Let's be honest, talking about a time when you might not be able to fully care for yourself isn't exactly a fun conversation. But putting it off is a far bigger risk. Long-term care planning is really just about creating a roadmap for your future—thinking through your health, personal, and financial needs down the line.

It's about making decisions now about the kind of care you’d want, and just as importantly, how you'd pay for it. Getting ahead of this ensures your wishes are respected and takes a massive weight off your family’s shoulders.

Why Long Term Care Planning Matters Now

Many people think this is something only for the elderly, but that's a dangerous misconception. A sudden illness or an unexpected accident can create a need for long-term care at any age. At its core, planning is about keeping control over your life, no matter what health challenges pop up.

Think of it like this: you wouldn't start a cross-country road trip without a map, a budget, or a rough idea of where you'll sleep at night. If you did, every flat tire or detour would become a stressful, chaotic mess. Without a long-term care plan, families are thrown into that exact situation—forced to make emotional, costly decisions in the middle of a crisis. That kind of pressure can strain even the strongest relationships and bank accounts.

The Realities of Needing Care

The truth is, needing long-term care is more common than most of us think. As we all live longer, the odds of developing a chronic condition that requires some help just go up. This isn’t a small trend; it's a major shift happening worldwide.

The global long-term care market is expected to grow from USD 1.27 trillion in 2025 to a staggering USD 1.76 trillion by 2032. That huge number reflects the growing number of families who will be facing these challenges and costs. You can dig into the specifics of these trends in this detailed report from Coherent Market Insights.

A well-structured plan is the ultimate act of empowerment. It provides a clear blueprint for your care, protects your hard-earned assets, and gives your loved ones the gift of peace of mind.

Taking Control of Your Future

Starting your long-term care planning while you're healthy and clear-headed puts you in the driver's seat. It's your chance to answer the big questions that will define your quality of life later on.

- Where do you want to receive care? Most people say they'd prefer to stay in their own home. Looking into the benefits of aging in place can help you decide if that’s the right path for you.

- Who do you want making decisions for you? You can legally name the people you trust to handle your healthcare and finances if you ever can't.

- How will you cover the costs? A good plan explores all the angles—insurance, personal savings, government programs—before you're in a pinch.

Ultimately, this preparation turns a giant, scary "what if" into a structured, manageable process. It makes sure your future is guided by your choices, not by chance.

Assessing Your Future Care Needs and Options

Solid long term care planning always begins with an honest self-assessment. Think of it like a doctor reviewing your medical history before making a diagnosis—you have to understand your own situation to anticipate what kind of support you might need down the line. This isn’t about gazing into a crystal ball; it's about making smart, educated guesses based on the facts you have right now.

Start by considering your family’s health history. Do chronic conditions like heart disease or dementia run in your family? What about your own current health and lifestyle? These are the clues that can help you paint a clearer picture of the level of care you might need someday. It helps turn a vague "what if?" into a more practical "what kind of care?"

Exploring the Landscape of Care

Once you have a better idea of your potential needs, it’s time to explore the different places where that care can be provided. Each option offers a unique mix of independence, social life, and medical support. It helps to think of it less as a list of facilities and more as a spectrum of lifestyles.

The choices can feel a bit overwhelming at first, but they generally fall into a few key categories, each designed for different needs and preferences.

Understanding the Key Differences in Care Levels

Making the right choice really boils down to an individual's specific needs, especially their ability to manage Activities of Daily Living (ADLs). These are the fundamental, everyday self-care tasks like bathing, dressing, eating, and getting around. How well a person can handle these tasks is often the single most important factor in figuring out the right level of care.

To really get a handle on this critical concept, you can learn more about what Activities of Daily Living are in our detailed guide.

Looking at ADLs helps you match personal needs with the right environment. For instance, someone who just needs a hand with meals and medication reminders might do great in an assisted living community. On the other hand, a person who needs significant help with mobility and personal hygiene might be better suited for a skilled nursing facility or intensive in-home care.

A critical part of long-term care planning is visualizing yourself or your loved one in these different settings. It's about finding an environment that not only meets physical needs but also supports emotional well-being and personal dignity.

We've put together a table to help you compare the most common long-term care options at a glance. It breaks down what each one offers, what it typically costs, and who it's best suited for.

