On average, you can expect the home senior care cost to fall somewhere between $25 and $35 per hour. But honestly, that national average is just a starting point.

The final figure on your invoice depends entirely on the specific support your loved one needs, how many hours of care are required, and, of course, where you live.

What Is the True Cost of Aging in Place?

Thinking about the cost of in-home care is a bit like pricing out a home renovation. The final bill isn't just the cost of lumber; it’s the combination of materials, the skill level of the contractor you hire, and how big the project is.

Similarly, the "true cost" of aging in place is much more than a simple hourly rate. It’s a blend of different services, a caregiver's specific qualifications, and the intensity of support your family member actually needs. Let's break down these foundational costs to give you a clear financial picture from the get-go.

Understanding the Hourly Rate Foundation

The most common way families budget for home care is by looking at that hourly rate. It’s the basic building block for everything else. In 2025, the typical cost for in-home senior care across the U.S. lands in that $25 to $35 per hour range.

This rate gets nudged up or down by your location, the caregiver's experience, and the complexity of the tasks they'll be handling. You can learn more about how agencies calculate these rates by exploring some helpful in-home care cost breakdowns.

When you do the math, a standard 40-hour week of care could add up to $1,000 to $1,400. On an annual basis, that’s a significant investment, which is why getting your budget right from the start is so important.

Key Takeaway: The hourly rate is your starting point, not the final number. The total home senior care cost depends on how many hours you need and what kind of support is provided during those hours.

How Service Levels Impact Your Cost

It makes sense when you think about it: not all care is the same, and the price naturally reflects that. The specific services your loved one needs will directly influence the hourly rate you pay. A caregiver providing companionship and helping with meals will cost less than a certified nursing assistant (CNA) who is trained to help with bathing, dressing, and mobility.

To give you a clearer idea, let's look at how the hourly cost can change based on the level of care required.

Estimated Hourly Costs by In-Home Care Level

This table illustrates how the type of care required directly influences the hourly cost, providing families with a baseline for budgeting.

| Type of Care | Common Services Provided | Typical National Hourly Rate |

|---|---|---|

| Companion Care | Social interaction, meal prep, light housekeeping, errands | $25 – $30 |

| Personal Care | Help with bathing, dressing, grooming, and mobility (ADLs) | $28 – $33 |

| Skilled Nursing | Medication administration, wound care, medical monitoring | $50 – $100+ |

This breakdown really highlights why a detailed needs assessment is the crucial first step. When you pinpoint the exact level of support required, you can avoid paying for services you don’t need and get a much more accurate estimate of your family's financial commitment.

Ultimately, having this foundational knowledge empowers you to ask the right questions, find truly quality care, and make a plan that feels both supportive and affordable.

The Hidden Factors That Drive Your Final Bill

When you start looking into home care, you'll see agencies advertise an hourly rate. It's easy to think of that number as the final price, but it's really just the starting point. Several critical factors can shift your final bill, and knowing what they are is the key to creating a realistic budget for the true home senior care cost.

Think of it like booking a flight. You see an initial price, but that changes once you choose a window seat, check a bag, or add extra legroom. Home care is a lot like that—the base rate gets adjusted based on your loved one’s specific situation. While the level of care required is the biggest piece of the puzzle, it's far from the only one.

The Impact of Geography on Your Costs

Where you live plays a huge role in what you can expect to pay. Just like a gallon of milk costs more in a big city than in a small town, caregiving wages vary significantly from place to place. A caregiver in a high-cost area like North Jersey or San Francisco will naturally have a higher hourly rate than one in a quieter, more rural community.

These differences are tied directly to local economies, the demand for caregivers, and state minimum wage laws. That’s why national averages are a helpful guidepost, but getting quotes from local agencies is the only way to get an accurate picture. Even within New Jersey, you'll see different rates in a bustling part of Bergen County compared to a more relaxed community in Cumberland County.

Level of Care and Caregiver Expertise

The single biggest driver of your final home senior care cost is the complexity of support your loved one needs. There’s a clear difference in both the skill and the price tag between basic companionship and hands-on medical assistance.

- Companion Care: This covers things like conversation, preparing meals, and light housekeeping. It requires less specialized training, making it the most affordable type of care.

