The Real Cost of Aging in Place: Monthly Care Breakdown

Figuring out the monthly expenses for in-home care can be a daunting task. But understanding this investment is essential for families wanting the best care for their loved ones. This section clarifies the costs involved, providing much-needed guidance.

Understanding the Cost Components

In-home care costs aren't fixed. Several factors influence the final monthly expense. The type of care needed is a major one. Companion care, offering companionship and help with daily routines, generally costs less than skilled nursing care. Skilled nursing involves medical services from registered nurses or licensed practical nurses. Simply put, specialized care means higher costs.

The number of hours needed each week also directly affects the monthly total. A few hours a week is less expensive than 24/7 care. Even within 24-hour care, there are differences. Live-in care, where a caregiver lives in the home, can differ in cost from having multiple caregivers working in shifts. Staffing and logistics affect pricing.

Typical Monthly Costs

Giving exact numbers is tricky because of regional differences and individual needs. However, understanding the general range is helpful. A few hours of weekly help could cost from a few hundred to over a thousand dollars monthly. More extensive care, like several hours daily, increases the cost significantly.

For example, 24-hour in-home care in the U.S. varies widely based on location and care type. As of 2025, the average is around $18,144 per month, but it can range from $15,000 to over $25,000 per month. Cost of living differences across the country contribute to this variation. You can find more detailed statistics at Global One Home Care. These higher care levels usually mean multiple caregivers, specialized services, and more administrative work.

Budgeting for In-Home Care

When budgeting, think beyond the hourly or daily rate. Consider extra costs like caregiver travel, special equipment, and potential overtime for holidays or unexpected events. These add up and should be part of your financial plan. Understanding these different costs helps families make a realistic budget and explore different payment options.

Part-Time Vs. Around-the-Clock: What You'll Actually Pay

The cost of in-home care depends heavily on the level of care needed. Whether you need a few hours a week or round-the-clock support significantly changes your monthly expenses. Let's explore how costs increase from occasional help to comprehensive 24/7 care.

Part-Time Care: Occasional Help

For families needing help occasionally, such as errands, meal preparation, or light housekeeping a few times a week, costs are generally lower. For instance, four hours of care twice a week at a rate of $30 per hour totals around $960 per month. This can be a reasonable expense for many families and provides valuable support for seniors and their caregivers.

Full-Time Care: Daily Assistance

When someone needs daily assistance, like help with bathing, dressing, and medication reminders, costs naturally rise. If you need an average of eight hours of care per day at $30 per hour, the monthly cost would be about $7,200. This type of care helps seniors keep their independence while getting the support they need for daily tasks.

24/7 Care: Comprehensive Support

Around-the-clock care offers the most comprehensive in-home support. This care model uses a team of caregivers working in shifts to provide constant supervision and assistance. This is especially important for people with complex medical needs or those who need continuous monitoring. The monthly cost for 24/7 care can vary from $15,000 to over $25,000, based on location and specific care requirements.

