Before you even start gathering documents, the very first step in the Medicaid application process is figuring out if you're eligible. It might seem obvious, but you’d be surprised how many people dive into the paperwork without checking this first. Taking a few minutes to understand the rules upfront can save you a ton of time and frustration down the road.

First, Check if You Are Eligible for Medicaid

Figuring out Medicaid eligibility can feel like navigating a maze, but it really comes down to two main things: your personal situation (like age or disability) and your financial standing. It’s not a one-size-fits-all program; think of it as a set of different pathways to get coverage, each designed for specific groups.

The best place to start is by seeing which category you or your loved one might fit into. Medicaid is designed to serve distinct populations, ensuring support gets to those who need it most.

- Low-Income Adults: If you're under 65, your state’s decision on Medicaid expansion is huge. In states that expanded the program under the Affordable Care Act (ACA), adults with incomes up to 138% of the Federal Poverty Level (FPL) can often qualify.

- Pregnant Women and Children: These groups usually have more generous income limits than other adults. This is to ensure mothers and kids get critical healthcare access early on.

- Seniors (Aged 65 and Older): Older adults can get coverage, but they must meet specific limits on both their income and their assets (like savings or property).

- Individuals with Disabilities: Many people who receive Supplemental Security Income (SSI) are automatically eligible for Medicaid. Others can qualify based on their specific disability and financial situation.

Understanding the Financial Requirements

Once you've found your likely category, it’s time to look at the numbers. For most people, Medicaid uses a figure called Modified Adjusted Gross Income (MAGI) to determine if you qualify financially. It’s basically your household's taxable income with a few tweaks. This is the number they’ll compare against the income limits for your household size in your state.

Every state has slightly different rules, and your household size plays a big role. A single person in an expansion state will have a very different income cutoff than a family of four.

Key Insight: I can't stress this enough: whether your state expanded Medicaid is the single biggest factor. Expansion states cover a much broader group of low-income adults. Non-expansion states have much tighter rules, often restricting eligibility to very specific groups like pregnant women, children, or people with qualifying disabilities.

The Medicaid landscape is always changing. For example, recent data from early 2025 shows how much state policies matter. While overall Medicaid managed care enrollment saw a 3.9% dip year-over-year nationally, states like North Carolina actually saw growth. This is a perfect example of why you must check your own state’s specific guidelines. States that expanded Medicaid saw a smaller 3.6% enrollment drop, while non-expansion states had a steeper 5.4% decline. You can explore further analysis of these enrollment trends to see how these policies impact real people.

To get a clearer picture, it helps to break down the main factors that go into the eligibility decision.

Key Factors Influencing Medicaid Eligibility

| Eligibility Factor | Description | What You Need to Know |

|---|---|---|

| Income | Your household's Modified Adjusted Gross Income (MAGI). | This is the primary financial test. The limit is based on a percentage of the Federal Poverty Level (FPL) and varies by state and household size. |

| Household Size | The number of people in your tax household (yourself, spouse, dependents). | A larger household size means a higher income limit. Be sure to count everyone correctly according to Medicaid rules. |

| Age | Your age category (e.g., child, adult under 65, senior 65+). | Different age groups have different eligibility pathways and income rules. |

| Disability Status | Whether you have a disability recognized by the Social Security Administration. | Having a qualifying disability can make you eligible even if your income is slightly higher than the standard limits. |

| State of Residence | Whether your state has expanded Medicaid under the ACA. | This is a game-changer. It dramatically expands who is eligible, especially for childless adults. |

These elements all work together to determine the final outcome. Your income might be perfect, but if you're in the wrong category for your state, you may not qualify.

Putting It All Together: A Real-World Scenario

Let’s make this real. Imagine a single mother, Maria, who lives in New Jersey (an expansion state) with her 8-year-old son. She has a part-time job and earns $28,000 a year. Her household size is two.

In 2024, the Federal Poverty Level for a household of two is $20,440. Because New Jersey expanded Medicaid, the income limit is 138% of that FPL, which comes out to roughly $28,207 for Maria's family. Since her $28,000 income is just under that threshold, both she and her son would almost certainly be eligible for NJ FamilyCare, which is New Jersey's Medicaid program.

Now, let's see what happens if Maria lived in a non-expansion state. Her income would likely be too high for her to qualify as a parent, even though her son would probably still get coverage through the Children's Health Insurance Program (CHIP). It’s the exact same family, but a different state completely changes the outcome. This shows just how critical your location is when you apply for Medicaid.