- Personal Care: This involves help with Activities of Daily Living (ADLs) like bathing, dressing, and getting to the bathroom. Caregivers, often Certified Nursing Assistants (CNAs), need specific training, which increases the hourly rate.

- Skilled Nursing Care: For medical needs like wound care, injections, or managing complicated equipment, you'll need a Licensed Practical Nurse (LPN) or a Registered Nurse (RN). This is the most expensive level of in-home care because it involves advanced medical expertise.

A caregiver's experience and certifications also factor into the cost. A professional with a decade of experience and specialized dementia training will, quite rightly, cost more than someone who is new to the field.

A common mistake families make is underestimating the level of care their loved one actually needs. A thorough needs assessment from the start is crucial to match you with a caregiver who has the right skills, preventing a costly and disruptive change down the road.

Agency vs. Independent Hire

Another fork in the road is deciding whether to hire through an agency or find a caregiver independently. Each path comes with very different financial implications. While hiring through an agency often has a higher hourly rate, that price tag covers a lot of important overhead.

Hiring Through an Agency:

- Screening and Vetting: The agency handles background checks, verifies credentials, and interviews every candidate.

- Taxes and Insurance: The agency takes care of payroll, taxes, and liability insurance, which protects your family from legal and financial headaches.

- Backup Care: If your regular caregiver gets sick or goes on vacation, the agency is responsible for sending a qualified replacement.

Hiring an Independent Caregiver:

- Lower Hourly Rate: Since you're paying the caregiver directly, the hourly cost is often lower.

- You're the Employer: You take on all the responsibility of an employer—interviewing, checking references, managing payroll taxes, and getting your own liability insurance.

- No Backup Plan: If your caregiver can't make it, you're on your own to find a substitute.

Hiring independently might look cheaper on paper, but the extra responsibilities and potential risks can make it a more complicated choice. The slightly higher home senior care cost of using an agency buys you security, convenience, and invaluable peace of mind.

How Home Care Costs Stack Up Against Other Options

So, is in-home care really the most affordable choice for your family? To get a clear answer, you have to look past the hourly rate and see the whole financial picture, especially when you compare it to other senior living options.

I like to think of it like going out to dinner.

Home care is a lot like ordering from an 'à la carte' menu. You pick and pay for only the specific services you actually need, whether that’s just a few hours of companionship a week or more intensive daily support. On the other hand, assisted living and nursing homes are more like an 'all-inclusive' resort package. You pay one flat monthly fee that covers everything—housing, meals, activities, and care—whether you use all of it or not.

That key difference is where you can find major savings with home care, especially for seniors who don't need round-the-clock supervision just yet.

