It's a common question we hear from families all the time: "Does Medicare pay for home health care?" The short answer is yes, it does pay for home health care. But—and this is a big but—it’s not what most people think.

Medicare's home health benefit isn't designed for long-term daily support. Think of it as a temporary medical bridge to help you recover at home after an illness, injury, or hospital stay. It’s not a permanent caregiver. Understanding this critical distinction is the first step to navigating your care options.

What Medicare Home Health Really Means

Many families hope that Medicare's home health benefit will cover ongoing, daily assistance with things like bathing, dressing, and meals. In reality, the program has a much more specific purpose: providing skilled medical care in your own home.

This benefit is a cornerstone of Medicare, allowing millions of seniors to get professional treatment without needing to be in a hospital or a nursing home. The goal is recovery—helping you get back on your feet, manage your health condition, and regain your independence.

Key Things to Know Upfront

To get a clear picture right from the start, you need to know the fundamental rules of this coverage. The entire benefit is built around medical necessity and a formal plan of care ordered by a doctor.

Here are the core ideas we'll dive into:

- It’s Medically Focused: Coverage is triggered by a need for skilled nursing care or therapy, not just help with daily chores.

- It Requires a Doctor's Order: A physician must certify that you need these services and create an official plan of care.

- It's Not Long-Term Care: The benefit is for intermittent, part-time support, not 24/7 or ongoing custodial care.

Understanding these foundational rules is essential. Medicare's home health benefit is designed to be a short-term recovery tool, filling a critical gap between a hospital stay and returning to self-sufficiency. It is not a substitute for the long-term services and supports many families require.

It's also helpful to know how providers communicate their services. Many use comprehensive digital marketing strategies for healthcare to explain what they offer while ensuring they meet patient trust and compliance standards. Our goal here is to cut through the noise and clarify what Medicare actually provides, so you can navigate your options with confidence.

Differentiating Home Health Care and Personal Care

When families ask, "Does Medicare pay for home health?" the biggest source of confusion almost always comes down to two similar-sounding terms: home health care and personal care. Both happen at home, and both are designed to help. But in Medicare’s eyes, they are worlds apart.

Getting this distinction right is the key to understanding how Medicare’s entire home care benefit works.

Think of it this way: recovering from a major surgery is like climbing a mountain. You need a skilled medical guide—a physical therapist or a nurse—to map out the safest route, manage your health, and teach you the specific techniques to reach the summit. That’s home health care.

But you also need someone to set up your base camp, cook your meals, and make sure you have clean clothes. This support is absolutely essential for your journey, but it isn’t medical guidance. That’s personal care. Medicare is set up to pay for the skilled guide, not the base camp support.

What Is Skilled Home Health Care?

At its core, skilled home health care is medical care ordered by a doctor and delivered by licensed health professionals right in your own home. The entire focus is on treating an illness or injury. It’s a clinical service, just in a much more comfortable setting.

This is the only type of in-home care that Original Medicare is designed to cover.

The services have to be medically necessary for you to get better, and they must require the hands-on skills of a professional. For example:

- A registered nurse changing a complex surgical dressing to prevent a serious infection.

- A physical therapist designing and supervising exercises to help you walk again after a fall.

- A speech-language pathologist working with a stroke survivor to help them relearn how to swallow safely.

- An occupational therapist teaching you how to use special equipment to bathe or get dressed on your own.

Medicare’s logic is simple: If the task demands the specific training of a licensed medical professional to be done safely and correctly, it might be covered. If not, it likely falls into the personal care bucket.

Understanding Personal Care Services

Personal care, which you’ll often hear called custodial care, is all about providing non-medical help with what experts call Activities of Daily Living (ADLs). These are the routine things most of us do every day without a second thought—bathing, dressing, eating—that can become difficult after an illness or due to age.

This type of care is all about maintaining comfort, safety, and a healthy living space. It doesn't require a medical license, just a helping hand.

Common Personal Care Tasks

- Bathing and Grooming: Helping with a shower, getting dressed, and other personal hygiene.