Gathering Your Essential Application Documents

Once you've figured out that you likely qualify, it's time to gather your paperwork. I always tell my clients to think of themselves as detectives building a case. Your mission is to give the Medicaid agency a crystal-clear, undeniable picture of your situation. The more organized you are right now, the fewer headaches and delays you'll face down the road.

A complete application is your single best tool for a smooth process. Missing just one pay stub or bank statement can push your application to the bottom of the pile, easily causing weeks or even months of frustrating delays. Let's walk through exactly what you'll need to pull together.

Proving Who You Are and Where You Live

First things first, the state needs to confirm your identity and that you're a true New Jersey resident. This is the foundation of your application, and getting it right is non-negotiable.

Make sure any ID you use is current and not expired. An outdated driver's license is one of the most common reasons for an immediate snag in the process.

- Proof of Identity: A valid, government-issued photo ID is the gold standard. Your best bets are a New Jersey driver's license, a state-issued non-driver ID card, or a U.S. passport.

- Proof of Citizenship/Immigration Status: You'll need to show you are a U.S. citizen or a lawfully present immigrant. Your birth certificate, naturalization certificate, or valid immigration papers (like a Green Card) will satisfy this.

- Proof of Residency: The agency needs to see your New Jersey address on an official document. A recent utility bill (gas, electric), your current lease agreement, or a mortgage statement works perfectly.

The strictness of this step makes sense when you consider the sheer scale of Medicaid. With roughly 71.4 million people enrolled across the country as of early 2025, state agencies depend on solid verification. That figure, representing about 21% of the entire U.S. population, shows why these standardized requirements are so critical. You can learn more about the national Medicaid enrollment data to see the bigger picture.

Documenting Your Financial Situation

This is where the real legwork comes in. You need to provide a completely transparent look at your household's income and, in some cases, your assets. This is the information that directly determines if you fall within the financial limits for the specific program you need.

For most folks under 65, the application will focus almost entirely on income. But for those who are aged, blind, disabled, or applying for long-term care services like home care, asset verification becomes just as important.

Pro Tip: I can't stress this enough: create a dedicated folder for your application. It can be a physical file folder or a digital one on your computer. As you get each document, put it in the folder immediately. This simple habit will save you from that last-minute panic of trying to find a misplaced bank statement.

Let’s get into the specifics of the financial proof you’ll need.

Income Verification

You must document every single source of income for every household member who is applying. This is a place for total honesty and thoroughness.

- Pay Stubs: Gather your most recent pay stubs from the last 30 days.

- Tax Returns: Your most recently filed federal tax return gives a great annual overview.

- Other Income Proof: If you get money from Social Security, a pension, unemployment, or child support, you'll need the official award letters or statements showing the amounts.

Asset Verification (If Applicable)

If you're 65 or older, have a disability, or are specifically applying for home care or nursing home services, you'll also need to document your assets. This is to ensure you meet the very strict resource limits for these programs.

- Bank Statements: Provide recent statements for all of your checking and savings accounts.

- Retirement Accounts: Include statements from any 401(k), IRA, or other retirement funds.

- Property Deeds: Required if you own property besides the home you live in.

- Life Insurance Policies: You'll need the paperwork showing the cash value of any policies you hold.

Essential Information for Every Household Member

Finally, you will need a Social Security Number (SSN) for every single person in your household who is applying for coverage. This is an absolute requirement. The state uses it to verify your identity and income with other government agencies. If someone in your home isn't applying for benefits, you typically don't need to provide their SSN.

Don't panic if you can't find a document like a birth certificate. You can contact the vital records office in the state where you were born to order a certified copy. It's always best to start that process as soon as possible, as it can take a few weeks. Taking these steps ensures your application isn't just complete, but strong.

You’ve gathered all the paperwork, organized it neatly, and now you’re at the finish line: submitting the application. This is where all that careful preparation really pays off. Thankfully, you have a few different ways to officially apply for Medicaid, so you can choose the method that works best for you.

For many people, the most direct route is through the federal Health Insurance Marketplace at HealthCare.gov. It’s built to be a one-stop shop. When you go through the process of applying for health coverage, the system automatically flags whether your income and household size might qualify you for Medicaid. If it looks like you’re eligible, your information gets securely passed along to NJ FamilyCare to kick off the enrollment process. It’s a pretty smooth hand-off.

