When it comes to planning for long-term care, many of us put it on the back burner. It feels like a problem for "future you" to handle. But I've seen firsthand that waiting is one of the biggest gambles you can take with your financial security and personal well-being. Thinking about this now isn't about giving in to fear; it's an act of taking control. It brings a profound sense of relief for both you and your family down the road.

Why You Need to Start Planning for Long Term Care Today

Let's be real: needing some form of long-term care isn't a remote possibility. For most of us, it's a probability. This isn't just a guess—the numbers paint a very clear picture.

The Overwhelming Odds

Statistics consistently show that a majority of us will need a helping hand as we get older. Globally, an estimated 70% of people turning age 65 will require some type of long-term care service in their lifetime. We're living longer, which is fantastic, but it also means the demand for care is growing rapidly. You can learn more about these long-term care statistics and see why this has become such a critical issue for families everywhere.

These aren't just numbers on a page. They represent real families facing tough situations. Without a plan, you could drain a lifetime of savings, place an immense emotional and financial burden on your loved ones, and ultimately, lose say over your own life.

The goal of planning isn't to predict the future with perfect accuracy. It's about building a resilient safety net that protects your assets, honors your wishes, and gives everyone peace of mind, no matter what happens.

Moving Beyond the Worst-Case Scenario

Thinking about how to plan for long term care isn't about dwelling on what could go wrong. It’s about making sure your voice is heard and your life continues on your own terms. A solid plan puts you in the driver’s seat.

It answers the tough questions before a crisis forces your family to guess:

- Who will make decisions for me if I can't? Without legal documents like a power of attorney, this could end up in a courtroom, creating unimaginable stress and conflict for your family.

- How will we pay for care without bankrupting my spouse or depleting our family's resources? A clear funding strategy protects the financial future of the people you care about most.

- Where will I receive care? Stating your preference—whether it's aging in place at home or moving to a specific community—removes the guesswork and honors your wishes.

By tackling these questions now, you're giving your family a roadmap. You're giving them the gift of clarity. It transforms what could be a chaotic, painful crisis into a manageable process, all guided by your own voice.

Defining Your Own Future Care Needs

Before you start crunching numbers or calling lawyers, you need to get crystal clear on one thing: what does "care" actually look like for you? A good long-term care plan isn't a generic template. It’s deeply personal, built around your specific health, your lifestyle, and what you truly want for your future.

Think of this as the bedrock of your entire plan. It starts with an honest look at your own health and your family’s medical history. Are there conditions like heart disease or dementia that run in the family? This isn't about dwelling on the worst-case scenario. It's about being practical and prepared for what might be ahead.

This kind of personal inventory is what allows you to plan for long term care in a way that’s realistic and genuinely reflects your life.

Your Lifestyle and Where You Want to Be

The "where" is just as important as the "what." Where do you see yourself as you get older? Do you want to stay in your own home, surrounded by familiar comforts? Or does the thought of a lively community with friends and activities just down the hall sound more appealing?

There's no single right answer here—only the one that feels right for you.

- Aging in Place: This is what most people prefer. It means staying in your own home, which might involve some modifications, bringing in home caregivers, and leaning on a support system of family and friends. It offers the most independence but also requires a lot of planning and coordination.

- Assisted Living Community: These facilities strike a nice balance. You get your own private space but also have access to shared dining, social events, and help with daily tasks when you need it.

- Continuing Care Retirement Community (CCRC): Think of these as a one-stop-shop for care. They offer a full spectrum on one campus, allowing you to move from independent living to assisted living or skilled nursing as your needs evolve, all without a major move.

Thinking this through now makes sure everyone knows what you want, which makes the financial and legal planning much more straightforward.

The most powerful part of this process is making your wishes known. Clearly communicating your desires removes the burden of guessing from your loved ones during a potential crisis, allowing them to act as your advocate with confidence.