Comparing Long Term Care Service Options

| Type of Care | Common Services Provided | Typical Environment | Best For Individuals Who… |

|---|---|---|---|

| In-Home Care | Companionship, meal prep, housekeeping, personal care, skilled nursing visits | In the individual's own home or a family member's home | Want to remain in a familiar setting and need flexible, customized support. |

| Assisted Living | Help with ADLs, medication management, meals, social and recreational activities | Residential community with private or semi-private apartments | Are mostly independent but need some daily support and want a social environment. |

| Skilled Nursing Facility | 24/7 medical care, rehabilitation services, memory care, extensive personal care | Clinical, hospital-like setting with professional medical staff | Have complex medical needs or significant cognitive decline requiring round-the-clock supervision. |

| Continuing Care Community | A full continuum of care from independent living to skilled nursing on one campus | A large campus with various housing types and levels of care | Want to plan for the future and "age in place" without having to move as their needs change. |

This comparison should give you a clearer starting point. Each path has its own benefits, and the best one depends entirely on the person's health, finances, and personal wishes.

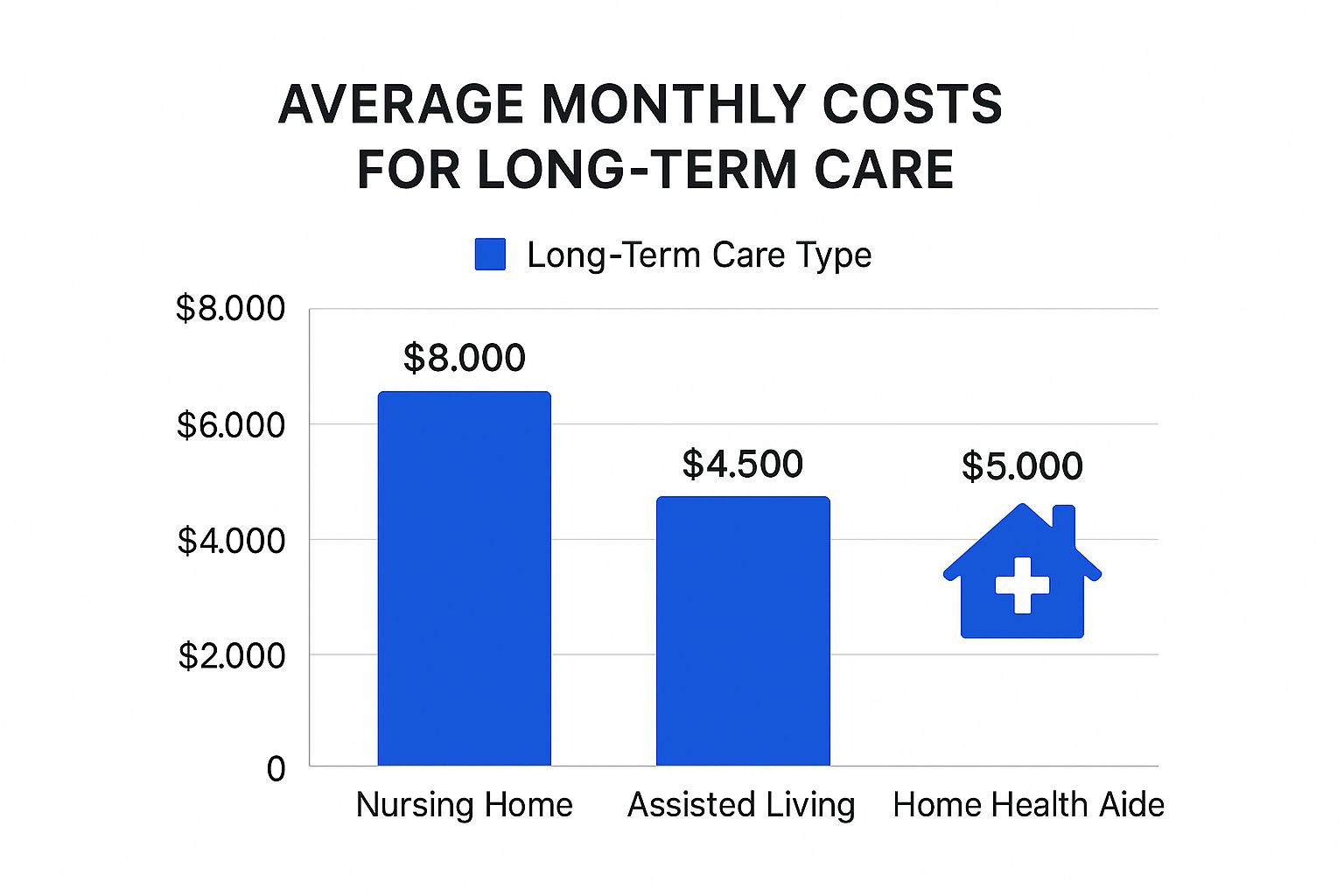

Of course, the financial piece of this puzzle is huge. The infographic below gives you a real-world snapshot of the average monthly costs for different types of long-term care.

As you can see, while nursing homes provide the most intensive care, they also come with the highest price tag. Home care and assisted living offer different cost structures for varying levels of support.

This growing need for care isn't just a personal issue—it's a global trend. The long-term care market hit about USD 1.39 trillion in 2024 and is expected to reach USD 2.48 trillion by 2033, all thanks to our aging population. It’s a clear sign that planning ahead has never been more important.

How to Fund Your Long Term Care

Talking about how to pay for long-term care can feel a little uncomfortable. But facing it head-on is one of the smartest things you can do for your financial future. It’s no different than planning for retirement or a child’s college education—it just requires a clear strategy and an honest look at the tools available.

When you tackle the financial side of long term care planning, you take back control. It ensures a health crisis doesn’t automatically spiral into a financial one. Let's walk through the main ways families in New Jersey fund these essential services.

Paying from Personal Resources

The most direct way to cover long-term care is by using your own money. This is often called private pay or self-funding, and it means drawing from personal savings, retirement funds like a 401(k) or IRA, and other investments you've built over the years.