Navigating Different Submission Methods

While the federal Marketplace is a great option, it’s not your only one. You can also apply directly with New Jersey's Medicaid agency, and they offer several ways to do it.

- Online State Portal: New Jersey has its own dedicated online portal. This is often the quickest way to apply directly, letting you upload your documents and even track your application's status from home.

- Mail-In Application: If you prefer a paper trail, you can always download, print, and mail in a physical application. It’s a classic, reliable method, but be prepared for it to take the longest.

- Phone Application: Sometimes it’s just easier to talk to a person. You can apply over the phone with a state representative who will walk you through all the questions.

- In-Person Assistance: If you're feeling overwhelmed or have a more complicated situation, visiting your local County Board of Social Services is an excellent choice. You can get one-on-one help from someone who handles these forms every day.

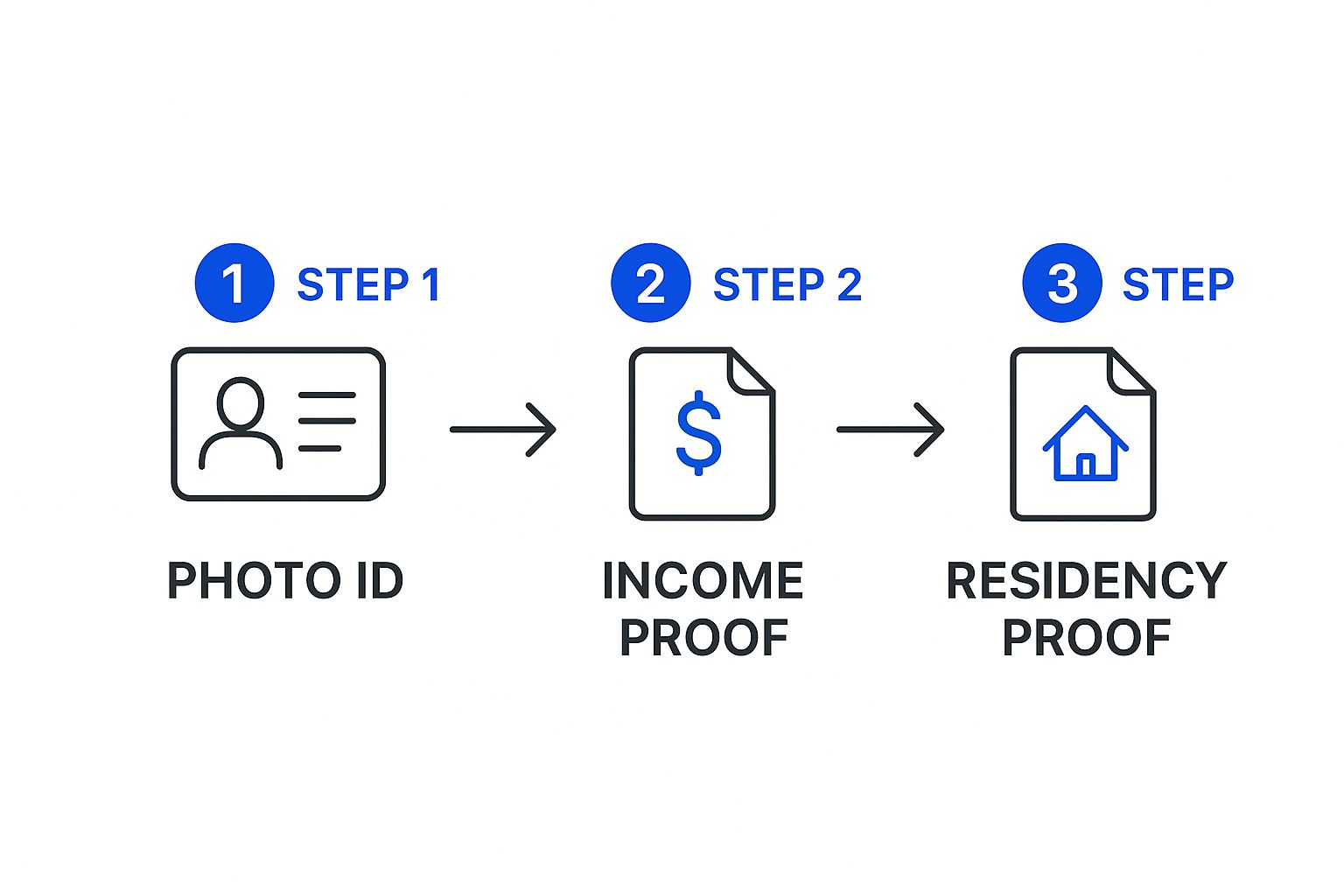

No matter which path you take, the core documents you'll need are the same. This image breaks down the absolute essentials.