Decoding the Different Levels of Care

"Long-term care" is a broad term that covers a whole spectrum of services. Knowing the specifics helps you build a much more accurate plan. Generally, care falls into three main buckets.

1. Companion Care and Homemaker Services

This is the starting point for many. It's all about non-medical help that combats isolation and keeps the home running smoothly. A caregiver might help with preparing meals, running errands, light housekeeping, or simply providing some friendly conversation.

2. Personal Care (Assistance with ADLs)

This level of care involves hands-on help with Activities of Daily Living (ADLs). These are the basic, fundamental tasks of self-care. In fact, needing help with two or more ADLs is often what triggers benefits from a long-term care insurance policy. ADLs include things like:

- Bathing and grooming

- Getting dressed

- Eating

- Transferring (like getting out of bed and into a chair)

- Toileting

3. Skilled Nursing Care

This is the highest level of care, delivered by licensed professionals like registered nurses (RNs) or physical therapists. It involves medical tasks like managing complex health conditions, giving injections, wound care, or rehabilitation therapy. This care can happen at home or in a dedicated facility, often following a hospital stay.

By picturing where your needs might fall across these levels, you can transform a vague idea into a concrete, actionable plan.

Understanding the Real Costs of Long Term Care

Once you have a picture of what ideal care looks like, the next, very real question is: What’s this actually going to cost? It's easy to feel intimidated when tackling the financial side of long-term care, but honestly, facing these numbers head-on is one of the most empowering things you can do. A solid funding strategy is built on a clear understanding of the potential expenses.

The truth is, costs aren't one-size-fits-all. They can change dramatically depending on where you live, the specific type of care needed, and the number of hours required each week. Getting 40 hours of in-home care, for example, comes with a very different price tag than moving into a full-time memory care community.

A good way to get your bearings is to start with the national averages. This gives you a baseline to work from before you start digging into the costs specific to your own community.

