The short answer? Medicaid does not pay a flat dollar amount for assisted living. Instead, it’s designed to cover specific personal care and health services through state-run waiver programs. The resident almost always pays for their own room and board out of pocket.

Unpacking Medicaid Payments for Assisted Living

When families start looking into how much Medicaid will pay for assisted living, they often think it works like regular health insurance—where a procedure or a stay has a set reimbursement rate. But Medicaid’s approach is totally different. It’s built to pay for care services, not housing costs.

Think of an assisted living facility as a combination of a hotel and a healthcare provider. The "hotel" part—your actual apartment, meals, and utilities—is what’s known as room and board. Federal rules are pretty clear: Medicaid can't pay for these costs directly. That part of the bill is up to the resident, who typically uses their Social Security benefits, pensions, or other personal income to cover it.

What Medicaid Covers Versus What You Pay

The "healthcare provider" part is where Medicaid comes in. It funds the critical support services that help residents live safely and manage their health. This includes hands-on help with Activities of Daily Living (ADLs) and other medical needs. For the 18% of assisted living residents who rely on this kind of support, it’s what makes this level of care financially possible. You can read more about national assisted living statistics on AHCA.org.

So, even though the median annual cost for assisted living is around $64,200, Medicaid’s help is laser-focused on the care part of that figure. Getting your head around this distinction is the single most important step in planning for long-term care.

Medicaid Assisted Living Coverage At-a-Glance

To make this split a bit clearer, here’s a simple breakdown of who typically pays for what in an assisted living setting.

| Expense Category | Typically Covered by Medicaid? | Resident's Responsibility? |

|---|---|---|

| Personal Care (Bathing, Dressing) | Yes | No |

| Medication Management | Yes | No |

| Skilled Nursing Services | Yes | No |

| Room & Apartment Costs | No | Yes |

| Daily Meals & Dining Services | No | Yes |

| Housekeeping & Laundry | No | Yes |

| Social & Recreational Activities | No | Yes |

While this table gives you a good at-a-glance summary, the exact details can and do change from state to state. The main thing to remember is that Medicaid's financial help is all about services, not the physical living space. Understanding this from the start helps set realistic expectations for what Medicaid will cover and what you’ll still need to budget for.

Understanding How HCBS Waivers Fund Your Care

So, if Medicaid doesn't directly pay for an assisted living apartment, how does it cover the actual care you need? The answer is a powerful tool called a Home and Community-Based Services (HCBS) Waiver. Getting a handle on these waivers is the secret to understanding how much Medicaid will actually contribute to your care.

Think of an HCBS waiver like a specialized scholarship for long-term care. Instead of a single, rigid federal program, each state gets to design its own unique waivers. This allows them to meet the specific needs of different groups, like seniors, people with physical disabilities, or adults with developmental challenges.

The whole point of these waivers is to provide a smarter, more cost-effective alternative to nursing home care. States figured out long ago that it's often cheaper—and frankly, much better for a person's well-being—to deliver support services in a community setting like assisted living rather than a more expensive institution.

The Role of 1915(c) Waivers

You’ll probably hear the term 1915(c) waiver thrown around a lot. Don't let the jargon intimidate you. It's just the section of the Social Security Act that gives states the green light to create these specialized "scholarships." It allows them to "waive" certain federal Medicaid rules so they can focus services on people who would otherwise need to be in a nursing home.

For instance, a state could create a 1915(c) waiver specifically for frail elderly adults. This program would then fund a whole menu of services designed to help them live safely and independently in an assisted living community.

This is the core of what Medicaid pays for:

- Personal Care: This is the hands-on help with Activities of Daily Living (ADLs) we all need eventually—things like bathing, dressing, grooming, and eating.

- Medication Management: A critical service to make sure residents take their prescriptions correctly and on schedule.

- Skilled Nursing Services: Waivers can cover intermittent nursing care, like wound care or injections, right in the facility.

