When you start planning for in-home support, the first question on everyone's mind is always the same: "What's this going to cost?"

Let's get right to it. The national median home care cost per hour in 2025 is $33. Think of that number as a solid starting point for your budget, but remember that it can shift quite a bit depending on where you live and the exact services your loved one needs.

Breaking Down the Average Home Care Cost Per Hour

Knowing the average hourly rate is a great first step, but it’s just a benchmark. The final price tag is shaped by several factors, a bit like how the cost of a car depends on its specific model and features. The biggest driver, by far, is the level of care required.

For instance, basic companion care—which covers things like conversation, light housekeeping, and preparing meals—is going to be on the lower end of the cost spectrum. It's incredibly valuable, but it's not as intensive as personal care.

Personal care involves more hands-on assistance with what experts call "activities of daily living" (ADLs). This includes help with things like:

- Bathing and personal hygiene

- Dressing and grooming

- Mobility, like moving from a bed to a chair

- Medication reminders

Because this kind of care requires more specialized training and physical effort from the caregiver, the hourly rate is naturally going to be higher.

National Averages and Regional Differences

The national median cost for non-medical in-home care is a useful baseline for your financial planning. As mentioned, for 2025, that figure is $33 per hour.

However, rates can vary dramatically from state to state, with medians ranging from as low as $24 to as high as $43 per hour. This is all tied to local labor markets, cost of living, and demand. For example, California’s median rate hovers around $37.08 per hour, while Delaware’s is one of the country's lowest at $24.72.

The key takeaway is that your location plays a massive role in your final budget. A caregiver's hourly wage is directly tied to the local cost of living and state minimum wage laws.

To give you a clearer picture of what to expect, here’s a simple breakdown of how different service levels typically price out.

Typical Hourly Home Care Rate Breakdown

| Service Level | Common Tasks | Typical Hourly Rate Range |

|---|---|---|

| Companion Care | Conversation, errands, light housekeeping, meal prep | $28 – $32 |

| Personal Care | Bathing, dressing, grooming, mobility assistance | $30 – $36 |

| Specialized Care | Dementia/Alzheimer's care, post-op support, chronic illness management | $34 – $40+ |

This table shows how the rates climb as the caregiver's responsibilities and required skills increase.

While hourly rates are perfect for initial planning, it’s also important to see the bigger picture. You can learn more about how these numbers translate into a full budget by exploring our guide on the total in-home care cost per month. This will help you put together a much more complete financial plan.

Key Factors That Drive Your Hourly Rate

While the national average is a decent starting point, the final home care cost per hour you'll pay is rarely that simple. Think of it like ordering a pizza—the base price is one thing, but the final cost really depends on the toppings you add. Several key factors come together to determine your family's unique hourly rate.

The biggest factor, by far, is the level of care your loved one needs. Basic companion care, which covers things like conversation, running errands, and light meal prep, usually sits on the lower end of the cost spectrum. It’s a vital service for combating loneliness and providing a helping hand around the house.

However, the rate climbs as the needs become more hands-on. Personal care, which involves help with daily activities like bathing, dressing, and mobility, requires more training and physical effort from the caregiver. Naturally, this commands a higher price.

Specialized Skills and Scheduling Needs

Beyond the basics, specialized training is a major element that shapes the hourly cost. If your loved one needs a caregiver with a specific skill set, the rate will reflect that expertise.

- Dementia and Alzheimer's Care: Caregivers trained in memory care provide essential support for those with cognitive decline, which often justifies a higher wage.

- Post-Operative Support: Helping someone recover after surgery might require knowledge of mobility protocols and careful monitoring.

- Chronic Illness Management: Supporting someone with a condition like diabetes or Parkinson’s disease requires specialized experience and training.

Another huge piece of the puzzle is when you need the care. Just like in other professions, caregiving often costs more during off-hours. You should expect to pay a premium for services on weekends, overnight, or on major holidays.