- Meal Preparation: Planning and cooking healthy meals, or even helping with feeding if needed.

- Mobility Assistance: Giving a steady arm to help someone move around the house or get out of bed.

- Light Housekeeping: Simple tasks like laundry, dusting, or washing dishes that keep the home clean and safe.

- Companionship and Errands: Providing social interaction or running to the grocery store.

The Critical Connection to Medicare Coverage

This distinction is precisely why Medicare’s rules feel so strict. The program was built to cover medical treatment, so it won’t pay for services that are purely for personal care. This is also why a doctor’s order is non-negotiable—a medical professional has to certify the need for skilled help. You can learn more about the specifics of what is home health nursing in our detailed guide on the topic.

But here’s the one crucial exception: Medicare might cover a home health aide for personal care tasks, but only if you are also getting skilled nursing or therapy. The personal care has to support the medical plan.

For instance, if a nurse visits twice a week to manage your wound care, Medicare might also approve a home health aide for a few hours to help with bathing. Why? Because keeping you clean helps prevent infection and supports the overall goal of your medical recovery.

Ultimately, grasping that "home health" means medical and "personal care" means non-medical is the single most important step you can take to set realistic expectations for your family’s care journey.

Meeting Medicare's Strict Eligibility Rules

Just because home health care feels like the right fit doesn't mean Medicare will automatically foot the bill. The program has a very specific checklist, and you have to tick every single box to get approved. These aren't just suggestions; they're firm, non-negotiable requirements.

Getting a handle on these criteria is the first step toward having a productive conversation with your doctor and setting realistic expectations. Think of it like needing four specific keys to unlock a door—miss even one, and the door to coverage stays shut. Let's walk through exactly what those keys are.

The Four Pillars of Medicare Home Health Eligibility

To get home health services covered by Medicare, a patient has to meet all of the following conditions. Each one builds on the last, painting a clear picture of who this benefit is truly for.

-

You Must Be Under a Doctor's Care: It all starts with your physician. A doctor must create and regularly review a formal plan of care, overseeing your treatment from start to finish.

-

A Doctor Must Certify Your Need for Skilled Care: Your doctor needs to officially state that you require intermittent skilled nursing, physical therapy, speech-language therapy, or ongoing occupational therapy. This is the medical proof your claim rests on.

-

You Must Be "Homebound": This is where most people get tripped up. Being homebound doesn't mean you're bedridden 24/7. It simply means leaving home is a major, difficult effort. Your doctor has to certify this status.

-

You Must Use a Medicare-Certified Agency: The agency providing your care can't just be any company; it has to be officially approved by Medicare. This ensures they meet federal health and safety standards.

For a deeper dive into these rules with more examples, our guide on Medicare home health requirements breaks it all down.

What Does "Homebound" Really Mean?

Let's clear up the confusion around the homebound rule. You can still qualify as homebound even if you leave the house for medical appointments, religious services, or short, infrequent trips like visiting an adult day care program.

The real question is: Does leaving your home take a considerable and taxing effort? This could be because an illness or injury makes it hard to move around, requiring you to use a wheelchair, walker, or get help from another person. If so, you likely fit the definition.

For example, someone recovering from hip surgery who finds walking exhausting would probably qualify. But a person who can easily drive themselves to the grocery store would not.

