Decoding the True Cost of In-Home Care

Understanding the cost of in-home care can be a daunting task. It's not a simple, fixed price, but rather a combination of several factors. Knowing these factors is crucial for making informed decisions. Let's break down these elements to help you navigate the process.

Key Factors Affecting In-Home Care Costs

The price of in-home care isn't random. Several key elements influence the final cost, and understanding these can help you plan and budget effectively.

-

Care Needs: The required level of care is a primary factor. Someone needing help with basic tasks like cooking or light cleaning will likely have lower costs than someone needing specialized medical care. For instance, companionship care may only involve a few hours a week, whereas 24/7 skilled nursing care requires a team of professionals.

-

Caregiver Qualifications: Experienced caregivers, like registered nurses, usually have higher hourly rates than home health aides providing basic assistance. Specialized certifications, such as dementia care training, also impact the cost. Matching caregiver skills to specific needs balances quality care with affordability.

-

Geographic Location: Like housing costs, in-home care expenses vary by location. Cities with a higher cost of living typically have higher care costs. In the United States, the average cost of 24-hour in-home care for seniors in 2025 is about $18,144 per month. This translates to an hourly rate of roughly $27, although costs vary based on location and the specific level of care. In expensive cities like Boston, fees can exceed $25,000 per month. Learn more here. Even rural areas may see increased costs due to caregiver shortages.

-

Agency vs. Private Hire: Choosing between an agency and hiring a caregiver privately impacts the cost. Agencies handle payroll, insurance, and background checks, increasing the overall cost. However, they also provide oversight and support. Private hires may offer lower hourly rates but increase the family’s administrative burden.

Understanding the Different Cost Structures

Understanding various cost structures is critical for budgeting. In-home care costs are typically presented in several ways:

-

Hourly Rates: These vary based on the factors above. It's important to understand what services are included in the hourly rate and what might be an added expense.

-

Daily Rates: Daily rates are typical for people needing multiple hours of care per day and can provide more predictable costs than hourly billing.

-

Monthly Rates: These usually apply to extensive care needs, such as 24/7 assistance. While providing a consistent monthly cost, it's important to review included services and any extra costs.

-

Package Deals: Some agencies offer package deals combining services at a bundled price. These can be cost-effective but require careful review to ensure they meet individual needs.

By considering these factors and understanding pricing models, you can navigate the in-home care landscape and make choices that meet your loved one's needs and your budget.

Hourly vs. Round-the-Clock Care: Making the Financial Choice

Choosing between hourly and 24-hour in-home care is a big financial decision. It's about balancing your loved one's needs with the cost of different care schedules. Truly understanding this means looking beyond just the hourly rates and considering the long-term costs.

Calculating Your Needs: A Practical Framework

Start by evaluating your loved one's current situation. Make a list of their daily needs. Include what they can do themselves and what they need help with. Can they dress and bathe, or do they need help moving around and remembering medications? This assessment helps figure out the right level and frequency of care. Even small changes in the schedule can make a big difference in the total cost.

Hourly costs for non-medical in-home care can vary widely. The national median hourly rate is around $33. However, state averages range from $21 in Louisiana and Mississippi to $50 in Maine. This shows how regional economics and service demand play a role. You can find more detailed statistics here. Getting local quotes and understanding what's included in the hourly rate is essential.

To help illustrate the cost differences, let's look at a comparison table:

This table compares the costs of different in-home care arrangements across various regions of the United States, showing how hourly rates translate to weekly and monthly expenses.

| Care Type | National Average | Low-Cost Regions | High-Cost Regions | Monthly Total |

|---|---|---|---|---|

| Hourly (4 hours/day) | $33/hour | $21/hour | $50/hour | $3,960 – $9,900 |

| Hourly (8 hours/day) | $33/hour | $21/hour | $50/hour | $7,920 – $19,800 |

| 24-Hour Care (Live-in) | Varies | $10,000 – $12,000/month | $15,000 – $20,000/month | $10,000+ |

As you can see, the cost of care can change dramatically depending on the region and the type of care needed. It's important to weigh these factors when making your decision.

Tipping Points: When Hourly Care Becomes Costly

As care needs grow, hourly care can become more expensive than 24-hour care. This often happens when someone needs help overnight or for long stretches during the day. If you need 15 hours of daily care at $30/hour, that's $450 per day. This adds up to a significant monthly expense. 24-hour care, while a big commitment, might be a better value and offer more consistent support.