Agency vs. Independent Caregivers

How you find your caregiver also plays a big role in the final cost. Hiring an independent caregiver directly might look cheaper on paper since you’re not paying agency overhead. But going this route makes you the employer. That means you're on the hook for background checks, payroll taxes, liability insurance, and scrambling to find backup care if your caregiver gets sick.

A home care agency, on the other hand, handles all of that for you. Agency caregivers are typically bonded, insured, and thoroughly vetted. The slightly higher hourly rate covers these protections and the sheer convenience of having the agency manage scheduling, payroll, and replacement caregivers. For many families, that built-in support system and peace of mind are well worth the investment.

How Your Location Changes Home Care Costs

Just like the price of a house shifts dramatically from a bustling city to a quiet suburb, the home care cost per hour is deeply connected to your zip code. It's not random—it’s a direct reflection of the local economy. Things like the regional cost of living, state minimum wage laws, and the simple supply and demand for qualified caregivers all play a huge role in what you'll end up paying.

For instance, an hour of care in a high-cost urban center is almost always going to be more expensive than in a rural town. That's because caregivers need to earn a competitive wage that allows them to live in that specific area.

This geographic price difference is critical, especially when you consider that an overwhelming 90% of seniors want to age in their own homes rather than move to a facility. This trend really highlights the need for affordable, accessible care. For many people with moderate needs, staying at home is the most sensible option financially. You can learn more about this growing demand and its benefits in this in-depth industry report.

