When you start looking into in-home care, one of the first questions on your mind is almost always, "How much is this going to cost?" The short answer is that in-home care typically runs anywhere from $25 to over $50 per hour.

But the real answer is a bit more nuanced. The final price tag depends entirely on the kind of support your loved one needs, from simple companionship to more complex medical assistance.

Your Direct Answer to In-Home Care Costs

Trying to understand the costs of in-home care can feel a little confusing at first, but it doesn't have to be. Think of it like building a custom service plan—the price changes based on the options you select. A companion who helps with social visits and light errands will naturally cost less per hour than a registered nurse who manages medications and provides direct medical treatments.

This is exactly why there’s no single, flat rate for in-home care. The cost is built specifically around your family's needs. And the demand for these personalized services is growing fast. In 2025, the U.S. home care market is expected to be worth an incredible $155.9 billion, which shows just how vital this support has become for families everywhere. You can explore more data on this market growth at IBISWorld.com.

Key Takeaway: The single biggest factor that shapes the cost is the level of care required. The best way to manage your budget effectively is to match the services you choose directly to what your loved one actually needs.

To give you a clearer picture of what to expect, let's break down the typical hourly rates you might see here in Mercer County.

Estimated In-Home Care Hourly Rates by Service Level

This table gives you a snapshot of average costs for different types of care. Just keep in mind that these are estimates. The final rate will always depend on the specific agency you work with and your family's unique situation.

| Service Level | Description | Estimated Hourly Rate |

|---|---|---|

| Companion Care | Provides social interaction, light housekeeping, meal prep, and errands. | $25 – $35 |

| Personal Care | Includes all companion duties plus hands-on help with bathing, dressing, and mobility. | $30 – $40 |

| Skilled Nursing Care | Medical care from an LPN or RN, including wound care, injections, and medication management. | $45 – $60+ |

As you can see, the rates climb as the caregiver's required skills and responsibilities increase, which is pretty standard across the industry. This structure ensures you're only paying for the exact level of expertise your situation calls for.

What Really Drives the Cost of Home Care

When families start exploring in-home care, one of the first questions is always about cost. But there isn't a simple, one-size-fits-all price tag, because care isn't an off-the-shelf product. It's a deeply personal service, built entirely around an individual’s unique needs and circumstances. The final price is a direct reflection of that support, ensuring you only pay for what truly makes a difference.

The single biggest factor that influences how much is in home care is the level of assistance required. A care plan centered on companionship and light housekeeping will naturally have a different cost than one that involves hands-on personal care or specialized medical support from a licensed professional.

Think of it like a custom-built home. Every element in a care plan—from the caregiver's qualifications to the number of hours—contributes to the final structure. This approach ensures your loved one gets the precise support they need, without any unnecessary expenses.

Several key variables work together to determine the final hourly or daily rate. Getting a handle on these factors will empower you to build a care plan that fits both your loved one’s needs and your family’s budget.

Core Pricing Factors

- Level of Care Needed: This is the foundation of the cost. A client who just needs a hand with errands and meals has very different needs than someone who requires help with bathing, mobility, or managing a chronic condition.

- Caregiver Credentials: A caregiver's qualifications are tied directly to the rate. A Certified Home Health Aide (CHHA) will command a different rate than a Registered Nurse (RN), who is licensed to administer medications and handle more complex medical tasks.

- Frequency and Duration of Visits: The total number of hours per week is a major driver of the overall budget. A few hours of respite care twice a week is far less of a financial commitment than daily visits or around-the-clock, 24/7 live-in support.

- Geographic Location: Where you live absolutely matters. Labor costs, local demand, and state regulations in areas like Mercer County all influence the standard rates that agencies such as NJ Caregiving set for their services.

Choosing the Right Level of In Home Care

Feeling overwhelmed by all the different types of in-home care? You're definitely not alone. It can feel like a lot to sort through, but let's break it down and make it simple.

Picking the right service tier is the single most important step in both managing your budget and making sure your loved one gets the support they truly need. This choice directly impacts how much is in home care, because you don’t want to overpay for services you don't use. Even more importantly, getting this right prevents underestimating their needs, which is crucial for their safety and well-being.

The demand for these services is growing fast. The global home care market is projected to hit an incredible $595.10 billion in 2025 and nearly double by 2032. You can read more about this massive growth and what it means for families like yours at Coherent Market Insights.

To help you figure out what's best, let's walk through the three main categories using some real-world examples.

Companion Care for Social Connection

Think of companion care as bringing in a supportive friend. This level of care is perfect for seniors who are still fairly independent but could really use some regular social interaction and a little help keeping the house in order.

