Think of the Medicaid spend down like a deductible on your health insurance. It's a way to qualify for coverage even if your income is a little too high on paper. You simply have to show that you're spending your "excess" income on approved medical bills. Once you've met that amount, Medicaid steps in to cover the rest.

This system is a critical safety net, bridging a tough financial gap for many people.

Understanding the Core Concept of Medicaid Spend Down

At its heart, the Medicaid spend down is a pathway to eligibility for people caught in a difficult spot. They have too much income to qualify for Medicaid outright, but not nearly enough to afford their necessary medical care. The spend down allows you to subtract your medical expenses from your income, effectively lowering it to meet the eligibility threshold.

Here's a simple way to look at it: Medicaid has a set income limit. If your monthly income is over that line, the difference is considered your "excess income." The spend down process requires you to prove you've paid for or incurred medical bills equal to that excess amount. Once you have, you're considered "medically needy" and become eligible for coverage for the rest of that period.

The Medically Needy Program

In many states, including New Jersey, the spend down provision is part of what's called a "Medically Needy Program," sometimes known as a "Surplus Income Program." The name says it all: it’s for people who aren't destitute but become financially strapped because of high healthcare costs.

The goal isn't to leave you with nothing. Instead, it ensures your own resources go toward your health first, before public assistance begins. This approach helps people with chronic conditions, disabilities, or those needing long-term care get vital support without becoming completely impoverished.

For instance, if a state's Medicaid income limit is $2,000 a month and your income is $2,200, you would need to "spend down" that $200 difference on qualified medical costs. This could include things like doctor's visit co-pays, prescription drugs, or even old unpaid medical bills. Once you've proven you've spent that $200, Medicaid can start covering your other approved costs. You can find more details by reading expert articles on how states implement these rules.

Key Takeaway: The spend down process doesn't mean you have to be left with zero dollars. It's about demonstrating that your medical costs effectively lower your available income to the point where you meet your state's eligibility threshold.

To make this concept even clearer, let's break down the essential terms in a simple table.

Key Spend Down Concepts at a Glance

This table breaks down the core components of the Medicaid spend down process to provide a quick, easy-to-understand overview.

| Concept | Simple Explanation | What It Means for You |

|---|---|---|

| Medically Needy Income Limit (MNIL) | The maximum income you can have to qualify for the Medically Needy Program in your state. | This is the target number. Your goal is to show your income is at or below this limit after subtracting medical bills. |

| Excess Income | The amount your income is over the MNIL. | This is the specific dollar amount you need to "spend down" each period to become eligible for Medicaid. |

| Spend Down Period | The timeframe (usually 1 to 6 months) during which you must incur medical expenses to meet your excess income amount. | You'll need to gather and submit all your qualifying medical bills from within this specific window. |

| Qualifying Medical Expenses | Approved medical costs that can be used to meet your spend down. | These can include doctor visits, prescriptions, old medical debt, and even some insurance premiums. |

Understanding these pieces is the first step to making the spend down process work for you, not against you.

How It Works in Practice

So, how does this all play out in the real world? The process follows a few key steps that turn the theory into a manageable plan.

- Determine Your Excess Income: Your local Medicaid agency calculates the difference between your monthly income and the state's Medically Needy Income Limit (MNIL).

- Track Your Medical Bills: You have to carefully collect and submit all receipts and bills for qualifying medical expenses you incurred during your spend down period.

- Meet the Threshold: Once the total of your submitted medical bills equals your excess income, you've officially met your spend down.

- Activate Coverage: After meeting the spend down, your Medicaid coverage kicks in to help pay for any other approved medical costs for the rest of the period.

This structured approach ensures that assistance is directed right where it's needed, protecting people from the crushing financial weight of major health problems.