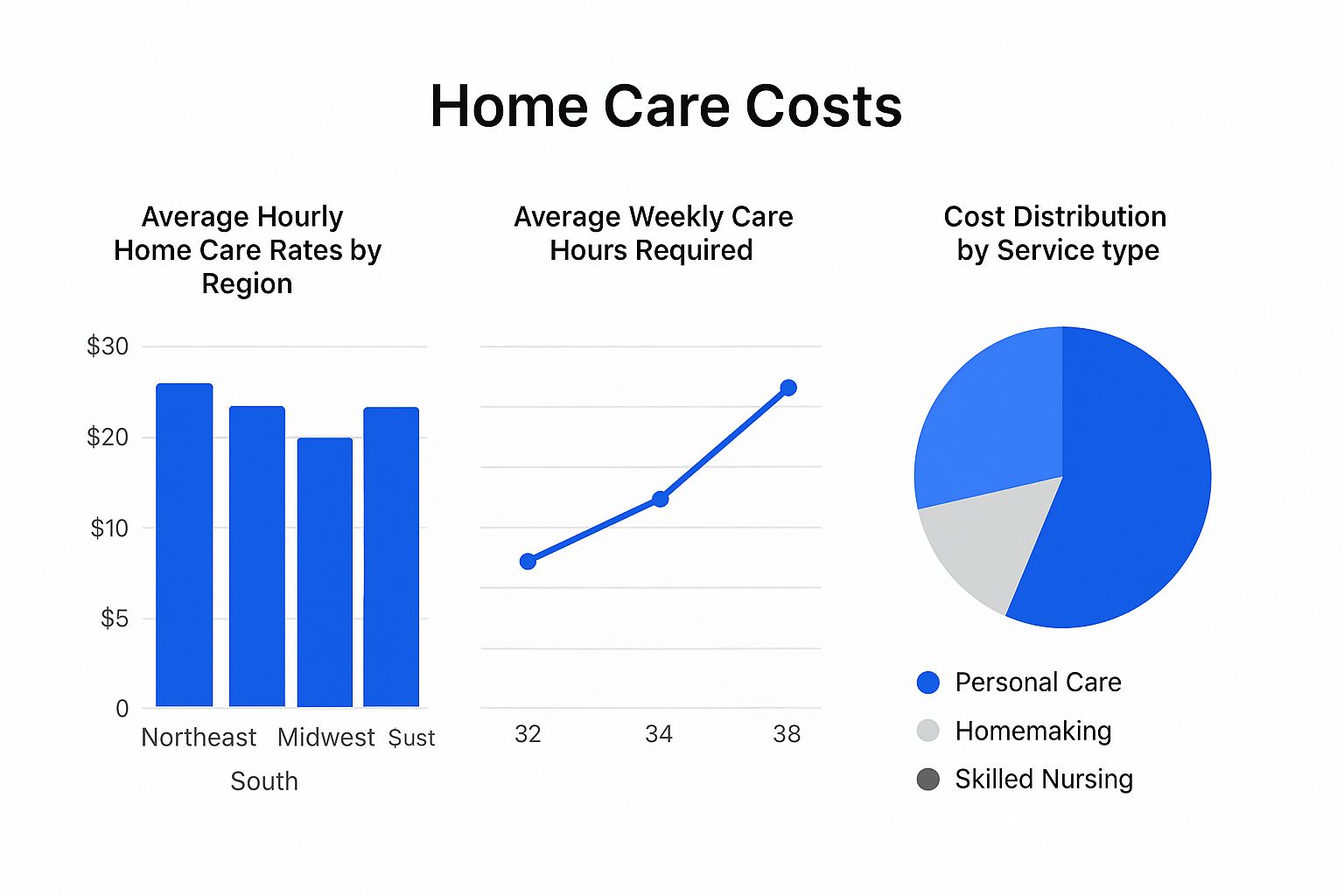

This chart breaks down where the money typically goes, giving you a visual guide to average costs and how services are distributed.

As you can see, costs can swing quite a bit depending on where you live. The data also shows that personal care needs are usually the biggest cost driver, which is why a thorough needs assessment is so critical for accurate budgeting.

Comparing Home Care and Assisted Living

For seniors who are still fairly independent but just need a hand with a few daily tasks, home care is often much easier on the wallet than moving into an assisted living facility. An assisted living community bundles rent, utilities, meals, and basic help into one bill that can easily top $5,000 per month.

If your loved one only needs about 15-20 hours of care per week, the home senior care cost will almost certainly be much lower. This approach lets them stay in the comfort of their own home while getting the exact support they need. The financial "break-even point" usually happens when a senior's needs become 24/7, at which point the bundled services of a facility might start to make more sense.

The Clear Financial Edge Over Nursing Homes

When you put home care side-by-side with a skilled nursing facility, the financial gap becomes even starker. Nursing homes provide the most intensive level of care you can get outside of a hospital, and their prices absolutely reflect that. It’s not unusual for a semi-private room to cost over $9,000 a month, with private rooms costing even more.

Caregiver wages and workforce shortages have pushed home care costs up, but even with those trends, the difference is huge. Take a high-cost state like Massachusetts, for example. In 2024, full-time home care was estimated at about $86,944 for the year. A semi-private nursing home room in that same state? Nearly double, at around $173,375 annually. If you're interested in learning more, you can read about these emerging home health care industry trends and how they affect costs.

Beyond the Dollars and Cents: While cost is a huge piece of the puzzle, the real value of home care goes way beyond the budget. The ability to stay at home offers priceless emotional and psychological benefits—comfort, independence, and the irreplaceable gift of one-on-one, dedicated attention from a familiar caregiver.

Let's break down the annual costs for a direct comparison.