A companion might spend a few afternoons a week with your mom, playing cards, fixing a light lunch, or tidying up the kitchen. They can also provide transportation, driving her to doctor's appointments or the grocery store. The main goal here is to fight off loneliness and keep the home environment safe and engaging.

Scenario Example: Robert’s father lives by himself and recently stopped driving. A companion visits three times a week to share meals, take him to the library, and help with the laundry. It keeps him active and connected to his community.

Personal Care for Daily Assistance

When everyday tasks start to become a real challenge, personal care steps in to provide hands-on support. This includes everything offered in companion care, but adds direct help with what we call Activities of Daily Living (ADLs)—things like bathing, dressing, grooming, and moving around safely.

A personal caregiver provides dignified, respectful assistance to maintain hygiene and prevent accidents. For example, they can help your father get in and out of the shower safely or assist your mother with getting dressed in the morning.

Skilled Nursing for Medical Needs

This is the highest level of care you can get at home, and it's provided by a Licensed Practical Nurse (LPN) or a Registered Nurse (RN). Skilled nursing is for individuals who have medical conditions requiring clinical expertise.

Services might include wound care, managing IVs and catheters, giving injections, or closely monitoring complex health conditions like diabetes or heart disease. This isn't about household chores; it's about bringing hospital-grade medical care into the comfort of home, often after a hospital stay or to manage a long-term illness.

Agency Care vs. Hiring an Independent Caregiver

When you realize a loved one needs help at home, one of the first big decisions you’ll face is how to find that help. Should you go through a professional home care agency or hire an independent caregiver directly? This choice goes far beyond just the hourly rate—it's a fundamental decision about convenience, security, and your own level of involvement.

Getting this right from the start can make all the difference for your family.

Weighing Your Responsibilities

Working with an established agency like NJ Caregiving is like getting an all-in-one package. They handle all the tough stuff: intensive background checks, credential verification, payroll, taxes, and insurance. This built-in structure provides a huge sense of security. If your regular caregiver gets sick or needs a vacation, the agency seamlessly arranges for a qualified replacement. You're never left scrambling, ensuring care is always there when you need it.

Hiring an independent caregiver, on the other hand, puts you in the driver's seat. While it can sometimes seem more affordable at first glance (since you aren't paying for agency overhead), it means you become the employer. That's a significant commitment. You're now responsible for every single detail, from vetting to scheduling to legal paperwork.

When you hire independently, you're taking on a whole new set of jobs:

- Vetting and Background Checks: You'll need to conduct interviews and, crucially, pay out-of-pocket for comprehensive background screenings to ensure your loved one's safety.

- Payroll and Taxes: You are legally the employer. That means you have to manage payroll, withhold the correct taxes, and file all the necessary paperwork with the IRS.

- Liability and Insurance: What happens if there's an accident? You'll need to get your own liability and workers' compensation insurance to protect yourself and your caregiver from injuries on the job.

- Backup Care: If your caregiver calls out sick, has a family emergency, or quits unexpectedly, finding a qualified replacement on short notice is entirely up to you.

The choice often comes down to what you value most. An agency offers a safety net and professional oversight, while hiring independently provides more direct control at the cost of taking on full employer responsibilities.

