Yes, Medicare absolutely covers home health care—but it's not the open-ended benefit many families assume it is. It's a common point of confusion, so let's clear it up right away. This benefit is specifically designed for short-term, skilled medical care you receive at home while recovering from an illness, injury, or surgery. It's not a long-term solution for daily help.

Yes, Medicare Covers Home Health Care Under Specific Rules

When you or a loved one needs care at home, figuring out what insurance will pay for is often the first, and most stressful, step. The good news is that Original Medicare (both Part A and Part B) includes a solid home health benefit.

The biggest hurdle for families is understanding the line Medicare draws in the sand: it covers skilled medical care but generally does not cover non-medical custodial care (like help with bathing, dressing, and meals on its own).

Think of it this way: Medicare home health is like having a hospital's rehabilitation team come to your house for a limited time. Their goal is treatment and recovery. It’s not set up to provide around-the-clock assistance or help with daily chores.

For a great primer on the basics, the Medicare Cheat Sheet is a helpful resource to get your bearings.

Key Coverage Details at a Glance

To get these benefits, you have to meet several strict requirements all at once. It’s not enough to just have a doctor recommend it; the situation has to fit Medicare's specific definition of need. We dive deep into the fine print in our guide on Medicare home health requirements.

Just how important is this benefit? Medicare is a massive payer for these services, covering about 42% of all home health visits in the U.S. This isn't surprising when you consider that 86% of home health patients are age 65 or older.

To make things simpler, here’s a quick table summarizing what Medicare’s home health benefit looks like in practice.

Medicare Home Health Coverage at a Glance

| Coverage Aspect | What It Means for You |

|---|---|

| Eligibility | You must be under a doctor's care, need skilled services, and be certified as "homebound." |

| Covered Services | Includes part-time skilled nursing, physical therapy, occupational therapy, and speech therapy. |

| Home Health Aides | Covered for personal care (like bathing) only if you're also getting skilled nursing or therapy. |

| Costs for Services | You pay $0 for covered home health care services from a Medicare-certified agency. |

| Equipment Costs | You pay a 20% coinsurance for any durable medical equipment (DME), like walkers or hospital beds. |

This table provides a high-level overview, but as you can see, the details matter—especially when it comes to qualifying and understanding what you might pay out-of-pocket for equipment.

Understanding Which Home Health Services Are Covered

When a doctor recommends care at home, it's easy to get your hopes up, but it's vital to know exactly what medical services Medicare will and won't pay for. The entire benefit hinges on one key phrase: intermittent skilled care. This isn't a round-the-clock caregiver service; think of it instead as specific, part-time medical support ordered by your doctor to help you recover from an illness or injury.

It’s like having a specialist make a house call. A skilled nurse might visit a few times a week to change a complex surgical dressing, manage IV medications, or keep a close eye on a condition like congestive heart failure. Their work is purely medical and requires professional training.

Skilled Therapies for Recovery

Beyond nursing, Medicare covers therapies designed to get you back on your feet and restore your independence. These services are the backbone of recovery after a serious health event like a stroke, a bad fall, or joint replacement surgery.

The main therapies covered are:

- Physical Therapy (PT): This is all about restoring movement, building strength, and improving balance. A physical therapist might come to your home to guide you through exercises so you can walk safely again after a hip operation.

- Speech-Language Pathology Services: These services help with communication and swallowing problems. After a stroke, a speech therapist can be crucial for helping you regain the ability to speak clearly or swallow food safely.

- Occupational Therapy (OT): OT focuses on helping you manage essential daily activities—things like bathing, getting dressed, or preparing a simple meal. But there’s a catch: Medicare only covers OT if you also need and qualify for skilled nursing, PT, or speech therapy.

Key Takeaway: Medicare’s home health benefit is built for medical recovery, not for general help around the house. The services have to be skilled, medically necessary, and part of a formal plan of care from your doctor.

The Role of Home Health Aides

This is where a lot of families get tripped up. Will Medicare pay for a home health aide to help with personal tasks like bathing or dressing? The answer is a qualified yes, but only in very specific situations.

A home health aide can provide hands-on personal care, but only if you are also receiving skilled care from a nurse or therapist. The aide’s job is to support the primary medical care you're already getting; their services can't be the only reason for home health care. For a deeper dive, you can find a great breakdown explaining when Medicare will pay for a home health aide.

For example, if a nurse is visiting three times a week to manage your wound care, Medicare might also cover an aide for a limited time to help you bathe safely. But if you only need help with bathing and have no other skilled medical needs, Medicare will not cover it.

How to Qualify for Medicare Home Health Benefits

Getting Medicare to cover home health services isn't a given. It's more like a checklist where every single box has to be ticked. If even one requirement is missed, coverage can be denied, which is why it’s so important for families to understand the rules of the game.