Annual Senior Care Cost Comparison

This table gives a side-by-side look at the estimated annual costs for different types of senior care, highlighting the financial trade-offs you might face.

| Care Option | Average Annual Cost | Key Features |

|---|---|---|

| In-Home Care (44 hrs/wk) | ~$62,000 | Personalized, one-on-one care in the senior's own home. Flexible hours. |

| Assisted Living (Private Room) | ~$66,000 | Apartment-style living with communal dining and activities. 24/7 staff available. |

| Nursing Home (Semi-Private) | ~$109,000 | 24/7 skilled medical care and supervision in a clinical setting. |

Ultimately, the most cost-effective path is the one that best matches your loved one’s specific needs. For anyone with moderate care requirements, home care often strikes the perfect balance of personalized support, independence, and financial common sense.

A Local Look at Home Care Costs in New Jersey

While national averages give you a decent starting point, the numbers that truly matter are the ones in your own backyard. The home senior care cost can feel a bit abstract until you zoom in on your specific state, county, and even your own town. For families here in the Garden State, getting a handle on the local financial landscape is the most critical first step you can take.

New Jersey, with its diverse communities and generally higher cost of living, paints its own unique picture. The state's average hourly rates for home care are typically a bit higher than the national median, which really just reflects our regional economy.

Let's break down those broad statistics into practical, local information that can help you budget with real confidence.

New Jersey Home Care Rates Compared

On average, a family in New Jersey can expect to pay somewhere between $30 and $38 per hour for home health aide services. This is slightly above the national range, a trend you'll see across much of the Northeast where wages and the operational costs for agencies are just higher.

But that statewide average doesn't tell the whole story. The cost can shift significantly depending on which part of New Jersey you call home.

- North Jersey (think Bergen or Hudson Counties): This region, being so close to New York City, almost always has the highest rates in the state. The demand for great caregivers is fierce, and the cost of living naturally pushes prices up.

- Central Jersey (like Mercer or Middlesex Counties): Here, you'll often find costs that land much closer to the state average. Places like Princeton and Hamilton have strong care networks, but the rates tend to be more moderate than what you'll find up north.

- South Jersey (Camden and Atlantic Counties, for example): This region typically offers the most affordable home care options in the state. A lower cost of living is directly reflected in the hourly rates for caregivers.

When you start budgeting, it's so important to get quotes from a few different agencies right in your specific county. Sometimes, a five-mile difference can lead to a noticeable change in the hourly home senior care cost.

State-Specific Programs for Financial Relief

The good news for New Jersey residents is that the state offers several programs designed to make aging in place a more affordable reality. These resources can seriously offset the out-of-pocket expenses tied to home care, making it an achievable goal for many families.

One of the most impactful programs is Jersey Assistance for Community Caregiving (JACC). This program provides a wide range of support for seniors who might otherwise be at risk of needing to move into a nursing home. It gives qualified individuals a monthly budget they can use for all sorts of services, including:

- In-home care and personal assistance

- Respite care to give family caregivers a break

- Adult day care

- Home modifications to improve safety

- Transportation services

JACC is specifically built for seniors who meet certain income and asset limits but don't quite qualify for Medicaid. It acts as a vital bridge, providing the support seniors need to stay independent and safe in their own communities. You can discover more about these local resources by exploring our guide to caregiving in NJ.

By understanding both the regional cost differences and the state-specific aid that's available, you can build a far more accurate and sustainable budget for your loved one's care.

Funding Strategies to Make Home Care Affordable

Figuring out the cost of home senior care is one challenge; figuring out how to pay for it is another story entirely. For many families, the idea of funding long-term care feels completely overwhelming. But it's important to know that simply paying out-of-pocket is just one of many options.

The key is to think like a financial planner and assemble a portfolio of funding sources that can work together. This isn't just about writing a check. We'll walk through established strategies like long-term care insurance and government benefits, plus some creative solutions you might not have considered. Our goal is to help you build a sustainable plan that makes quality care an achievable reality, not a source of constant financial stress.

Tapping into Insurance Policies

One of the most direct ways to cover care costs is through an insurance policy designed for exactly this purpose. If your loved one planned ahead, this could be a major source of funding.

Long-Term Care Insurance (LTCI): This is the most obvious one. These policies are bought years in advance, specifically to cover services like in-home care when the time comes. You'll need to dig into the policy details to understand its "elimination period" (the waiting time before benefits start) and the daily or monthly benefit amount it provides.