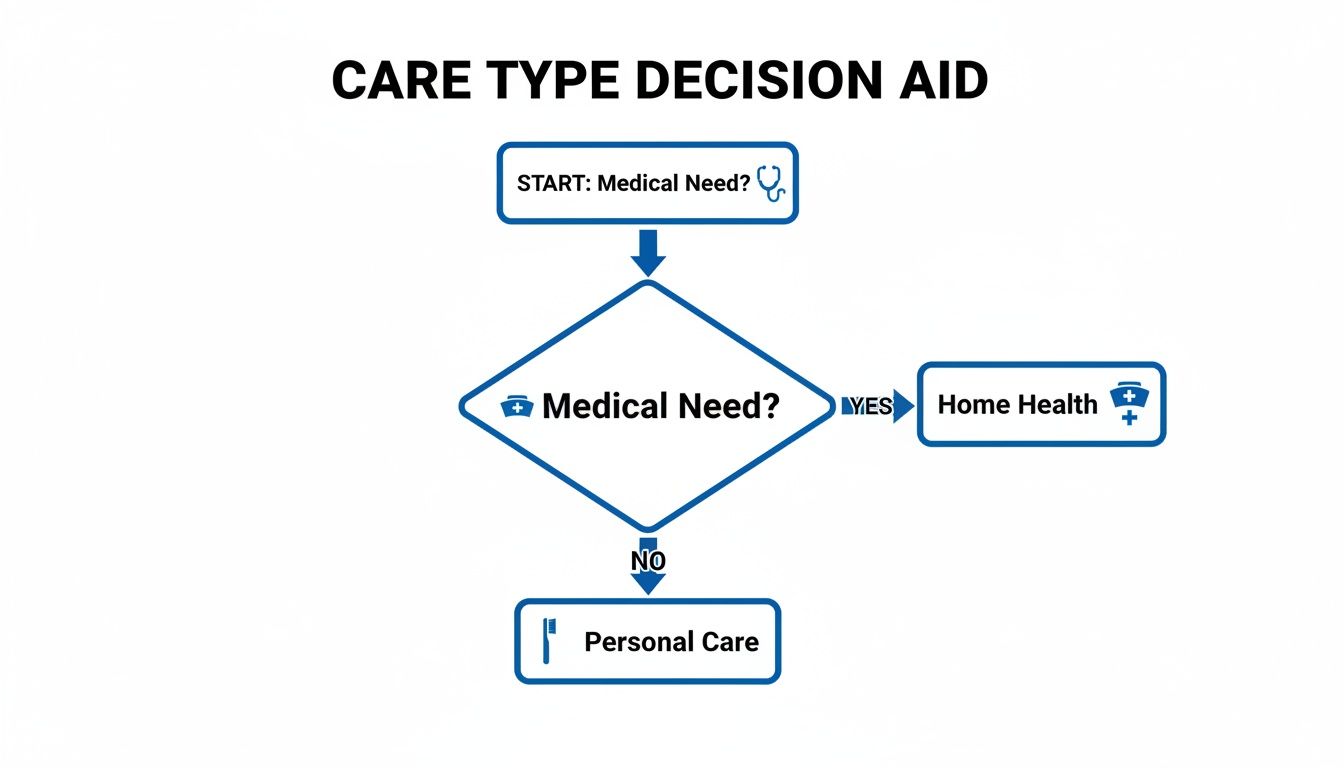

This decision tree helps visualize that first critical step: determining if the need is truly medical.

As the flowchart shows, a documented medical need is the non-negotiable starting point for getting Medicare to cover home health services.

Alright, once your doctor gives the green light and confirms you're eligible, the big question becomes, "So, what kind of help can we actually get at home?" It's a critical question, and getting the answer right is key to setting realistic expectations for recovery.

Think of Medicare's home health benefit less like an all-purpose handyman and more like a specialized medical team that comes to you. Each service has a specific, skilled purpose, and they all work together to help you get back on your feet in the comfort of your own home. Let's open up that medical bag and see exactly what's inside.

Part-Time Skilled Nursing Care

The foundation of the entire home health benefit is part-time or intermittent skilled nursing care. This is usually the main reason someone qualifies, and it has to be delivered by a Registered Nurse (RN) or a Licensed Practical Nurse (LPN).

Pay close attention to the words "part-time" and "intermittent." This isn't around-the-clock care. It means help is provided for fewer than eight hours a day and for less than seven days per week. Medicare is not set up to pay for 24/7 nursing at home.

So, what does "skilled" nursing actually look like?

- Wound Care: This could be changing complex dressings for surgical wounds or treating stubborn pressure sores.

