive monthly fee that covers room, board, and care.

While the cost of home care is on the rise—driven by things like wage increases and staffing shortages—it often remains the most budget-friendly choice, especially when compared to intensive facility care. For example, in Massachusetts, full-time home care might average around $86,944 a year. A semi-private room in a nursing home, however, could be nearly double that at $173,375. That’s a massive difference, and it’s a big reason why so many families are drawn to home-based solutions. You can discover more insights about these home care industry trends on globalonehomecare.com.

To really put things in perspective, let’s look at a side-by-side comparison of the national median costs for different types of senior care.

Annual Senior Care Cost Comparison

The numbers below give a general idea of the financial landscape for senior care. Remember, these are national estimates, and your actual costs will depend heavily on your location and specific needs.

| Type of Care | Average Annual Cost | Key Considerations |

|---|---|---|

| In-Home Care (44 hrs/week) | $61,776 | Costs are flexible and based on hours needed. Ideal for seniors who own their homes and want to maintain independence. |

| Assisted Living Facility | $54,000 | Includes housing, meals, and some personal care. A good middle-ground for social engagement and moderate support. |

| Nursing Home (Semi-Private) | $94,900 | Offers 24/7 skilled medical care and supervision. Best for individuals with complex, chronic health conditions. |

This table illustrates the different financial commitments involved, helping you see where in-home care fits into the broader picture of senior living options.

The True Value Beyond the Price Tag

Here’s the thing: the most expensive option isn't automatically the best one, and the cheapest isn't always practical. The right choice is all about your loved one’s specific needs.

A nursing home's all-inclusive price might seem high, but for someone who needs round-the-clock skilled medical attention, it’s often the safest and most effective solution. That cost covers constant medical supervision that would be incredibly difficult and even more expensive to replicate at home.

For many families, however, in-home care offers an unmatched combination of affordability and emotional well-being. It allows a senior to remain in a cherished, familiar environment, surrounded by a lifetime of memories.

This is especially true for seniors who own their homes and just need a helping hand with daily activities. In these cases, paying for a few hours of help each day is far more economical than footing the bill for a full-time residential facility. More importantly, it preserves a priceless sense of independence and dignity—and that’s a value you just can’t put a number on.

How to Navigate Paying for In Home Care

Understanding what drives your in home care costs is half the battle; figuring out how to actually pay for it is the other. This part of the journey can feel intimidating, but there are far more ways to fund care than most families initially realize. The secret is knowing where to look and what you can expect from each option.

For many, the first stop is private funds. This is the most straightforward route and includes things like personal savings, retirement accounts (think 401(k) or IRA), pensions, and annuities. In fact, research shows that about two-thirds of adults over 65 who aren't on Medicaid can cover at least two years of paid home care with just their income and available assets.

But since care needs often last longer than two years, it's smart to look at every possibility to build a plan that can go the distance.

Using Long-Term Care Insurance

If you or your loved one planned ahead by purchasing a long-term care (LTC) insurance policy, now is the time to pull it out and see what it covers. This specific type of insurance is designed to pay for services like in-home care, assisted living, or a nursing home.

These policies can be a lifesaver, but they definitely have their own rulebook.

- Elimination Period: Most policies don't start paying on day one. There's usually a waiting period of 30 to 90 days where you'll need to cover costs yourself.

- Coverage Caps: Look for any daily, weekly, or lifetime limits. This tells you exactly how much of the bill the policy will actually foot.

- Benefit Triggers: Coverage typically kicks in once a person can no longer perform a set number of Activities of Daily Living (ADLs), like bathing or dressing, without help.

It's so important to read the fine print here. Some older policies can have very specific requirements or frustrating paperwork, so it’s always a good idea to call the insurance company early and get a clear understanding of their claims process.

The Role of Government Programs

Government programs can be a huge source of funding for in-home care, but they're also widely misunderstood. The two big ones are Medicare and Medicaid, and they do very different things.

Crucial Distinction: Medicare is a federal health insurance program for people 65 and older. Medicaid is a joint federal and state program for low-income individuals. Their rules for covering home care are worlds apart.

Medicare's role in long-term home care is extremely limited. It’s set up to cover short-term, skilled medical care after an injury or illness—not ongoing personal or "custodial" care. For instance, Medicare might pay for a nurse to visit and change a wound dressing for a few weeks, but it will not pay for a caregiver to help with bathing and meals for months at a time.

Medicaid, on the other hand, is the single largest public payer of long-term care services in the U.S. To qualify, you have to meet strict income and asset limits, but for those who do, it's a lifeline. Many states offer Home and Community-Based Services (HCBS) waivers specifically designed to help people get care at home instead of moving to a nursing facility. These waivers can cover personal care, help around the house, and other non-medical support.

