Trying to piece together long-term care can feel like you've been handed a 1,000-piece puzzle with no picture on the box. One provider handles in-home help, another manages physical therapy, and a third coordinates medical appointments. It's confusing. This traditional, fee-for-service approach often forces families to become full-time care coordinators, a role that’s as exhausting as it is inefficient.

Medicaid Managed Long Term Care (MLTC) flips that script completely.

The Shift to Coordinated Long Term Care

Instead of Medicaid paying for every doctor's visit and therapy session one by one, the state contracts with a Managed Care Organization (MCO). This MCO gets a set monthly payment to handle all aspects of a person’s care.

Think of the MCO as a dedicated project manager for your loved one's health and well-being. Their main goal isn't just to react to health problems but to proactively provide comprehensive, person-centered care that prevents costly hospital stays and improves quality of life. The whole model is built around keeping individuals in the least restrictive setting possible—which, for most people, is their own home.

Why New Jersey Embraced This Model

This move toward managed care isn't just a fleeting trend. It’s a smart, strategic response to the needs of a growing older population. The number of states with Medicaid Managed Long-Term Services and Supports (MLTSS) programs skyrocketed from just eight in 2004 to 24 by 2021.

This growth, detailed in an analysis from LTCfocus.org, shows a clear national shift toward more efficient ways to deliver long-term care. Here in New Jersey, where MLTSS is mandatory for eligible individuals, this model is the key to unlocking the home and community-based services that allow people to age with dignity in familiar surroundings.

At its core, MLTC is about proactive, holistic care. By assigning a single care manager, the system ensures that all aspects of a person's health—medical, social, and functional—are considered together, leading to better outcomes and a more dignified care experience.

This coordinated approach is a game-changer for families. Here’s a quick look at how the two models stack up.

MLTC vs Traditional Medicaid at a Glance

This table breaks down the key differences between the managed care model and the traditional fee-for-service system, highlighting how MLTC fundamentally changes the care experience.

| Feature | Medicaid Managed Long Term Care (MLTC) | Traditional Fee-for-Service Medicaid |

|---|---|---|

| Care Coordination | A single care manager oversees a holistic plan. | Care is fragmented; families often coordinate multiple providers. |

| Service Delivery | Proactive; focuses on preventing crises. | Reactive; pays for services as they are needed. |

| Main Focus | Keeping individuals at home and in the community. | Primarily covers medical services and nursing home care. |

| Provider Network | Members choose from a network of approved providers. | Members can see any provider who accepts Medicaid. |

| Payment Model | MCO receives a fixed monthly payment per member. | State pays for each individual service rendered. |

As you can see, the MLTC model is designed for integration and prevention, making it a much more streamlined and supportive system for families navigating long-term care needs.

This coordinated approach offers a few powerful advantages:

- A Single Point of Contact: Families work with one dedicated care manager who knows their loved one’s complete health picture. No more juggling calls and appointments.

- Proactive Care Planning: The focus is squarely on preventing health crises before they happen, which helps slash emergency room visits and hospitalizations.

- Personalized Service Delivery: Care plans are built around individual needs and goals, promoting independence and allowing more people to get the support they need right in their own community.

Ultimately, the goal of medicaid managed long term care in New Jersey is to create a more connected and supportive system. That’s where organizations like NJ Caregiving come in. We partner directly with MCOs to deliver the high-quality, in-home services that make this model work, helping families understand their options and ensure their loved ones can truly thrive at home.

How to Qualify for MLTC in New Jersey

Figuring out how to qualify for Medicaid Managed Long Term Care (MLTC) can feel overwhelming, but it really boils down to two main things. Think of it like a two-sided coin: on one side, you have clinical need, and on the other, financial standing. To get approved, New Jersey needs to see that your loved one both requires a certain level of care and meets the state's strict financial limits.

The whole process is designed to make sure that this intensive support goes to the people who truly need it most. It kicks off with a formal application and then moves through a series of official evaluations to get a complete picture of your family member's situation.