Life Insurance Conversions or Accelerated Benefits: Here's something many people don't realize: a life insurance policy can sometimes be used to pay for care while the policyholder is still living. Some policies have an "accelerated death benefit" rider, which lets you access a portion of the death benefit for qualifying medical expenses. Another route is a life settlement or viatical settlement, which allows you to sell the policy to a third party for a lump sum of cash.

Navigating Government Programs

Federal and state programs are a cornerstone of funding for many families, but each has very specific rules and eligibility requirements. Getting a handle on these is crucial to unlocking potential benefits.

Medicare vs. Medicaid:

This is a common point of confusion, but these two programs play very different roles in paying for home care.

- Medicare: Think of this federal program as being for short-term, skilled medical care after a hospital stay. It does not cover long-term, non-medical "custodial" care—the kind of help needed for bathing, dressing, or making meals.

- Medicaid: This joint federal and state program is the biggest single payer for long-term care in the U.S. It’s needs-based, which means applicants have to meet strict income and asset limits to qualify. Many states now offer Home and Community-Based Services (HCBS) waivers that fund in-home care as a direct alternative to a nursing facility.

The growing demand for aging in place is changing how states use these funds. As of 2025, the U.S. home care industry brings in over $107 billion in revenue, a number fueled by the strong preference among seniors to stay right where they are. In fact, over 30 states now offer Medicaid waivers to fund home-based care, with some even providing monthly stipends directly to families. You can discover more insights about home care industry trends on nchstats.com.

Unlocking Veterans Benefits

For those who served our country, the Department of Veterans Affairs (VA) offers incredibly valuable programs that can make a real dent in the home senior care cost. The most significant of these is the Aid and Attendance benefit.

The VA Aid and Attendance benefit is a pension supplement for wartime veterans and their surviving spouses who need help with daily living activities. This monthly, tax-free payment can be used to pay for in-home care from an agency or even a family member.

Eligibility is based on service history, income, and a documented need for care from a doctor. The application process can be detailed, but the financial support it provides can be a true game-changer for families who qualify. For more details on local support, you can also explore our visual guide to caregiving in New Jersey.

Creative Home-Based Funding

Finally, some families turn to the assets they already own to create a funding stream for care. A reverse mortgage allows homeowners aged 62 and older to borrow against their home equity. They can receive payments as a lump sum, a monthly amount, or a line of credit.

While this can provide immediate cash, it’s a complex financial tool. It has long-term implications that absolutely should be discussed with a trusted financial advisor before moving forward.

How to Create a Realistic Home Care Budget

All this information is great, but turning it into a financial plan you can actually use is what really matters. Crafting a budget for home care isn't just about crunching numbers. It’s about building a clear, sensible roadmap that gives your family confidence and peace of mind.

This is the step where the abstract concept of home senior care cost becomes a concrete, manageable plan. Let’s walk through how to build that budget from the ground up, turning your research into real-world action.

Start with a Thorough Needs Assessment

Before you can get a single accurate quote, you have to know exactly what kind of support you need. A detailed needs assessment is the foundation of any realistic budget. Think of it like creating a detailed blueprint before you start building a house.

Start by listing all the Activities of Daily Living (ADLs) and Instrumental Activities of Daily Living (IADLs) your loved one needs help with. Be specific. Does "meal prep" just mean popping a frozen dinner in the microwave, or does it mean cooking a full meal from scratch? Does "mobility help" mean offering a steadying arm, or does it require full assistance to get out of a chair? The details make all the difference.

This process helps you pin down the two biggest factors driving your final cost: the number of care hours needed each week and the skill level required from the caregiver.

A common mistake is to underestimate the level of need, which almost always leads to budget problems down the road. To get the full picture, bring everyone to the table—your loved one, siblings, and even their doctor. A realistic plan starts with an honest evaluation.

Research and Compare Local Agencies

With your needs assessment in hand, it's time to gather real-world quotes. While national averages are a decent starting point, local pricing is what you'll actually be paying. Make it a goal to contact at least three different agencies in your specific area to get a true feel for the market rate.

When you talk to them, look past just the hourly rate. You need to uncover the full value each agency provides. Be sure to ask:

- What is included in the hourly rate? Does it cover things like mileage for errands?

- Are there different rates for nights or weekends? This is a very common practice that can significantly impact your budget.