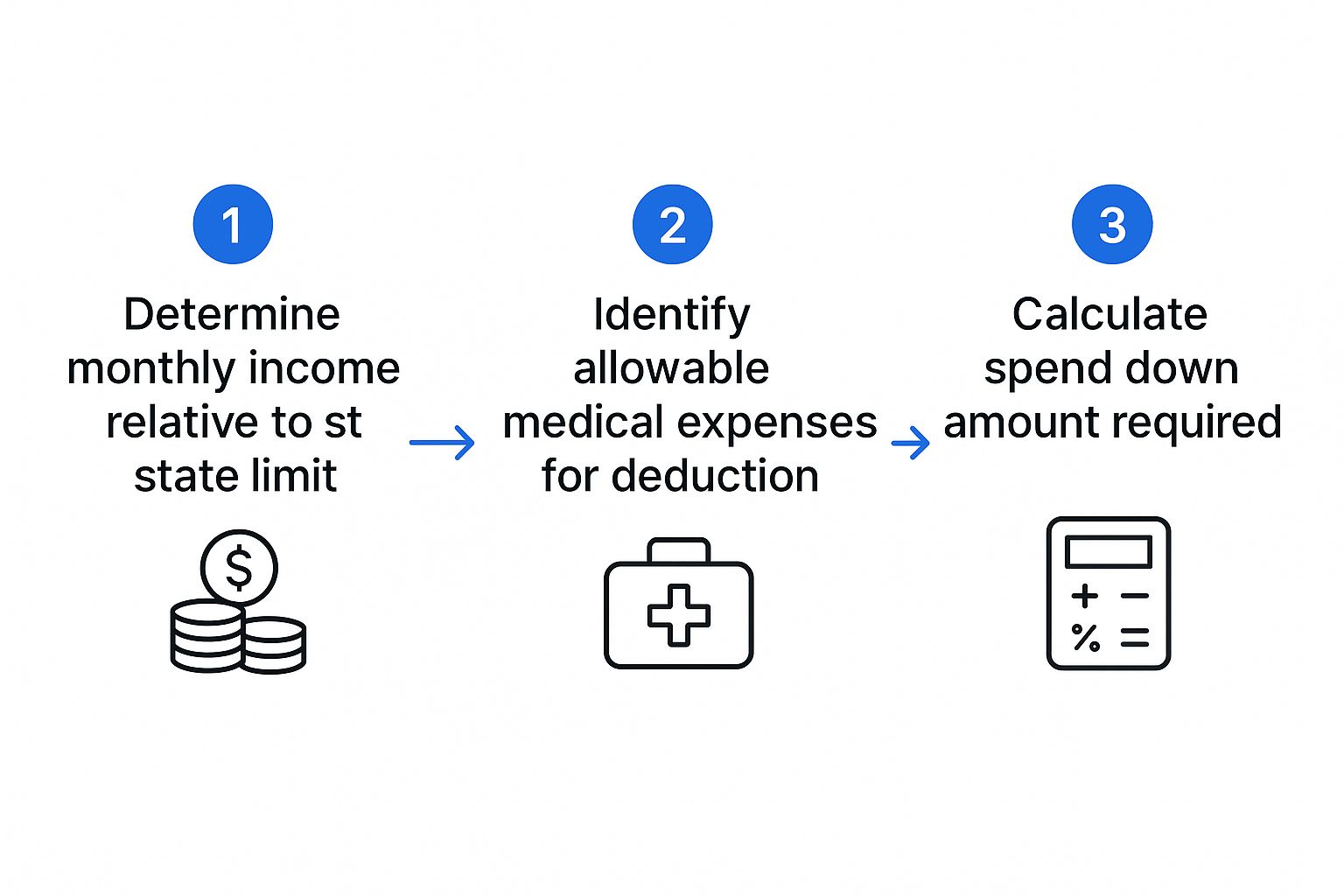

Calculating Your Spend Down Amount Step-by-Step

Trying to make sense of Medicaid spend down rules can feel overwhelming, but figuring out the actual math is often simpler than people think. Once you get past the confusing jargon, the process boils down to a clear, straightforward formula. It's all about finding the difference between what you have and what Medicaid allows.

The basic equation looks like this: Your Monthly Countable Income – Your State's Medically Needy Income Limit (MNIL) = Your Monthly Spend-Down Amount.

This little bit of math turns an abstract rule into a concrete number. It gives you a clear financial target to aim for each month before your Medicaid coverage can kick in.

The Spend Down Calculation in Action

Let's walk through an example to see how this works in the real world. Meet John, a recent retiree in New Jersey whose income is just a little too high to qualify for Medicaid outright.