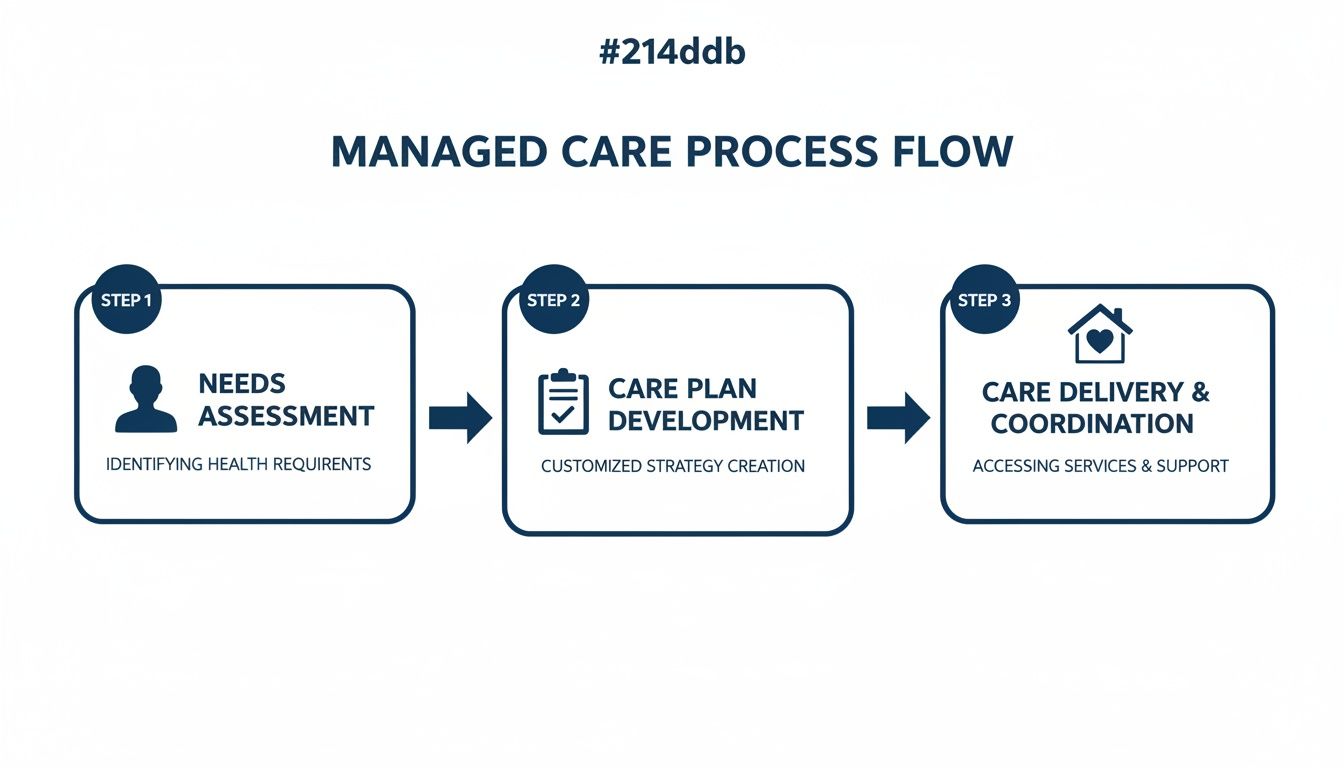

This simple visual breaks down the managed care journey, from identifying what help is needed to creating a plan and coordinating the actual care.

The flow from "Needs" to "Plan" to "Care" shows how MLTC provides a structured, organized system of support once someone is approved.

The Clinical Eligibility Assessment

First things first, we have to establish that your loved one has a genuine clinical need for long-term care. This isn't about a specific diagnosis. It's about how their health conditions affect their ability to manage day-to-day life.

To figure this out, a registered nurse from the Office of Community Choice Options will visit for a comprehensive, in-person assessment. They’ll be looking at your loved one’s ability to handle Activities of Daily Living (ADLs) and Instrumental Activities of Daily Living (IADLs).

- Activities of Daily Living (ADLs): These are the absolute basics of self-care, like bathing, dressing, eating, and getting around safely.

- Instrumental Activities of Daily Living (IADLs): These are the more complex tasks someone needs to live independently—things like managing money, cooking meals, or using transportation.