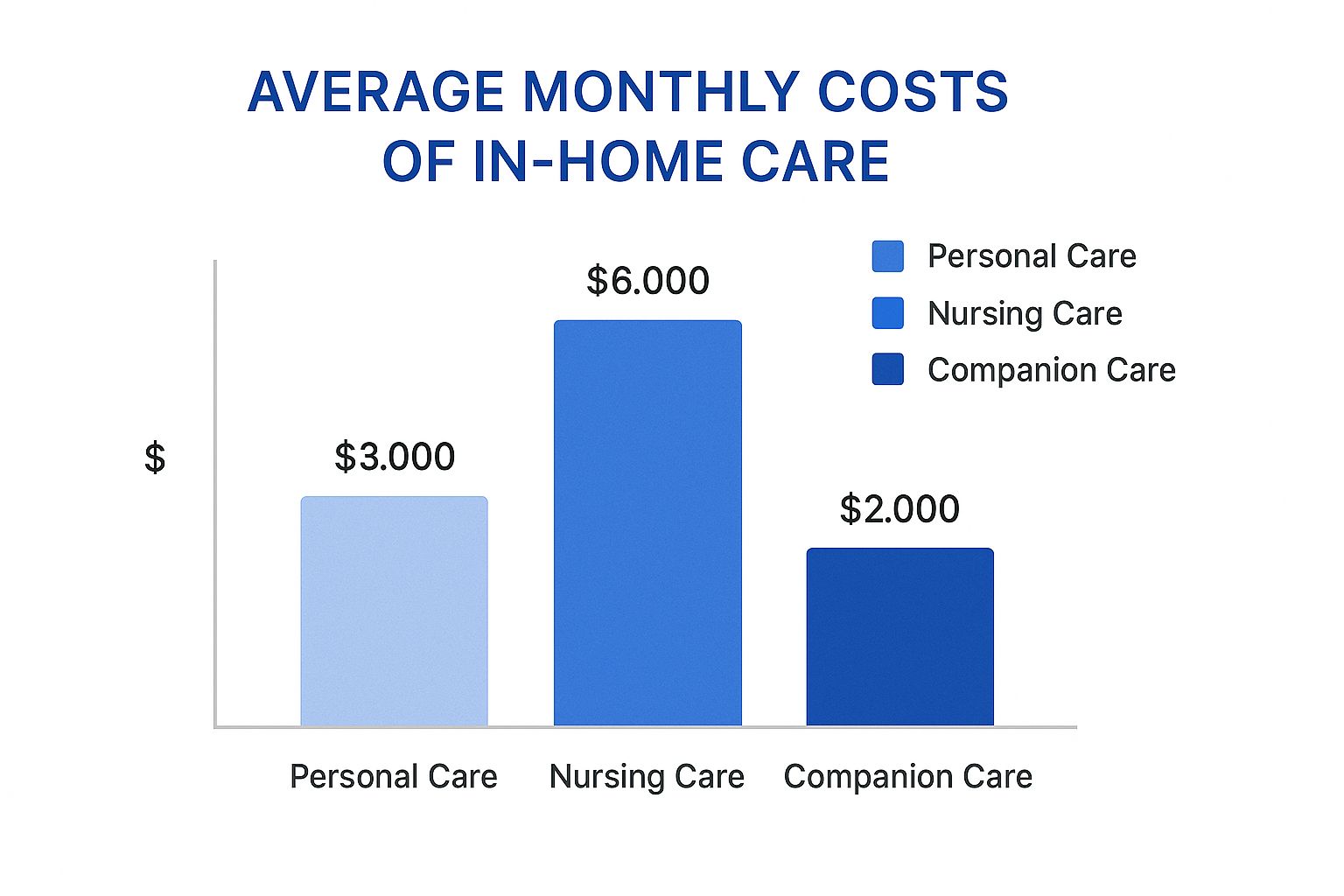

The following infographic visually compares average monthly costs for various in-home care services:

As the infographic illustrates, monthly costs for companion care are significantly lower than for personal or nursing care. This demonstrates how important it is to choose the right level of care based on individual needs.

To help you better understand the potential costs involved, we've compiled a table comparing average monthly expenses for different levels of in-home care services.

Monthly In-Home Care Cost Comparison by Service Level

This table breaks down the average monthly costs for different levels of in-home care services across the United States, from basic companion care to specialized nursing care

| Type of Care | Hours per Week | National Average Monthly Cost | Low-Cost Regions | High-Cost Regions |

|---|---|---|---|---|

| Companion Care | 10 | $1,200 | $900 | $1,500 |

| Personal Care | 20 | $2,400 | $1,800 | $3,000 |

| Home Health Aide | 30 | $3,600 | $2,700 | $4,500 |

| Skilled Nursing | 40 | $4,800 | $3,600 | $6,000 |

This table provides a general overview; actual costs will vary depending on your location and specific needs. Be sure to research providers in your area for accurate pricing.