This route gives you the most freedom and choice, hands down. When you pay out-of-pocket, you have total say over the type of care, the provider you choose, and where you receive it. The big catch? With the high cost of care, even a healthy nest egg can disappear much faster than you’d think.

Exploring Long Term Care Insurance

A more structured game plan involves Long-Term Care Insurance (LTCI). This is a special type of policy built specifically to cover services that your regular health insurance or Medicare won't touch.

Think of it like car insurance. You pay premiums over time so that if you have a fender bender—or in this case, need ongoing care—the policy is there to handle the major expenses. It’s a powerful tool for protecting your hard-earned assets.

A well-chosen long-term care insurance policy acts as a protective shield for your assets, ensuring that the cost of care doesn't force you to sell your home or liquidate your retirement savings.

When you’re looking at policies, you have to dig into the details. The key things to check are:

- Daily or Monthly Benefit Amount: The maximum amount the policy will pay each day or month.

- Benefit Period: The total length of time the policy will pay out, which could be a few years or even a lifetime.

- Elimination Period: This is basically the policy's deductible. It's the number of days you must pay for care yourself before the insurance starts paying.

It’s also crucial to see how a policy works in different settings. If you’re hoping to age in place, you can explore the specifics of using long-term care insurance for home care to make sure it aligns with your goals.

Understanding Government Programs

For a lot of families, government programs end up being a critical piece of the financial puzzle. But it's vital to know which program does what, because some common mix-ups can lead to very expensive mistakes.

The Limited Role of Medicare

Let's get this straight right away: Medicare is not a long-term care solution. This is one of the biggest and most costly misunderstandings in care planning.

Medicare might cover short-term, skilled nursing care for up to 100 days after a qualifying hospital stay, like for rehab after surgery. What it doesn't cover is the ongoing custodial care—the help with daily activities like bathing, dressing, and eating—that most people need.

Medicaid as a Financial Safety Net

Medicaid, on the other hand, is the nation's primary government payer for long-term care. Unlike Medicare, this is a needs-based program created for people with limited income and assets.

Qualifying means meeting some pretty strict financial rules. This often involves a process called "spending down," where a person has to use their own money to pay for care until their assets fall below their state's Medicaid threshold.

A critical rule to know about is the "five-year look-back period." When you apply for Medicaid, the state will comb through your financial records for the last five years. Any money or assets you gifted or transferred for less than their value during that time can trigger a penalty, delaying your eligibility for benefits. This rule exists to stop people from simply giving their assets away to qualify.