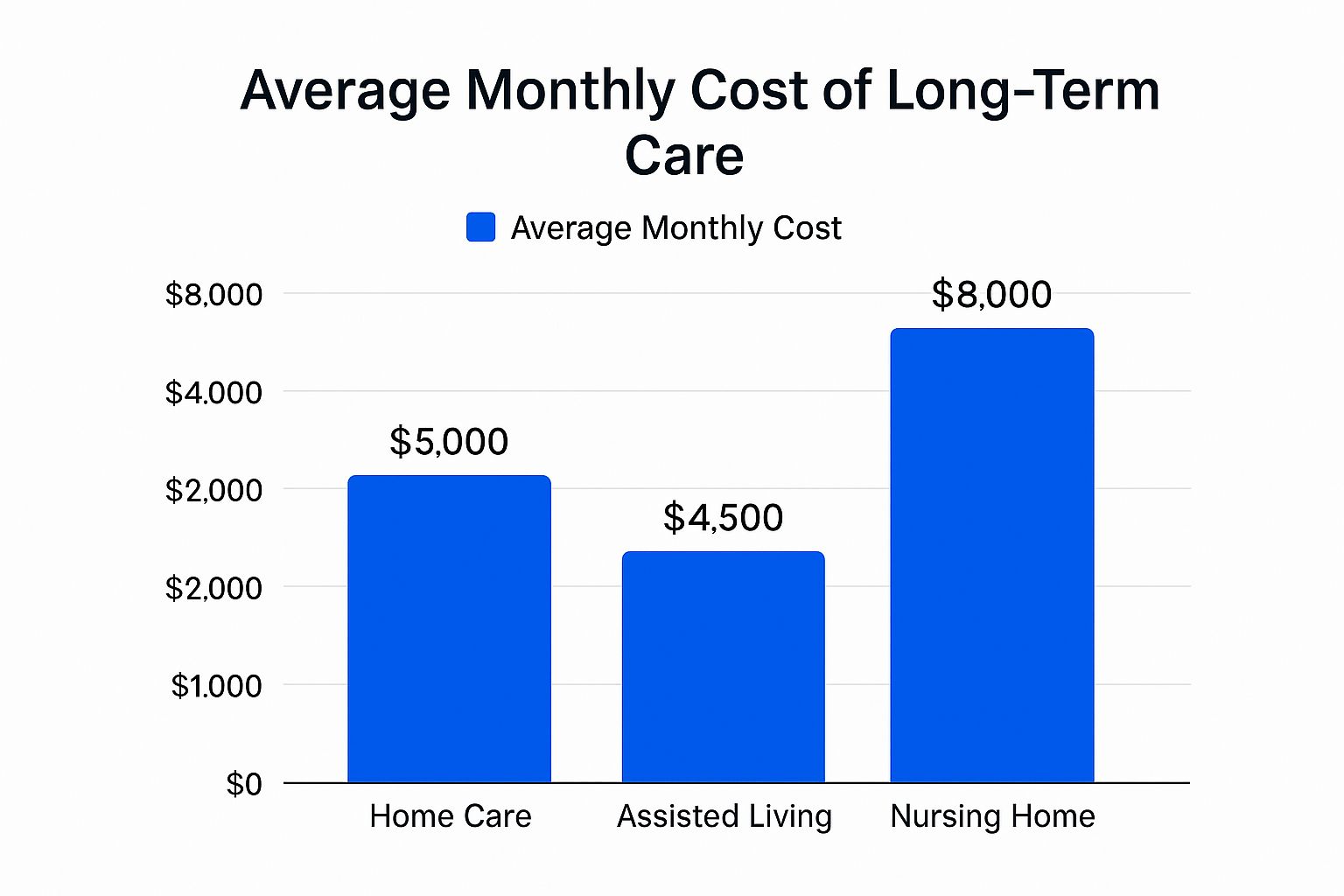

The infographic below gives a quick visual breakdown of the median monthly costs for the three main types of long-term care services across the United States.

As you can see, the costs climb pretty steeply as the need for medical supervision and environmental support grows.

A Deeper Dive Into the Numbers

While national data is a useful starting point, your personal reality will almost certainly look different. Local economies, the demand for care in your area, and state-specific regulations all have a huge impact on pricing. A nursing home room in a small rural town might cost a fraction of what you’d pay in a major city.

To give you a clearer sense of the financial scope, the table below breaks down the median national costs with a bit more detail for each setting.

Estimated Monthly Long Term Care Costs in the US

| Type of Care | Median Monthly Cost (National Average) | Brief Description |

|---|---|---|

| In-Home Care (Homemaker Services) | $5,720 | Provides non-medical help like meal prep, companionship, and light housekeeping for around 44 hours a week. |

| Assisted Living Facility | $4,774 | Offers housing, meals, and support with daily living activities within a community environment. |

| Nursing Home (Semi-Private Room) | $8,669 | Delivers 24/7 skilled nursing and medical oversight for people with complex health conditions. |

| Nursing Home (Private Room) | $9,733 | Provides the same level of skilled care as a semi-private room but with the added privacy of a personal space. |

Note: These figures represent median costs and can vary widely.

Seeing these numbers can be a bit of a shock, but it really drives home why having a dedicated plan is so critical. Without one, these kinds of expenses can quickly drain a lifetime of savings.

The Impact of Location and Duration

The need for care is anything but a remote possibility. Research shows that more than half (56%) of Americans turning 65 will eventually develop a disability serious enough to require long-term support. The total financial impact is massive, with seniors needing an average of $138,000 in services over their lifetime.

These costs are also heavily shaped by geography. For instance, a semi-private nursing home room in Texas might run you about $5,600 a month, but that same room in Alaska could soar past $34,000. You can find more detailed data on these care statistics to get a better handle on these regional differences.

Keep in mind that for many people, care isn't just one thing. It's common for someone to receive care at home for a while, then move to an assisted living facility for a couple of years, and later need a skilled nursing home.