- John's Total Monthly Income: Between Social Security and a small pension, John brings in $1,850 a month.

- Allowable Deductions: New Jersey lets him subtract certain expenses. There's a $20 standard deduction and his $174.70 Medicare Part B premium. His countable income is $1,850 – $20 – $174.70 = $1,655.30.

- State's Income Limit (MNIL): We'll say New Jersey's MNIL for a single person is $1,215 per month.

- The Calculation: Now, we just subtract the MNIL from his countable income: $1,655.30 – $1,215.

The result is $440.30. This is John's monthly spend-down amount—the total he needs to rack up in medical bills each month before Medicaid will start paying for his care.

This visual helps break down the flow from your total income to your final spend-down target.

As you can see, it’s a three-stage process that gives you a predictable goal to work toward.

Understanding Your Spend-Down Period

Your spend-down amount doesn't exist in a vacuum. It operates within a specific timeframe called the spend-down period, which is the window you have to accumulate enough medical bills to meet your target.

State Medicaid programs usually set spend-down periods that last anywhere from one to six months. This timeline is critical because it determines the total bill amount you need to show before your coverage starts.

Let’s go back to John and his $440.30 monthly spend down. The period set by his state makes a huge difference.

- One-Month Period: If New Jersey uses a one-month cycle, John has to incur $440.30 in medical costs every single month to stay eligible.

- Three-Month Period: If the period is three months, his total spend-down obligation becomes $1,320.90 ($440.30 x 3). He would need to submit bills for this amount over that three-month window.

- Six-Month Period: For a six-month period, the total he needs to cover jumps to $2,641.80 ($440.30 x 6).

Longer periods can be a big help if you have large but infrequent medical expenses, giving you more time to meet the threshold. On the other hand, a shorter period might be better if your medical costs are consistent month after month.

Knowing your state's specific period is just as important as knowing the amount itself. It gives you a roadmap, allowing you to plan appointments or procedures strategically to align with your eligibility timeline.

Qualifying Medical Expenses for Your Spend Down

Once you have your spend-down number, the next big question is a practical one: what bills can you actually use to meet it? This is a common stumbling block. Many people accidentally undercount their expenses, which can unfortunately delay their Medicaid eligibility.

The good news is that the list of qualifying medical costs is probably much broader than you think. It goes way beyond just a major hospital bill or a surgeon's fee. Medicaid spend down rules are designed to account for the wide variety of health-related costs that really impact a household budget. Knowing what counts is the secret to getting your coverage activated.

Core Medical Services That Count

Let's start with the basics. These are the common medical expenses that most people think of right away when they start tracking their healthcare spending.

You can almost always use these costs to meet your spend down:

- Doctor and hospital bills: This covers any co-pays, deductibles, or the full cost of services you have received but haven't yet paid.

- Prescription drug costs: The out-of-pocket amount you pay at the pharmacy is a major qualifying expense.

- Dental services: Necessary dental work, like cleanings, fillings, dentures, or crowns, is eligible.

- Vision care: This includes your eye exams, prescription glasses, and contact lenses.

These foundational costs often make up a huge chunk of a person's spend down. The trick is to keep detailed records of every single bill and receipt from these services.

Remember, the key term here is "incurred." The service has to be incurred, meaning you've received the care and now owe the money. You don’t necessarily have to have paid the bill yet to submit it to the Medicaid agency as proof.

Expanding Beyond the Obvious Expenses

This is where a real strategy comes into play. So many people struggle to meet their spend-down target simply because they don't realize how many other health-related expenses can be counted. Medicaid gets that healthcare isn't just about what happens inside a clinic.

Think bigger—what does it take to manage your health every single day? This often includes premiums for other types of insurance and the costs of essential in-home support.

Health Insurance Premiums

One of the most powerful—and most overlooked—categories is the money you're already spending on other health insurance. These are regular, predictable bills that can become the bedrock of your spend-down plan.

Eligible premiums usually include:

- Medicare Part B premiums: That monthly amount taken out of your Social Security check? It counts.

- Medicare Part D premiums: The cost of your prescription drug plan is also a valid expense.

- Private health insurance premiums: If you pay for a Medigap (supplemental) plan or another private policy, those premiums are eligible, too.