Navigating these complex rules is what effective long term care planning is all about. Working with an elder law attorney is often the best move to create a strategy that works with Medicaid's requirements while still protecting your family's financial future.

Getting Your Legal House in Order

A detailed financial strategy is only one piece of a solid long term care plan. The other, equally critical piece is the legal framework that protects you, your assets, and your wishes when you can't speak for yourself.

Without these legal documents, even the most well-funded plan can hit a wall, leaving your family trying to make impossible decisions under immense stress.

Think of it this way: your financial plan is the car's engine, but the legal documents are the steering wheel and the brakes. They give you and the people you trust the ability to navigate your plan and react to whatever life throws your way. These documents aren't just suggestions; they are legally binding instructions that make sure your choices are honored.

Who Will Make Decisions for You?

One of the first and most important steps is legally appointing people you trust to act on your behalf. This isn't a single role but two distinct ones that require separate legal documents. Getting this wrong can leave huge gaps in your plan.

- Durable Power of Attorney for Finances: This document gives someone you choose the authority to manage your financial life. This person, your "agent," can step in to pay bills, handle investments, or manage property if you become unable to do so.

- Healthcare Power of Attorney: Sometimes called a healthcare proxy, this document empowers a different agent to make medical decisions for you. They can talk to doctors, approve treatments, and access your records, ensuring your care aligns with what you would have wanted.

It's vital to have both. A financial agent can't make medical decisions, and a healthcare agent can't get into your bank accounts. Keeping these roles separate ensures the right person is handling the right responsibilities.

Stating Your Medical Wishes Ahead of Time

Beyond just picking your decision-makers, you can also give direct instructions about your medical care. This takes the awful burden of guessing off your loved ones' shoulders during an already emotional time and keeps you in control of your end-of-life care.

A Living Will is a legal document that clearly states the kinds of medical treatments you would or would not want if you are terminally ill or permanently unconscious. This often includes instructions on things like life support or feeding tubes. An Advance Directive is a broader term that frequently combines a Living Will and a Healthcare Power of Attorney into a single, comprehensive document.

These documents are your voice when you can no longer speak for yourself. They provide clear, legally enforceable instructions that guide your family and medical team, preventing confusion and potential conflict.

Using Legal Tools to Protect Your Assets

A smart long term care plan also involves legally shielding the assets you've worked your entire life to build. While savings and insurance are key, legal structures like trusts can add a powerful layer of security, especially if you think you might need Medicaid down the road.

Think of an Irrevocable Trust as a secure vault for your assets. Once you place things like your home or investments into this trust, they are no longer legally yours. You give up direct control, but in return, those assets are protected from creditors. And, after the five-year Medicaid look-back period, they won't be counted when determining your eligibility for benefits. This strategy can help you qualify for assistance without being forced to spend down your entire nest egg.

Having the right legal documents in place is non-negotiable for a complete long-term care plan. The table below summarizes the key players and their roles.

Essential Legal Documents for Your Plan

| Legal Document | Primary Purpose | Key Decisions It Governs |

|---|---|---|

| Durable Power of Attorney | To appoint someone to manage your finances. | Banking, real estate, investments, bill payments. |

| Healthcare Power of Attorney | To appoint someone to make medical decisions. | Medical treatments, choice of doctors, care facilities. |

| Living Will | To state your end-of-life treatment wishes. | Use of life support, feeding tubes, resuscitation. |

| Irrevocable Trust | To protect assets for Medicaid eligibility. | Transferring ownership of assets to a legal entity. |

Because these legal tools have major, long-lasting consequences, it is absolutely essential to work with an experienced elder law attorney. They can help you draft documents that are valid in New Jersey and build a legal strategy that lines up perfectly with your financial plan and your personal goals.

Building Your Long Term Care Planning Checklist

Talking about long term care planning is one thing, but turning those ideas into action can feel like the hardest part. Let’s break it down. This practical checklist turns what feels like a monumental task into a clear, manageable roadmap for you and your family.

Think of each step as a milestone on the path to a secure future. By tackling them one by one, you’ll build momentum and gain clarity, making sure every angle of your plan is thoughtfully covered.

Starting the Conversation and Assessing Needs

Before you even touch a financial statement or legal document, you have to get everyone on the same page. The foundation of any solid plan is open, honest communication.