Factors Influencing Costs

Besides the number of hours, several other factors affect the overall cost. Weekend or holiday coverage often has higher rates. Also, specialized care, such as dementia care or care requiring medical professionals, generally costs more than basic companion care. Affordability is a major concern for many families. The average cost of non-medical in-home care in 2025 is $33 per hour nationally, ranging from $24 to $43 per hour depending on the state. This expense can add up, especially for families managing multiple care needs. Learn more about in-home care costs here. Understanding available insurance options is crucial when planning to age in place; for example, consider the factors impacting long term care insurance cost. Carefully considering these factors helps families create a realistic budget and explore payment choices.

Location Matters: How Geography Impacts Your Monthly Bill

When researching "how much does in home care cost per month," you'll quickly find that location significantly impacts pricing. The cost of identical care can change drastically depending on where you live. This isn't solely due to general cost-of-living differences; several other geographic factors also influence in-home care expenses.

Regional Variations in Caregiver Wages

One key factor is the local cost of labor. Caregiver wages are influenced by factors like state minimum wage laws, the overall job market, and the availability of qualified caregivers.

Areas with a higher cost of living and a competitive job market tend to have higher caregiver wages. This translates directly into higher in-home care costs for consumers. For example, you can expect to pay significantly more in cities like New York or San Francisco than in rural areas with lower labor costs.

Caregiver Availability and Demand

The supply and demand of caregivers also play a role in pricing. Rural areas or regions with rapidly aging populations may experience caregiver shortages.

This scarcity can drive up prices as agencies compete for qualified staff. Conversely, areas with a larger pool of caregivers might have more competitive pricing. Consistent, reliable care depends on caregiver availability, making this a crucial factor to consider when calculating in-home care costs per month.

State and Local Regulations

State and local regulations also influence costs. Different states have varying licensing requirements and regulations for in-home care agencies.

These regulations impact agency operating costs, which ultimately get passed on to consumers. States with stricter training requirements for caregivers, for instance, may have higher overall care costs. Researching specific regulations in your area is essential.

Cost Differences: Urban vs. Rural

The difference in monthly in-home care costs between major metropolitan areas and rural communities can be substantial. In major cities, factors like higher operating costs, increased competition for caregivers, and greater demand often result in higher prices.

Rural areas may have lower operating expenses and a potentially less competitive market, leading to lower costs. However, caregiver shortages in these areas can sometimes inflate prices. Families coordinating care from a distance should carefully consider these geographical cost variations.

Navigating Geographical Cost Variations

Understanding geographical cost variations is crucial for families considering relocation or managing care remotely. Researching average costs in your specific area is essential.

Contacting local agencies, like Caring Hands Senior Services, can provide personalized cost estimates based on individual needs. This proactive approach helps families make informed decisions and budget effectively for in-home care without compromising quality.

The Hidden Variables Driving Your In-Home Care Expenses

While knowing the average cost of in-home care is a good starting point, it's important to remember that it doesn't tell the whole story. Several factors can significantly impact your actual monthly expenses. Understanding these hidden variables is essential for creating a realistic budget. Let's delve into some of the key elements that influence the final cost.

Care Recipient's Condition and Needs

The care recipient's health and required level of care are primary cost drivers. Basic companion care for someone needing minimal help will naturally be less expensive than specialized care for an individual with a complex condition like dementia or a chronic illness.

For instance, if the care recipient needs help with mobility or medication management, these services add to the overall cost. Specialized care often requires caregivers with specific training and expertise, which is reflected in their rates.

Caregiver Qualifications and Certifications

The caregiver's qualifications and certifications also influence the cost. A Certified Nursing Assistant (CNA) or a caregiver with specialized training, such as in dementia care, will typically have a higher hourly rate than a caregiver providing basic companion care.

This difference in cost is often attributed to the advanced skills and experience these professionals possess. Just as specialists in any medical field command higher fees than general practitioners, specialized caregivers also earn higher rates.

Agency vs. Independent Caregiver

Choosing between a home care agency and an independent caregiver significantly affects cost. Agencies handle tasks like scheduling, payroll, and background checks. These administrative services contribute to their overhead, leading to higher rates.