Balancing Quality and Affordability

Finding affordable, quality care often means finding creative solutions. Families might combine professional hourly care with help from family members at other times. This blended approach can keep the quality of care high while lowering the overall cost. You can also research other recurring expenses, like monthly storage costs, to gain a better understanding of managing a budget.

Planning for Financial Sustainability

Long-term care planning requires open communication about finances. Explore available resources, such as long-term care insurance or veterans' benefits. Honest talks about financial limits help families make realistic choices that balance care quality with affordability. Planning ahead helps avoid financial strain and ensures sustainable, high-quality care for your loved one.

Why Your ZIP Code Shapes Your In-Home Care Budget

The cost of in-home care can differ dramatically based on location. It's not just a simple city versus small-town divide; even seemingly similar areas can have vastly different prices for the same services. Understanding these regional variations is crucial for accurate budgeting. How much does in-home care cost where you live? Let's delve into the factors behind these price discrepancies.

Decoding Regional Cost Factors

Several key factors contribute to the geographical variations in in-home care costs. These include caregiver wages, market competition, state regulations, and local living costs.

For instance, in areas with a higher cost of living, caregiver wages are typically higher, directly impacting the overall cost of care. The level of competition among in-home care agencies in a specific area also plays a role. Additionally, state-specific regulations regarding caregiver qualifications or training can influence pricing.

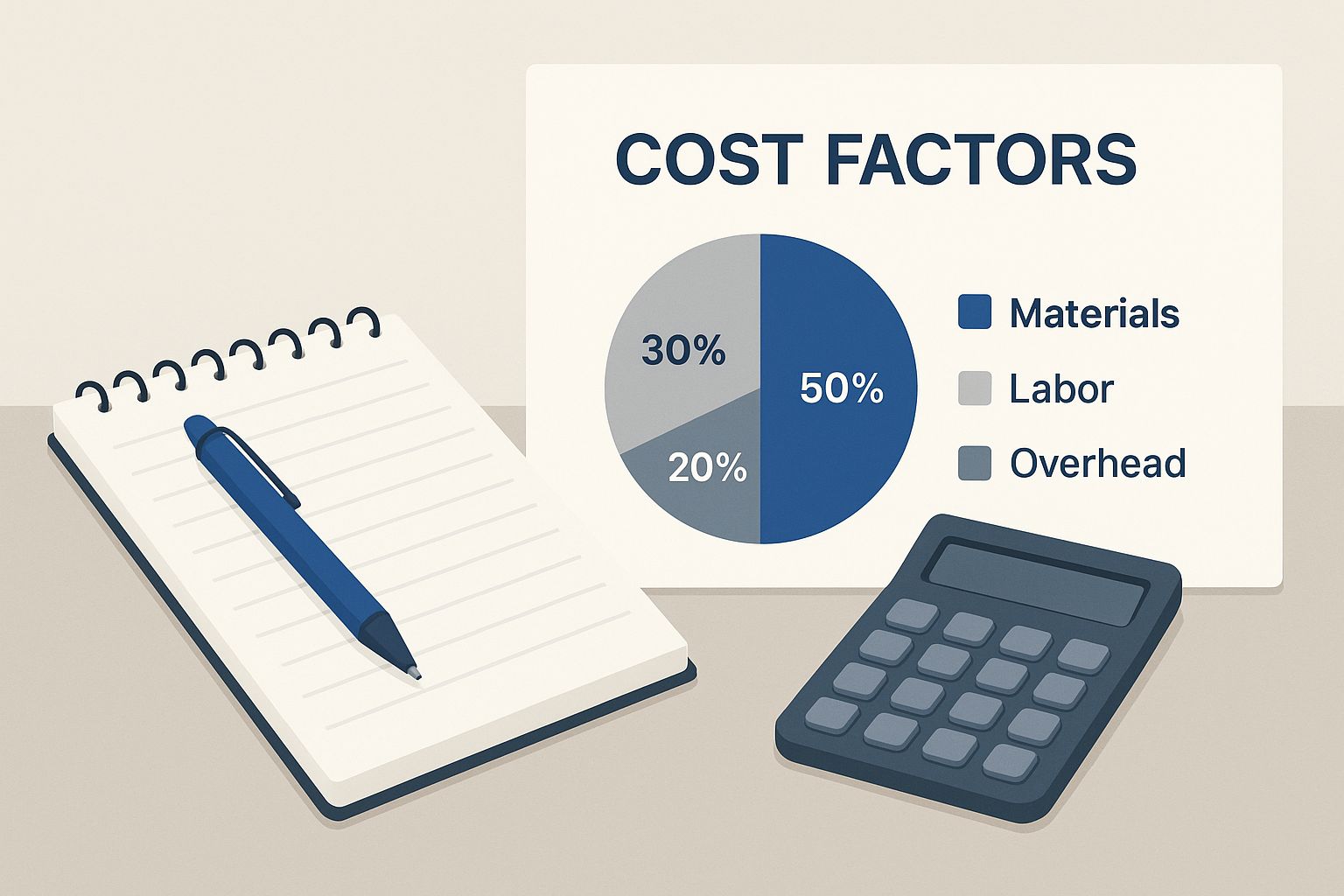

This infographic visually represents the key cost factors involved in in-home care. It highlights how different expenses contribute to the total cost, underscoring the need for a comprehensive approach to budgeting.