In-Home Care and Medically Necessary Modifications

For countless seniors and people with disabilities, staying safe and healthy at home requires some extra help. Thankfully, these costs are recognized as legitimate medical expenses under most state Medicaid spend down rules.

This category can include things like:

- Home health aide services: The cost of hiring an aide for personal care—like bathing, getting dressed, or preparing meals—is a significant qualifying expense.

- Durable medical equipment: Items such as walkers, hospital beds, wheelchairs, and oxygen equipment all count.

- Medically necessary home modifications: If a doctor orders it, the expense of installing a wheelchair ramp, grab bars in a bathroom, or a stairlift can be put toward your spend down.

These rules can differ by state. For instance, in Georgia, the medically needy income limit is $317 per month for an individual. To become eligible, an applicant has to prove their medical expenses bring their income below that threshold. The state specifically allows costs like health insurance premiums and medical supplies to be counted. You can see more about how Georgia's program works on bethelgardens.com.

Navigating State-Specific Rules and Income Limits

Ever wonder why you can't find one simple, universal answer for Medicaid rules? It’s because the program was designed that way from the start. Medicaid is a joint effort between the federal government and each state. While the feds set broad guidelines, every state runs its own show. This creates a patchwork of regulations across the country, meaning a rule in one state can be completely different from the next.

This is the single most important reality to grasp when you start looking into Medicaid spend down rules. What works for a family in New York won't necessarily apply to someone in Florida or Texas. Key details like income limits, what counts as an asset, and even how long you have to spend down can change dramatically from one state line to another. It's anything but a "one-size-fits-all" system.

The Medically Needy Income Limit: Your State’s Magic Number

The most critical number in the whole spend down equation is the Medically Needy Income Limit (MNIL). You can think of the MNIL as the specific income finish line you have to cross in your state. Once your countable income is at or below this level—after subtracting your medical bills—you finally become eligible for Medicaid coverage.

Because each state sets its own MNIL based on its local cost of living and other economic factors, this number can be wildly different depending on where you live.

For instance, a densely populated state with a high cost of living like New York will likely have a higher MNIL. This acknowledges that residents simply need more money for basic necessities. On the other hand, a state with a lower cost of living may have a much lower MNIL.

This variation is exactly why you can't rely on general advice or stories from a friend in another state. Your entire financial strategy has to be built around your specific state’s MNIL.

How State Rules Create Different Outcomes

Let's look at how these differences play out in the real world. Imagine two people with the exact same income and medical needs, but they live in different states.

- Scenario A (New York): New York has a Medically Needy Program with its own income limit and a one-month spend down period. An applicant here would need to meet their spend down target every single month to stay eligible.

- Scenario B (Florida): Florida also has a Medically Needy Program, but it might use a different spend down period—maybe three or even six months. That longer window could allow someone with a large, one-time medical expense to qualify for a longer stretch of coverage.

These differences in the spend down period are just as crucial as the income limit itself. A shorter period often works better for people with consistent, ongoing medical expenses, while a longer one can be a lifesaver for those facing large, less frequent bills.

Finding Your Local Regulations

So, how do you cut through the confusion and find the definitive rules for your area? You have to go straight to the source. Relying on national articles alone just isn't enough; you need local, specific information.

Here’s where to look to get the most accurate details for your state:

- Your State’s Official Medicaid Website: This is your primary source of truth. Search online for your state’s "Department of Health," "Human Services," or "Medicaid Agency." From there, look for sections on eligibility, medically needy programs, or long-term care.

- Area Agency on Aging (AAA): These local and regional non-profits are funded to give free guidance to seniors. They offer benefits counseling and can connect you with experts who truly understand your state’s specific rules. You can find your local AAA through resources like the National Council on Aging (NCOA).

- State Health Insurance Assistance Programs (SHIP): SHIP counselors are trained volunteers who provide free, unbiased help with both Medicare and Medicaid questions. They are genuine experts in local regulations.

Ultimately, successfully navigating Medicaid spend down means becoming an expert on your state’s specific program. Taking the time to track down this local information is the most critical step you can take.