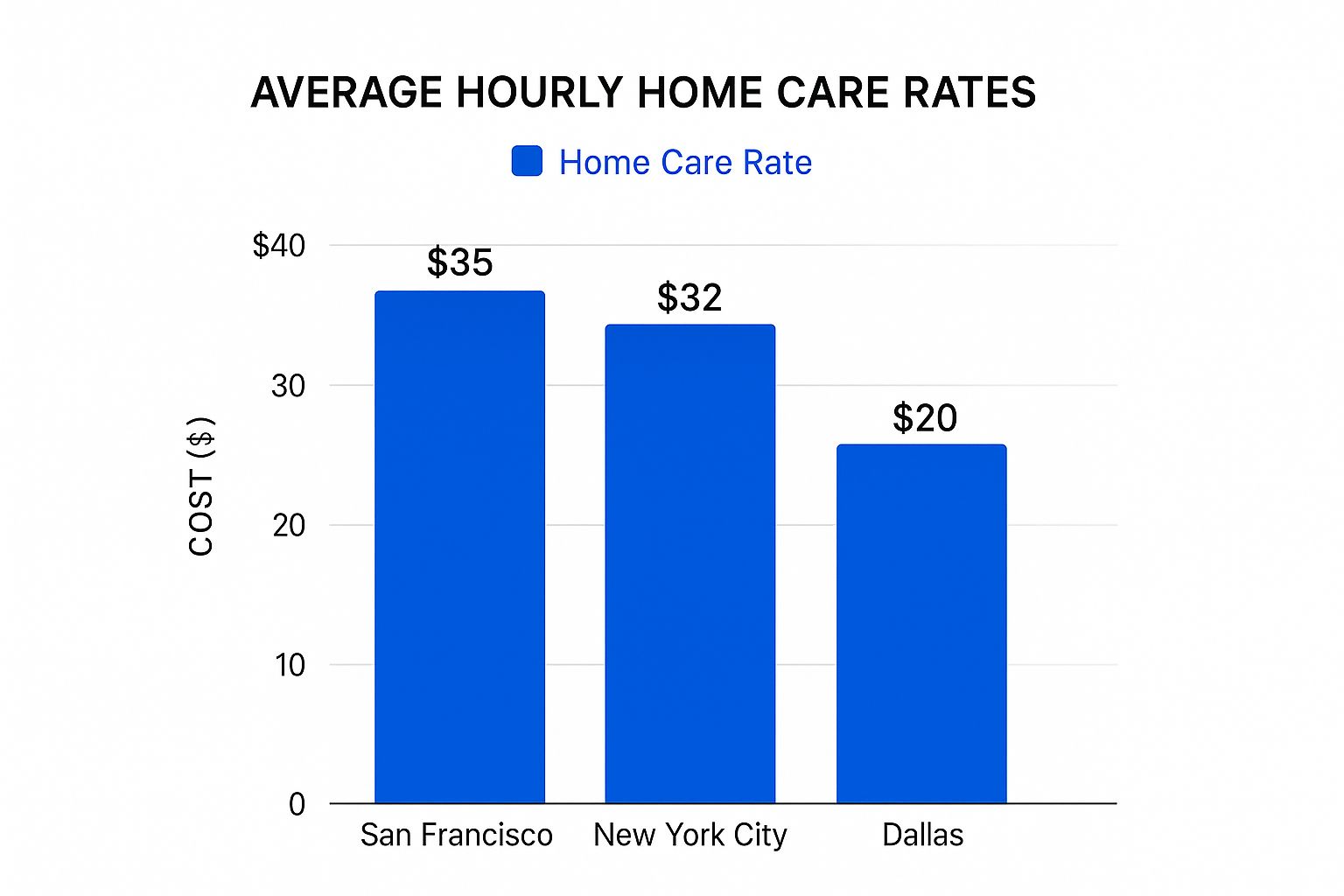

Comparing Costs Across the Country

To see just how much location matters, let's look at how the numbers stack up across different states. The variance can be surprisingly wide, driven by everything from local regulations to the availability of caregivers.

The table below gives you a snapshot of the median hourly rates in a few states, showing the spectrum from high-cost to more affordable areas.

State-by-State Hourly Home Care Cost Comparison

| State | Median Hourly Rate | Notes (e.g., Urban vs. Rural) |

|---|---|---|

| Washington | $34.50 | High cost of living, especially in metro areas like Seattle. |

| Massachusetts | $34.00 | Rates are higher in Boston and surrounding affluent suburbs. |

| California | $32.00 | Major urban centers like San Francisco and L.A. drive up the average. |

| Florida | $25.00 | Costs vary widely between coastal cities and inland communities. |

| Texas | $24.00 | More affordable rates, but costs are rising in cities like Austin. |

| Alabama | $20.00 | Lower cost of living contributes to more accessible rates. |

This side-by-side look makes it clear: where you live is one of the biggest factors in your home care budget.

Now, let's zoom in even further to see how this plays out between major cities.

As the chart shows, the cost in San Francisco is nearly double that of Dallas. It’s a perfect example of how local wages and living expenses flow directly into the rate you'll be quoted.

Understanding these regional differences is essential for realistic financial planning. It helps prevent "sticker shock" and grounds your budget in the economic reality of your specific community.

Ultimately, knowing where your area fits into the national picture is the first step toward creating a care plan that’s both sustainable and accurate from the very beginning.

Budgeting for 24/7 and Live-In Care

When a loved one requires constant support, the financial picture changes completely. The typical home care cost per hour model doesn’t quite fit anymore. Instead, families looking for round-the-clock supervision usually weigh two main options, and each one has a very different price tag.

The first route is 24/7 care, which involves multiple caregivers working in shifts to make sure someone is always awake and alert. This is the gold standard for comprehensive support, but it’s also the most expensive because you’re billed for every single hour—all 168 hours in a week.

Then there’s live-in care, which is often a more affordable solution. With this setup, one primary caregiver lives in the home and is given room, board, and a designated break for sleep. Rather than charging by the hour, this service is typically billed at a flat daily or monthly rate.

Understanding the Financial Commitment

The cost difference between these two models is huge. For true 24/7 care, the monthly bills can be overwhelming. Recent industry data shows the average cost for this level of non-medical support is around $21,823 per month, which adds up to more than $260,000 over a full year.

Live-in care, while still a major investment, typically costs significantly less than hourly 24/7 coverage. This is because the caregiver has designated rest periods, making the daily rate more manageable for long-term planning.