- Therapeutic Services: This could include physical, occupational, or speech therapy to help maintain mobility and function.

This a-la-carte approach lets states build a support plan around an individual's real-world needs. It ensures Medicaid funds are used efficiently, paying only for the care that’s truly necessary.

State-by-State Differences Are the Norm

This is a big one: these waiver programs are not the same everywhere. One state might have a fantastic program that serves thousands, while a neighboring state’s program could be small with a long waiting list. Because these waivers are optional for states, the differences can be dramatic.

In fact, the entire landscape of Medicaid for assisted living varies wildly across the U.S. for this very reason. Recent data shows that 41 out of 47 responding states use at least one home care program, most often a 1915(c) HCBS waiver, to cover services in assisted living.

The most important thing to remember is that your eligibility and the services you can get are completely dictated by the waiver programs in your specific state. What’s true for someone in Florida won’t necessarily apply in Ohio.

Some states even have multiple waiver programs, each for a different population. Someone in New Jersey, for example, would need to look into the specific options available in the Garden State. You can dive deeper into this by checking out our guide on the New Jersey Medicaid waiver program.

Waivers Fund Services, Not Housing

Let’s circle back to the most critical point. HCBS waivers pay for services, not the roof over your head. Even if you're approved for a comprehensive waiver that covers all your personal and medical care, you are still responsible for paying the assisted living facility's monthly room and board fee.

This payment usually comes from the resident's own income, like Social Security or a pension, and sometimes with help from family. While some states have Optional State Supplements (OSS) to help low-income residents with housing costs, that's a separate program from the HCBS waiver itself.

So, when you ask, "How much does Medicaid pay for assisted living?" the answer is always tied to the specific care services approved under your state's waiver—not the monthly rent.

Qualifying for Medicaid Assisted Living Benefits

Figuring out if you or a loved one qualifies for Medicaid to help pay for assisted living can feel like you're trying to put together a puzzle with a thousand tiny pieces. The good news is that it really boils down to two main requirements: one that looks at your finances and another that assesses your physical need for day-to-day help.

Let's break down both of these areas so you can walk into the application process feeling confident and prepared.

Think of it like getting approved for a special grant. First, you have to prove you meet the financial need. Then, you have to show that you fit the specific purpose the grant was created for—in this case, needing a certain level of hands-on assistance. You need both pieces of the puzzle to fit perfectly to get approved.

The Financial Eligibility Puzzle

Medicaid is designed to help people with limited resources, so the financial review is pretty thorough. While every state has its own specific numbers, they all look at your income and your assets.

Income Limits: This is the total amount of money you have coming in each month from sources like Social Security, pensions, or investments. For 2024, this limit often hovers around $2,829 per month for one person, but remember, that number can change depending on where you live.

Asset Limits: This covers your "countable" assets—things like the money in your bank accounts, stocks, or bonds. The limit here is usually quite low, often just $2,000 for an individual.

But here’s a crucial point: not everything you own counts against you. Medicaid has rules in place to exempt certain assets so people aren't left with nothing.

- Your Main Home: In most situations, your primary residence is exempt, especially if you plan to return or if your spouse still lives there. This protection usually applies up to a certain equity value, often over $700,000.

- One Car: Your primary vehicle typically isn't counted toward the asset limit.

- Personal Belongings: Everyday things like furniture, clothing, and household goods are exempt.

- Pre-Paid Funeral Plans: If you have an irrevocable funeral plan under a certain amount, it’s also excluded.

If you find that your finances are just a little over the limit, don't give up hope. You might be able to use a "spend down" strategy. This allows you to pay for medical care out-of-pocket until your assets fall below the required limit. To get a better handle on how this works, you can find great information on Medicaid spend-down rules in New Jersey that can help clarify the process.

The Functional Eligibility Assessment

Meeting the financial rules is only half the battle. You also have to demonstrate a clear medical need for the kind of support an assisted living facility provides. This is what's known as meeting the Nursing Home Level of Care (NHLOC) criteria.