This "continuum of care" means the total time can easily stretch to three to five years, and even longer for those with conditions like Alzheimer's. When you multiply the monthly costs by that duration, the potential lifetime expense makes it clear that early, thoughtful planning isn't just a good idea—it's an absolute necessity. Now that you have a grasp of the costs, you're ready to explore how you can build a strategy to fund them.

Crafting Your Long Term Care Funding Strategy

Once you have a handle on the potential costs, the next conversation is about how to pay for it all. This is often the part that feels the most intimidating, but you likely have more options than you think. The real key is to build a layered approach—a financial safety net woven from different sources that fits your unique situation.

The process has to start by clearing up a few common—and potentially very expensive—misconceptions. So many families assume their standard health insurance or Medicare will be there to cover long-term care. In nearly all cases, that’s just not true.

Medicare vs. Medicaid: What You Absolutely Must Know

It’s crucial to understand the roles Medicare and Medicaid play because they are fundamentally different. Mistaking one for the other or relying on them blindly can completely derail your financial plan.

-

Medicare: Think of this as your health insurance for immediate, acute medical problems. It covers things like doctor visits, hospital stays, and maybe some short-term skilled nursing care right after a hospital stay (like for physical therapy). But here’s the critical part: it does not pay for long-term custodial care. That’s the day-to-day help with activities like bathing, dressing, and eating, which is what most long-term care actually is.

-

Medicaid: This program does cover long-term care, but it’s a needs-based safety net run by the state and federal government. To qualify, you must have very limited income and few assets. For most people, this means spending down their life savings to meet the strict eligibility rules, which can be a devastating financial blow, especially for a healthy spouse left behind.

Here’s the single most important thing to remember: Medicare is a health insurance program, not a long-term care plan. Medicaid is a safety net, but qualifying often means giving up the assets you worked a lifetime to build.

Exploring Your Private Funding Options

Since government programs are so limited, most people need to create a plan using private funding. These are the tools designed to protect your savings and ensure you can get quality care when you need it most.

Traditional Long Term Care Insurance

This is a straightforward insurance policy designed for one thing: to cover long-term care costs. You pay a regular premium, and if you need care later on and meet the policy's triggers (usually needing help with two or more Activities of Daily Living), it pays out a daily or monthly benefit up to a set limit.

The sweet spot for buying this kind of policy is typically in your mid-50s to early 60s. Premiums are much more affordable at that age, and you're more likely to be healthy enough to pass the underwriting. Waiting until your late 60s or 70s makes it far more expensive and difficult to get covered.

Hybrid Life Insurance/LTC Policies

These hybrid policies have become incredibly popular. They combine a life insurance death benefit with a long-term care rider. If you end up needing care, you can access the death benefit while you're still living. If you never need care, your heirs receive the full life insurance payout.

This approach gives you more flexibility and solves the "use it or lose it" problem that worries people about traditional LTC insurance. They often have guaranteed premiums that won't go up, but they do require a larger upfront premium, either as a lump sum or paid over a fixed period, like 10 years.

Annuities with Long Term Care Riders

Annuities can also be set up to help pay for care. With a long-term care annuity, you can leverage an initial investment to create a much larger pool of money specifically for care expenses. If you need it, the annuity provides monthly payouts. If you don't, the remaining funds can pass to a beneficiary.

Tapping Into Your Home Equity

For homeowners, the equity you’ve built in your property is another powerful resource. A reverse mortgage lets homeowners aged 62 and older convert a portion of their home equity into cash. You can get the money as a lump sum, monthly payments, or a line of credit.

You don't have to make monthly mortgage payments, but the loan comes due when you sell the house, move out for good, or pass away. It can be an effective strategy, but it's a major financial decision that absolutely requires counseling from a HUD-approved advisor to make sure you understand all the implications.

The market itself reflects this growing need for creative funding solutions. The global long-term care market was valued at around USD 1,274 billion in 2025 and is projected to hit USD 1,757 billion by 2032. This explosive growth is driven by aging populations and medical advances. You can explore more projections on the long-term care market to see the bigger picture.