Independent caregivers may offer lower hourly rates. However, families take on more responsibility, including managing schedules, taxes, and liability. The decision between an agency and an independent caregiver often comes down to balancing cost with convenience and risk management.

Scheduling Flexibility and Premiums

Scheduling flexibility also plays a significant role in cost. Last-minute requests, overnight care, or care on holidays and weekends usually incur premium charges. These premiums compensate caregivers for working less desirable hours or shifts that are in higher demand.

Consistent, regularly scheduled care is typically more cost-effective than sporadic or emergency care. For more information on effectively managing your home care schedule, see How to master scheduling home care services.

Negotiability of Costs

Understanding which costs are negotiable and which are fixed is crucial for budget management. While base hourly rates are often predetermined, some costs, like travel expenses or the duration of specific tasks, may be open for discussion.

In addition, broader market forces influence in-home care costs. These include factors like staffing shortages and advancements in technology. The home healthcare market is projected to grow at a CAGR of 7.96% between 2024 and 2030, partly driven by the growing demand for aging-in-place solutions.

However, staffing shortages and high caregiver turnover continue to affect the quality and availability of care. Technological advancements are helping improve efficiency and expand the scope of patient care. For more insights into these trends, see Home Care Statistics. Understanding these factors allows families to make informed decisions about managing expenses while maintaining quality care.

Navigating the Payment Maze: Finding Money for Monthly Care

Finding financial resources for monthly in-home care can be a significant challenge for families. Often, it requires piecing together funds from multiple sources to cover the full cost. This section explores various payment options and strategies to help you secure the financial support needed for quality in-home care.

Traditional Funding Sources

Several well-established methods can help fund in-home care. Medicare, a federal health insurance program, covers some in-home services, but its coverage is limited. It typically focuses on short-term, skilled care after a hospital stay.

This means Medicare might cover a few weeks of skilled nursing care after a surgery, but not long-term personal care assistance. For example, help with bathing, dressing, or meal preparation might not be covered under Medicare.

Medicaid, a joint federal and state program, can fund long-term in-home care. However, eligibility requirements are often complex and vary by state. Medicaid is needs-based, requiring applicants to meet specific income and asset limits.

Applying for Medicaid can be a daunting process. Families often seek assistance from elder law attorneys or Medicaid specialists to navigate the application. Long-term care insurance can also be a helpful resource. However, policies differ significantly in coverage and benefits.

It's essential to understand the specifics of your policy, including coverage limits, elimination periods, and inflation protection, to plan effectively. Carefully review your policy or consult with an insurance professional to understand its provisions.

Veterans Aid & Attendance

The Veterans Aid & Attendance benefit can provide financial support for in-home care for veterans and surviving spouses. Eligibility depends on service history, medical needs, and financial status. Applying for this benefit requires detailed documentation.

Working with veterans’ organizations or specialized advisors can be beneficial during the application process. This benefit can greatly reduce the cost of in-home care for eligible veterans and their families.

Exploring Creative Financing Options

Beyond traditional methods, families sometimes explore creative financing strategies. These options include converting life insurance policies, exploring home equity loans or lines of credit, and establishing family care agreements.

Each option presents its own advantages and disadvantages. For example, converting a life insurance policy can provide funds for care, but it reduces or eliminates the death benefit. Home equity options can provide access to needed funds but carry the risk of foreclosure.

Family care agreements, where a family member provides care in exchange for compensation, require clear legal and financial arrangements to protect all parties involved. It's important to consider the long-term implications of each option.

State-Specific Assistance Programs

Many states offer programs designed specifically to support in-home care. These programs vary in eligibility, coverage, and application processes. Researching programs in your location can uncover valuable resources.

These state-specific programs can often supplement other funding sources, making in-home care more affordable. They can provide a vital safety net for families struggling to manage care costs. You might be interested in: How to master finding in-home care payment options.