Exploring Veterans Benefits

For anyone who has served in the military, the Department of Veterans Affairs (VA) offers some fantastic benefits that can help with in home care costs. These programs are often overlooked but can provide a major financial boost.

One of the most helpful is the Aid and Attendance benefit. This is an extra monthly pension amount for wartime veterans and their surviving spouses who meet certain medical and financial needs. It’s specifically for those who need help with daily activities. Best of all, this tax-free benefit can be used to pay for an agency like NJ Caregiving or even to pay a family member who is providing care.

Taking the time to look into these options—from your own savings to government and veteran aid—can feel like a lot. But by exploring each path, you can put together a solid financial strategy to make sure your loved one gets the quality care they deserve, right where they want to be.

Your Top Questions About In-Home Care Costs Answered

Trying to figure out the financial side of senior care can feel like a maze. As you start putting a plan together, you're bound to have questions about how different situations might affect your budget. Here, we’ll tackle some of the most common concerns families have about in-home care costs with direct, clear answers.

Think of this as your quick-reference guide. Getting these details straight from the start can make all the difference in creating a care plan that’s both effective for your loved one and sustainable for your family.

Does Medicare Pay for 24-Hour In-Home Care?

This is easily one of the biggest points of confusion, and the short answer is almost always no. In nearly all situations, traditional Medicare does not pay for 24-hour in-home care, especially if the support needed is custodial.

So, what’s custodial care? It's the non-medical help with everyday life—what we call Activities of Daily Living (ADLs)—like bathing, dressing, eating, and getting around safely. Medicare’s home health benefit is strictly for short-term, skilled medical care prescribed by a doctor, like a nurse visiting to change a wound dressing after a hospital stay. It was never designed to cover long-term, round-the-clock personal support.

Families who need constant supervision for a loved one usually have to turn to other funding sources, such as:

- Personal savings, pensions, or other private funds

- A long-term care insurance policy

- Medicaid, but only for those who meet the strict financial eligibility rules

Are There Hidden Costs When Hiring a Caregiver?

It's so important to look beyond the advertised hourly rate. Other expenses can pop up and significantly change your total in-home care costs. Whether you go through an agency or hire a caregiver directly, there are potential "hidden" fees you need to know about.

If you're working with an agency, always ask about:

- Initial Assessment Fees: Some agencies charge a one-time fee for the initial evaluation and care plan development.

- Premium Rates: Don't be surprised if the cost goes up for care provided on weekends, overnight, or on holidays.

- Mileage Reimbursement: If a caregiver uses their own car to run errands or drive your loved one to appointments, you’ll likely need to cover their mileage.

Deciding to hire an independent caregiver means you become an employer in the eyes of the law. This adds a layer of financial responsibility that catches many families off guard. You’ll be on the hook for managing payroll taxes, getting workers' compensation insurance, and paying into unemployment. Overlooking these duties can lead to serious legal and financial trouble down the line.

How Can I Reduce In-Home Care Costs Without Sacrificing Quality?

Absolutely. There are several smart ways to manage your budget while making sure your loved one gets fantastic care. It really comes down to finding efficiencies and using community resources to supplement professional help.

First, take a careful, honest look at how many hours of professional support you truly need. You might find a hybrid approach works perfectly, where family members can comfortably cover certain shifts, and a paid caregiver fills in the gaps. This alone can dramatically cut your weekly expenses.

A great way to lower costs is by tapping into local, often subsidized, community services. Your local Area Agency on Aging is an excellent starting point for finding programs like Meals on Wheels or volunteer transportation services.

Using these programs means you can reduce the number of tasks a paid caregiver has to do, which lets you book fewer hours. And for seniors who are more independent but could use some social time and supervision, an adult day care program can be a much more affordable option than full-time in-home care.

Is It Cheaper to Hire an Independent Caregiver Than an Agency?

On the surface, hiring an independent caregiver often looks cheaper. Their hourly rate is usually lower because there's no agency overhead baked in. But to make a smart decision, you have to look at the total cost and the responsibilities you’re taking on.

Professional agencies, like NJ Caregiving, handle all the tricky administrative work for you. That means they run rigorous background checks, verify certifications, manage the payroll and taxes, and provide liability insurance. Most importantly, they have backup caregivers ready to go, so you’re never left in a bind if your regular aide gets sick or has an emergency.

When you hire independently, all of those headaches fall on your shoulders. You become the manager, the HR department, and the payroll specialist. You have to weigh the initial savings on the hourly rate against these added risks, administrative chores, and potential legal costs. For many families, the peace of mind and security an agency provides is worth far more than the slightly higher hourly rate.

At NJ Caregiving, we believe in being completely transparent and helping you find the right care solution for your family's needs and budget. If you're in the Princeton, NJ area and have more questions about planning for in-home care, our team is here to help. Contact us today to learn more about our compassionate and professional services.