In the end, the strongest plans often mix and match these options. You might have a hybrid policy as your first line of defense, with a reverse mortgage ready as a backup if your care needs are more extensive than the policy covers. The goal is to build a solid financial plan that gives you options, control, and—most importantly—peace of mind.

Securing Your Wishes with Essential Legal Documents

Once you’ve mapped out your care preferences and figured out a funding strategy, it's time to make those wishes legally binding. This part of how to plan for long term care is all about making sure your voice is heard, even if you can’t speak for yourself.

It's a step many people put off, but without these key legal documents, you're leaving your family to face heartbreaking decisions and potential legal battles during an already impossible time. These aren't just for end-of-life scenarios; they’re critical for managing your affairs if you become temporarily or permanently incapacitated. They give legal authority to the people you trust most, preventing family conflict and providing much-needed clarity.

The Power of Attorney: A Two-Part Safeguard

A Power of Attorney (POA) is a foundational document that lets you appoint a person or organization to manage your affairs if you can no longer do so. Think of it as one of the most important tools for protecting your autonomy. For complete long-term care planning, you really need two distinct types.

Durable Power of Attorney for Finances

This document grants someone you trust—your agent—the authority to handle your financial life. This isn't just about paying bills. It can cover managing investments, filing taxes, and even applying for benefits like Medicaid on your behalf. The "durable" part is essential; it means the document stays in effect even if you become incapacitated.

Imagine this real-world scenario: a father has a stroke, but he never set up a durable POA. His family couldn't access his bank account to pay the mortgage or his mounting medical bills. They had to go through a costly and lengthy court process to be appointed as his conservator, adding immense stress to an already tragic situation.

Durable Power of Attorney for Healthcare

Often called a healthcare proxy or medical power of attorney, this document lets you name an agent to make medical decisions for you when you can't. This person will be your advocate—communicating with doctors, consenting to treatments, and making choices based on the wishes you've already discussed with them. It's crucial to choose someone who truly understands your values and can stay calm under pressure.

Your Living Will: Voicing Your Medical Preferences

A living will is different from a POA. It’s a written statement that details your desires for medical treatment in specific, often end-of-life, situations. It serves as a guide for your healthcare agent and doctors, spelling out your preferences on things like life-sustaining procedures.

Here are some of the choices you can specify in a living will:

- Use of Life Support: Your wishes regarding mechanical ventilation or dialysis.

- Tube Feeding: Whether you want artificial nutrition and hydration if you can no longer eat or drink.

- Palliative Care: Instructions to prioritize your comfort and manage pain above all else.

Without a living will, doctors are often obligated to provide every possible treatment, which might not be what you would have wanted. This document ensures your values guide your care.

A living will speaks for you when you can't. It's a gift of clarity to your loved ones, sparing them from making agonizing decisions about your care without knowing what you would have wanted.

Putting It All Together for Complete Protection

These documents don’t work in isolation; they form a comprehensive legal shield, protecting both your finances and your health autonomy. Having them in place is a non-negotiable part of any solid long-term care plan.

A Quick Comparison of Key Documents

| Document | Primary Function | Who It Empowers |

|---|---|---|

| Financial POA | Manages financial and legal affairs. | Your financial agent. |

| Healthcare POA | Makes medical decisions on your behalf. | Your healthcare agent. |

| Living Will | States your wishes for end-of-life care. | Informs your agent and doctors. |

Once you have these documents prepared—usually with the help of an elder law attorney—make sure your appointed agents have copies and fully understand their roles. Taking this simple step now can prevent chaos later and ensure your plan is carried out just as you intended.

Of course. Here is the rewritten section, crafted to sound completely human-written and natural, following the provided style guide and requirements.

Your Long-Term Care Planning Questions, Answered

Even with a solid plan in place, it's completely normal for questions and a bit of uncertainty to creep in. Let's be honest, this process can feel overwhelming. That’s why I’ve put together this section—to tackle the common questions and points of confusion I hear from families all the time.