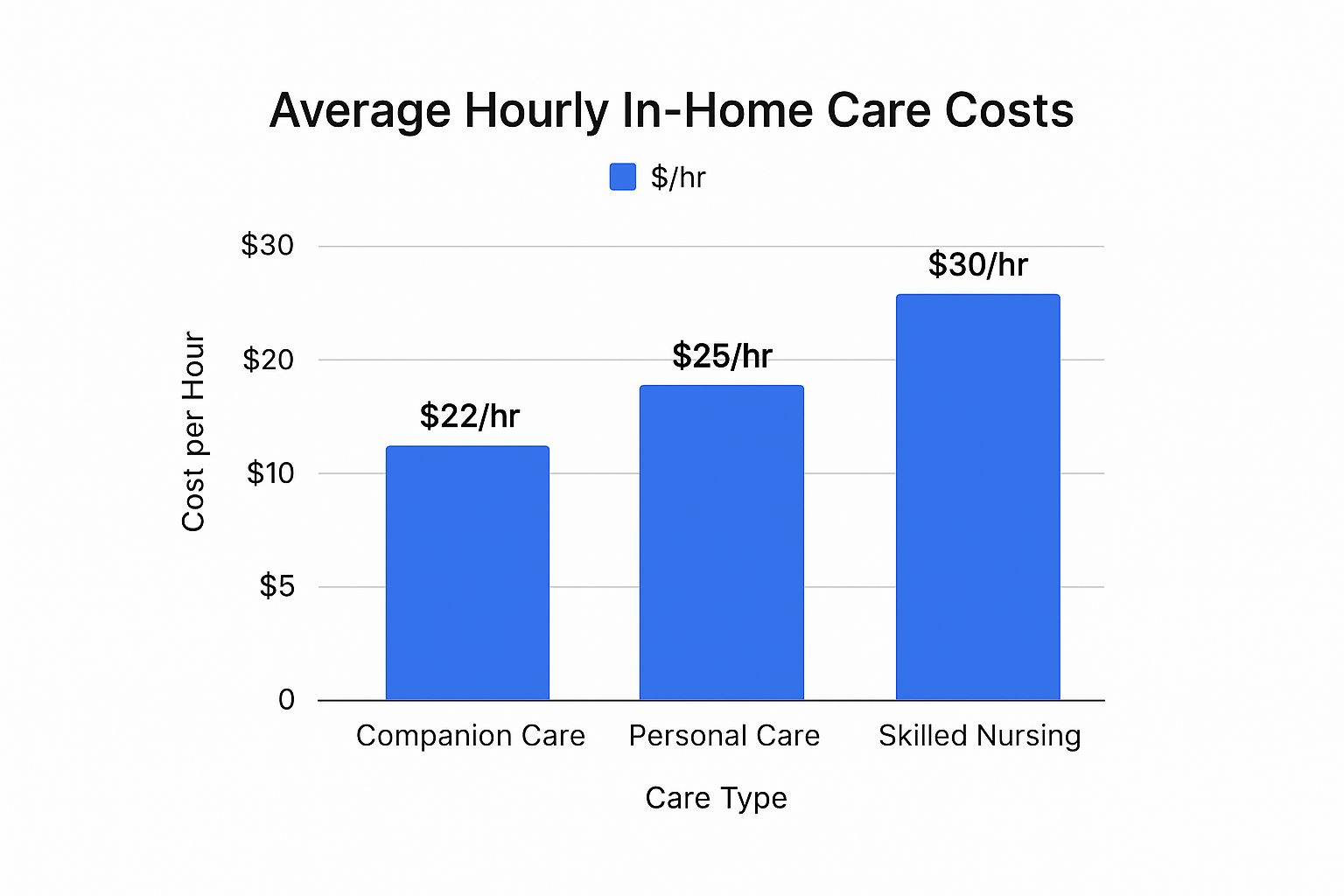

So, how does this translate to cost? This chart gives a good visual.

As you can see, costs naturally increase with the level of care required. Agency rates might seem higher, but they bundle in all the administrative and security services that you would otherwise have to manage—and pay for—on your own.

To make it even clearer, let's break down the pros and cons side-by-side.

Agency vs. Independent Caregiver: A Comparison

The table below offers a straightforward look at what you get—and what you give up—with each option.

| Feature | Home Care Agency | Independent Caregiver |

|---|---|---|

| Hiring & Vetting | Handles all screening, background checks, and credential verification. | Your responsibility. You must source, interview, and vet candidates. |

| Payroll & Taxes | Manages all payroll, tax withholding, and legal employment paperwork. | Your responsibility. You must act as the employer and handle all IRS requirements. |

| Insurance | Provides liability and workers' compensation insurance. | Your responsibility. You must purchase separate insurance policies. |

| Backup Care | Arranges a qualified replacement caregiver if the primary one is unavailable. | Your responsibility. You must find and arrange for backup care on your own. |

| Training & Oversight | Provides ongoing training and professional supervision for caregivers. | You are responsible for any training or performance management. |

| Cost | Typically a higher hourly rate that includes all administrative services. | Often a lower hourly rate, but with additional out-of-pocket costs and responsibilities. |

| Control | You have less direct control over hiring a specific individual. | You have full control over who you hire and the terms of employment. |

Ultimately, there's no single "best" answer—only what's best for your specific situation. An agency provides a comprehensive, worry-free service, while hiring directly offers more autonomy for those willing to take on the role of an employer.

Navigating Your Payment and Funding Options

Understanding the costs is one thing, but figuring out how to actually pay for care is the next big hurdle. Think of this section as your financial roadmap, where we’ll walk through the different ways families cover the expense of in-home care.

Let's be upfront: the reality for most families is that they start by paying for care directly out of their own pockets. This is often called private pay.