Navigating Caregiver Shortages and Market Dynamics

It might be surprising to learn that affluent areas sometimes offer more affordable in-home care than rural locations. This can be attributed to a higher concentration of qualified caregivers seeking better pay and working conditions in more populated areas. Conversely, rural areas can experience caregiver shortages, pushing prices up due to limited availability. This means that even with a lower overall cost of living, in-home care expenses in rural regions can be unexpectedly high.

The Importance of Local Research

Understanding the link between your ZIP code and in-home care costs is essential for effective planning. Begin by researching local agencies and comparing their pricing structures. Don't solely rely on national averages, which can be misleading. Carefully consider your loved one's specific needs and how those needs translate into costs within your area.

This localized budgeting approach promotes realistic expectations and helps avoid financial surprises down the road. For families managing care remotely or considering relocation, this geographic perspective is particularly valuable for potential cost savings. If you’re thinking of moving closer to family for support, factor in local care costs to make well-informed decisions. By understanding the regional dynamics of in-home care expenses, families can confidently navigate the financial landscape and ensure the best possible care for their loved ones.

Uncovering the Hidden Costs That Shock Family Budgets

While understanding the hourly or monthly rate for in-home care is essential, it's often just the beginning. Many families are surprised by additional expenses, potentially straining their budgets. Knowing these hidden costs upfront allows for better planning and helps avoid financial surprises.

Beyond the Hourly Rate: Unforeseen Expenses

Several costs are often overlooked when initially budgeting for in-home care. These can include travel expenses for caregivers, particularly if your loved one lives in a remote area. Specialized training, such as Alzheimer's Association or dementia care training, might also increase the caregiver’s hourly rate. Additionally, medical equipment, like walkers or hospital beds, may not be included in the standard care package and could require separate purchases.

Bundled vs. Itemized Costs: Decoding the Fine Print

Some in-home care providers offer bundled packages, including various services for a set price. While seemingly convenient, these packages might include services you don’t need. Itemized billing, although potentially more complex, allows you to pay only for the services your loved one requires. Always request a detailed breakdown of the pricing structure from potential providers to understand what’s included and what’s considered an extra expense.

Emergency Coverage and Backup Plans: Preparing for the Unexpected

Life is unpredictable, and having a backup plan for care is crucial. If your regular caregiver is unavailable due to illness or an emergency, you'll need a replacement. Some agencies provide backup caregivers at no extra cost, while others charge premium rates for last-minute replacements. Factor this potential cost into your budget and clarify the agency’s policy on backup care. Understanding the overall financial burden of caregiving is also important. For instance, a 2025 Care.com report indicates that American families spend, on average, 40% of their household income on caregiving (including child, elder, and pet care), with child care alone accounting for 22%.

Negotiating and Planning for Financial Stability: Taking Control of Costs

Don't hesitate to negotiate with agencies or private caregivers to establish a transparent pricing agreement. Clearly outline your loved one's needs, the required services, and your budget limitations. A well-defined agreement protects both parties and ensures clear expectations.

Building a financial buffer into your budget is also essential. This cushion helps absorb unexpected costs, preventing financial strain. Consider exploring long-term care insurance, which can help cover some in-home care expenses, providing additional financial security. By addressing these often overlooked factors, you can make informed decisions, navigate the complexities of in-home care costs, and secure the best possible support for your loved one.

Navigating the Insurance Maze: What's Actually Covered

Understanding insurance's impact on in-home care costs is essential. Often, there's a significant difference between what people think their insurance covers and the actual benefits. This section clarifies typical coverage under Medicare, Medicaid, and private insurance, highlighting potential gaps to help you avoid financial surprises and secure the best possible care.

Medicare: Decoding the Benefits

Medicare covers some skilled home health care, but only under specific circumstances. Services like intermittent skilled nursing care, physical therapy, occupational therapy, and speech-language pathology may be covered. However, Medicare generally doesn't cover long-term custodial care. This includes help with activities of daily living, such as bathing, dressing, and eating. This distinction is crucial to understand when budgeting for in-home care costs.