First off, everything starts with a doctor. You must be under a physician's care, and the services you receive have to be part of an official plan of care. This isn't just a casual suggestion—it's a formal, documented treatment plan that your doctor sets up and reviews regularly.

On top of that, your doctor has to certify that you medically require at least one skilled service. This could be intermittent skilled nursing, physical therapy, or speech-language pathology. This is the clinical foundation for your entire eligibility.

The Doctor’s Role and Face-to-Face Encounter

Before care can even begin, Medicare insists on a documented face-to-face meeting with a physician or another approved provider, like a nurse practitioner. This appointment must be directly related to the main reason you need home health care in the first place.

The timing is specific: this encounter has to happen either within the 90 days before you start home health care or within the 30 days after your care begins. The whole point is to make sure a qualified medical professional has personally assessed your condition and agrees that in-home services are medically necessary.

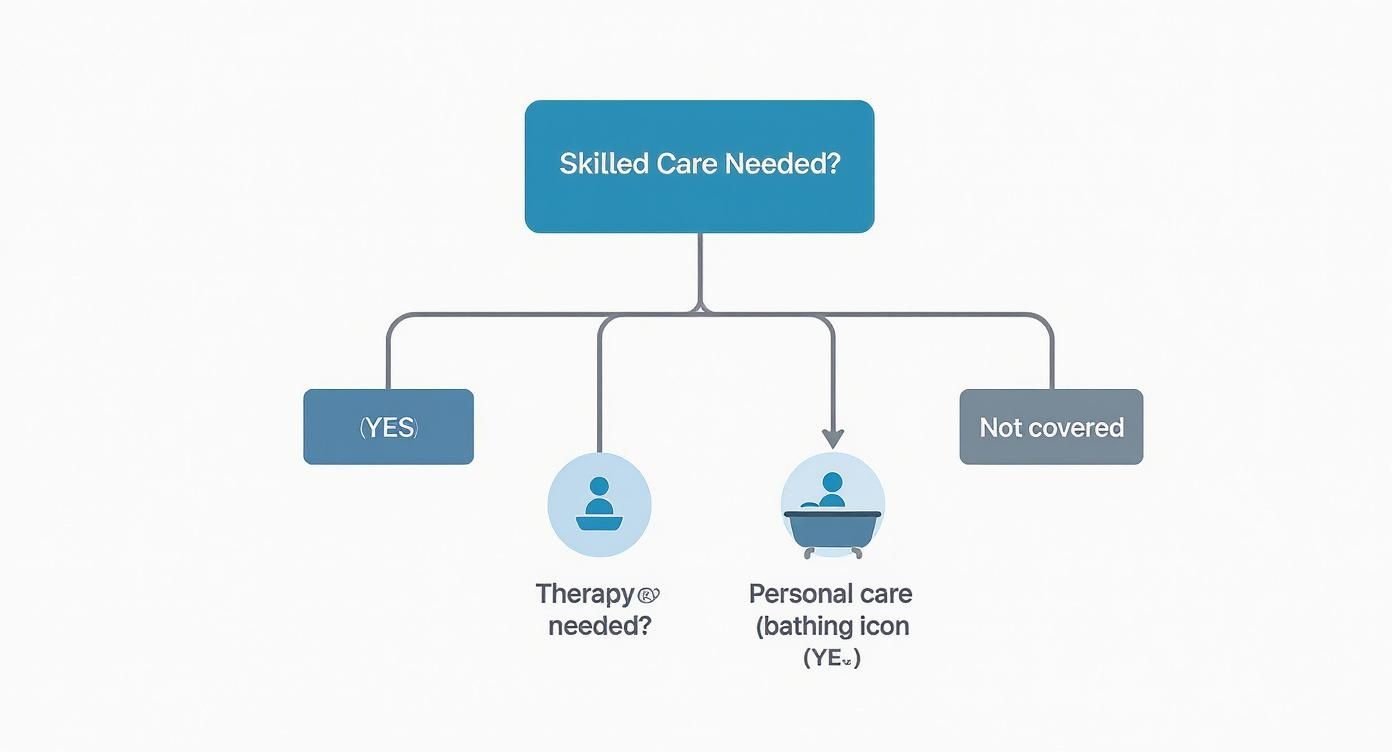

This visual really helps clarify how the need for skilled care acts as the gateway for all other covered services.

As the flowchart shows, services like personal care are only covered as a downstream benefit—after a primary need for skilled nursing or therapy is established.

What Does Being Homebound Actually Mean?

The term "homebound" is probably one of the most misunderstood parts of the process. It doesn't mean you're bedridden or can never, ever leave your house.

You are considered homebound if leaving your home requires a considerable and taxing effort. This could be due to an illness or injury where you need the help of another person or medical equipment like a walker or wheelchair.