Having these three pieces—proof of who you are, what you earn, and where you live—is the foundation of every successful application.

Practical Tips for a Smooth Submission

From my experience, each application method has its own little quirks. If you’re applying online, save your progress often. There's nothing more frustrating than losing an hour of work because your browser timed out.

For mail-in applications, I always recommend sending them via certified mail. That tracking number and proof of delivery can be a lifesaver if your paperwork ever gets delayed or misplaced.

Ultimately, the method you choose isn't as important as the accuracy of the information you provide. Before you hit "submit" or seal that envelope, double-check every single entry.

Key Takeaway: Your main goal is to submit a complete and error-free application. A simple typo in a Social Security number or a forgotten income source can cause major delays. It’s worth taking a few extra minutes to be thorough.

It's also good to know that the world of Medicaid is always changing, especially due to policy shifts. For example, national enrollment numbers are still in flux after the pandemic. While total enrollment was at 78.4 million in mid-2025—which is still 10% higher than before the pandemic—the picture varies wildly from state to state.

Some states, like North Carolina, saw enrollment jump by 54%, while others saw declines. These changes are often tied to states adopting the ACA expansion and updating their renewal processes, which directly affects who qualifies and how applications are handled. You can read more about the evolving Medicaid application landscape to see how these trends might impact your application.

What Is the Easiest Way to Apply?

So, what's the "easiest" way? For most people in New Jersey who are comfortable with technology, applying online through either HealthCare.gov or the NJ FamilyCare portal is typically the simplest. These websites guide you step-by-step, won't let you skip required fields, and usually lead to faster processing.

But "easy" is personal. If you feel more at ease talking through your situation with a person, then calling the helpline or visiting your county office is absolutely the right choice for you. The most important thing is to pick the path that makes you feel confident and in control. That attention to detail is what will get you to a successful outcome.

What to Expect After You Apply

You’ve submitted the application, and now comes the part that often feels the most stressful: the waiting game. It’s easy to feel like your application has disappeared into a black hole, but knowing what’s happening behind the scenes can make this period much more manageable.

Once your paperwork is in, a caseworker at the Medicaid agency begins the verification process. They’ll be reviewing every document you sent, cross-referencing your information with various state and federal databases to confirm details like your income, assets, residency, and citizenship. This is exactly why a complete and accurate application is so critical—it helps this stage move along without unnecessary delays.

Understanding the Processing Timeline

So, how long does this all take? In my experience, you should generally expect a decision within 45 to 90 days. For most standard applications based on income, the state aims for a 45-day turnaround.

However, if your eligibility is based on a disability, the timeline often stretches closer to the 90-day mark. This is simply because it requires a more detailed review by a specialized medical review team.

A few things can really impact how long you'll wait:

- A Complete Application: I can't stress this enough. An application that's perfectly filled out with all the right documents will always move the fastest.

- The Type of Application: As I mentioned, disability-based applications just take longer. It’s a more complex review.

- Agency Caseloads: Sometimes, it’s just busy. Policy changes or certain times of the year can cause a surge in applications, creating a backlog that slows things down for everyone.

If you hit the 60-day mark and haven't heard a peep, it's a good idea to check on your application's status. Most state portals now let you track its progress online, or you can always call the Medicaid helpline for an update.

Responding to a Request for More Information

It’s incredibly common to get a letter or notice asking for more information. Don't panic! This is a normal part of the process and doesn’t mean you’re heading for a denial. It just means the caseworker needs to clarify something before they can make a final decision.

The request could be for something simple, like a more recent pay stub, proof of a new address, or details about an asset. The notice will include a strict deadline by which you must submit the documents. Pay close attention to this date. Missing it is one of the easiest and most common reasons for an application to be denied.

Pro Tip: Always make copies of every single document you send back to the agency. I highly recommend sending it via certified mail. This gives you a paper trail proving you responded on time, which can be a lifesaver if any issues pop up later.