Private pay simply means using personal savings, retirement accounts, or other family assets to cover the hourly rates. The biggest advantage here is flexibility. You can choose any provider you want and customize the level of care without needing to wait for approvals from an insurance company or government agency. With the global demand for home care services expected to become a USD 596.8 billion market by 2025, knowing all your funding avenues is more critical than ever. You can see the full analysis of this growing trend in a detailed report from Future Market Insights.

However, private pay isn't the only game in town. There are several other resources that can make a real difference and ease the financial load, though each comes with its own set of rules and limitations.

Exploring Insurance and Government Benefits

Beyond tapping into personal funds, it’s absolutely worth your time to investigate insurance policies and government programs. Many families are genuinely surprised to learn what resources might be available once they start digging into the details.

Here are the main options you’ll want to look into:

- Long-Term Care (LTC) Insurance: If your loved one was forward-thinking enough to get an LTC policy, now is the time to pull it out and read the fine print. These policies are built specifically for services like in-home care, but you need to understand the details—like benefit triggers, daily payment limits, and the "elimination period" (a waiting period before benefits kick in).

- Medicare: This is where a lot of confusion happens. Let’s be clear: Medicare does not pay for long-term custodial care (the day-to-day help with activities like bathing, dressing, and meals). It will only cover short-term, skilled nursing care at home if a doctor prescribes it, usually right after a hospital stay.

- Medicaid: Unlike Medicare, Medicaid can be a major source of funding for in-home care, but only for those who meet its very strict income and asset limits. The programs are different in every state but often cover personal care and other non-medical support.

- Veterans (VA) Benefits: If your loved one is a veteran or a surviving spouse, they might qualify for benefits like the Aid and Attendance pension. This can provide a significant monthly payment to help pay for care services.

Crucial Insight: Please don't assume you won't qualify for assistance. Every program has its own unique, and sometimes complicated, rules. Taking the time to investigate every single option is a vital step in creating a care plan that’s sustainable for the long haul.

Common Questions About In Home Care Costs

Even after you've sorted through the different levels of care and potential funding sources, the practical questions start to surface. It's one thing to understand the concepts, but it's another to know what it all means for your family's budget. The bottom line really matters.

This is where we get into the nitty-gritty. We'll tackle the most frequent financial questions we hear from families right here in Mercer County—the real-world worries about hidden fees, insurance gaps, and how to find a solution that won't break the bank.

Are There Hidden Costs I Should Know About?

This is probably the most critical question you can ask when figuring out how much is in home care. It’s not always just about the hourly rate. Some agencies have other charges that can pop up, so it's incredibly important to ask for a complete fee schedule right from the start. No one likes surprises on their bill.

Keep an eye out for a few common extra costs:

- Mileage Reimbursement: If your caregiver runs errands or drives your loved one to appointments in their personal vehicle, you’ll likely be billed for the mileage.

- Holiday and Weekend Rates: It's standard practice for agencies to charge a higher rate, often time-and-a-half, for services on major holidays or sometimes even weekends.

- Live-In Care Expenses: While a live-in caregiver often comes with a flat daily rate, remember that you're also responsible for providing their room and board.

Is Live In Care Cheaper Than 24 Hour Care?

In most cases, yes. When you need round-the-clock supervision, live-in care is almost always the more budget-friendly choice. That’s because a live-in caregiver resides in the home and is paid a flat daily rate, which accounts for them having designated breaks and a period for sleep.

On the other hand, 24-hour care involves multiple caregivers working in shifts (typically two 12-hour or three 8-hour shifts) to ensure someone is always awake and alert. Since you're paying an hourly rate for every single one of those 24 hours, the cost adds up much more quickly.

Key Insight: The real deciding factor between live-in and 24-hour care comes down to the intensity of care needed. If a loved one has significant medical needs overnight or is prone to wandering, the higher cost of having an awake and alert caregiver 24/7 is a necessary investment in their safety.

Can I Use My Insurance for Home Care?

That all depends on what kind of insurance you have. Most modern long-term care insurance policies are specifically designed to cover in-home care services, but the benefits can differ dramatically from one plan to the next. You’ll need to dig into your specific policy to see what the daily benefit amount is and if there’s an "elimination period" (a waiting period) before the coverage kicks in.

Medicare is a different story. It is not designed to cover long-term custodial (non-medical) or 24-hour care at home. Medicare's home health benefit is for short-term, intermittent skilled care that has been ordered by a doctor, like after a hospital stay.

Trying to make sense of these financial details can feel like a job in itself, but you don't have to figure it all out alone. The team at NJ Caregiving is here to walk you through all the costs and help find a path forward that works for your family. Visit us at https://njcaregiving.com to schedule a consultation.