Now, that sounds intimidating, but it doesn't mean you have to be sick enough for a nursing home. It simply means you need help with a certain number of basic daily tasks, which experts call Activities of Daily Living (ADLs).

A state-appointed clinician will visit to do a functional assessment. They'll be looking at how well you can handle these fundamental self-care tasks on your own:

- Bathing: Getting in and out of the shower or tub and washing up.

- Dressing: Being able to get your clothes on and off.

- Toileting: Getting to the bathroom and managing hygiene independently.

- Transferring: Moving from a bed to a chair or wheelchair without help.

- Continence: Having control over bladder and bowels.

- Eating: Being able to feed yourself after a meal has been prepared.

To qualify for waiver services in most states, an applicant typically needs to show they require help with at least two or three of these ADLs.

Key Takeaway: Functional eligibility is all about showing a genuine need for daily, hands-on support. The state wants to see that without the care provided in an assisted living community, your health and safety would be at risk, potentially leading to a more expensive and intensive nursing home stay down the road.

Getting through both the financial and functional sides of the application is the key to unlocking Medicaid benefits for assisted living. The more you understand where you stand on both fronts and prepare your documents, the smoother the entire process will be.

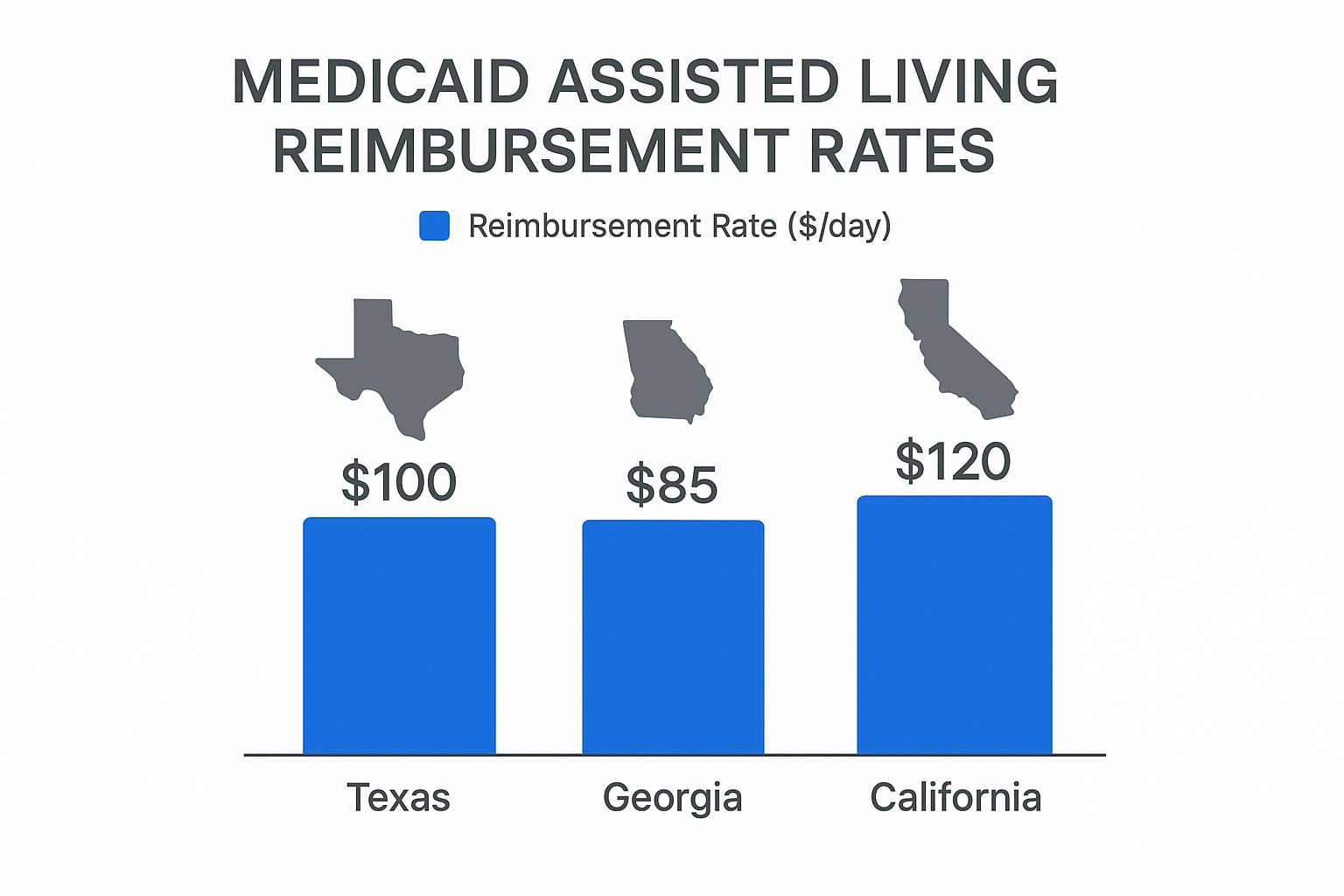

How State Programs Shape Your Coverage

Medicaid isn’t a one-size-fits-all benefit—it’s more like a patchwork quilt stitched together by the federal government and each state. What you get in covered services and daily reimbursement can shift dramatically the moment you cross state lines.

Each state decides which Home and Community-Based Services (HCBS) waiver programs to run, how many people can enroll, what income and asset limits apply, and which services make the cut. That autonomy drives the wide range of Medicaid assisted living benefits nationwide.

Take California, for example. With a higher cost of living and a booming senior population, it often offers richer waiver programs—higher payment rates and a broader service menu. In contrast, a state juggling tighter budgets may deliver a leaner package with tougher eligibility rules and multi-year waiting lists.

Comparing State Waiver Programs