Handling the Final Decision

Eventually, you'll receive an official determination letter in the mail. This is it—the letter will clearly state whether you've been approved or denied. Each outcome has its own set of next steps.

If You Are Approved

Congratulations! This determination letter is your official key to the program. It will state the exact date your coverage begins, which is often retroactive to the date you first applied. Shortly after, you’ll get a welcome packet in the mail.

This packet is important, so don't just set it aside. It will contain your Medicaid ID card and information about choosing a Managed Care Organization (MCO). In New Jersey, most people on Medicaid must enroll in an MCO, which is a private health insurance company that manages your healthcare services. You’ll need to pick one from a list of approved plans in your county.

If You Are Denied

Getting a denial letter is disheartening, but it’s not always the final word. The letter is required to explain the specific reason why you were found ineligible. This reason is your roadmap for what to do next.

You have the right to appeal the decision. The denial notice will include clear instructions on how to request a Fair Hearing and a firm deadline for filing your appeal, which is usually between 30 and 90 days. If you believe the denial was a mistake—maybe they miscalculated your income or used outdated information—filing an appeal is a critical step. Preparing for a hearing involves gathering evidence and being ready to clearly explain why the denial was incorrect.

Common Mistakes That Can Derail Your Application

Knowing how to apply for Medicaid is one thing, but knowing what not to do is just as important. Believe it or not, a surprising number of applications get delayed or even denied because of simple, avoidable errors. Getting a handle on these common pitfalls ahead of time can make the whole process smoother and seriously boost your chances of a quick approval.

We aren't talking about complex legal loopholes here. These are everyday mistakes that are easy to make when you're overwhelmed with paperwork and deadlines. Something as basic as a blurry copy of a pay stub or an expired driver's license can be enough to stop your application in its tracks. When that happens, the caseworker has to send it back, costing you precious weeks.

Let’s walk through some real-world scenarios where tiny missteps created huge headaches and, more importantly, how you can sidestep them completely.

Miscalculating Your Income or Household Size

This is probably the most common—and most impactful—mistake people make. Medicaid is a numbers game, and getting the numbers wrong right out of the gate can lead to an instant denial. So many applicants accidentally report their net income (what they take home after taxes) instead of their gross income (the full amount before any deductions).

Here’s the thing: Medicaid eligibility is almost always based on your gross income. A family might look at their paychecks and think they qualify, only to be turned down because their gross income is a few hundred dollars over the limit for their household size.

Another frequent issue is getting the household size wrong. Medicaid has very specific rules about who counts in a household, and it usually matches who you claim on your federal tax return. Forgetting to list a dependent child or including a roommate who isn't a tax dependent can throw off the entire calculation and lead to the wrong decision.

A Real-Life Example: Take John, a single father applying for himself and his son. He reported his income correctly but completely forgot about the small amount of child support he receives each month. The state's system cross-checked its records, flagged the difference, and his application was delayed for six weeks while he scrambled to get the right paperwork together.

Submitting Outdated or Incomplete Documents

The documents you provide are the proof for your application. If your proof is weak, your case falls apart. Submitting a bank statement from six months ago or providing only two pay stubs when the application asks for a full month's worth are classic errors.

Always, always check the dates. Most agencies need documents from within the last 30 to 45 days. Your goal is to give the caseworker a current, accurate snapshot of your financial situation, not an old photograph. This is why keeping a dedicated folder and double-checking every single document against the application's checklist is such a critical habit to build.

To help you stay on track, I've put together a quick guide to some of the most frequent application blunders and how to make sure they don't happen to you.

Application Pitfalls and How to Sidestep Them

Navigating the paperwork can feel like a minefield. Below is a quick-reference table that breaks down the most common mistakes we see, why they cause problems, and exactly how you can avoid them. Think of this as your cheat sheet for a smoother application process.

| Common Mistake | Why It's a Problem | How to Avoid It |

|---|---|---|

| Reporting Net Income | Your income looks lower than it actually is for eligibility purposes, leading to an incorrect assessment and likely delays. | Always use your gross (pre-tax) income. You can find this on your pay stubs or tax return. When in doubt, call and ask. |

| Forgetting an Income Source | Omitting sources like child support, freelance work, or alimony will create a discrepancy when the state cross-checks records, halting your application. | Before you fill anything out, make a physical list of every single place your household gets money from. Check it twice. |

| Using Expired IDs | The state cannot verify your identity with an expired document. This is an automatic roadblock for that piece of proof. | Check the expiration dates on your driver's license, state ID, or passport well before you apply. Get them renewed if they're close. |

| Missing Deadlines | If the agency asks for more information, you have a strict deadline. Missing it often leads to an automatic denial, and you have to start over. | Open all mail from the Medicaid agency immediately. Mark the response deadline on your calendar and send documents back via certified mail for proof. |

By keeping these points in mind, you're not just filling out a form—you're actively preventing the most common reasons for delay.