To be considered clinically eligible for MLTC, an individual generally needs help with three or more ADLs. This assessment confirms that they require what's known as a "nursing-facility level of care," even if the ultimate goal is for them to receive that care right at home.

Meeting the Financial Requirements

Once the clinical need is confirmed, the spotlight shifts to the financial side of things. New Jersey Medicaid has very specific income and asset limits that every applicant must meet. These rules are non-negotiable and require a lot of careful documentation.

The financial review is often the most challenging part of the application. It involves a detailed look-back at the applicant's financial history to ensure all assets and income sources are accounted for according to state and federal regulations.

Gathering all the right financial paperwork ahead of time is one of the best things you can do for a smooth process. You’ll definitely need to have these items ready:

- Proof of Income: This includes Social Security statements, pension records, and pay stubs from any other source of regular income.

- Asset Documentation: Get ready to pull together bank statements, property deeds, life insurance policies, and records for any investment accounts.

- Proof of Identity and Residency: You'll also need standard documents like a birth certificate, driver’s license, and recent utility bills.

The exact income and asset numbers can change, so it’s critical to work with the most up-to-date information. For a complete breakdown, check out our guide to https://njcaregiving.com/new-jersey-medicaid-income-limits/ to see precisely what counts. And while our focus here is on qualifying in New Jersey, it can also be helpful to understand different strategies for protecting assets from Medicaid as part of your long-term planning.

Navigating both the clinical and financial requirements demands real attention to detail. Having all your medical and financial paperwork organized and ready to go can make a huge difference, speeding up the approval and helping you avoid common delays.

Discovering Your Covered In-Home Care Services

Once your loved one is approved for Medicaid Managed Long Term Care (MLTC), you gain access to a whole range of services with one simple goal: to help them live safely and comfortably right where they want to be—at home. These plans aren't just about basic medical appointments; they offer a practical support system that tackles the real-world challenges seniors and people with disabilities face every day. It's all about getting the right help at the right time.

This isn't just a small program, either. The move toward home-based care is a massive shift. Back in 2020, Medicaid Long-Term Services and Supports (LTSS) helped 5.6 million people across the country. And get this—a whopping 72% of them, or 4.0 million individuals, received their care exclusively in their homes and communities. This really shows how much families prefer to age in place, which is the entire philosophy behind MLTC.

Core In-Home Support Services

At the very heart of any MLTC plan are the core services that provide direct, hands-on help. This isn't a generic checklist. The support is specifically tailored to your loved one's needs, based on their initial assessment and a care plan that gets updated as their needs change. The goal is to fill in the gaps that make living at home difficult.

The most common and vital of these is Personal Care Assistance (PCA). This is when a trained home health aide comes to the home to help with what we call Activities of Daily Living (ADLs).

This could mean help with:

- Bathing and Grooming: Making sure personal hygiene is handled with dignity.

- Dressing: Giving a hand to get ready for the day.

- Toileting and Incontinence Care: Providing sensitive and respectful support.

- Mobility Assistance: Helping your loved one get around the house safely, move from a bed to a chair, or simply preventing a fall.

- Meal Preparation: Cooking healthy meals that follow any specific dietary rules.

The real beauty of managed care is its person-centered approach. The care plan isn’t a one-size-fits-all document; it’s a living blueprint created with input from the member, their family, and their care manager to address their unique goals and preferences.

Skilled and Therapeutic Care at Home

Beyond help with daily tasks, MLTC plans also cover necessary medical and therapeutic care delivered right in the home. This blend of health and personal care is what makes the whole system work so well. It helps stop small health issues from turning into major crises that land someone in the hospital.

Common skilled services include:

- Skilled Nursing: A registered nurse (RN) or licensed practical nurse (LPN) can visit to handle medical tasks like wound care, giving injections, or keeping an eye on vital signs for chronic conditions.

- Physical Therapy: MLTC plans are built to cover crucial in-home therapies, including services from physical therapy clinics that help with recovery after an injury or surgery and work to maintain strength and mobility.

- Occupational Therapy: This helps people relearn how to do daily tasks, like cooking or writing, and can help adapt their home environment to make things easier.

- Speech Therapy: This is so important for someone recovering from a stroke or dealing with other conditions that make it hard to communicate or swallow.