- Initiate the Family Discussion: Find a relaxed, pressure-free time to talk with your spouse, kids, or other trusted relatives about your wishes. It helps to frame this as a positive step—a way to protect the family, not a morbid conversation about worst-case scenarios.

- Conduct a Personal Health Audit: Take an honest look at your current health, your lifestyle, and your family's medical history. This isn't about being negative; it's about being realistic. This assessment will help you anticipate the level of care you might one day need, whether it's simple in-home help or more intensive support.

Evaluating Your Financial Landscape

Once you have a sense of your potential needs, the next question is always: "How will we pay for this?" A thorough financial review is absolutely essential for making choices that are both realistic and sustainable.

A financial health check-up is not just about counting assets; it's about aligning your resources with your care preferences to create a plan that is both desirable and financially viable.

This means looking at every available resource and understanding how all the pieces of the puzzle fit together.

- Review Personal Savings and Investments: Tally up your retirement accounts, savings, and other assets. This gives you a clear picture of your capacity for private pay.

- Explore Insurance Options: Look into Long-Term Care Insurance policies. Could one of these policies help shield your hard-earned assets from the staggering costs of care?

- Understand Government Benefits: It's time to research the specific eligibility rules for Medicaid right here in New Jersey. Knowing the guidelines around income, assets, and the crucial five-year look-back period is critical if you want to plan effectively.

Assembling Your Professional Team

Here’s the good news: you don't have to figure all this out alone. In fact, you shouldn't. Building a team of experts ensures your plan is legally sound, financially optimized, and truly aligned with your personal goals.

Your advisory team should include professionals who live and breathe the complexities of aging and long-term care. An elder law attorney is vital for drafting essential documents like Powers of Attorney and specialized trusts. A financial advisor can help you structure your assets and map out a funding strategy. This kind of expert guidance gives you the confidence that your plan is built on a rock-solid foundation.

Your Long-Term Care Planning Questions, Answered

Even after mapping everything out, it's completely normal to have a few lingering questions when it comes to long-term care planning. Let's tackle some of the most common ones we hear from families, giving you the clear, straightforward answers you need to feel confident about your next steps.

When Should I Even Start Thinking About This?

This is a big one. While there isn't a magic age, the sweet spot for most people is their early to mid-50s. Why then? It’s usually when you're still in good health, which makes getting long-term care insurance much more affordable and easier to qualify for.

Starting early also gives you the incredible advantage of time—more time to save and more time to make thoughtful decisions without the stress of an immediate health crisis. But don't worry if you're past that window. It’s never truly too late to start, and there are still powerful planning options available even for those in their 60s or 70s.

I Have Medicare. Won't That Cover My Long-Term Care?

This is probably the single most dangerous—and costly—misconception out there. Let's be crystal clear: Medicare does NOT pay for long-term custodial care. That means help with daily essentials like bathing, getting dressed, or eating isn't covered.

What Medicare might cover is short-term, skilled nursing care, but only for a very limited period (up to 100 days) and only after you’ve had a qualifying hospital stay. It is absolutely not a solution for ongoing, long-term needs. This is the critical blind spot that makes proactive planning so essential. You simply cannot bank on Medicare to be your safety net here.

A lack of long term care planning is a plan to fail. It often means your life savings are depleted, your choices are limited, and your family is left to make incredibly difficult decisions during a crisis.

What's the Worst That Could Happen If I Don't Make a Plan?

Putting this off can unfortunately create a perfect storm of problems. Without a plan, you essentially give up control over your own future. Your family, who you love and want to protect, might be forced to make huge decisions for you under immense stress, which can easily lead to painful disagreements and emotional burnout.

The financial hit can be devastating, as your life savings get drained to cover the high costs of care. Your choices for where and how you receive that care shrink dramatically, often leaving you with whatever facility happens to have a Medicaid bed open. On top of all that, if you don't have legal documents like a power of attorney in place, your family could face a costly, time-consuming court battle just to get the authority to manage your affairs.

For families in Princeton and across Mercer County, you don't have to navigate these decisions alone. At NJ Caregiving, we specialize in providing compassionate, professional in-home care that honors your loved one's independence and dignity. Discover how our personalized care plans can support your family's needs at njcaregiving.com.