You can still get out for medical appointments, religious services, or even a trip to the barber. But if your condition makes leaving home a major physical ordeal, you'll likely meet the criteria.

This requirement is particularly relevant for people with conditions like dementia. For instance, a multi-year analysis of 13.6 million beneficiaries found that 27.7% of those using home health had a dementia diagnosis. Many of them started care while living in the community, showing how conditions that make leaving home difficult can trigger these benefits. You can find the full study on dementia and home health care trends from JAMA Network Open.

Understanding how these rules apply is crucial, and you can learn more about how Medicare covers home health care for dementia in our detailed guide.

Finally, there’s one last piece to the puzzle: the care must be provided by a Medicare-certified home health agency. Your doctor or a hospital discharge planner can help you find a certified agency in your area, including those serving Mercer County and Princeton.

Navigating Home Health Costs and Payments

When families start looking into whether Medicare covers home health, one of the most welcome surprises is the cost. For nearly all approved services, your out-of-pocket expense is zero. That’s a huge relief when you’re already navigating a challenging recovery.

If you’re receiving care from a Medicare-certified home health agency, Medicare foots the entire bill for all approved skilled services. That means you pay $0 for skilled nursing visits, physical and occupational therapy, speech-language pathology, and even visits from a home health aide. There are no deductibles or copayments to worry about for these core services.

The Exception: Durable Medical Equipment

There is one important exception to that $0 cost rule: durable medical equipment (DME). If your doctor orders specific medical equipment for you to use at home as part of your care, you will be responsible for a part of the cost.

This equipment isn't about therapy itself, but the tools you need to stay safe and recover at home. Think of items like:

- Walkers or wheelchairs

- Hospital beds

- Oxygen equipment

- Patient lifts

For these items, you’ll typically pay 20% of the Medicare-approved amount after you’ve met your annual Part B deductible. The home health agency or a separate DME supplier handles the billing with Medicare, and you’ll get a bill for your coinsurance share. It’s always smart to double-check that both your home health agency and the equipment supplier accept Medicare assignment to avoid any surprise charges.

How Payments Work Behind the Scenes

It can also be helpful to understand how Medicare pays the agencies providing your care. It helps explain why your care is structured the way it is. Medicare uses a model called the Home Health Prospective Payment System (PPS), which pays agencies in 30-day blocks of care. You’ll often hear these called "payment episodes."

This bundled payment model isn't about paying for an endless string of individual visits. Instead, it encourages agencies to provide efficient, goal-oriented care designed to help you meet specific recovery milestones within that 30-day window.

This is a system backed by a major financial commitment from Medicare. In a recent year, Medicare spent around $15.7 billion on home health services nationwide. Payments to agencies are projected to go up by another 0.5% next year—about $85 million—which really shows how important this kind of in-home care has become. You can dig into the details on these payment updates in this fact sheet from CMS.gov.

Ultimately, this payment structure ensures your plan of care is regularly reviewed and updated to fit your needs, all while keeping your direct costs for skilled services at zero.

Comparing Original Medicare vs. Medicare Advantage for Home Care

How you get your home health benefits depends entirely on which Medicare path you've chosen. While both Original Medicare and private Medicare Advantage (MA) plans are required by law to cover the same essential home health services, the way you actually access that care can feel worlds apart.

Think of it like two different roads leading to the same destination. Original Medicare is the public highway—direct and straightforward. Medicare Advantage is more like a private toll road with its own specific rules, exits, and on-ramps.

With Original Medicare, you have the freedom to choose any Medicare-certified home health agency that serves your neighborhood. As long as your doctor confirms you need the care and you meet the basic eligibility rules, you can get started without asking Medicare for permission. It's a direct approach that gives you maximum flexibility and choice.

Key Differences in How Plans Operate

Medicare Advantage plans, which now cover more than half of all people on Medicare, operate a lot more like a typical HMO or PPO health plan. This introduces a few extra steps and potential limitations you need to be aware of to avoid surprise bills or delays.

The two biggest differences really come down to:

- Provider Networks: MA plans contract with a specific network of home health agencies. To get your care covered, you have to use an agency that's in-network with your plan.

- Prior Authorization: This is a big one. Most MA plans require prior authorization before you can start receiving home health services. This means the insurance company must review your case and formally approve the care as medically necessary before the agency can send a nurse or therapist to your home. This approval process can sometimes slow things down right when you need help the most.

Important Note: While more people on Medicare Advantage plans are using home health care these days, studies have shown that they often receive care for a shorter period of time. The number of visits tends to be lower compared to those on Original Medicare, which is likely a result of the cost-management strategies used by private insurance companies.