Bringing these professional services directly to your loved one creates a seamless circle of support. For more specifics, it can be helpful to learn more about how Medicaid covers these in-home care services in New Jersey.

Other Essential Support Systems

A strong medicaid managed long term care plan knows that good health is about more than just medicine. It’s also about having a safe environment and making sure the entire family is supported.

That's why many plans include a variety of other essential benefits:

- Home Modifications: These are often small but critical changes to make the home safer, like installing grab bars in the bathroom, building a wheelchair ramp, or adding a stairlift.

- Specialized Dementia Care: For those with Alzheimer’s or other forms of dementia, caregivers get special training to manage challenging behaviors and provide compassionate, effective support.

- Respite Care: This service is a lifeline for family caregivers. It provides a professional caregiver to step in for a short time, giving you a much-needed break to rest and avoid burnout.

- Medical Social Services: These are professionals who can help you navigate the system, connect your family with community resources, find counseling, and build a wider support network.

By bundling all these services together, MLTC plans create a true safety net. It’s what makes it possible for people to stay independent, healthy, and connected to their communities for as long as possible.

Choosing the Right Home Care Agency for Your Plan

Getting approved for a Medicaid Managed Long Term Care (MLTC) plan is a huge win for your family. It's a moment of relief, but it's really just the starting line. Now comes the most important part: picking the right home care agency to bring that plan to life.

This isn't just a logistical step; it's a decision that will directly shape your loved one's daily comfort, safety, and overall happiness.

Your Managed Care Organization (MCO) will give you a list of their approved, in-network agencies. While that narrows the field, the real work of finding the perfect fit is up to you. You're looking for a partner, not just a provider—an agency that gets your family's values and your loved one's unique needs.

Verifying Credentials and Experience

Before you get into the feel-good stuff, you have to nail down the basics. A truly professional agency will be proud to show you their qualifications. Think of this as checking the foundation of a house. If it's not solid, nothing else matters.

Start with these non-negotiables:

- Licensing and Accreditation: Is the agency fully licensed by the State of New Jersey? Any extra accreditations from healthcare organizations are a major plus.

- MCO Partnership: Double-check with the agency that they are an approved provider for your specific MCO. This is key to avoiding billing headaches down the road.

- Experience with Specific Conditions: If your loved one is dealing with Alzheimer's, Parkinson's, or recovering from a stroke, you need an agency with proven experience and specialized training in that area. Ask them directly.

Getting these questions out of the way first helps you quickly weed out any agencies that won't work, so you can focus your time on the real contenders.

Evaluating Caregiver Quality and Training

The caregivers are the heart and soul of any home care agency. The person who walks through your loved one's door becomes a part of their daily life, so you need to know how the agency finds, trains, and supports them. An agency that invests in its team is far more likely to provide the consistent, compassionate care you're looking for.

A well-supported caregiver is an effective caregiver. Inquire about ongoing training, supervision, and support systems for their staff. This focus on employee well-being often translates directly into better, more compassionate care for clients.

When you're talking to potential agencies, get specific with your questions about their team:

- Screening Process: What does your background check involve? Do you run criminal checks, call references, and verify credentials for every single caregiver?

- Training and Development: What kind of initial and ongoing training do your caregivers get? Do you offer specialized training for complex conditions like dementia or diabetes?

- Assignment and Matching: How do you decide which caregiver goes to which client? Do you think about personality, language, and cultural background, or just clinical skills?

- Supervision and Oversight: Who monitors the caregiver’s performance? If there's a problem, who do I call, and what's your process for fixing it?

Understanding these internal processes gives you a clear window into the agency's commitment to quality. To get a head start, you can explore a curated list of trusted home care agencies that accept Medicaid in New Jersey.