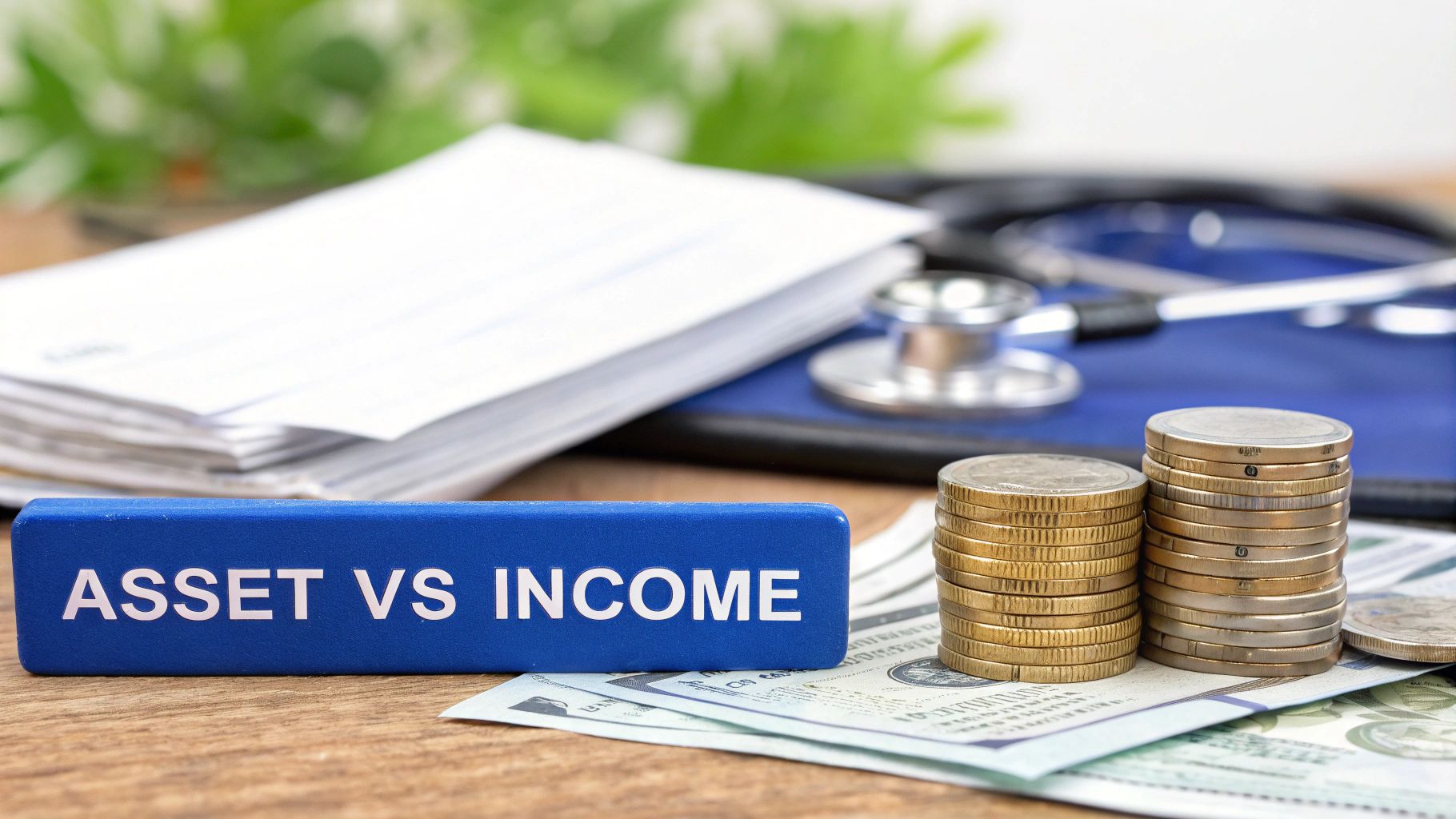

How Your Assets Impact Medicaid Eligibility

While income gets most of the spotlight, it’s only half of the financial picture for Medicaid. Your assets—the things you own—are just as critical in determining whether you qualify for assistance. Medicaid has very strict limits on what an applicant can own, and understanding this second piece of the puzzle is absolutely essential.

Think of it like this: your income is your monthly cash flow, while your assets represent your total savings and wealth. To be eligible for Medicaid, you have to meet two separate and distinct limits—one for income and one for assets. Forgetting about the asset side is a surprisingly common mistake that can lead to a quick denial of benefits.