Home Health Coverage Original Medicare vs Medicare Advantage

To make it even clearer, let's put the two side-by-side. Understanding these differences is crucial when you’re planning for or in immediate need of care at home.

| Feature | Original Medicare | Medicare Advantage |

|---|---|---|

| Provider Choice | You can use any Medicare-certified agency that serves your area. | You must use a home health agency that is in your plan's network. |

| Referrals | No referral needed beyond your doctor's official order and care plan. | A referral from your primary care doctor might be required. |

| Approval Process | Care begins once your doctor certifies it and you meet the eligibility rules. | Prior authorization from the plan is nearly always required before care can start. |

| Potential Costs | $0 for covered home health services. 20% coinsurance for medical equipment. | Copayments or coinsurance may apply. Costs for medical equipment can also vary. |

Ultimately, there’s no single "best" choice; it's about what works for your health needs and financial situation. Knowing how each system works empowers you to navigate it successfully.

For those looking into other long-term care solutions, it's also helpful to see how Medicaid coverage for assisted living is different from Medicare’s focus on short-term, skilled home health. While Medicare is your health insurance, Medicaid is a needs-based program that may cover certain long-term custodial care that Medicare simply doesn't.

How to Find a Home Health Agency and Get Started

Knowing you qualify for Medicare-covered home health is a huge step, but what comes next? You have to find the right agency to provide that care.

Often, this process kicks off during a hospital stay. A discharge planner or case manager will be your main point person, helping coordinate everything needed for a smooth transition back home.

But what if you aren't in the hospital? If you’re at home and your health is declining, your primary doctor is where you start. They’re the one who must officially certify your need for care and create your plan. Be open with them about the challenges you're facing at home so they can make the right referral.

Using Medicare's Care Compare Tool

One of the best resources you have is Medicare's official Care Compare website. This is a powerful, free tool that lets you search for and evaluate Medicare-certified home health agencies in your area, including right here in Mercer County and Princeton.

Think of it as a Yelp specifically for healthcare providers. You can see crucial information at a glance, which helps you make an informed choice instead of just going with the first name you're given.

When you're on the Care Compare site, pay close attention to the star ratings. These are based on real patient survey results and quality data, giving you a quick snapshot of an agency's performance and how satisfied other families were with their care.

Key Questions to Ask Potential Agencies

Once you have a shortlist of agencies, it's time to interview them. Don't be shy about asking direct questions to make sure they're the right fit for your family. Having a checklist ready can make this process feel much more manageable.

Consider asking things like:

- Licensing and Certification: Are you certified by Medicare and licensed by the state of New Jersey?

- Staffing: How do you screen your caregivers and nurses? What kind of training and supervision do they get?

- Plan of Care: How will you work with my doctor to develop and update my personalized plan of care?

- Communication: Who is my main point of contact? How can I reach them after hours or on weekends if something comes up?

Choosing an agency is a big decision. By using tools like Care Compare and asking the right questions, you can feel confident that you’re picking a partner who will deliver excellent, reliable care.

Answering Your Medicare Home Health Questions

Even when you have a good handle on the basics, real-life situations always bring up more questions. Let's tackle some of the most common ones we hear from families trying to figure out the Medicare home health benefit.

How Long Does Medicare Home Health Care Last?

This is a big one, and the answer isn't a simple number of weeks or months. There's actually no hard-and-fast limit.

Instead, Medicare structures the benefit around 60-day certification periods. As long as you still meet the core requirements—being homebound and needing skilled care—your doctor can simply recertify your plan of care for another 60 days. This can continue as long as the need exists. The key thing to remember is that coverage ends when your condition has stabilized and you no longer need a skilled nurse or therapist to improve or maintain your health.

Will Medicare Cover 24-Hour Care at Home?

No, and this is probably the most critical point of confusion for families. Medicare does not cover 24-hour-a-day care. The benefit is strictly for intermittent or part-time skilled services.

Think of it this way: Medicare is designed for medical recovery, not for long-term custodial support. It won’t pay for someone to be there around-the-clock just for supervision or to help with daily tasks like meals and bathing if that’s the only care you need.

For that kind of continuous support, families typically need to look at private-pay services or see if they qualify for other programs, like Medicaid.

Do I Get to Choose My Own Home Health Agency?

Your power to choose really depends on the type of Medicare plan you have.

If you're on Original Medicare, you absolutely have the right to pick any Medicare-certified home health agency that serves your area. Your doctor might suggest an agency they trust, but the final choice is always yours.

It's a different story if you're enrolled in a Medicare Advantage plan. With these plans, you'll almost always have to stick to an agency within your plan's approved network to make sure the services are covered. Going "out-of-network" could leave you with some significant out-of-pocket bills.

Trying to piece all this together can feel overwhelming, but you're not in it alone. If you've discovered that your loved one in Mercer County needs more hands-on help than Medicare provides, NJ Caregiving is here to fill in the gaps. Visit us at https://njcaregiving.com to see how our compassionate personal care and nursing services can bring you peace of mind.