Spotting these variations early helps you set realistic expectations. One state’s waiver might include specialized memory care, while another covers only basic personal assistance. That directly affects your out-of-pocket costs and the number of facilities accepting Medicaid.

- Enrollment Caps: Some programs cap the number of slots. Once full, new applicants join a waiting list that can stretch on for years.

- Income and Asset Limits: Federal guidelines exist, but states can choose higher income thresholds or more generous asset exemptions.

- Covered Services: Think beyond bathing and dressing—one state may fund transportation or adult day care, while another sticks to the essentials.

As the image shows, a Medicaid bed in California can bring in nearly 40% more per day than one in Georgia. That gap influences how many Medicaid residents a facility can serve.

A Closer Look At State Differences

Below is a side-by-side snapshot of how waiver programs can diverge from state to state. Notice both the financial thresholds and the unique services each program highlights.

Example of State Medicaid Waiver Program Variations

The table below illustrates key features of three distinct HCBS waiver programs. It’s a quick way to see how variable these benefits can be.

| State | Program Name Example | Typical Financial Limit (Example) | Unique Covered Service (Example) |

|---|---|---|---|

| California | Assisted Living Waiver (ALW) | $1,737 monthly income limit for an individual (2024) | Enhanced care for residents with dementia or cognitive impairments. |

| Texas | STAR+PLUS HCBS Waiver | $2,829 monthly income limit for an individual (2024) | Pest control and minor home modifications to ensure safety and accessibility. |

| Florida | Statewide Managed Medical Care Long-Term Care (SMMC-LTC) Program | $2,829 monthly income limit for an individual (2024) | Personal Emergency Response Systems (PERS) for immediate assistance. |

Even when dollar figures look close, the roster of covered services can steer you toward one program over another. Always review your state’s waiver manual before making arrangements.

Your Local Rules Are the Only Rules That Matter: It’s essential to research your state’s specific Medicaid agency and HCBS waiver programs. National averages and examples from other states are helpful for context, but your eligibility and benefits will be determined entirely by local regulations.