- IV Therapy: Administering medications or nutrition intravenously right in your living room.

- Injections: Giving shots that are too complex or difficult for you to administer yourself.

- Patient Education: A huge part of this is teaching. A nurse can show you or your family how to manage a new diagnosis like diabetes or care for a new ostomy.

A Full Suite of Essential Therapies

Right alongside nursing, Medicare brings in the therapy team. These services are all about restoring function and getting you back to your life. They aren't just general exercises; they are specific treatments prescribed by your doctor and delivered by licensed therapists.

- Physical Therapy (PT): If you've had a fall, surgery, or illness, a physical therapist will work with you to rebuild strength, improve your balance, and get you moving safely again. They might guide you through exercises to walk without a walker or use your new cane correctly.

- Occupational Therapy (OT): This is all about the "occupations" of daily life. An occupational therapist’s goal is to help you perform activities like getting dressed, bathing, or making a simple meal safely and on your own.

- Speech-Language Pathology Services: Often needed after a stroke or another neurological issue, a speech therapist can help with communication problems or difficulties with swallowing to ensure you can eat and drink safely.

These core services—skilled nursing and the therapies—are really the engine of the home health benefit. They represent the active, medical treatment that Medicare is designed to fund.

The Role of a Home Health Aide

This is where many families get tripped up, but the rule is straightforward. Medicare will cover a home health aide to help with personal care—things like bathing, dressing, and using the bathroom—but only if you are also receiving skilled nursing or therapy.

A home health aide can't be a standalone service under this benefit. Their job is to support the skilled care you're already getting. For example, an aide helping you shower safely is seen as directly supporting a physical therapist's goal of improving your mobility.

What Medicare Covers vs. What It Doesn't

It's crucial to understand the line between skilled medical care and everyday personal help. Medicare is designed for the former. This table breaks down the differences to give you a clearer picture.

Covered vs. Non-Covered Home Services Under Medicare

| Service Category | Example of Covered Service | Example of Non-Covered Service |

|---|---|---|

| Nursing Care | A nurse visiting to change a surgical wound dressing or administer IV medication. | A nurse or aide staying 24/7 to monitor your condition. |

| Personal Care | A home health aide helping you bathe, if you're also getting skilled nursing or therapy. | A home health aide providing bathing assistance as the only service you need. |

| Housekeeping | No direct coverage. | Meal preparation, grocery shopping, cleaning, or laundry services. |

| Therapy | A physical therapist teaching you exercises to regain strength after a hip replacement. | A personal trainer helping with general fitness exercises. |

| Transportation | No direct coverage. | Driving you to doctor's appointments or to run errands. |

| Companionship | A medical social worker providing counseling to cope with an illness. | Someone to sit with you, read, or provide general companionship. |

As you can see, Medicare's focus is on short-term, skilled services that have a clear medical purpose. It is not a long-term care solution for ongoing daily assistance.

Other Important Covered Services

Beyond that core team, Medicare includes a couple of other key supports:

- Medical Social Services: If the emotional or social side of an illness is becoming overwhelming, a medical social worker can step in. They can connect you with valuable community resources or provide counseling.

- Durable Medical Equipment (DME): Your home health agency won't provide a hospital bed or walker directly, but Medicare Part B will help cover it. You'll typically pay 20% of the Medicare-approved amount for DME after meeting your Part B deductible.

This approach of treating people at home isn't just better for patients; it's also incredibly cost-effective. In fact, beneficiaries who use home health services cost the program about 42% less than similar patients who don't. That saves Medicare roughly $3,600 per person each month by avoiding costly hospital and nursing facility stays. You can learn more about the financial benefits of home health care and see how impactful it is.

Navigating Your Costs and Financial Responsibility

Let’s talk about the bottom line. When your doctor says you need skilled care at home, one of the first questions on anyone's mind is, "What is this going to cost?" For families already navigating a health crisis, getting a clear answer on the finances is a huge relief.