Countable Assets Versus Exempt Assets

The good news is that Medicaid doesn't look at everything you own. It divides your property into two very clear categories: countable assets and exempt assets. Getting this distinction right is the key to figuring out where you stand.

Countable assets are the resources Medicaid expects you to use first to pay for your medical care. These are the assets that are readily available to you. They usually include:

- Cash in checking and savings accounts

- Stocks, bonds, and mutual funds

- Certificates of Deposit (CDs)

- A vacation home or any other property that isn't your primary residence

- Any vehicles beyond your main one

The total value of all your countable assets must fall below a very low threshold. For most New Jersey Medicaid programs, this limit is just $2,000 for a single person. If you're over this limit, you won't qualify until your assets are reduced.

Assets That Do Not Count Against You

On the other hand, exempt assets are things you own that Medicaid agrees not to count toward your eligibility limit. These are typically the essential items you need for daily living.

The whole point of exempting certain assets is to make sure that qualifying for long-term care doesn't leave you completely destitute. You shouldn't have to sell your home or your only car just to get the medical help you desperately need.

Here are some of the most common types of exempt assets:

- Your Primary Home: In most situations, the home you live in is exempt, especially if your spouse or a dependent child still lives there. There are equity limits, but for many, the house is protected.

- One Vehicle: One car or truck that you use for transportation is typically exempt from the asset calculation.

- Personal Belongings: This category covers your furniture, clothing, jewelry, and general household goods.

- Prepaid Funeral Plans: An irrevocable, prepaid burial plan is a very common and accepted exempt asset.

This system is designed to protect your core resources while making sure that financial assistance goes to those who have the greatest need.

Proven Strategies for Reducing Your Assets

So, what happens if your countable assets are over that $2,000 limit? Don't panic—you aren't automatically disqualified forever. What you need is a strategy to legally "spend down" your assets until you're at the allowable level. This does not mean giving your money away recklessly, as that can trigger harsh penalties.

It means making smart, approved purchases that directly benefit you. Legitimate ways to reduce your assets include:

- Paying off debts: Using your extra cash to pay down a mortgage, clear credit card balances, or settle other loans is an excellent first step.

- Making home repairs: You can invest in your exempt primary residence by fixing the roof, updating an old furnace, or making it more accessible with a wheelchair ramp.

- Purchasing essential items: Buying new appliances, needed furniture, or a more reliable car are all valid ways to turn countable cash into exempt personal property.

- Setting up a prepaid funeral plan: Paying for burial expenses ahead of time is a permitted strategy that also takes a significant burden off your family down the road.

By using these approved methods, you can bring your finances in line with the Medicaid spend down rules without putting your future care at risk.

Smart Strategies to Meet Your Spend Down

Knowing your spend-down number is one thing. Actually hitting that target month after month is a completely different ballgame. Instead of just waiting for medical bills to pile up and hoping for the best, you can take control of the situation. A little bit of thoughtful planning can turn the spend-down process from a stressful monthly scramble into a predictable part of your financial life.

The secret is to think ahead. By strategically timing necessary medical procedures and using powerful financial tools like trusts, you can align your biggest expenses with your spend-down period. This approach flips the script, turning medicaid spend down rules from a frustrating obstacle into a manageable part of your healthcare strategy.

Proactive Planning for Medical Costs

One of the smartest moves you can make is scheduling significant, non-emergency medical services to fall squarely within your spend-down period. It’s easy to put off major health investments because of the cost, but these are precisely the kinds of expenses that can help you meet your spend-down requirement in one go.

Think about timing these types of appointments or purchases:

- New Hearing Aids: A good set of hearing aids represents a substantial expense, making it an ideal candidate for satisfying a larger spend-down amount.

- Major Dental Work: Procedures you might have been putting off, like crowns, bridges, or dental implants, are often necessary and can easily cover your spend-down target.

- Vision Needs: Purchasing new prescription glasses or finally scheduling that cataract surgery can be timed perfectly to meet your goal.

When you line up these planned expenses, you ensure you’ll qualify for Medicaid coverage for the rest of the period. That means any unexpected medical issues that pop up later will be covered.