Start by contacting your state’s Medicaid office or your Area Agency on Aging. They’ll have the latest details on programs, financial requirements, and application steps so you know exactly how much Medicaid can contribute toward assisted living where you live.

Navigating the Application and Potential Waitlists

Knowing how much Medicaid might pay for assisted living is one thing, but actually getting those funds is a whole different ballgame. It requires navigating a multi-step application process that can feel more like a marathon than a sprint. This isn't just about filling out a single form; it’s a series of approvals that have to happen in the right order, and long waits are often part of the deal.

The journey doesn’t usually start with the assisted living waiver itself. First, you have to be approved for your state's general Medicaid program. Only after you’ve cleared that financial hurdle can you even be considered for the specialized waiver that covers assisted living services. For a detailed walkthrough, our guide on how to apply for Medicaid breaks down these critical first steps.

Once you have that basic Medicaid eligibility squared away, the next major phase begins: applying for the specific Home and Community-Based Services (HCBS) waiver. This involves a separate request and a detailed functional assessment to prove that you meet the "nursing home level of care" criteria we talked about earlier.

The Reality of Waiver Waitlists

Here’s where many families hit a major snag: waiver waitlists. States get a fixed amount of federal money for these programs, which means they can only approve a certain number of people. When the number of eligible applicants is greater than the available slots, a waitlist is created.

These waitlists can drag on for months or even years, depending entirely on your state and the specific waiver you're after. This is a massive factor to consider when planning for long-term care.

A waitlist exists because the demand for affordable assisted living care far outstrips the state's funded capacity. Getting on this list as early as possible is often the single most important step you can take.

Understanding why these delays happen can help set more realistic expectations. States have to manage their budgets carefully, and HCBS waivers are a significant financial commitment. Economic downturns can squeeze these resources even tighter. In fact, projections for 2025 suggest that potential Medicaid funding cuts could create serious challenges for the assisted living sector, possibly shrinking access and making these waitlists even longer.

Strategies for Managing the Wait

Being on a waitlist doesn't mean you’re out of options. A little proactive planning can make a world of difference. Here are a few effective strategies to consider while you wait for a waiver slot to open up.

- Apply Early: The moment it seems like care might be needed down the road, start the application process. The sooner your name is on the list, the shorter your wait will feel.

- Explore All Waiver Options: Some states offer more than one HCBS waiver program. You might find that one has a shorter waitlist than another, so it pays to investigate every program you might qualify for.

- Understand Prioritization: Certain states will bump applicants up the list based on the urgency of their need. If someone is at immediate risk of having to enter a nursing home, they may get priority. Check your state's policy to see how this works.

- Consider Alternative Programs: Look into non-Medicaid state assistance programs or Veterans' benefits, like Aid and Attendance, which can help shoulder care costs in the meantime.

- Stay in Touch: Once you're on a list, check in with the agency from time to time. This ensures they have your current contact information and confirms your spot is secure.

Getting through the application process and a potential waitlist takes a good deal of patience and persistence. By starting early and exploring every avenue, you can seriously improve your chances of securing the support needed to make assisted living affordable.

Your Next Steps to Secure Assisted Living Care

Figuring out how Medicaid can help with assisted living costs feels complicated, but it boils down to a partnership. Medicaid doesn't just write a check for the entire monthly bill; instead, it pays for specific care services through programs run by your state. Your success really depends on getting a handle on the rules, eligibility limits, and application process right where you live.

The road to getting approved can be a long one. It often involves digging up lots of financial paperwork, going through a health assessment, and sometimes, even sitting on a waitlist. But with the right information and a clear plan, you can tackle this with confidence. This isn't just about checking boxes—it's about taking control now to secure the best care for yourself or someone you love.

Creating Your Action Plan

The best way to feel in control is to start taking small, concrete steps today. Don't wait until you're in a crisis to figure out your options. Use this checklist to get organized and build some momentum for the journey ahead.