Fortunately, when it comes to eligible home health services under Original Medicare (Part A and Part B), the answer is refreshingly simple. For all of the skilled nursing visits, physical therapy, occupational therapy, and other approved services, you pay $0.

That's right. There's no deductible to meet and no copayment for these visits. Medicare covers 100% of the approved costs for the skilled care itself, because they know it helps you recover more effectively and avoid far more expensive hospital stays down the road.

The Exception: Durable Medical Equipment

However, there is one key area where you will have some financial responsibility: durable medical equipment (DME). This is a broad category that includes items your doctor prescribes for use at home, like walkers, hospital beds, oxygen equipment, or wheelchairs.

Medicare absolutely helps pay for this equipment, but it falls under your Part B benefits. For any DME, you are typically responsible for:

- 20% Coinsurance: You will need to pay 20% of the Medicare-approved amount for the equipment.

- Part B Deductible: This 20% coinsurance only kicks in after you’ve met your annual Part B deductible.

This cost-sharing for DME is a crucial detail to remember as you plan your expenses. To get a better handle on your financial obligations and see how payments are managed behind the scenes, a deeper understanding of claims processing can be really helpful.

How Medicare Advantage Plans Handle Costs

The financial picture can look quite different if you're enrolled in a Medicare Advantage (Part C) plan. These are private insurance plans, and while they are required by law to cover the same essential home health services as Original Medicare, they get to set their own cost-sharing rules.

So, instead of paying nothing for skilled visits, your Medicare Advantage plan might require:

- Copayments: A fixed dollar amount for each home health visit.

- Coinsurance: A percentage of the cost of the services.

- In-Network Providers: A strict requirement that you only use a home health agency within your plan's specific network.

It is absolutely essential to check directly with your Medicare Advantage plan provider. Call them and ask for a clear explanation of your specific costs for home health care and for a list of their in-network agencies. This one step can save you from a world of surprise bills.

How Medigap Can Help Fill the Gaps

If you have Original Medicare, a Medicare Supplement Insurance policy—often called Medigap—can be a huge asset. These plans are designed specifically to help cover your out-of-pocket costs.

A Medigap policy can cover the 20% coinsurance for durable medical equipment, potentially dropping your out-of-pocket expenses for things like a walker or hospital bed down to zero. Looking into the average cost of home health care can give you a broader perspective on how all these numbers fit together. Just be sure to review your specific Medigap policy to confirm its coverage for DME coinsurance.

How to Arrange Home Health Services in New Jersey

Figuring out that a loved one qualifies for Medicare home health is a huge relief. Now, what's next? Getting care started in New Jersey isn’t as complicated as it might seem—it’s a clear process that brings the doctor, a certified agency, and your family together as a team.

Following these steps makes sure the care is not just medically necessary, but also officially documented and green-lit by Medicare from the very beginning. This sets everyone up for a smoother recovery journey at home without any surprise coverage gaps.

Start the Conversation with Your Doctor

Everything starts with a trip to the doctor. A physician's order is the essential first step—the key that unlocks Medicare's home health benefits. You’ll need to schedule an appointment to specifically discuss the need for skilled care at home.

When you go, be ready to talk about the real-world challenges. Explain why leaving the house is a major physical struggle and describe the medical tasks that need a professional's touch, like physical therapy or changing a surgical dressing. If the doctor agrees, they will write up and sign an official Plan of Care.

Think of this document as the official game plan. It clearly spells out:

- The exact types of skilled care required (like nursing or physical therapy).

- How often and for how long the visits should be.

- The medical diagnosis that makes this care necessary.

- The specific goals of the treatment.

Find a Medicare-Certified Home Health Agency

With the doctor's order in hand, your next job is to pick a home health agency. You have the freedom to choose any provider you like, but here's the critical part: they must be certified by Medicare. This certification is your guarantee that the agency meets federal health and safety standards.

You can find and compare agencies right in your area using Medicare's official Care Compare tool on their website. It’s always a good idea to pick an agency that serves your specific part of New Jersey. A local provider often means better coordination and quicker responses when you need them.