So, which one is right for you? It really comes down to the intensity of care needed. For someone who requires constant, active supervision—even through the night—24/7 hourly care is a necessity. But for an individual who is mostly safe overnight but just needs someone present in the house, live-in care can be a much more sustainable option. You can get a deeper understanding of planning for these expenses in our guide to the total 24-hour in-home care cost.

Finding Ways to Pay for In-Home Care

Getting a handle on the hourly rate for home care is one thing. Figuring out how to actually pay for it is where most families start to feel the pressure. But here’s the good news: your private savings are far from the only tool in the shed. There are several financial programs and tools designed specifically to help cover the home care cost per hour.

One of the best strategies, if you planned ahead, is Long-Term Care (LTC) Insurance. If you or your loved one has a policy, now is the time to dust it off and see what it covers. These policies were created for this exact situation, helping you pay for daily care while protecting your hard-earned assets.

Of course, not everyone has an LTC policy. For many families, that’s when government programs become an absolute lifeline.

Exploring Government and Other Financial Options

Medicaid is a major resource, but a lot of people write it off, assuming they have too much saved up to qualify. That's where Medicaid waivers and "spend-down" programs come into play. These rules are designed to help seniors get home care benefits even if their income is a bit higher than the usual limits. It can feel like a maze of regulations, but our Medicaid spend-down calculator can give you a starting point to see if you might be eligible.

Don't just assume you won't qualify for help. Many of these programs were created to help middle-income families manage the steep cost of long-term care, not just those with very low incomes.

It's also worth looking into support for veterans. The Veterans Aid & Attendance benefit can be a huge help, offering a monthly pension supplement to veterans and their surviving spouses to put toward in-home assistance.

Beyond these big programs, there are a few other financial avenues you can explore:

- Reverse Mortgages: For homeowners 62 and older, this lets you tap into your home's equity for cash without having to move or sell the house.

- Life Insurance Conversions: Some life insurance policies can actually be converted into funds you can use for long-term care expenses.

- Annuities: Depending on the type, certain annuities can be set up to provide a reliable income stream to help pay for ongoing care.

Looking at all these possibilities helps you build a complete financial map. It shifts the conversation from worrying about the cost to confidently creating a care plan you can sustain.

Your Questions About Home Care Costs, Answered

Even after you've got the basics down, you're probably still wrestling with a few specific questions about the home care cost per hour. Let’s tackle some of the most common ones head-on so you can move forward with confidence.

A big one we hear all the time is about Medicare. Will it help pay for this kind of care? In most cases, the answer is no. Medicare is set up to cover short-term, skilled medical care—think a nurse visiting after a hospital stay. It wasn't designed for ongoing personal help like bathing, making meals, or companionship.

Another common crossroads is choosing between a home care agency and a seemingly cheaper independent caregiver. While hiring someone directly might look like it saves money on the hourly rate, it also makes you the employer. That means you're on the hook for taxes, insurance, and scrambling for a backup when they call in sick. Agencies handle all that behind-the-scenes work, which gives you reliability and peace of mind for that slightly higher cost.

Building a Care Budget That Lasts

Putting together a financial plan that you can sustain for the long haul is absolutely essential. The first step is to get a really honest look at how many hours of care you truly need each week.

- Track the Need: For one full week, jot down every single time your loved one needed a hand with something.

- Separate Wants from Needs: Figure out what is "must-have" support (like help getting out of a chair safely) versus "nice-to-have" assistance (like extra housekeeping).

- Plan for the Future: It's smart to factor in a small annual increase to your budget. This helps you stay ahead of inflation and the reality of rising caregiver wages.

A mistake many families make is only budgeting for today's needs. It’s often much wiser to plan for a little more care than you think you need right now. That cushion can be a lifesaver when an unexpected health change or new routine pops up.

Thinking through these details from the beginning helps ensure your financial plan is realistic and won't fall apart down the road.

Ready to build a personalized care plan that fits your family's budget? The team at NJ Caregiving is here to walk you through your options and find the perfect solution. Visit us at https://njcaregiving.com to learn more.