Here are the first things you should do:

- Contact Your Area Agency on Aging (AAA): Make this your very first call. These are local experts who offer free, unbiased advice on every senior care resource in your community. They can point you to the exact Medicaid waiver programs you need to look into.

- Gather Essential Documents: Start pulling together key financial and personal records right away. Think bank statements, proof of income (like Social Security or pension letters), information on any assets, a birth certificate, and a Social Security card. Having this file ready will make the application process so much smoother.

- Research Your State's Waiver Programs: Head straight to your state’s official Medicaid website. Look for terms like "Home and Community-Based Services" (HCBS) or "waivers." This will lead you to the exact names of the programs that help fund assisted living and spell out their specific eligibility rules.

Have More Questions About Medicaid?

When you start digging into the details of Medicaid, a lot of "what-if" questions pop up. It's completely normal. As you're planning, certain concerns almost always come to the surface. Let's tackle some of the most common ones families have when trying to figure out how Medicaid fits into an assisted living plan.

How Do I Pay for Room and Board if Medicaid Won’t?

This is easily the most frequent question we hear, and the answer is thankfully pretty straightforward. Federal rules don't allow Medicaid to pay for housing costs, so residents have to cover their room and board with other funds. For most seniors, this ends up being a predictable mix of their income sources.

The main source is almost always their Social Security retirement benefits. That monthly check typically goes right to the assisted living facility. The resident gets to keep a small amount—usually between $60 and $120—as a Personal Needs Allowance (PNA). This little bit of pocket money is for personal items like toiletries, a haircut, or a few snacks.

Other common income sources are often layered on top:

- Pensions: If there's a monthly pension, that income is also applied to the room and board fee.

- Optional State Supplements (OSS): Some states offer this extra payment to help low-income residents bridge the financial gap in assisted living.

- Family Contributions: It’s quite common for family members to chip in to cover any remaining costs each month.

The idea is to combine all these income streams to meet the facility's monthly fee for housing and meals.

Can I Keep My Home and Still Qualify for Medicaid?

Yes, in most situations, you can. This comes as a huge relief to many families who are terrified of losing their home. Medicaid rules have specific protections for a primary residence, but you do have to meet a few conditions.

The key protection is the "intent to return home" provision. If you state that you plan on returning to your home someday—even if it seems medically unlikely—the home is generally considered an exempt asset while you're alive.

There is a catch, though: a limit on your home equity. For 2024, that limit is $713,000 in most states. Some states, like California, have higher thresholds. If your home's equity is over that limit, you might not qualify unless your spouse or a dependent child is living there.

A Quick Word on Estate Recovery: It's really important to understand the Medicaid Estate Recovery Program (MERP). While your home might be safe during your lifetime, after a Medicaid recipient passes away, the state can try to recoup what it spent on your care by making a claim against your estate. And that estate often includes the home.

What if My Income Is Slightly Too High for Medicaid?

It can be incredibly frustrating to find out your monthly income is just a few dollars over the Medicaid limit. The good news is that many states have a legal tool designed for this exact problem: a Qualified Income Trust (QIT), which you might also hear called a Miller Trust.

Think of a QIT as a special-purpose bank account. If your income is over the state's limit (often $2,829 per month in 2024), you can have your income checks deposited directly into this trust. The trust then pays your share of care costs and other approved medical bills.

By funneling your income into the QIT, that money legally isn't counted as "yours" when Medicaid checks your eligibility. It's a legal workaround that allows you to qualify for benefits you'd otherwise be denied.

This option is only available in what are known as "income cap" states. If you're in this boat, the best next step is to talk with an elder law attorney. They can tell you if a Miller Trust is the right move and help you get it set up correctly.

At NJ Caregiving, we know that sorting through all these financial and legal details can feel overwhelming. Our team is here to provide the compassionate in-home care that lets your loved ones live with dignity and independence. To learn more about our services in Mercer County, visit us at https://njcaregiving.com.