Using a Pooled Income Trust

For anyone dealing with consistently high excess income, a Pooled Income Trust can be a game-changer. Just think of it as a special kind of bank account managed by a non-profit organization. This trust gives you a legal way to set aside your excess income each month so it isn't counted by Medicaid.

It’s a straightforward process:

- Each month, you deposit your excess income—the amount over the Medicaid limit—into the trust.

- The non-profit manages these funds, pooling them with deposits from other people in similar situations.

- You can then ask the trust to pay your personal bills, like rent, utilities, or groceries, from your account.

This strategy effectively shields your surplus income from the spend-down calculation. It lets you qualify for Medicaid while still using your own money to cover essential living expenses. It’s a sophisticated tool, but for many, it’s an invaluable way to maintain financial stability.

Key Insight: A Pooled Income Trust isn't about hiding money. It is a legally recognized tool that allows individuals with disabilities to shelter their income to maintain essential public benefits like Medicaid and Supplemental Security Income (SSI).

The Power of Meticulous Record-Keeping

None of these strategies will work without solid proof. Your ability to meet your spend down is entirely dependent on your ability to document every single qualifying expense. Meticulous record-keeping is your single best defense against a denial of benefits. You absolutely need a dedicated system for organizing every medical bill, pharmacy receipt, and explanation of benefits.

This paperwork is non-negotiable. A 2013 study revealed that medical and long-term care costs are so high that nearly 10% of older Americans eventually spend down their assets to qualify for Medicaid. This shows just how common this journey is and highlights why careful financial tracking is so critical. You can discover more about how spend down impacts older adults in this detailed analysis.

When you keep organized records, you’re creating undeniable proof for the Medicaid agency. More importantly, you're empowering yourself to manage the entire process with confidence and clarity.

Common Questions About the Spend Down Process

Digging into the details of Medicaid can feel like opening a Pandora's box of "what if" scenarios. As you start lining up your finances to meet the spend down rules, you're bound to run into some very practical questions.

This section is all about getting you clear, direct answers to the most common sticking points people hit. Think of this as the real-world stuff that can make or break your eligibility. Getting it right helps you sidestep the usual traps and move forward with confidence.

Can I Prepay Medical Bills to Meet My Spend Down?

This is easily one of the most common questions we hear, and the short answer is almost always no. Medicaid has a very specific rule here: a medical expense has to be "incurred" during your spend down period. In plain English, that means you've already received the service or product, and you now have a real bill to show for it.

Trying to prepay for a future doctor's visit or a surgery scheduled for next month won't count toward your current spend down. The system is built to help with existing medical debt, not future what-ifs. It’s always smart to double-check with your local New Jersey Medicaid office, as there can be rare exceptions for very specific services, but don't count on it.

What if My Bills Are Less Than My Spend Down Amount?

This is a tough one, but the rule is crystal clear. If your total eligible medical expenses for the month (or whatever your period is) don't add up to your required spend down amount, you won't qualify for Medicaid coverage for that period. It's an all-or-nothing situation.

You're still on the hook for paying those medical bills yourself.

Important Takeaway: Medicaid coverage only kicks in after you prove you've incurred medical costs that meet or exceed your spend-down amount. There's no partial qualification. You either hit the target, or you don't.

This is exactly why it’s so critical to track every single qualifying expense. That small pharmacy co-pay, the cost of medical supplies, a specialist visit—it all adds up, and every dollar counts.

Do I Have to Pay Bills Before Medicaid Kicks In?

Not always, and this is a crucial point that trips a lot of people up. The magic word is "incur," not "pay." You simply need to have received the medical care and officially owe the money.

You can gather up these unpaid bills and submit them to the Medicaid agency as proof you've met your spend down. Once you've crossed that threshold, Medicaid can actually step in to help pay for those very same bills, plus any other approved medical costs you have for the rest of that coverage period. This is a huge relief, as it means you don't have to find a way to pay large sums out of pocket just to get your benefits started.

Navigating these rules can be complex, but you don't have to do it alone. For personalized support and expert care in Mercer County, trust NJ Caregiving to help your family manage in-home care needs with compassion and expertise. Learn more about our services at https://njcaregiving.com.