Failing to Report Changes in Your Situation

Finally, remember this: your application isn't a one-and-done deal. It's a living document. Life happens, and you are required to report significant changes to the Medicaid agency promptly—both while you're applying and after you're approved.

This includes major life events like:

- Getting a new job or a raise

- Losing a job or having your hours cut

- Moving to a new address

- Getting married or divorced

- Having a baby or adopting a child

Not reporting a raise that pushes you over the income limit, for instance, can cause major headaches down the road. Being proactive and transparent is always your best bet. By learning from these common stumbles, you can present a clear, accurate, and compelling case for your eligibility.

Frequently Asked Questions About Applying

Even after walking through the process, it’s completely normal to have questions pop up about your specific situation. Let's be honest, the path to getting Medicaid isn't always a straight line, and some of the rules can feel confusing.

Let’s tackle some of the most common questions we hear from families trying to figure this all out. Getting clear, straightforward answers can give you real peace of mind and the confidence to take the next step.

Can I Apply for Medicaid if I Have a Job?

Yes, absolutely. This is one of the biggest and most persistent myths about Medicaid. Having a job does not automatically disqualify you.

The real question isn't whether you're employed, but whether your total household income is below the limit for your family size here in New Jersey. Plenty of hard-working people—especially those in part-time, seasonal, or lower-wage jobs—still qualify for coverage.

It's all based on your gross (pre-tax) income. So even if you’re working, it’s always worth checking your numbers against the official guidelines. The whole point of the ACA expansion in New Jersey was to help cover working adults who don't have affordable health insurance options through their employer.

What Is the Medicaid Look-Back Period?

This is a really important one, especially for anyone who needs long-term care services like in-home support or a nursing home. The "look-back" period is a five-year (60-month) window where Medicaid carefully reviews your financial history.

Essentially, the agency looks back at the 60 months right before you applied to see if you gave away money or sold assets for less than they were worth. It's a rule designed to stop people from simply handing over their savings to family just to meet the very strict asset limits for long-term care.

Important Takeaway: If Medicaid finds that you improperly transferred assets during this look-back period, it will lead to a penalty. This isn't a fine you pay; it's a period of ineligibility where Medicaid will not pay for your long-term care. The length of that penalty is calculated based on how much you transferred.

What Happens if My Income Changes After I'm Approved?

Life happens, and your financial situation can definitely change. If you're approved for Medicaid, you're required to report any significant changes in your household—including a pay raise or a new job—to the state agency, usually within 10 days.

If your new income pushes you over the Medicaid limit, you might lose your eligibility. But you won't just be left without any options. This kind of change usually triggers a "special enrollment period" on the Health Insurance Marketplace.

This allows you to sign up for a private health plan through Get Covered NJ, and you'll often qualify for financial help to lower your monthly payments. The system is set up to create a smooth transition from Medicaid to other affordable coverage.

Can I Get Temporary Coverage While I Wait for a Decision?

In certain urgent cases, yes. New Jersey has something called presumptive eligibility (PE). It’s temporary, immediate Medicaid coverage that you can get while your full application is still being processed. It’s not for everyone, but it’s a critical lifeline for people with immediate medical needs.

Who might qualify for PE?

- Pregnant women

- Children under 19

- Parents or caretaker relatives with dependent children

- Certain adults who need immediate medical attention

A qualified hospital or clinic can often determine if you're eligible for PE right on the spot. It ensures you can get the care you need right away instead of waiting the typical 45 to 90 days for a final decision on your full application.

Navigating the complexities of Medicaid and securing the right in-home care can be overwhelming. At NJ Caregiving, we specialize in helping families in Mercer County understand their options and access compassionate, professional care. If you or a loved one needs support to live safely and comfortably at home, we're here to help. Discover our personalized care services by visiting us at https://njcaregiving.com.