Payment Source Summary

The table below provides an overview of different payment sources for in-home care, including their typical coverage, eligibility requirements, and application processes. This information can help you understand the various options available and choose the best fit for your situation.

| Payment Source | Typical Coverage | Eligibility Requirements | Application Timeline | Coverage Limitations |

|---|---|---|---|---|

| Medicare | Limited, short-term skilled care | Qualifying hospital stay, medical necessity | Relatively quick | Primarily post-acute care |

| Medicaid | Long-term care services | Income and asset limits, functional need | Lengthy, complex | Varies by state |

| Long-Term Care Insurance | Varies by policy | Policy specific | Varies by policy | Benefit limits, waiting periods |

| Veterans Aid & Attendance | Supplemental income | Wartime service, medical/financial need | Can be lengthy | Specific eligibility criteria |

| Life Insurance Conversion | Lump sum or monthly payments | Existing life insurance policy | Varies by insurer | Reduces/eliminates death benefit |

| Home Equity | Loan or line of credit | Homeownership, equity | Varies by lender | Interest payments, risk of foreclosure |

| Family Care Agreements | Compensation for family caregiver | Formal agreement between family members | Depends on family arrangement | Legal and tax implications |

By carefully considering these funding avenues and creating a comprehensive plan, families can effectively manage the financial aspects of in-home care and ensure loved ones receive the support they need.

Smart Strategies to Lower Your Monthly Care Expenses

Managing the costs of in-home care can be a significant challenge for many families. Finding the right balance between providing quality care and managing expenses requires careful planning and creative solutions. This section explores practical strategies to reduce monthly costs without compromising the well-being of your loved one.

Designing Hybrid Care Plans

One effective way to lower care expenses is to create a hybrid care plan. This involves combining professional care with support from family members. For example, a professional caregiver might provide care during weekdays, while family members take over evenings and weekends. This blended approach can significantly reduce reliance on paid caregivers, resulting in substantial savings.

Open communication and careful scheduling are essential for a successful hybrid care plan. Coordinating schedules among family members can prevent caregiver burnout and ensure consistent, high-quality care.

Leveraging Technology for Efficiency

Technology offers innovative ways to enhance care and reduce costs. Remote monitoring systems allow caregivers to check in on loved ones remotely, potentially reducing the need for overnight care. Philips Lifeline is one example of a company offering these systems.

Medication management apps can also be helpful. These apps can remind seniors to take their medications, reducing medication errors and minimizing the need for constant reminders from caregivers. The use of technology, while not a replacement for human interaction, can improve care efficiency and potentially lower overall expenses.

Utilizing Community Resources

Exploring community resources can supplement private care and alleviate financial strain. Many communities offer adult day care programs, providing seniors with social interaction and engaging activities during the day. These programs can be a more affordable alternative to full-time in-home care and offer much-needed respite for family caregivers.

Volunteer caregiver services are another valuable resource. Some organizations offer volunteers who can assist with tasks like transportation or grocery shopping, further reducing the burden on families. For veterans, exploring financial assistance programs can be particularly helpful: Financial Assistance for Veterans.

Innovative Cost-Saving Arrangements

Thinking creatively about care arrangements can also lead to significant savings. Caregiver sharing involves families with similar needs splitting the cost of a caregiver's time. This collaborative approach can make quality care more affordable for everyone involved.

Optimizing the caregiver's schedule is another strategy. By grouping tasks efficiently and minimizing downtime, families can reduce the total hours billed. For more information on finding caregiving support, this resource may be helpful: How to master finding resources for caregiving support.

Maintaining Quality While Reducing Costs

While cost reduction is important, maintaining the quality of care should always be the top priority. When implementing cost-saving measures, consider the potential impact on the care recipient’s well-being. Carefully evaluate the risks and benefits of each approach to ensure appropriate care standards are met.

Open communication with caregivers, regular monitoring of care quality, and ongoing adjustments to the care plan are essential for successful cost management while upholding excellent care. Contact Caring Hands Senior Services to discuss personalized care options tailored to your needs and budget.