Think of this as your practical, no-nonsense troubleshooting guide. We'll clear up the "what ifs" and common misunderstandings that can feel like roadblocks on your planning journey.

At What Age Should I Start Planning for Long Term Care?

There's no magic birthday, but if you ask most financial advisors and insurance experts, they'll point to your early-to-mid 50s as the sweet spot to really dig into this. This isn't an arbitrary number; there are a couple of very practical reasons behind it.

First up is your health. In your 50s, you're much more likely to be in good health, which is a huge factor when you're trying to qualify for long-term care insurance. If you wait until a health issue pops up, your options can shrink dramatically, or the cost can skyrocket.

Second is the simple math of it all. Premiums for these policies are directly tied to your age and health when you apply. The younger and healthier you are, the lower your premiums will be. Starting early gives you a much longer runway to absorb this cost into your budget, rather than having to suddenly account for a large new expense later on.

The real takeaway here isn't about a specific age. It's about taking action before a health crisis forces your hand. When you're proactive, you stay in the driver's seat with the most choices available to you.

Does My Regular Health Insurance Cover Long Term Care?

This is easily one of the most common—and most dangerous—misconceptions out there. The short answer is almost always no.

Your standard health insurance plan, whether it's from your job or the marketplace, is built to cover acute medical needs—things like doctor visits, hospital stays, surgery, and prescription drugs.

What it absolutely does not cover is what we call custodial care. This is the non-medical, hands-on help with Activities of Daily Living (ADLs) like bathing, dressing, eating, or just getting around safely. This kind of support is the very foundation of most long-term care, and it falls completely outside the scope of regular health insurance and even Medicare. Relying on your health plan for this will leave you with a massive, and likely unaffordable, financial gap.

How Long Will I Actually Need Care?

While every person's situation is unique, looking at the averages helps ground your financial plan in reality. It's important to remember that care rarely happens in just one place. A person's needs almost always evolve. For example, it’s quite common for someone to start with a year or two of in-home care before needing to move to a facility.

Here's what the data generally shows:

- The average length of stay in an assisted living facility is around 28-29 months.

- Research reveals that nearly 60% of people in assisted living will eventually need a higher level of care, meaning a move to a nursing facility.

- For those who do need a nursing home, the average stay ranges from a little over one year to more than two years for long-term residents.

When you start to piece these stages together, it's not unusual for a person to need some form of care, across different settings, for a total of 3 to 5 years. Once you multiply the monthly cost of care by that length of time, you can see exactly why a solid funding plan is non-negotiable.

What Is the Difference Between Assisted Living and a Nursing Home?

People often use these terms as if they mean the same thing, but they describe fundamentally different environments and levels of care. Getting this distinction right is critical when you plan for long term care, as it directly impacts both the cost and your loved one's quality of life.

| Feature | Assisted Living Facility | Nursing Home (Skilled Nursing Facility) |

|---|---|---|

| Primary Focus | Social model with health support. Promotes independence and community. | Medical model with 24/7 care. For complex health needs. |

| Level of Care | Help with ADLs, medication management, meals, and housekeeping. | 24-hour skilled nursing, physical therapy, and medical supervision. |

| Typical Resident | Needs help with daily tasks but is largely independent and doesn't need constant medical attention. | Has chronic health conditions or disabilities requiring round-the-clock professional care. |

| Environment | Apartment-style living with private rooms, shared dining, and social activities. | Clinical setting, often with semi-private rooms and a focus on medical treatment. |

Put simply: assisted living is for someone who needs a helping hand, while a nursing home is for someone who needs ongoing medical care from licensed professionals.

Feeling overwhelmed by the planning process is normal, but you don't have to do it alone. The experts at NJ Caregiving can help you understand your in-home care options and create a plan that supports independence and honors your wishes. To learn how our compassionate caregivers in Mercer County can help, visit us at https://njcaregiving.com.