Medicaid: Navigating Eligibility and Coverage

Medicaid offers more extensive in-home care coverage than Medicare, often including personal care services. However, it's a needs-based program with strict income and asset requirements. The application process can be complicated. Seeking guidance from your local Medicaid office or an elder law attorney is highly recommended.

Private Insurance: Understanding Your Policy

Private insurance policies vary widely in their in-home care coverage. Some offer limited benefits for skilled care, while others provide more extensive coverage for both skilled and custodial care through long-term care insurance riders. Carefully review your policy to understand your benefits and limitations, like maximum coverage amounts or pre-authorization requirements.

Appealing Denied Claims: Steps for Success

If your in-home care claim is denied, don't be discouraged. First, understand the reason for the denial. Then, gather supporting documentation from your healthcare providers. Follow the appeals process outlined in your policy. If needed, consider seeking assistance from a patient advocate or insurance broker. Persistence and organization can significantly improve your appeal's success.

Exploring Alternative Funding Sources

Several alternative funding sources can help offset in-home care costs beyond traditional insurance. Veterans' benefits may provide financial assistance for eligible veterans and their spouses. Some in-home care expenses may be tax-deductible. Hidden Costs of Manual Leave Management offers insightful information on managing employee leave efficiently. Additionally, cost-sharing models, such as shared live-in care arrangements, can significantly reduce individual expenses. Exploring these options empowers families to develop sustainable care plans that address both financial and caregiving needs. By understanding insurance coverage nuances and exploring alternative funding, families can better manage the financial complexities of in-home care and ensure access to quality support.

Smart Strategies to Reduce Costs Without Sacrificing Care

Finding affordable in-home care doesn't mean compromising on quality. Many families find creative ways to lower expenses while still providing excellent support for their loved ones. This involves strategically thinking about caregiving needs and exploring different options. Let's explore some of these cost-saving approaches.

Hybrid Care Models: Blending Family and Professional Support

One effective strategy is combining family caregiving with professional services. This hybrid approach lets families provide direct care for some tasks, lessening the need for paid caregivers. For instance, family members might handle meal preparation and companionship visits, while professionals assist with bathing, medication management, or other skilled care needs.

This targeted use of professional caregivers can significantly reduce overall costs. Family members can contribute their time and effort where they feel most comfortable, while professionals handle tasks requiring specific expertise.

Technology’s Role: Enhancing Caregiver Efficiency

Technology can extend the reach of caregivers and improve their efficiency. Remote monitoring systems, for instance, can track vital signs and alert family or professionals to potential problems. This proactive approach can prevent costly hospitalizations and reduce the need for constant in-home supervision.

Additionally, telehealth consultations using platforms like Zoom can replace some in-person doctor visits, saving on travel time and expenses. This can be particularly helpful for routine check-ups or managing chronic conditions.

Cooperative Care Arrangements: Sharing Resources and Costs

Another innovative solution involves families sharing care resources. This might involve coordinating schedules with another family to share the cost of a caregiver for certain time blocks.

This "cooperative care" model can be especially helpful for families whose loved ones have similar needs and live near each other. These shared arrangements not only provide cost savings but also increased social interaction for those receiving care.

Evaluating Cost-Saving Measures: A Personalized Approach

While cost-saving measures are attractive, choosing options that truly align with your loved one's needs is essential. Carefully evaluate each strategy's potential impact on their well-being. A solution that works for one family might not be suitable for another.

This means considering factors like the level of care required, the individual's personality and preferences, and the family’s available resources. For example, if your loved one has complex medical needs, relying solely on family care might not be feasible.

Ensuring Long-Term Sustainability: Planning for the Future

By strategically combining these approaches, families can often achieve substantial cost savings—sometimes 20-40% below standard rates. However, it's crucial to focus on financial sustainability and maintaining high care standards.

This involves regularly reassessing the care plan, adjusting strategies as needs change, and planning for future long-term care expenses. Thinking proactively about long-term costs is essential for managing expenses effectively. With careful planning and thoughtful consideration, families can manage in-home care costs effectively without sacrificing the quality of care their loved ones deserve.

Are you seeking compassionate and personalized in-home care for your loved one in the Princeton, NJ area? Caring Hands Senior Services offers a wide range of services, including personal care, nursing services, respite care, and companionship. We are dedicated to enhancing independence, comfort, and quality of life. Visit us at Caring Hands Senior Services to learn more and explore how we can support your family's caregiving journey.