- What are the minimum shift lengths? Most agencies have a minimum, often three or four hours, so you'll want to know that upfront.

- How much notice is needed to change a schedule? Life happens, and flexibility is key.

Doing this research helps you avoid sticker shock and find a partner that fits both your care needs and your financial plan.

Budget for the Unseen Expenses

A truly realistic budget accounts for more than just the caregiver's hourly wage. A few "hidden" expenses can creep in and add up, so it's always smart to build in a small cushion for them.

Be sure to consider these potential extra costs:

- Home Supplies: You may need to stock up on gloves, specific cleaning supplies, or even certain food items for the caregiver to use while on the job.

- Potential Rate Hikes: Agencies sometimes have annual rate increases. It’s a good idea to ask about this from the start and factor in a small percentage increase each year.

- Emergency Backup Care: If a family member is the primary caregiver, what's the plan if they get sick or need a break? Budgeting for occasional respite care from an agency can be a total lifesaver.

By anticipating these costs, your budget becomes far more resilient and less likely to break under unexpected pressure. This proactive approach is essential for managing the long-term home senior care cost with confidence.

Frequently Asked Questions About Home Care Costs

When you start looking into senior care, it’s completely normal for the financial side of things to bring up a lot of questions. It can feel overwhelming. To help clear things up, we've put together straightforward answers to the most common concerns we hear from families just like yours.

Does Medicare Cover Non-Medical Home Care?

This is probably the biggest point of confusion for families, and the short answer is no. Medicare does not typically pay for non-medical, long-term care. This means "custodial" services—like help with bathing, getting dressed, preparing meals, or simple companionship—aren't covered.

Medicare is designed for short-term, skilled medical care, usually after a hospital stay or injury. So, if your loved one needs a registered nurse for wound care or a physical therapist to visit them at home, Medicare might cover it for a limited time. It's just not set up to fund ongoing, daily assistance with personal tasks.

Key Insight: It's easy to mix up Medicare and Medicaid, but they serve very different purposes. While Medicare is for short-term medical needs, Medicaid is a program based on financial need that often does cover long-term, non-medical in-home care for those who qualify.

Are Home Care Costs Tax-Deductible?

Yes, in many cases, the money you spend on home care can be tax-deductible. The IRS allows you to include certain medical expenses, and that can include the cost of in-home care, as long as it's primarily for medical reasons.

For the expenses to qualify, a licensed healthcare practitioner must certify that the individual is "chronically ill." The prescribed care plan needs to cover services like personal care (bathing, dressing) or necessary supervision for someone with a cognitive impairment, such as Alzheimer's. Of course, it's always smart to talk with a tax professional to see how this applies to your family's unique situation.

For more helpful details, check out our visual guide for NJ caregiving.

How Can We Reduce Care Costs Without Sacrificing Quality?

Bringing down the home senior care cost is a goal for most families, and you can absolutely do it without cutting corners on the support your loved one receives. The trick is to be smart with your resources.

- Create a Hybrid Plan: You don't have to choose between all-professional or all-family care. Many families find success by blending the two. A professional caregiver can handle the more physically demanding or sensitive tasks, like bathing, while family members can cover meals and companionship.

- Explore Local Programs: Look into what your state offers. New Jersey, for example, has the JACC program. Your local Area Agency on Aging is another fantastic resource that can connect you with programs designed to offset costs.

- Focus on Prevention: Sometimes the best way to save money is to prevent bigger problems. Investing a little in home safety modifications to prevent falls can save you from much higher care needs and medical bills down the road.

Is It Cheaper to Hire Independently?

At first glance, hiring a caregiver privately might seem like the cheaper route. You're not paying agency overhead, so the hourly rate is often lower. But that lower rate comes with a whole new set of responsibilities that can be costly and time-consuming.

When you hire someone on your own, you officially become their employer. That means you're on the hook for everything: running background checks, handling payroll taxes, securing liability insurance, and scrambling to find backup care when your caregiver gets sick or goes on vacation. An agency takes care of all of that for you, giving you a level of protection and peace of mind that most families find is well worth the difference in cost.

At NJ Caregiving, we get it. Figuring out home care costs can be a real challenge. Our team is here to walk you through your options and help build a personalized care plan that fits your family's budget and, most importantly, your loved one's needs. Visit us at https://njcaregiving.com to see how we can support you.