Checklist for Selecting Your MLTC Home Care Agency

Interviewing agencies can feel overwhelming. Use this checklist during your calls and meetings to make sure you hit all the critical points. It’ll help you compare your options side-by-side and feel confident in your final choice.

| Question to Ask | Why It's Important | Ideal Answer to Look For |

|---|---|---|

| "What is your protocol for a missed shift or emergency?" | This ensures continuity of care. You need to know your loved one will never be left alone without support. | "We have on-call staff and a system to dispatch a qualified replacement immediately." |

| "Can we meet the proposed caregiver before services begin?" | This is all about personal connection. It lets you gauge compatibility and comfort, which is crucial for a strong relationship. | "Absolutely, we encourage an initial meeting to ensure a good fit for everyone." |

| "How do you communicate with families about care updates?" | This sets clear expectations. You need to know how you'll be kept in the loop about your loved one's well-being. | "Our care manager provides regular updates and we use a shared communication log." |

| "How are care plans created and updated?" | This confirms they take a person-centered approach and can adapt as your loved one's health needs change. | "Plans are developed with the family and member, and reviewed regularly by a supervising nurse." |

Choosing the right agency under your MLTC plan is a decision that requires both your head and your heart. By asking the right questions and focusing on what truly matters—quality, safety, and compassion—you can find a trusted partner to support your loved one on their journey to age gracefully at home.

How MLTC Supports Family Caregivers

Medicaid Managed Long Term Care isn’t just about providing services to your loved one; it’s a powerful support network for the entire family. The truth is, caregiving can be physically and emotionally draining. MLTC plans are designed to acknowledge this reality by building in support for the unsung heroes—the family caregivers.

This support is absolutely essential for making the caregiving journey sustainable. Instead of leaving families to figure things out on their own, the managed care model provides real, tangible resources that help prevent burnout and improve the quality of care your loved one receives at home.

Providing Relief Through Respite Care

One of the most valuable benefits tucked into many MLTC plans is respite care. Think of it as a scheduled, professional stand-in. This service brings in a qualified home health aide to take over your caregiving duties for a short time, giving you a much-needed and well-deserved break.

This isn't a luxury; it's a lifeline. It's what allows you to run errands, get to your own appointments, or simply rest and recharge. Knowing a trained professional is there ensures your loved one’s needs are met, giving you complete peace of mind.

Respite care is a proactive tool against caregiver burnout. By providing structured breaks, it helps maintain the caregiver's own health and well-being, which is directly linked to better, more consistent care for their loved one over the long term.

For example, a daughter caring for her mother with dementia can use her respite hours to go to her own doctor's visit or meet a friend for lunch. These are simple acts of self-care that often become impossible without this kind of support.

Equipping You with Skills and Confidence

Beyond giving you a break, a strong medicaid managed long term care program also invests in you. Many Managed Care Organizations (MCOs) and their partner agencies offer caregiver training programs designed to equip you with the practical skills needed to handle complex care situations with more confidence.

This training can cover a wide range of essential topics, including:

- Safe Transfer Techniques: Learning the right way to help a loved one move from a bed to a wheelchair to prevent injury to both of you.

- Medication Management: Getting a handle on how to properly organize and administer medications.

- Condition-Specific Education: Gaining insights into managing specific conditions like Alzheimer’s, diabetes, or post-stroke recovery.

- Effective Communication Strategies: Learning how to connect and communicate with a loved one who may have cognitive or speech difficulties.

This education empowers you, turning you into a more effective and assured member of the care team.

Building a Sustainable Family Support System

Ultimately, MLTC strengthens the entire family unit. When a caregiver is supported, they can provide better care. When they have access to resources like respite and training, the whole home environment becomes less stressful and more stable.

Imagine a husband caring for his wife after a major surgery. Through their MLTC plan, he not only gets a home health aide to help with daily tasks but also receives training on proper wound care. This integrated support system reduces his anxiety, ensures his wife gets excellent care, and makes the recovery process smoother for everyone. It transforms caregiving from a solo burden into a true team effort.

Taking the Next Step: Key New Jersey Resources

You've done the hard part—you've started to understand the ins and outs of Medicaid Managed Long Term Care. But turning that knowledge into real, tangible help for your loved one is what counts. Getting there means taking clear, direct action, from filling out the right forms to finding a care partner you can trust.

Your immediate goal is twofold: get the official application process started with the right county agencies, and then find a care provider who can bring that approved plan to life in your loved one’s home.

Making the First Move

The journey always begins with the official application. In New Jersey, this means connecting with two different county-level agencies that handle the two sides of MLTSS eligibility: the clinical side and the financial side.