A crucial step in this process is the initial assessment visit. Once you select an agency, they will send a nurse or therapist to the home to conduct a thorough evaluation. This visit helps finalize the details of the Plan of Care in collaboration with your doctor.

What to Expect from the Plan of Care

The Plan of Care isn't a one-and-done document. It's a living, breathing guide that directs every aspect of the care being provided, and it’s a team effort between the agency and your physician.

Your doctor is required to review and re-certify this plan at least once every 60 days. This check-in ensures the care is still medically necessary and allows for adjustments as health needs change. If recovery is going well, visits might become less frequent. If new challenges pop up, the plan can be updated to add more support.

Knowing Your Rights and How to Appeal

Sometimes, you might not agree with a decision made about home health services. Care could be denied, reduced, or stopped before you and your doctor feel it's the right time. When that happens, it's so important to know you have the right to appeal.

If services are denied, the home health agency is required to give you a written notice explaining why. That notice will also give you detailed instructions on how to file an appeal. The key is to act quickly. An appeal is your chance to challenge the decision and make your case, ensuring you can advocate effectively for the care needed to recover safely at home.

Answering Your Top Questions About Medicare and Home Health

Once we’ve covered the basics of who qualifies and what’s included, the real-world “what if” questions start to pop up. These are the details that truly matter to families navigating the system day-to-day. Let's clear up some of the most common questions we hear.

How Long Can I Get Medicare Home Health Benefits?

This is a big one, and the answer is surprisingly flexible: there is no set time limit for Medicare home health benefits. As long as you continue to meet all the eligibility rules—meaning you’re still certified as homebound and still require skilled care—your benefits can continue.

The key is that your doctor must review and recertify your plan of care at least every 60 days. This isn't just paperwork; it’s a required check-in to confirm that the services are still medically necessary for your condition. Your coverage is based entirely on your ongoing medical need, not a predetermined number of weeks or months.

What if I Need More Than Part-Time Care?

Medicare’s home health benefit is specifically designed for what they call "intermittent" or "part-time" skilled needs. It's built to address a specific medical issue, not to provide round-the-clock supervision or long-term help with daily life.

If what your loved one really needs is more extensive, non-medical support—like help with bathing and dressing all day, meal preparation, or simple companionship—you’ll need to look at other options. These usually include:

- Hiring caregivers directly through a private-pay home care agency.

- Using a long-term care insurance policy, if one is in place.

- Applying for state-based Medicaid programs, like New Jersey's Managed Long-Term Services and Supports (MLTSS), which is designed for this kind of custodial care.

Can I Choose My Own Home Health Agency?

Yes, absolutely. The choice is 100% yours. You have the right to pick any Medicare-certified home health agency that serves your local area. A hospital discharge planner or your doctor might give you a list of agencies they’ve worked with, but that’s just a suggestion to get you started.

It’s always a good idea to do your own homework. Look up a few local agencies, check their quality ratings on Medicare's official comparison tool, and see which one feels like the best fit for your family’s specific needs and personality.

How Does Home Health Work if I Have a Medicare Advantage Plan?

If you have a Medicare Advantage (Part C) plan, you're still covered. By law, these plans must offer at least the same benefits as Original Medicare, and that includes home health care. The fundamental services you’re entitled to don't change.

What does change are the rules and costs. With a Medicare Advantage plan, you’ll likely find that you:

- Must use a home health agency that is in your plan’s network.

- May have to pay a copayment for each home health visit.

- Might need prior authorization from the insurance company before your care can begin.

The best first step is always to call your plan's member services number. They can give you a clear breakdown of your costs and provide a list of their approved, in-network home health agencies.

Figuring out the ins and outs of Medicare is just one piece of the puzzle. When you need dedicated, compassionate support at home here in New Jersey, NJ Caregiving is ready to help. We provide personalized services that enhance independence and bring peace of mind to families. Learn more about how we can support your family by visiting us at https://njcaregiving.com.