-

Your Local ADRC: This is your starting line. The Aging and Disability Resource Connection (also known as the Area Agency on Aging) is where you'll get information and schedule the required in-person clinical assessment. You can easily find your local office through the state directory.

-

Your County Board of Social Services: This is the office that handles the financial piece of the puzzle. For those in Mercer County, for example, the Mercer County Board of Social Services will review all income and asset documentation to determine if your loved one qualifies for Medicaid.

It's true that navigating these systems can feel overwhelming at times. The key is persistence. These agencies are the gatekeepers to the care your family needs, so starting that conversation is a step you can't skip.

The funding behind these programs is massive for a reason. Medicaid plays a huge role in long-term care across the country, covering costs for nearly two out of every three nursing home residents and countless more receiving care at home.

In 2021, total U.S. spending on long-term care services hit $467 billion, and a staggering 71% of that was paid for by public programs like Medicaid. Accessing these benefits is absolutely essential for New Jersey families facing these challenges.

You Don't Have to Go It Alone

While the county agencies determine eligibility, you need an expert on your side to help you prepare for what comes next. This is where a dedicated care partner like NJ Caregiving can make all the difference.

We help families like yours translate an approved Medicaid Managed Long Term Care plan into a real-world, personalized in-home support system.

A simple consultation can help you sort through your options, get ready for the assessments, and build a concrete plan for compassionate, professional care at home. Don't try to manage this complex process by yourself. Reach out and let a trusted partner guide you every step of the way.

Frequently Asked Questions About MLTC in New Jersey

Diving into Managed Long Term Care can bring up a lot of "what if" scenarios. Families naturally want to know how this all works in the real world. Let’s tackle some of the most common questions we hear from families just like yours across New Jersey.

Can I Keep My Own Doctor if I Enroll in an MLTC Plan?

For the most part, yes. MLTC plans work with a network of approved doctors, specialists, and other healthcare providers. The key is to check if your current doctors are part of their network before you choose a plan.

If they are, great! You can keep seeing them without a hitch. If they aren't, you might need to find a new primary doctor from the plan's list. Remember, the whole point of managed care is coordination, so having providers who are already connected within the network makes everything run much more smoothly.

What Happens if My Care Needs Change Over Time?

This is where the managed care model really shines. Your MLTC plan assigns a dedicated care manager who becomes your go-to person and advocate. They’ll perform regular check-ins and assessments to keep a close eye on your loved one’s health.

If things change—maybe after a hospital stay or as a condition gets more complex—that care manager is on it. They are responsible for updating the care plan, working directly with you and the medical team to adjust services. This ensures the support your loved one receives always matches what they need right now.

A key feature of medicaid managed long term care is its dynamic nature. The care plan is not a static document; it’s a living blueprint designed to adapt and evolve right alongside your loved one's health journey, ensuring they always have the right level of support.

This hands-on approach is designed to prevent crises before they happen, keeping care consistent and appropriate.

Is There a Cost to Me for MLTC Services?

If you or your loved one meet New Jersey Medicaid's financial rules, you generally have no out-of-pocket costs for the long-term care services covered by the MLTC plan. That means no premiums or co-pays for any of the approved services.

All the medically necessary support laid out in the care plan is fully covered. This typically includes things like:

- In-home personal care from a home health aide

- Skilled nursing visits

- Physical and occupational therapies

- Respite care for family caregivers

While the long-term care is covered, it's good to know you might still have small co-pays for some prescription drugs, which depends on your specific Medicaid eligibility.

How Long Does the MLTC Enrollment Process Take?

The timeline can definitely vary. The biggest steps are getting the financial application approved by the County Board of Social Services and having the clinical assessment done by the ADRC.

All in all, the entire process—from submitting that first application to being fully enrolled with a Managed Care Organization (MCO)—usually takes somewhere between 45 to 90 days. A great tip to speed things up is to gather all the required financial and medical documents before you even start. Having an experienced partner guide you through the paperwork can also help you sidestep common delays.

Understanding your options is the first step toward securing the best care for your loved one. If you have more questions or need help navigating the process, NJ Caregiving is here to guide you. Contact us today to learn how we can support your family's in-home care needs in New Jersey. Find out more at https://njcaregiving.com.